Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.2 billion and year to date flows stand at -$34.6 billion. New issuance for the week was $2.7 billion and year to date HY is at $136.1 billion, which is -23% over the same period last year.

(Bloomberg) High Yield Market Highlights

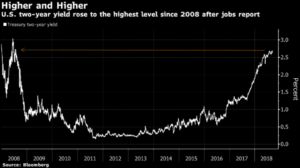

- The junk-bond index spread fell to just by 13 basis points wide of the post-crisis low as equities neared record highs and volatility declined for a fourth consecutive session.

- Bloomberg Barclays US Corporate High Yield Bond Index spread fell to 324bps, from 336bps 1 week earlier

- Post-crisis low was 311bps on Jan. 26

- Lipper reported an outflow from U.S. high yield funds for week ended September 12, the second consecutive week of outflow

- Supply slowed, with just $6b pricing MTD, another $6b waiting to price, led by Thomson Reuters

- MTD volume of $6b was a drop of more than 66% over comparable last year

- YTD volume stood at $136b, 23% drop year-over-year

- Supply-starved investors made beeline to Refinitiv/Thomson Reuters with orders of ~$6b for the 1st lien USD tranche, $4b for the USD senior unsecured tranche amid expectations that it would price tighter than initial price talk of 7% area and 9% area, respectively

- Risk appetite evident in demand for Carvana, a CCC-credit, which had orders more than 3x the size of the offering

- This followed Pacific Drilling adding a PIK tranche, first since May

- CCCs continued to outperform BBs and single-Bs with YTD return of 5.17%

- Investment-grade bonds are down 2.23% YTD

- Junk bonds supported by low default rate, strong earnings, steady U.S. growth

- Moody’s expects default rate to fall to 2.6% by year-end and 2.2% in August 2019

(Bloomberg) United Rentals Expands Footprint With $2.1 Billion Purchase

- United Rentals Inc. agreed to buy competitor BlueLine Rental for $2.1 billion to bolster its industrial- equipment reach across North America.

- The cash purchase will add about 46,000 rental assets to the buyer’s fleet in areas such as the U.S. coasts and Ontario, the companies said in a statement. The deal with private- equity firm Platinum Equity, which was approved by United Rentals’ board, is expected to close in the fourth quarter.

- United Rentals, already the country’s largest equipment- rental company by market share, has been looking to augment its growth across North America with targeted acquisitions. Since the beginning of last year, it has purchased Miami-based Neff Corp. for $1.3 billion, Chicago’s NES Rentals Holdings II for $965 million and BakerCorp International Holdings Inc., based in Seal Beach, California, for $715 million.

- The latest deal will add 114 BlueLine locations to United Rentals’ stable across 25 U.S. states, Canada and Puerto Rico.

- The transaction, which isn’t conditioned on financing and will be funded with newly issued debt and bank borrowing, will immediately increase United Rentals’ earnings, the company said.

- “The deal makes strategic sense for United Rentals, but will keep a brake on its credit profile and bond-performance potential in the near term,” Joel Levington, a credit analyst for Bloomberg Intelligence, said in a note.

- United Rentals plans to pause its $1.25 billion share repurchase program when the deal closes to allow the company to integrate the acquisition and “assess other potential uses of capital.”

(Business Wire) HCA Healthcare Chairman and CEO Milton Johnson to Retire

- Sam Hazen, the company’s president and chief operating officer, will succeed R. Milton Johnson as CEO on January 1, 2019; he has also been appointed a member of the board of directors

- Johnson will retire as CEO, effective December 31, 2018; he will continue as chairman of the board of directors through the company’s 2019 annual shareholders’ meeting on April 26, 2019

- At the company’s 2019 annual shareholders’ meeting, Johnson will retire from the board of directors; on that same date, the board of directors plans to appoint Thomas F. Frist III, a current board member, to be chairman of the board of directors.

- Hazen has been with the company for almost 36 years. Prior to his present position as president/COO, he served as the company’s chief operating officer, president-operations, Western Group president and Western Group CFO.

(Reuters) Dalian Wanda trims AMC stake

- Chinese billionaire Wang Jianlin’s real estate-to-media conglomerate Dalian Wanda Group is exploring a deal to cut its stake in AMC Entertainment Holdings, the world’s largest cinema operator.

- The move is the latest sign of how Wanda, like many of its Chinese peers, is under pressure from the country’s regulators to reduce overseas holdings after embarking on a major acquisition spree in the United States and Europe.

- Wanda is exploring a deal in which AMC would borrow hundreds of millions of dollars through a convertible bond, and then use that money to buy back some of Wanda’s 60 percent stake, sources said yesterday. Wanda controls AMC through its ownership of Class B shares, and aims to retain control after any deal, the sources added.

- Private equity firms, including Silver Lake Partners and Apollo Global Management, are in talks with AMC about making the debt investment, the sources said. They could obtain board representation at AMC as part of any deal, the sources added.

(Bloomberg) Hershey to Acquire Pirate Brands From B&G Foods

- Hershey agreed to acquire Pirate Brands, including the Pirate’s Booty, Smart Puffs and Original Tings brands, from B&G Foods for $420 million.

- Hershey expects the acquisition to add to its financial targets

- Transaction will be financed with cash on hand and short-term borrowings

- Deal expected to close in the fourth quarter of 2018