(Bloomberg) High Yield Market Highlights

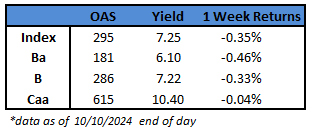

- The US junk-bond market stalled at the start of the fourth quarter and is headed for its second weekly loss this month and the biggest in five months. That’s after recording losses for seven straight sessions, the longest losing streak since mid April. Yields jumped to a four-week high of 7.25% and are on track to end the week at least 15 basis points higher, the largest jump in a week since April

- The modest losses extended across ratings in the US high-yield market after a series of macro data points showed a relatively strong labor market, expanding US services activity and above all underlying inflation rising more than forecast. That crashed hopes of a 50-basis-point interest-rate cut by the Federal Reserve

- In fact, Atlanta Fed President Raphael Bostic even said he was open to leaving interest-rates unchanged at one of the two meetings this year

- Renewed concerns that policy easing may slowdown fueled losses across the US junk-bond market

- Junk-bond yields are set to rise for the second week in a row. And BB yields climbed to a seven-week high of 6.10% after steadily gaining for nine days, the longest in 32 months. Yields are up 17 basis points week-to-date, the biggest jump in six months. BBs racked up losses for seven successive sessions, and are set to post the biggest weekly loss since week ended April 19

- CCCs are set to record the first weekly loss in more than three months as yields are poised to close the week higher, the first weekly jump in six

- While there was disappointment that the Fed may not cut rates by 50 basis points again in November, strong macro-economic data against the backdrop of a gradually easing rate policy quelled fears of a recession and provided a benign, stable environment for borrowers in the junk-bond market

- Credit markets remain resilient in the face of rising rate volatility and Fed-related uncertainty, Brad Rogoff and Dominique Toublan from Barlcays wrote on Friday

- Higher yields and relatively tight spreads pulled borrowers from the sidelines, although at a slower pace after the supply deluge last month

- The primary market priced more than $4b in four sessions this week, driving October volume to almost $9b

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.