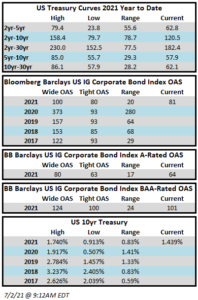

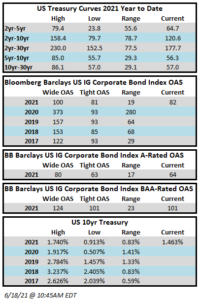

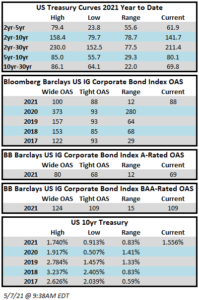

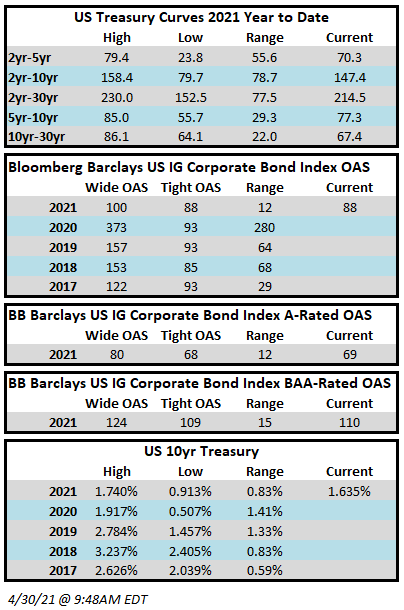

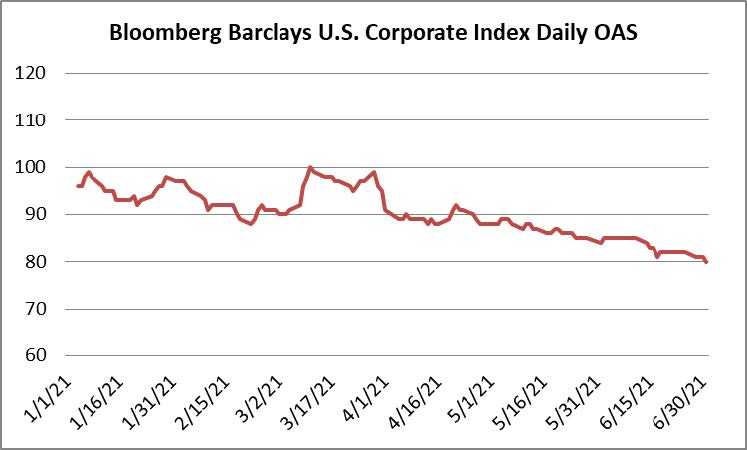

Investment grade corporate credit experienced positive performance during the quarter with a one-two punch of lower Treasury rates and tighter credit spreads. As a result, investors were able to claw back some of the losses that were incurred during the first quarter of 2021. The option adjusted spread (OAS) on the Bloomberg Barclays US Corporate Bond Index compressed 11 basis points during the quarter, opening at 91 and closing at 80.

Lower Treasury rates benefited returns during the quarter as the 10yr Treasury opened at 1.74%, drifting lower throughout the stanza before finishing at 1.47%. Recall that the 10yr moved 83 basis points higher during the first quarter which was the primary driver of negative performance during that period. The Corporate Index posted a total return of +3.55% during the second quarter. This compares to CAM’s gross quarterly total return of +2.78%. Through the first six months of 2021, the Corporate Index total return was -1.27%, while CAM’s gross year-to-date total return was -0.81%.

Portfolio Management & Positioning

We often find ourselves fielding questions from investors regarding the difference between our portfolio and the investment grade universe so we will walk through and refresh some of the ways that we differentiate. We build our investors highly customized separately managed accounts. Unlike a mutual fund or ETF, our clients know what they own within their portfolios down to the exact issuer and quantity. This is important for the individual investor because of the complete transparency it provides. Each individual account will be built with 20-25 positions. The invest-up period will occur over what we like to refer to as an abbreviated economic cycle, generally a period of 8-10 weeks that allows us to invest over a myriad of rate and spread environments.

Relative to the Bloomberg Barclays Corporate Index, we would best be described as “index aware” rather than looking to track or hug the benchmark. At the end of the day, we aim to provide our investors with a return that is as good or better than the Corporate Index but we would like to get there by taking less credit risk and less interest rate risk while incurring limited volatility along the way.

