(Bloomberg) High Yield Market Highlights

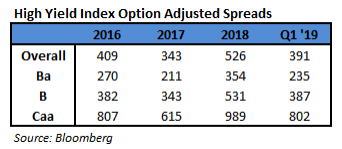

- S. junk bond returns turned negative yesterday across ratings for the first time in almost four weeks. Yields were off their near 12-month low as equities faltered and oil lost momentum.

- Issuers were undeterred, selling 5 deals for $2.6b, the busiest day in more than 4 weeks, with triple Cs accounting for almost 70% of the volume

- Junk bond returns remain best since 2009, with 8.47% year- to-date

- Retail funds estimate inflow of $926m at Tuesday’s close, JPMorgan wrote, citing Lipper

- Funds have reported inflows for the last five consecutive weeks

- 1Q saw an inflow of $13b, most since 3Q12’s $13.8b

- Energy returns stood at 9.93% YTD

- Ex-energy dropped to 8.2% after losing 0.06%

- Single-Bs and CCC returns were at 8.55% and 8.59% YTD, respectively

- BBs were at 8.2%

- Loans lagged bonds at 5.265%

- Steady growth, low default rate, and strong technicals provide friendly turf for junk bonds

- Moody’s global high-yield default rate dropped to 1.9% for the 12-month period ended March 2019, lowest since October 2011

- S. high-yield default rate is expected to close 2019 at 2.2%

(PR Newswire) U.S. Concrete Names Ronnie Pruitt President and COO

- S. Concrete, Inc., a leading supplier of ready-mixed concrete and aggregates in active construction markets across the country, announced today that Chief Operating Officer (“COO”), Ronnie Pruitt, 48, has been named President and COO, effective April 15, 2019. Mr. Pruitt will continue to report to Chairman and CEO, William J. Sandbrook, and in this expanded role will take over many corporate functions that support the Company’s operational business units.

- Pruitt, who has been with U.S. Concrete since 2015, has over 25 years of industry experience. Prior to joining U.S. Concrete, Mr. Pruitt served as Vice President of Martin Marietta Materials, Inc., and as Vice President of Cement Production and Vice President of Sales and Marketing of Texas Industries, Inc.

- “Ronnie has been instrumental in the strategic growth of our Company including very successfully integrating Polaris Materials, a major aggregates acquisition. His leadership and record of success with our ready-mixed concrete and aggregates operations has earned him this expanded role,” said U.S. Concrete Chairman and CEO William J. Sandbrook. “Ronnie is a champion for the health and safety of our employees, is dedicated to our environmental and sustainability initiatives and is laser focused on creating enhanced shareholder value through operational excellence. I am proud of Ronnie’s success and look forward to his enhanced contributions in his expanded role.”

(CNET) T-Mobile’s John Legere denies Justice Department pushback on Sprint merger

- The Justice Department’s antitrust division is determining whether a combination of the US’ third- and fourth-largest wireless service providers would pose a threat to competition, according to a Tuesday report by The Wall Street Journal. Earlier this month, staffers reportedly shared concerns about the deal and the carriers’ arguments that merging would lead to key efficiencies for the company.

- Legere tweeted that the premise of the Journal’s story “is simply untrue,” adding the company has no further comment.

- Last year, the two carriers announced their $26 billion deal to merge. It may still take several weeks for a final decision to be made, as several state attorneys general are reviewing the deal and the Federal Communications Commission is seeking more data from the companies about the proposed merger, according to the Journal.

(Company Filing) Western Digital Appoints Robert Eulau As Chief Financial Officer

- Western Digital Corp. announced the appointment of Robert Eulau to lead the company’s finance organization as executive vice president and chief financial officer (CFO), reporting to Steve Milligan, Western Digital’s chief executive officer (CEO). Eulau will join Western Digital on April 22, 2019 to begin his transition into the new role and will formally take over the CFO role from Mark Long on May 9, 2019. Eulau, who joins Western Digital with more than 30 years’ experience in financial and operational leadership roles in the technology industry, succeeds Long, who, as previously announced, will be leaving the company in June 2019.

- “Western Digital occupies an increasingly strategic position in today’s data-driven world. Bob Eulau’s background in optimizing financial and operational performance, paired with his strong leadership skills, will help position us to make the most of exciting short- and long-term growth opportunities,” said Milligan. “I’m thrilled to be adding an executive of Bob’s caliber to our leadership team and I look forward to working with him.”

- “I’m honored to join Western Digital at such an important time in the company’s history,” said Eulau. “The team has built a strong platform for growth and value creation, and I look forward to helping maximize the many opportunities ahead for the company.”

- Eulau was most recently CEO at Sanmina Corporation where he previously served for eight years as CFO. Previously, Eulau held chief financial officer positions at Alien Technology Corporation and Rambus Incorporated, and held a number of financial leadership roles at Hewlett-Packard Company. Eulau earned a Master’s in Business Administration (Finance/Accounting) from The University of Chicago and a Bachelor’s in Mathematics from Pomona College. He will be based at the company’s San Jose, CA headquarters location.

The Finance Companies, Energy, and Utilities sectors were the best performers during the quarter, posting returns of 9.00%, 8.27%, and 7.81%, respectively. On the other hand, Other Financial, Insurance, and Transportation were the worst performing sectors, posting returns of 5.12%, 6.33%, and 6.34%, respectively. At the industry level, refining, oil field services, pharma, and supermarkets all posted the best returns. The refining industry (12.20%) posted the highest return. The lowest performing industries during the quarter were retail REITs, office REITs, airlines, and life insurance. The retail REIT industry (2.86%) posted the lowest return.

The Finance Companies, Energy, and Utilities sectors were the best performers during the quarter, posting returns of 9.00%, 8.27%, and 7.81%, respectively. On the other hand, Other Financial, Insurance, and Transportation were the worst performing sectors, posting returns of 5.12%, 6.33%, and 6.34%, respectively. At the industry level, refining, oil field services, pharma, and supermarkets all posted the best returns. The refining industry (12.20%) posted the highest return. The lowest performing industries during the quarter were retail REITs, office REITs, airlines, and life insurance. The retail REIT industry (2.86%) posted the lowest return.