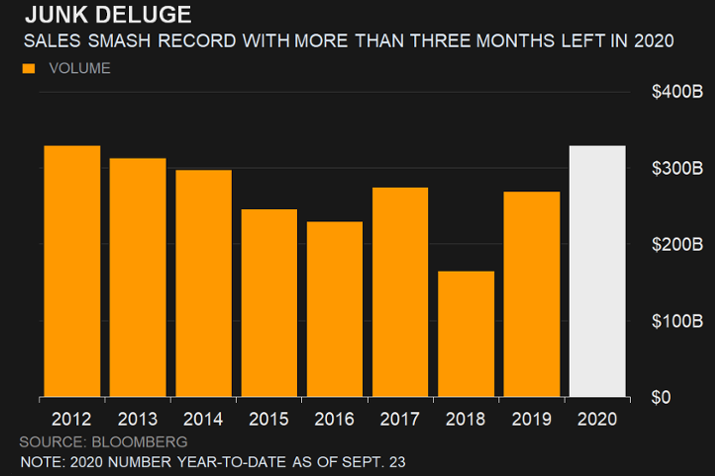

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$2.2 billion and year to date flows stand at $41.5 billion. New issuance for the week was $3.8 billion and year to date issuance is at $334.0 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bonds may be hit by market volatility after President Donald Trump and First Lady Melania Trump tested positive for the coronavirus. Meanwhile at least two deals are slated to be sold on Friday

- A key gauge of credit risk is lower, while stock futures tumbled as uncertainty mounted around the U.S. presidential elections

- Investors are already jittery, pulling over $2 billion from high-yield funds this week. This was the second straight week of withdrawals

- Demand for new issues is showing no signs of waning with investor orders as much as three to four times the amount of debt available

- Spreads tightened 7bps to close at an almost two-week low of 510bps more than Treasuries. Yields dropped 8bps to 5.69%

- The index posted gains of 0.17% on Thursday, the fourth straight session of positive returns

- CCCs have gained 1.05%, beating BBs and single Bs at 0.83% and 0.9% respectively