We manage credit risk through our bottom up research process. We thoroughly study each holding within the portfolio, evaluating individual credit metrics, looking to populate our investor portfolios with stable to improving credits that provide an opportunity to benefit from credit spread compression. Our composite consists of 100 issuers and 340 individual bond issues. The Corporate Index had 6,817 individual issues at the end of the second quarter, 4,290 of which would be classified as intermediate maturities, where we primarily invest. Simply put, we are highly selective while populating our investor portfolios and our research process dismisses a large percentage of the investable universe. We also have some hard and fast rules on the quality of our portfolio, the biggest of which is our 30% limitation to BAA-rated credit. BAA-rated bonds represent the riskier portion of the investment grade universe and the corporate index was 51.4% BAA-rated at the end of the second quarter, leaving CAM with a material underweight in lower quality credit relative to the index. Our up-in-quality bias allows us to target a solid A3 rating for each individual separately managed account.

As far as interest rate risk is concerned, we limit ourselves to intermediate maturities. During the invest-up period, we will populate new portfolios with maturities that range from 8 to 10 years. Then we will take advantage of the steepness of the 5/10 Treasury curve as well as the slope of the intermediate corporate credit curve, allowing those bonds to season, rolling down to the 5 year mark, at which point they will be ripe for sale and opportunistic redeployment of proceeds back into the 8-10 year range. This is one of the reasons we advise our investors to look at our portfolios with a 3-5 year time horizon, at a minimum, if they would like to get the most out of the strategy. As a result of our intermediate positioning, our composite modified duration at the end of the second quarter was 6.4 while the Corporate Index had a modified duration of 8.7.i We wrote at length on curves in our 1st quarter 2021 commentary and would encourage you to revisit if you would like to learn more.

As always, although we are attempting to maximize total return, the primary focus of our strategy is preservation of capital. We are not infallible but rarely will you see us pick up pennies in front of the proverbial steam roller to eke out a few extra basis points of return. Our decision process always comes down to risk and reward and although we will certainly take risks for the right reasons, our investors must be appropriately compensated.

Current Market Conditions

2020 will be a year that was remembered for liquidity runway, something that is not often associated with investment grade rated borrowers. Due to the uncertainty surrounding the depth and severity of the pandemic, we saw issuers rush to the new issue market in 2020 in an effort to bolster their balance sheets. In many cases, these were extremely high quality issuers who did not necessarily need to borrow, but at that time the mentality had become “borrow when you can, not when you have to”. Records for new issuance volume were shattered in 2020 as a result of this borrowing binge and the Corporate Index (excluding Financials) net leverage ratio rose from 2.5x at the end of Q1 2020 to 3.6x at the end of Q4 2020.ii There is evidence that the peak has passed as net leverage has since ticked down to 3.5x at the end of Q1 2021.iii It stands to reason that now, as North American economies are largely re-opened or getting more open by the day, we will continue to see an increase in earnings by those sectors most affected by the pandemic. There is reason to be optimistic about credit conditions as earnings rebound, borrowing abates and debt pay down follows suit. That said there are several risks that continue to loom through 2021 and beyond: lingering worries regarding inflation, Federal Reserve tapering and tight spread valuations amid a backdrop of eager lenders.

