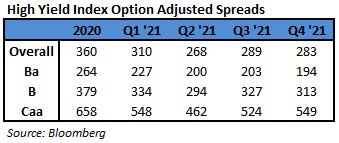

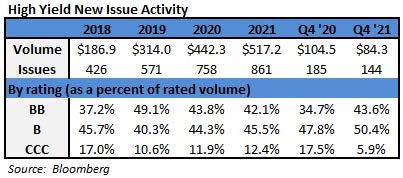

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$3.6 billion and year to date flows stand at -$10.6 billion. New issuance for the week was $6.0 billion and year to date issuance is at $25.4 billion.

(Bloomberg) High Yield Market Highlights

- The U.S. junk bond primary market was powered by leveraged buyouts this week as cyber security firm McAfee Corp. and Scientific Games Holdings, a gaming and lottery operator, together sold almost $3b, accounting for one-half of this week’s issuance volume as the high yield market recovered from its worst January on record.

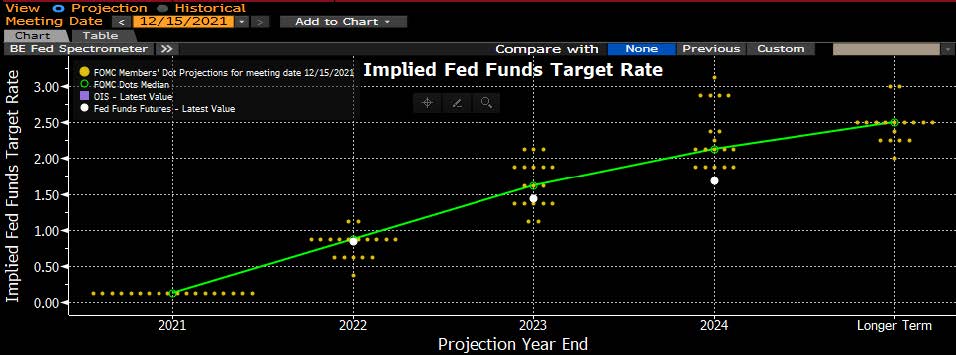

- Junk bond borrowers of all stripes – funding strategic acquisitions, LBOs and plain-old refinancing outstanding debt – seemed to be in a hurry to rush to the market to get ahead of the rate-hike cycle, which is widely expected to begin as early as March, and avoid the uncertainty volatility that may follow.

- The U.S. leveraged finance market was also undergoing a shift triggered by the Federal Reserve’s signal that rate hikes may begin in the next meeting and the overall hawkish tone suggesting an end to the easy money policy.

- The shift became evident in McAfee Corp. and Scientific Games Holdings moving a portion of bonds to term loan as the latter, with a floating rate coupon and spot higher in the capital structure, were more attractive to investors in a rising rate environment.

- The junk bond market was broadly resilient even as cautious investors pulled cash out of high yield retail funds.

- Investors pulled almost $4b from U.S. high yield funds, the biggest weekly outflow since March of 2021 and the fourth consecutive week of outflows, the longest streak since June of 2021.

- While weak earnings reports and increased central bank hawkishness drove a sharp sell-off in risk assets, “it is still too early to buy the dip,” Barclays strategist Brad Rogoff wrote on Friday, adding that monetary policy uncertainty is likely to remain elevated.

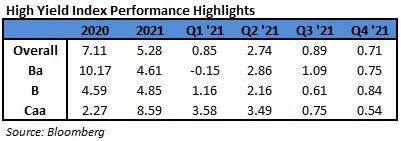

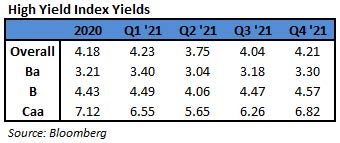

- The broader junk bond returns came under pressure on Thursday posting losses of 0.4% as yields jumped 15bps to 4.21%.

- Junk bonds may pause as U.S. equity futures reversed gains as concerns over inflation and monetary tightening outweighed earnings optimism driven by Amazon.com, Inc.

- Oil, meanwhile, has rocketed to a fresh seven-year high near $92 a barrel, and almost every indicator is pointing to the rally extending.

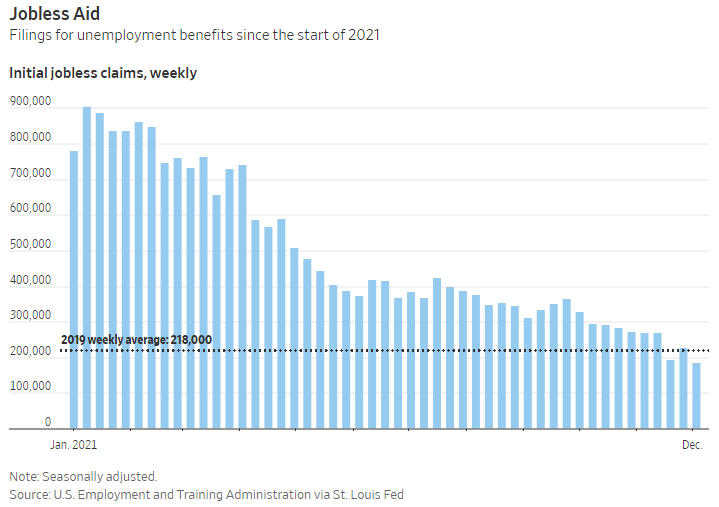

(Bloomberg) U.S. Job Growth Blows Past Estimates, Defying Gloom Over Omicron

- U.S. employers extended a hiring spree last month despite a record spike in Covid-19 infections and related business closures, with surging wages adding further pressure on the Federal Reserve to raise interest rates.

- Nonfarm payrolls increased 467,000 in January in a broad-based advance that followed substantial upward revisions to the prior two months, a Labor Department report showed Friday. The unemployment rate ticked up to 4%, and average hourly earnings jumped.

- The median estimate in a Bloomberg survey of economists called for a 125,000 advance in payrolls, though forecasts ranged widely. A variety of factors including omicron, seasonal adjustment and the way workers who are home sick are factored in make interpreting the January data challenging.

- The surprise display of strength suggests the labor market continues to improve, despite the temporary disruption from record-high levels of coronavirus infections and the resulting absenteeism from work. The data further reinforce Fed Chair Jerome Powell’s description last week of the labor market as “strong” and validate the central bank’s intention to raise interest rates in March to combat the highest inflation in nearly 40 years.

- The dollar jumped along with Treasury yields following the report. U.S. stock-index futures dipped slightly. Investors began to price in the slight possibility of a sixth quarter-point Fed rate hike by the end of this year, while continuing to see a March increase as a lock and nudging up the chance of a 50-basis-point jump.

- Meanwhile, the Labor Department’s report showed average hourly earnings rose 0.7% in January and 5.7% from a year ago, further fanning concerns about the persistence of inflation. The average workweek dropped.

- The faster-than-expected advance in pay could fuel market concerns about the Fed taking an even more aggressive stance on inflation this year.

- Despite the better-than-expected report, the impact of omicron on the labor market in January was substantial. There were 3.6 million employed Americans not at work due to illness, more than double that in December. Meanwhile, 6 million people were unable to work in the month because their employer closed or lost business due to the pandemic, roughly twice that in December.

- The potential for a weak — or even negative — payrolls print, largely because of virus-related disruptions, was well telegraphed in the days ahead of the report, including by White House and Fed officials.

- The job gains were broad based, led by a 151,000 advance in leisure and hospitality. Transportation and warehousing, retail trade and professional and business services also posted solid increases.

- The solid employment growth in several categories may reflect businesses choosing to retain more holiday workers than normal in the face of a tight labor market.