(Bloomberg) High Yield Market Highlights

- New bond sales in the US junk bond market soared past $48b this month to make it the busiest September ever, surpassing September 2020’s $47b. Issuers have priced $17.5b so far this week, the busiest week in five years. The last time the market was more active was the $18.3b notched in the week ended Sept. 18, 2020.

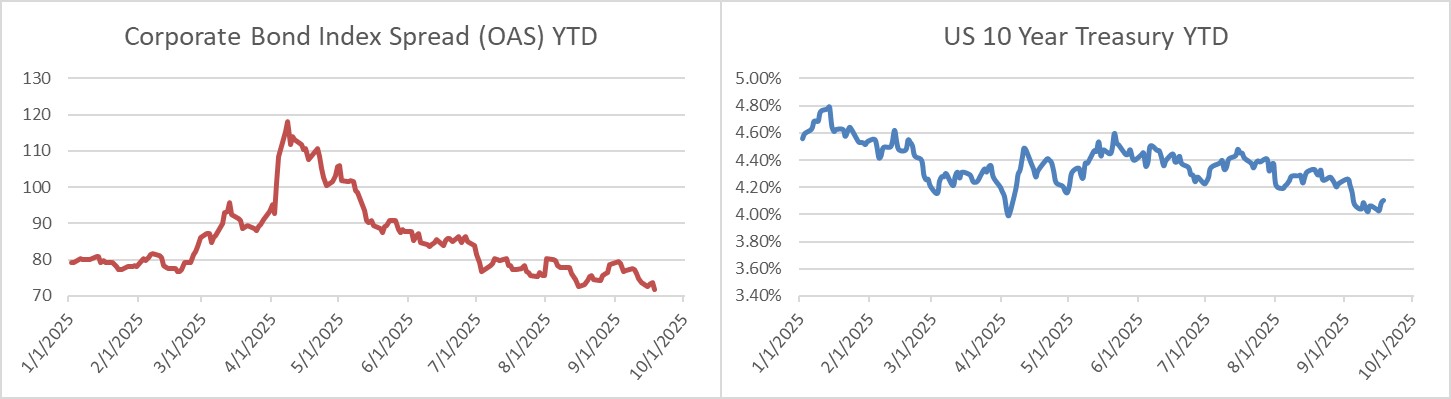

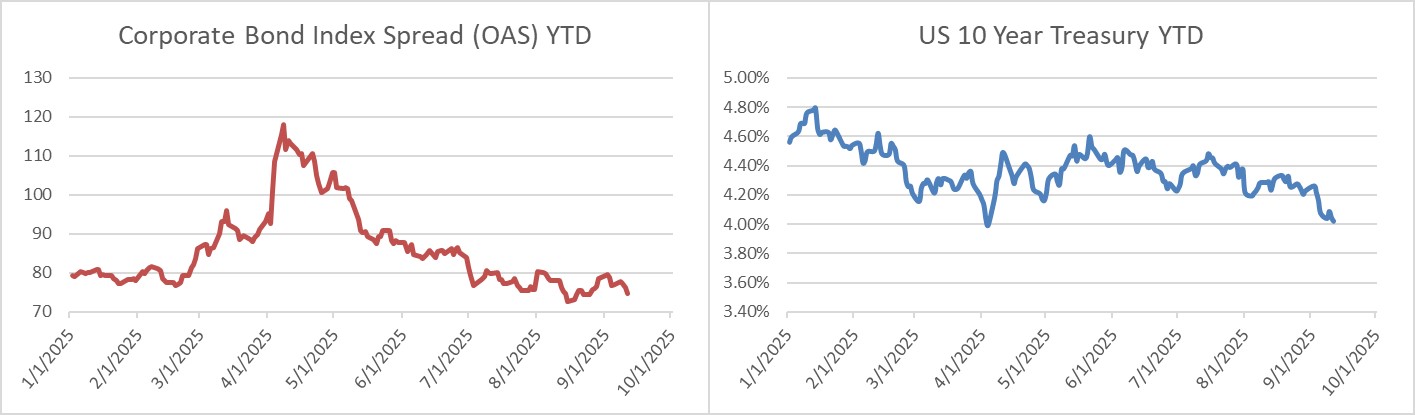

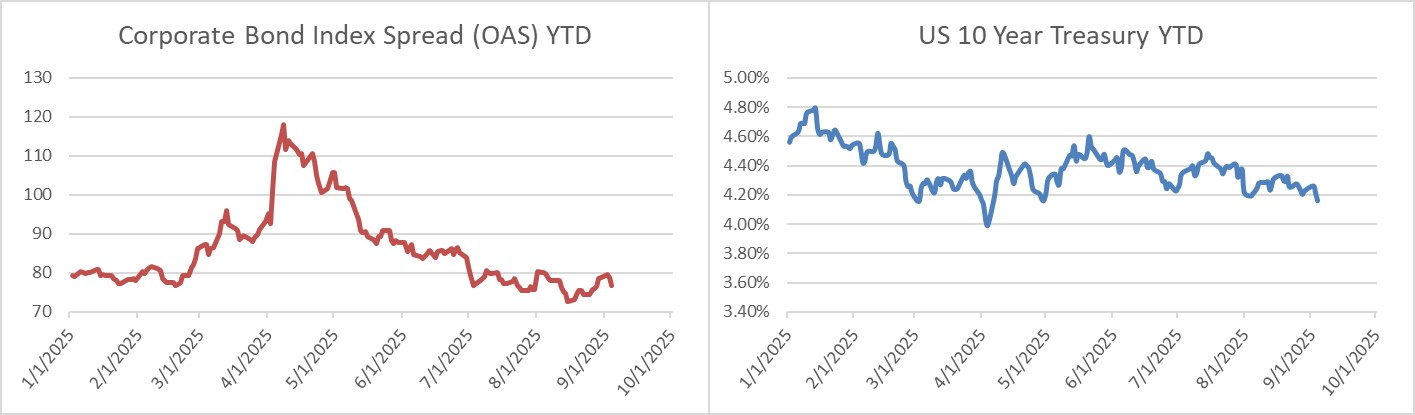

- The supply boom has persisted from early summer, bolstered by attractive yields, tight spreads and a relatively resilient economy against the backdrop of easier interest-rate policy.

- Four more borrowers tapped the market on Thursday for $4.5b, while 18 companies sold bonds this week. This has also been the busiest month overall for issuance since April 2021. It’s on track to be among the top five months on record for new issuance.

