Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $1.0 billion and year to date flows stand at -$6.0 billion. New issuance for the week was $0.8 billion and year to date issuance is at $286.8 billion.

(Bloomberg) High Yield Market Highlights

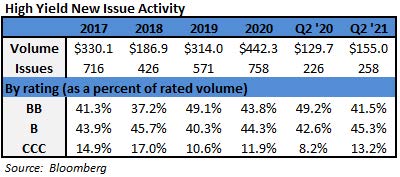

- The U.S. junk bond primary market finally emerged from its post-holiday malaise with Jaguar Land Rover set to sell $500 million of 8-year bonds as soon as today.

- The U.S. junk bond market is poised to post gains for the third consecutive week, with returns of 0.16%

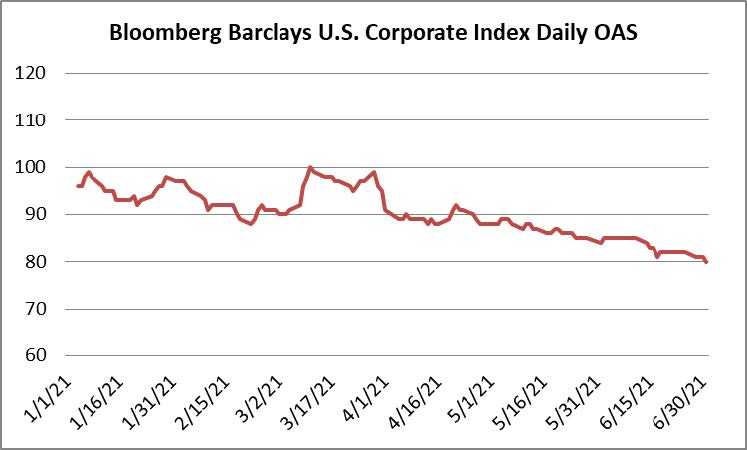

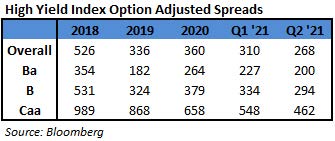

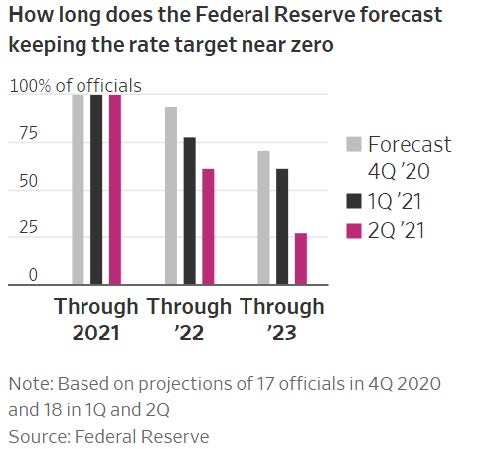

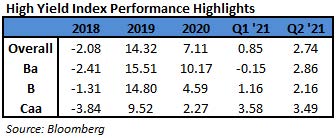

- Barclays revised the spread and returns forecast for high yield as the macro backdrop changed with vaccine rollout, fiscal stimulus and overall growth environment

- High yield index spreads will end the year at 275-300bps, revised from 250-375. The total returns will be 4%-4.5%, from 3.5%-4.5%, Brad Rogoff wrote in a note on Friday

- After a relentless rally plunged junk bond yields to all- time lows across ratings, the market stalled yesterday following fluctuating equities and volatile oil prices amid concerns how the clashes inside OPEC+ will play out

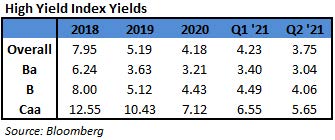

- Yields rose for the second straight session to close at 3.67% after setting a record low of 3.53% earlier in the week. The yields were up 8bps, the biggest one-day jump in seven weeks. Spreads closed at +271bps, also up 8bps

- The broader index came under pressure after a long rally as equities fell to post a modest loss of 0.11% on Thursday. The market is ending the week with gains of 0.16%

- CCC yields also rose for the second straight session to close at 5.48%, up 7bps. It hit a new low of 5.15% on July 6. The index posted a loss of 0.19% on Thursday and is expected to end the week with a loss of 0.04%

(The Wall Street Journal) Borrowing Is Back as Sign-Ups for Auto Loans, Credit Cards Hit Records

- Americans are borrowing again, in some cases at levels not seen in more than a decade.

- Consumer demand for auto loans and leases, general-purpose credit cards and personal loans was up 39% in April compared with the same period last year, according to credit-reporting firm Equifax It was also up 11% compared with April 2019, according to Equifax, which measured how often lenders checked consumers’ credit reports to make loan decisions.

- Lenders are meeting the moment. Equifax said lenders extended a record number of auto loans and leases in March, the latest month for which data are available. They also bumped up credit-card originations, issuing more general-purpose credit cards than any other March on record. Equifax’s data goes back to 2010.

- With vaccinations readily available in the U.S. and the economy reopening, many Americans are splurgingon cars, vacations and eating out. Higher prices, especially for cars and trucks, have also stoked loan demand.

- “There’s a significant increase in consumer-credit demand and a growing appetite to use credit on things like those vacations that were postponed for 18 months,” said Tom Aliff, senior vice president of analytics consulting at Equifax.

(Bloomberg) Oil Prices in Flux While OPEC+ Remains Deadlocked on Supply

- Oil prices continued to swirl as traders tried to fathom how the clash inside the OPEC+ alliance will play out in global markets.

- Early in the week, U.S. crude soared to a six-year high near $77 a barrel on fears that OPEC’s failure to agree a production increase would leave markets desperately tight. But the gains soon fizzled on concern that the dispute between Saudi Arabia and the United Arab Emirates could splinter the entire alliance and undo its production cuts agreement.

- Futures advanced 0.9% on Friday, gaining in tandem with other commodities. Nonetheless, crude is down 2.1% for the week and the main focus for traders in coming days will be whether the Organization of Petroleum Exporting Countries and its partners can repairs its split.

- Before talks broke down on Monday, Saudi Arabia proposed that the coalition gradually revive the 5.8 million barrels of daily capacity it still has off-line in monthly installments of 400,000 barrels through to the end of next year. But the UAE blocked an agreement, saying it will only support an extension of the pact if there are revisions to its own quota, which the country contends is outdated.

- The existing OPEC+ agreement states that output remains steady next month. That could cause world markets to tighten sharply, with forecasters such as Goldman Sachs Group Inc. warning the shortfall will amount to several million barrels a day.

- Yet the longer the dispute goes unresolved, traders are reckoning with another possible outcome: that the UAE follows through on veiled threats to quit OPEC, which could cause the entire alliance to dissolve into a production free-for-all reminiscent of last year’s Saudi-Russia price war.

- “The OPEC+ impasse could turn sour,” analysts at market intelligence firm Kpler Ltd. said in a report. “While the prospect of a non-agreement sounds like a bullish scenario, the less likely bearish scenario where OPEC+ tumbles and goes back to a free-for-all remains on the table.”