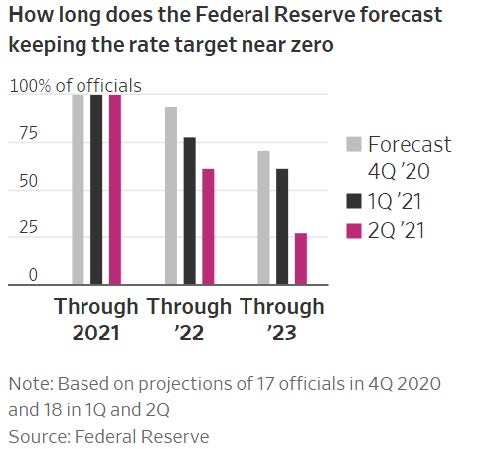

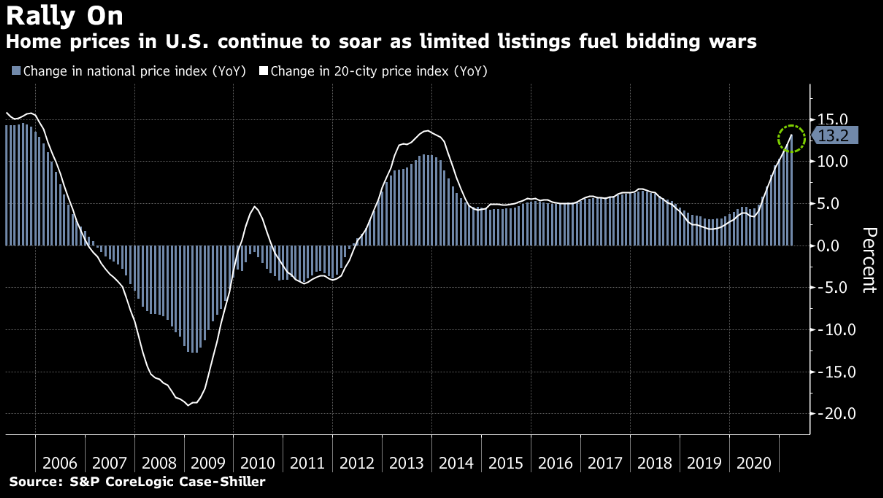

The first two risks really go hand in hand –mounting inflationary pressures and the associated FOMC response. It is likely that each of our readers has experienced price increases in one way or another but the Fed insists that much of these will be “transitory” in nature. We tend to agree with the Fed on this one and we revert to the official definition of inflation which is an unrelenting broad-based and sustainable increase in prices across the board. We, like the Fed, would argue that just because the cost of some goods have increased due to things like inventory and production shortages or a disruption of the semiconductor supply chain, it does not mean the table is set for runaway inflation. We believe that as inventory levels are right-sized and household balance sheets deploy excess capital, supply and demand will find equilibrium over time. Additionally, there are still millions of Americans that are unemployed and as federal unemployment assistance reverts to more normalized historical levels it will result in easing price pressures as workers rejoin the labor force. As far as the FOMC response is concerned, the results from the June meeting showed that the median projection is for an unchanged Fed funds rate in 2021 and 2022 with two rate hikes in 2023. While rate hikes are important for the front end of the yield curve, it is tapering that is the more immediate concern, in our view. We argue that technically the Fed has already begun tapering with its exit from the corporate bond market and the sale of its holdings which began in June of this year.iv Its corporate bond holdings, however, were miniscule in the grand scheme of things, at less than $14 billion total. Much larger pieces to this puzzle are its monthly purchases of Treasury securities at $80 billion and mortgage-backed securities at $40 billion. The Fed has yet to supply a timeline of when it will start to normalize its policy, perhaps dialing back on these purchases, but the market is now expecting a possible announcement on tapering at the end of August during the Fed’s Jackson Hole policy symposium. We think that the Fed will continue to be deliberate and cautious in its messaging and that it will be able to avoid a taper-tantrum like event, but we do acknowledge the risks associated with this view.

As far as the credit market goes, we do have some concerns about current valuations in some portions of the market but we also believe spreads can go tighter from here, especially in more non-discretionary sectors. The areas of uneasiness are largely corners of the market that are highly levered to reopening such as automotive, unsecured airlines, leisure, gaming, lodging and restaurants. The bonds of many of these companies are priced to perfection and some of the companies have borrowed to fund their way through the pandemic. It will take time to repair these balance sheets and unless the rosiest of reopening scenarios come to fruition these companies will not be able to remain investment grade rated entities. We are taking little to no exposure for our portfolio in these areas and ironically they have been some of the best performing portions of the bond market year to date. This illustrates our point about lenders and investors that are perhaps too eager to lend to such entities and what we would classify as classic “reach” in the search for yield. We may sacrifice some near term performance by not participating in these riskier areas of the market but we manage the portfolio with an eye on the long term and will continue to do so. While there is a risk that we could be wrong and these sectors will in fact live up to the most optimistic predictions, we remain skeptical.

Halfway Home

We have a sense of guarded optimism as we enter the second half of the year but risks remain. Unfortunately, the pandemic is not over and continues to rage on in some portions of the world. Thankfully, vaccination progress has the potential to achieve global normalization over the course of the next year, but variants and vaccine-resistant strains could threaten this timeline. The FOMC will remain in the spotlight as it attempts to manage investor expectations and craft its moves carefully. We at CAM plan to stick to the script. We will not be making wholesale changes to our strategy and we will likely be taking less risk than usual in the coming months given the current risk reward backdrop we are seeing in our market. Please reach out to us with any questions or concerns. We thank you for your continued interest and for placing your trust and confidence in us to manage your money.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i A representative sample of a newly invested individual separately managed account had a modified duration of 8.4 at 06/30/2021

ii Barclays, June 23 2021 “US Investment Grade Credit Metrics Q1 21 Update”

iii Barclays, June 23 2021 “US Investment Grade Credit Metrics Q1 21 Update”

iv Reuters, June 2 2021 “NY Fed says it will begin to sell corporate bond ETFs on June 7”