Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.5 billion and year to date flows stand at -$28.1 billion. New issuance for the week was $2.0 billion and year to date HY is at $94.7 billion, which is -29% over the same period last year.

(Bloomberg) High Yield Market Highlights

- Junk bond spreads have dropped to an 8-week low — just 18bps from the tightest in 10 years — as investors seem to shrug off geopolitical tensions, fears of trade war and rates volatility. Supply is tight and fund inflows have resumed.

- High yield index spread closed at +329

- CCC spreads have dropped 53bps YTD to close at 5-month low of +562

- For returns, CCCs continued to top BBs and single-Bs

- High yield supply thin, retail funds seeing cash inflows

- Summer is likely to see issuance picking up as acquisitions and buyouts gain some momentum

- Moody’s survey of non-financial companies finds that 65% of them were better off with the 2017 tax cut and they expect to use additional cash to repay debt, and to a lesser extent, repurchase stocks

(Fierce Wireless) Sprint slashes data prices with $15 unlimited plan for those willing to switch

- Sprint has unveiled one of the most aggressive wireless promotions yet, offering unlimited data, talk, and text for just $15 per line per month. The offer is for people who are switching to Sprint from another carrier. It can only be activated online, and does not require a contract.

- By undercutting its competitors on price, Sprint is making several points. First, the carrier appears confident that its network can handle a lot more traffic and perform as well as those of its competitors. Second, despite a major investment in new Sprint retail stores across the country, Sprint would rather sign up its new customers online than in person. Third, Sprint is not content to languish in fourth place in the U.S. market while it waits to see if U.S. regulators will approve its merger with T-Mobile next year.

- And finally, Sprint is underlining the point that a wireless market with four operators invites aggressive price promotion. Washington wants to see a competitive wireless market, but it doesn’t necessarily want to see carriers cutting prices to a point that threatens their ability to invest in next-generation networks.

- The promotion also underscores the cutthroat nature of a four-carrier wireless market. Some analysts say a three-carrier market is likely to result in fewer discounts for customers. This is a negative for consumers in the short term, but could be positive in the longer term, according to some analysts.

- Analyst Joe Madden of Mobile Experts has pointed out that in countries with just three carriers, higher margins create the financial opportunity for carriers to invest in new technologies, which ultimately lead to more value for consumers. Consumers may not see rock-bottom data prices, but they are able to get a lot more data for each dollar they spend. This is the type of argument that will almost certainly be made in Washington as the Justice Department and the FCC consider the proposed merger of Sprint and T-Mobile.

(Bloomberg) OPEC Highlights Demand Uncertainty Before Crucial Meeting

- OPEC emphasized the deep uncertainty over the strength of demand for its oil just a week before contentious talks on whether to raise production.

- There’s a “wide forecast range” for how much crude the Organization of Petroleum Exporting Countries needs to pump in the second half of the year, its research department said in a monthly report. With a range of uncertainty of 1.7 million barrels a day, demand could either be significantly higher, or slightly lower, than OPEC’s current output.

- “Looking at various sources, considerable uncertainty as to world oil demand and non-OPEC supply prevails,” said the report, published by OPEC’s secretariat in Vienna. “This outlook for the second half of 2018 warrants close monitoring.”

- OPEC and its allies will debate whether to revive halted output when they gather in Vienna next week. Saudi Arabia and Russia have said they want to raise supplies to prevent high prices hurting economic growth, but opposition among other producers is growing.

(Moody’s) Moody’s Downgrades Tenneco’s Debt Ratings

- The rating actions incorporate Tenneco’s proposed capital structure related to financing its planned acquisition of Federal-Mogul LLC (Federal-Mogul), a leading global supplier to automotive original equipment manufacturers and the aftermarket. On a pro forma basis for 2017, the transaction will increase Tenneco’s leverage to over 4x inclusive of estimated synergies, from 2.4x. This is transformational for Tenneco, both the acquisition of Federal Mogul as well as the plan to separate into two separate businesses with one focused on Aftermarket & Ride Performance and the other on Powertrain Technology.

- Tenneco is expected to acquire Federal-Mogul from affiliates of Icahn Enterprises L.P. for $5.4 billion. This is about a 7.2x multiple of Tenneco’s calculation of Federal-Mogul’s 2017 adjusted EBITDA (pre synergies). The acquisition is expected to close in the second half of 2018, subject to regulatory and shareholder approvals and other customary closing conditions.

- The ratings reflect the significant increase in leverage, with the expectation that improvement is unlikely over the near term, as approximately 75% of the synergies will not be realized until late 2019. Pro Forma debt/EBITDA is estimated at 4.8x, and about 4.2x adjusting for Tenneco’s projected synergies. The ratings also reflect a number of near-term execution risks including: operating the ongoing businesses while both integrating certain operations related to the planned separation; and implementing programs to achieve the planned synergies and working capital improvements.

