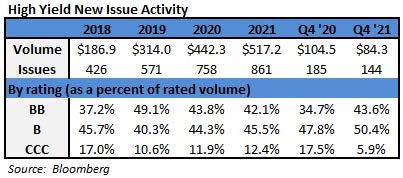

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$2.3 billion and year to date flows stand at -$25.6 billion. New issuance for the week was $1.0 billion and year to date issuance is at $33.2 billion.

(Bloomberg) High Yield Market Highlights

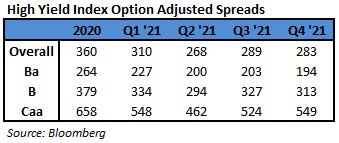

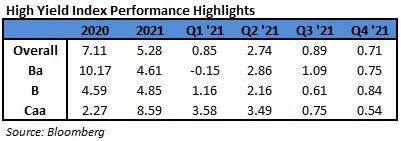

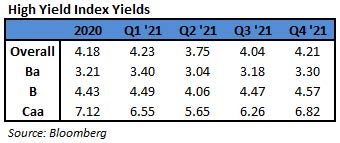

- U.S. junk bonds are headed toward the sixth straight weekly loss as yields jump to a fresh 16-month high of 5.85% amid global market turmoil after Russia’s invasion of Ukraine. This would be the longest losing streak in more than six years.

- The primary market ground to a halt after pricing a little more than $9b this month, the slowest February since 2016. It’s also the slowest start to a year for issuance since 2016, with year- to-date volume at $33b.

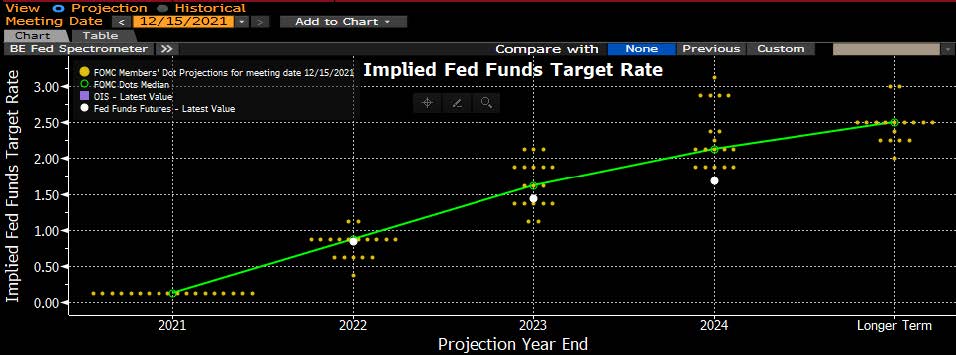

- Rising yields and steady losses in junk bonds across ratings came amid broader market turbulence this year caused by inflation concerns, a hawkish Federal Reserve and geopolitical tensions.

- Given the lack of clarity on macro risks, “risk assets will be under pressure in the near term,” Barlcays’ strategist Brad Rogoff wrote on Friday.

- The BB index, the most rate-sensitive part of the high-yield market, is now set to post its eighth straight weekly loss, the longest period of losses since July 2013, after yields veered toward a 19-month high of 4.83%.

- CCCs, the riskiest part of the junk-bond market, is also headed to end the week with losses. This would be the sixth consecutive week of losses as yields rose to a new 15-month high of 8.53%.

(Bloomberg) What the Russian Invasion Means for Credit

- Russia’s invasion of Ukraine will translate to more trouble for corporate debt, money managers say. Some also wonder if the latest market weakness is a buying opportunity.

- For now, few market participants are taking that risk. Companies postponed bond sales in the U.S. and Europe on Feb. 24 and credit risk gauges surged after Russia invaded Ukraine.

- The military action heightened volatility in global bond markets already roiled by inflation and tightening monetary policy. Now oil prices are rising to their highest levels since 2014, and wheat prices in Paris hit a record. The result of inflation plus slower growth may be stagflation that can be terrible for corporate bondholders.

- “The escalated uncertainty in Ukraine, and the spike in commodity prices, moderates the outlook for global growth and therefore increases the risk for corporate credit,” said Matt Toms, chief investment officer of fixed-income at Voya Investment Management.

- Borrowers who could sell debt easily on any day for much of the last two years are now having to look for windows of relative calm. Price swings in secondary markets are widening.

- New sales of U.S. investment-grade and junk bonds will likely shut down for the remainder of the week, according to people familiar with the matter. BellRing Brands on Feb. 24 withdrew a junk-bond deal that it had started marketing earlier in the week.

- U.S. leveraged loan prices fell 1/2 to a full point in muted secondary trading on Feb. 24, according to people familiar. Meanwhile, a gauge of U.S. credit risk spiked, with the cost to protect a basket of investment-grade dollar bonds against default rising to the highest level since July 2020.

- But even if the global growth picture is concerning, few U.S. companies will be severely affected by the invasion at this stage, investors said.

- “The entire global economy is going to be impacted by Russia and Ukraine, but there’s not really going to be a lot of direct impact in the U.S., in terms of issuers whose results are going to be directly impacted by what’s going on there,” said Jeremy Burton, a portfolio manager at Pinebridge Investments.

- Prices on investment-grade bonds now may end up being a great deal in retrospect, said Nicholas Elfner, co-head of research at Breckinridge Capital Advisors.

- “Keep your eyes on the long-term and don’t get sucked into the abyss of negativity,” Elfner said. “Short-term blips in volatility and weakness in financial markets tend to be long-term buying opportunities.”