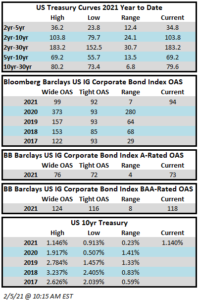

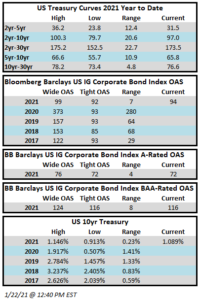

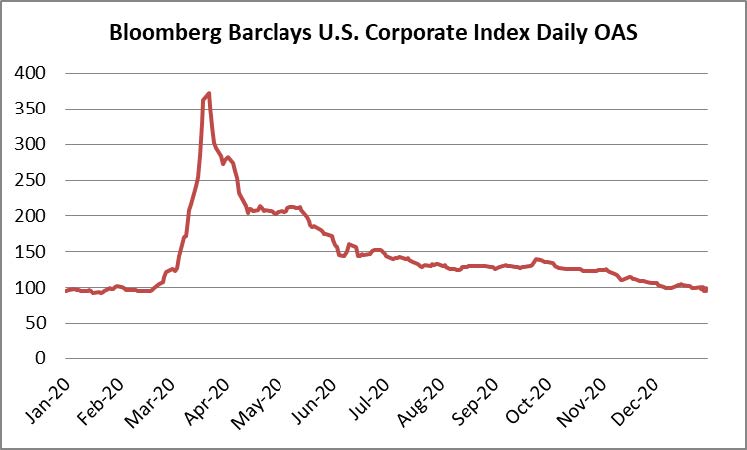

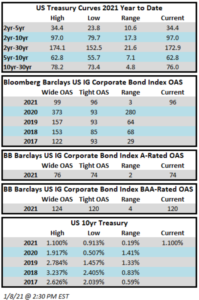

Price action in the corporate bond market this week would best be described as “grabby” with spreads consistently grinding tighter throughout the week. Spreads were wider the week before last but they have since reclaimed that ground that was given up. The Bloomberg Barclays US Corporate Index closed on Thursday February 4 at 94 after closing the week prior at 97. Treasuries are higher across the board this week and curves are at their steepest levels of the year. The 10yr Treasury closed last week at 1.065% and it is 8 basis points higher as we go to print on this Friday morning. Through Thursday, the corporate index had posted a year-to-date total return of -1.61% and an excess return over the same time period of +0.27%.

The high grade primary market saw solid volumes during the week on the back of a jumbo $14bln print from Apple. Over $45bln priced during the week. Year-to-date issuance stands at $172.8 billion. Investor demand for new issuance remains quite strong as the U.S. corporate bond market is one of the last bastions for positive nominal yields globally.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of January 28-February 3 were +$7.9bln which brings the year-to-date total to +$37.9bln.