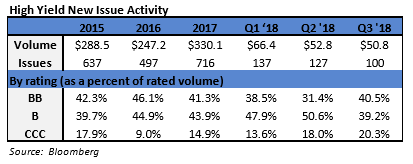

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.9 billion and year to date flows stand at -$47.4 billion. New issuance for the week was zero and year to date HY is at $162.2 billion, which is -35% over the same period last year.

(Bloomberg) High Yield Market Highlights

- S. junk bonds gained for the second straight session across the risk spectrum for first time in about two weeks, shrugging off outflows from retail funds. Yields dropped and spreads tightened and the energy index gained for a second consecutive session.

- Investors also seemed to ignore steadily declining oil prices, with oil briefly dropping below $50 in intra-day trading recently

- Energy was the worst performing sector this month as oil continued to drag and flirt with $50

- Outflows were negative for the week, and this was the 6th time when outflows exceeded $1b in the past 10 weeks

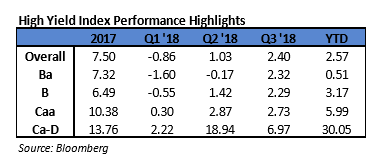

- Single-Bs replaced CCCs as best-performing asset YTD, with 0.86% returns vs 0.49% for CCCs

- Bloomberg Barclays high-yield index YTD return was at 0.03%

- November new issue was a mere $5b, lowest monthly volume since December 2015, slowest 11th month since at least 2006

- Supply shortage expected to continue into 2019 with UBS forecasting 15%-20% drop in issuance

- JPMorgan expects high yield supply flat in 2019 at about $200b

- Morgan Stanley expects supply to stay around $183b

- GS forecasts $150b in issuance next year

(Bloomberg) Steel Dynamics Plans to Spend $1.8 Billion to Expand Output

- Steel Dynamics Inc., the U.S. producer of the metal that has seen record cash flow, plans to spend as much as $1.8 billion to build a new facility that will have the capacity to produce advanced high-strength steel products.

- The electric-arc-furnace flat roll steel mill will have an annual output capacity of about 3 million tons, the Fort Wayne-based company said in a statement Monday. Construction is expected to begin in 2020 and the facility will start operating in the second half of 2021, it said. The investment is designed “to cost effectively serve not only the southern United States, but also the underserved Mexican flat roll steel market,” the company said.

- The steelmaker announced the investment that it said will generate 600 “well-paying” positions on the same day General Motors Co. said it could shutter four factories in the U.S. by the end of 2019. In October, Steel Dynamics reported record quarterly cash flow from operations on strong domestic demand for the metal.

(Business Wire) Western Digital Announces CFO Transition Plan

- Western Digital Corp. today announced that Mark Long, chief financial officer, chief strategy officer and president, Western Digital Capital, has decided he will step down from his current role to pursue opportunities as a private equity investor. Western Digital has begun a comprehensive search for a successor. To ensure a smooth leadership transition, Long will remain an active member of the company’s leadership team through June 1, 2019. Long will remain chief financial officer until his departure or until a permanent successor is appointed.

- Long has served as Western Digital’s chief financial officer since 2016. Prior to that, he served as the company’s executive vice president and chief strategy officer since February 2013. Additionally, Long has served as president, Western Digital Capital, a strategic investment fund targeting innovative companies within the data infrastructure and broader technology industry aligned to Western Digital’s strategic plan, since February 2013.

- “On behalf of the Western Digital Board of Directors and leadership team, I want to thank Mark for his valued partnership and tremendous contributions to the company over the years,” said Steve Milligan, Western Digital chief executive officer. “Mark has been instrumental in developing and overseeing the company’s growth strategy, including our successful acquisitions and integrations of Hitachi Global Storage Technologies and SanDisk. He helped create the foundation for Western Digital’s leadership in today’s data-driven world, and we are now well positioned to capitalize on the long-term opportunities associated with rapid growth in the volume and value of data. We wish Mark the best in his future endeavors and look forward to discussing the company’s long-term vision and strategy on Dec. 4, 2018, at our 2018 Investor Day.”

(Modern Healthcare) Most skilled-nursing facilities penalized by CMS for readmission rates

- The vast majority of skilled nursing facilities will receive a penalty on their Medicare payments for fiscal 2019 for poor 30-day readmission rates back to hospitals, according to new CMS

- Of the 14,959 skilled nursing facilities subject to the CMS’ Skilled Nursing Facility Value-based Purchasing Program, 73% received a penalty while 27% got a bonus. The data also show that the SNFs on average got worse at managing readmissions the longer they were in the program.

- The penalties, which went into effect for the first time on Oct. 1, were mandated by the Protecting Access to Medicare Act of 2014 in an effort to transition SNFs from fee-for-service to value-based payment. Under the program, SNFs can see up to a 1.6% bonus in their Medicare Part A payments or up to a 2% cut.

- The CMS has been providing SNFs quarterly confidential feedback reports since October 2016 regarding how they are doing on the readmission measure, but fiscal year 2019 was the first time the CMS penalized providers on performance.

(Bloomberg) Leveraged Loans Hit Rough Patch

- The U.S. leveraged loan market is showing a few cracks. A $6.5 billion loan that helped finance the leveraged buyout of a Thomson Reuters unit is quoted at around 97.25 cents on the dollar, after being sold for just shy of 100 cents. The $5.05 billion of loans for KKR’s buyout of Envision Healthcare now quoted at 96.125 cents on the dollar, around two months after being issued at 99.75 cents.

- These debts have weakened with the broader loan market, which on average is priced at its lowest level since 2016. And there are other signs of cooling in loans too: the percentage of new deals that had to increase pricing spiked earlier this month to the highest of the year, according to data compiled by Bloomberg. Loan offerings are getting pulled at the fastest rate since July. And U.S. leveraged-loan funds are seeing some of their biggest outflows in nearly three years.