- The unrelenting supply tide caused pressure on yields and prices on Thursday, slowing the broad rally that began last week. Gains stalled across ratings amid the huge wave of supply.

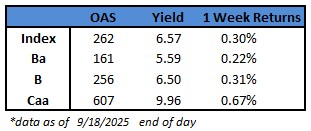

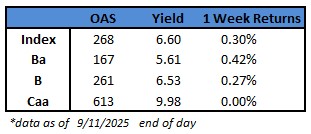

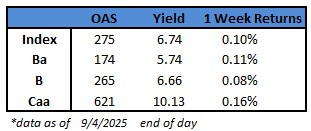

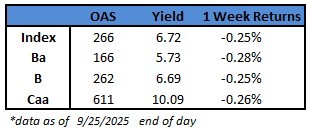

- Yields jumped 10 basis points, the largest one-day increase in more than three weeks, to 6.72%. Spreads widened to 266 basis points, driving the biggest one-day loss in three weeks

- BB yields climbed eight basis points to 5.73%, a three-week high, prompting a loss of 0.22% on Thursday, the most in three weeks. Spreads closed at 166 basis points. CCC yields advanced 12 basis points to cross the 10% mark and close at 10.09%, a two-week high. That fueled a loss of 0.35%, the largest in eight weeks and the most in the high yield market on Thursday.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.