Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.02 billion and year to date flows stand at $12.5 billion. New issuance for the week was $7.2 billion and year to date HY is at $102.1 billion, which is +16% over the same period last year.

(Bloomberg) High Yield Market Highlights

- Junk bonds will draw support from stabilizing equity and oil markets today, helped by better fund flows, after the heaviest bout of issuance in 14 months. Futures point to a firm open, following a bruising week for risk assets.

- Yesterday’s close was the lowest since March 8

- Futures on the S&P 500, Dow Jones and Nasdaq rose today in the wake of steep declines a day earlier

- Oil’s also opening firmer this morning, after suffering the biggest weekly drop since December

- However, concerns are mounting that the trade dispute could cripple global growth

- S. corporate high-yield funds swung to a small inflow of about $20mm for the week

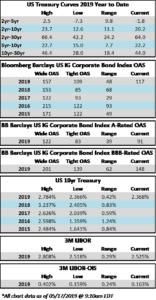

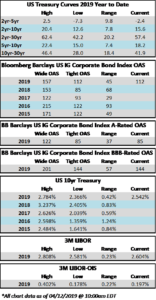

- High-yield index fell 0.25% yesterday, the biggest loss since May 13

- Spread widened 10bps to 398bps

- Index yield rose to 6.38% from 6.35%

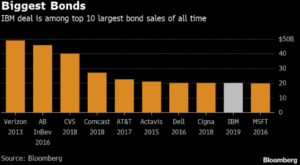

- The junk market is digesting $25b in new bonds, the most monthly supply since March 2018

(The Street) Sprint-T-Mobile US Merger Gets FCC Approval After 5G Network Development Pledge

- Sprint Corp. and T-Mobile shares surged Monday after U.S. Federal Communications Commission chairman Ajit Pai said he would recommend approval of their $26 billion merger plans.

- The FCC agreed to the tie-up following pledges from both companies to build 5G networks around the country, while ensuring “robust” infrastructure in rural areas, and to also enhance in-home broadband offerings to its customer base.

- “Two of the FCC’s top priorities are closing the digital divide in rural America and advancing United States leadership in 5G, the next generation of wireless connectivity,” Pai said in a statement. “The commitments made today by T-Mobile and Sprint would substantially advance each of these critical objectives.”

- “I’m also pleased that the companies have committed to a robust buildout of their mid-band spectrum holdings,” he added. “Demonstrating that 5G will indeed benefit rural Americans, T-Mobile and Sprint have promised that their network would cover at least two-thirds of our nation’s rural population with high-speed, mid-band 5G, which could improve the economy and quality of life in many small towns across the country.”

(Globe Newswire) Toll Brothers Reports FY 2019 2nd Quarter Results

- Toll Brothers, Inc., the nation’s leading builder of luxury homes, announced results for its second quarter ended April 30, 2019.

- Net income and earnings per share were $129.3 million and $0.87 per share diluted, compared to net income of $111.8 million and $0.72 per share diluted in FY 2018’s second quarter.

- Pre-tax income grew 15% to $176.2 million, compared to $152.7 million in FY 2018’s second quarter.

- Home sales revenues were $1.71 billion, up 7%; home building deliveries were 1,911, up 1%.

- Net signed contract value was $2.00 billion, down 16%; contract units were 2,424, down 9%.

- Backlog value at second-quarter end was $5.66 billion, down 11%; units in backlog totaled 6,467, down 8%.

- Home sales gross margin was 19.7%; Adjusted Home Sales Gross Margin, which excludes interest and inventory write-downs (“Adjusted Home Sales Gross Margin”), was 23.5%.

- Douglas C. Yearley, Jr., Toll Brothers’ chairman and chief executive officer, stated: “We are pleased with this quarter’s results, which exceeded our expectations for revenues, margins, and profits. Revenues, net income and earnings per share rose 7%, 16%, and 21%, respectively, compared to one year ago.

- “We are encouraged by the improvement in demand as the quarter progressed. FY 2019’s April contracts surpassed FY 2018’s April on both a gross and per-community basis. Although the Spring selling season bloomed late, it built momentum. We view this as a positive sign for the overall health of the new home market.

- “We continue to look for opportunities to grow and leverage our industry-leading brand as we expand our geographic footprint, product lines, and price points. Yesterday, we announced our entry into metro Atlanta with the acquisition of Sharp Residential. Atlanta was the largest U.S. housing market where we did not operate, and Sharp was one of Atlanta’s largest private home builders. This quarter we also opened our first communities in Salt Lake City, Utah and Portland, Oregon, which are markets we have entered organically and where we are already seeing healthy buyer interest.

- “According to recent reports, builder sentiment in May rose to a 7-month high and single-family housing starts in April were up 6.2% versus March. The industry is being buoyed by low interest rates, a strong employment picture, and a still-limited supply of new homes in many markets. With a positive macroeconomic backdrop, record low unemployment, continued wage growth, and solid consumer confidence, we are optimistic about the opportunities ahead.”