CAM High Yield Market Note

7/26/2019

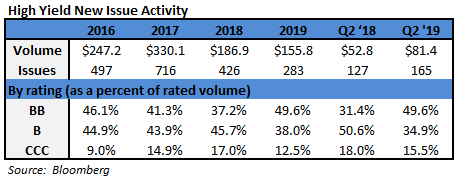

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $1.3 billion and year to date flows stand at $16.3 billion. New issuance for the week was $12.7 billion and year to date HY is at $150.5 billion, which is +34% over the same period last year.

(Bloomberg) High Yield Market Highlights

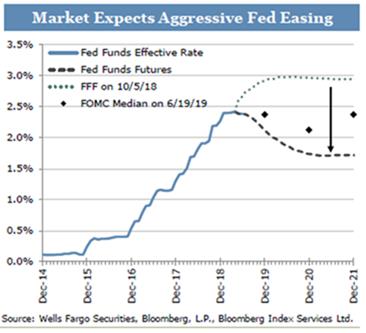

- U.S. junk bonds are poised for their sixth straight day of gains following a $1.3 billion inflow into high-yield retail funds, rising oil prices and higher stock futures.

- The high-yield bond index hit a new peak yesterday

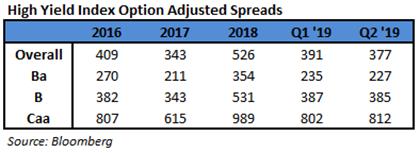

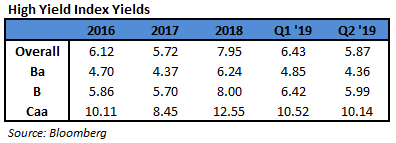

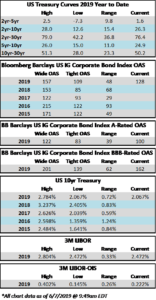

- The average yield-to-worst is 5.84%, while spreads tightened 5 basis points to 367bps over U.S. Treasuries, according to Bloomberg Barclays data. Spreads are 17bps tighter on the week

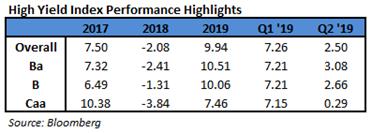

- Returns also hit a new peak for the year at 10.42%

- Cash is still pouring into the asset class as investors chase yield

- Lipper reported an inflow of $1.3b for the week ended July 24. That marks seven consecutive weeks of inflows — the first time this has happened since 2013

- New issue July volume is set to top $20b by the end of the day with as many as three issuers set to price deals Friday

- Returns by ratings category:

- BBs returns hit a new 2019 high of 11.067%

- Single-Bs were at 10.578%, also a new high

- CCCs were at 7.611%

- Loan returns were at 6.368% YTD

(PR Newswire) Encompass Health announces plans to build new inpatient rehabilitation hospital in Tampa Bay

- The hospital will be located at the corner of Dale Mabry Highway and Van Dyke Road in Tampa Bay and is expected to open in the second quarter of 2021. It will provide comprehensive rehabilitative services to patients overcoming a variety of debilitating illnesses and injuries such as stroke and other neurological disorders, brain injuries, spinal cord injuries, amputations and complex orthopedic conditions. Patients will receive at least three hours of intensive therapy for five days each week, frequent face-to-face visits with a physician and 24-hour nursing care during their stays.

- “This new hospital will help meet the growing demand for a hospital level of intensive physical rehabilitation in Tampa Bay,” said Linda Wilder, president of Encompass Health’s southeast region. “The new rehabilitation hospital will become part of Encompass Health’s integrated delivery network of 12 hospitals and 17 home health locations throughout Florida, which are focused on not only returning complex patients to their home but helping them remain home through coordinated and connected care.”

- Included in the hospital will be a spacious therapy gym, advanced rehabilitation technologies, an activities of daily living suite, cafeteria and dining room, in-house dialysis, pharmacy and courtyard. The project will bring approximately 100 full-time jobs to the community.

- (Reuters) Pulte full-year forecast disappoints, higher costs persist

- PulteGroup forecast full-year home sales and gross margins below analyst expectations, as it grapples with rising land costs.

- Homebuilders in the United States have struggled with a lower supply of homes, especially at the lower-price end of the housing market because of land and labor shortages, as well as expensive building materials and sluggish wage growth that has crimped demand.

- U.S home sales fell more than expected in June as a persistent shortage of properties pushed prices to a record high, suggesting the housing market was struggling to regain speed since hitting a soft patch last year.

- Chief Executive Officer Ryan Marshall, however, said he expected demand to pick up in the second half of the year, helped by lower mortgage rates.

- Pulte’s forecast overshadowed better-than-expected quarterly profit.

- Pulte expects to sell 22,300 to 22,800 homes this year, compared with estimates of 22,764 units, according to Refinitiv data.

- The company expects an average sales price of between $425,000 to $430,000 for the remainder of the year, and forecast gross margins to be between 23% and 23.3% for 2019, compared to a consensus of 23.9%.

(Indianapolis Business Journal) Steel Dynamics planning to build $1.9B plant, hire 600

-

- An Indiana company is planning to build a $1.9 billion flat-roll steel mill in south Texas and create about 600 jobs.

- Steel Dynamics Inc. said the electric arc-furnace unit will be in Sinton, about 25 miles northwest of Corpus Christi.

- The Fort Wayne-based company said in a statement this week that the site is strategically located for the southwestern U.S. and Mexico markets. President and CEO Mark Millett said Steel Dynamics has been developing a flat-roll steel business strategy for those areas for several years.

- Company officials say the mill will be able to produce up to 52 half-ton coils for the energy, automotive, construction and appliance industries. The site has transport access to railroads, highways and the Port of Corpus Christi.

- Construction should begin next year.