(CAM Note) S&P and Fitch have also downgraded the debt of Tenneco

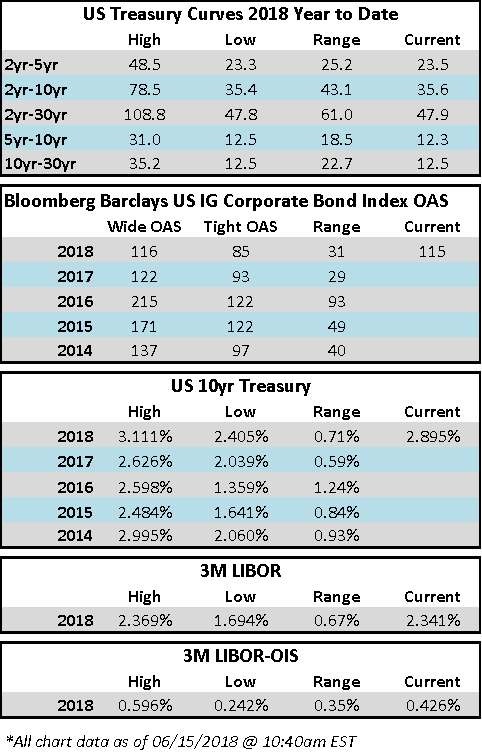

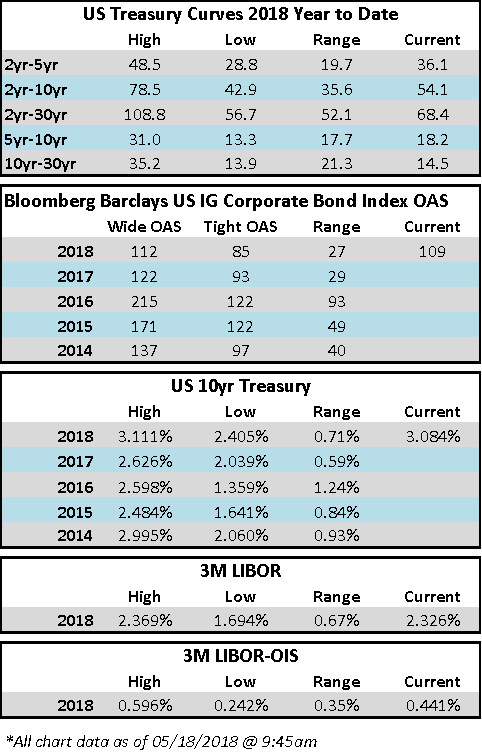

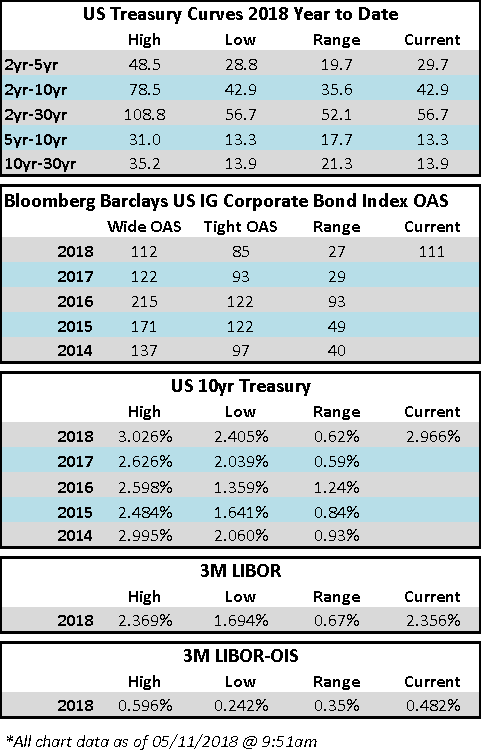

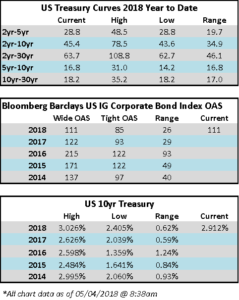

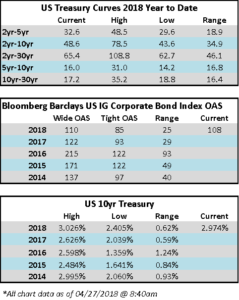

(CNN) Fed raises interest rates and signals faster hikes on the way

- The Federal Reserve on Wednesday lifted its benchmark rate by a quarter of a percentage point, the second hike this year.

- And a majority of policy makers said they now expect a total of four interest rate increases this year. Fed officials had been split about whether to raise rates three times this year or four.

- The decision reflected an economy that’s getting even stronger. Unemployment is 3.8%, the lowest since 2000, and inflation is creeping higher. The Fed is raising rates gradually to keep the economy from overheating.

- “The main takeaway is that the economy is doing very well,” Fed Chairman Jerome Powell said at a news conference. “Most people who want to find jobs are finding them, and unemployment and inflation are low.”