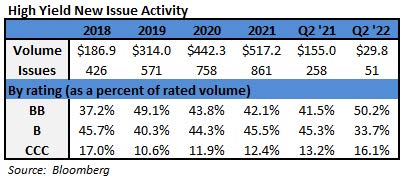

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.4 billion and year to date flows stand at -$53.5 billion. New issuance for the week was $0.7 billion and year to date issuance is at $70.4 billion.

(Bloomberg) High Yield Market Highlights

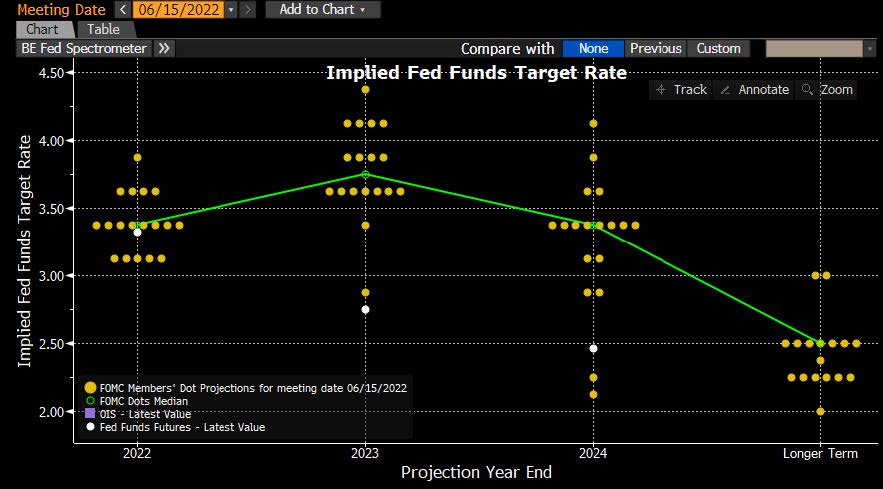

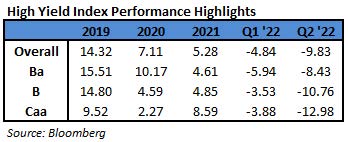

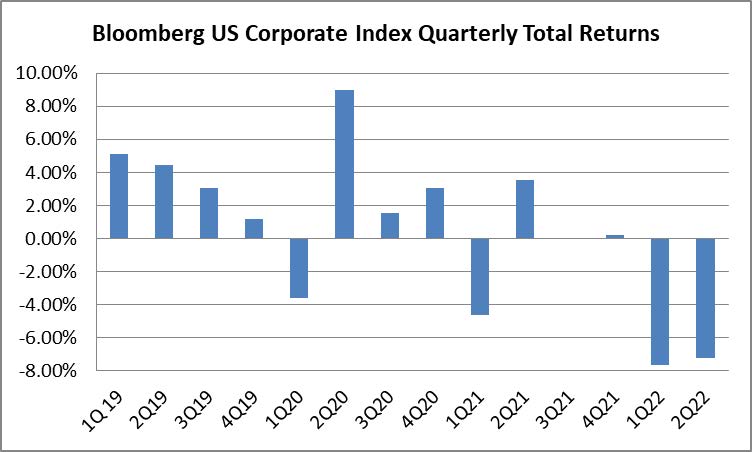

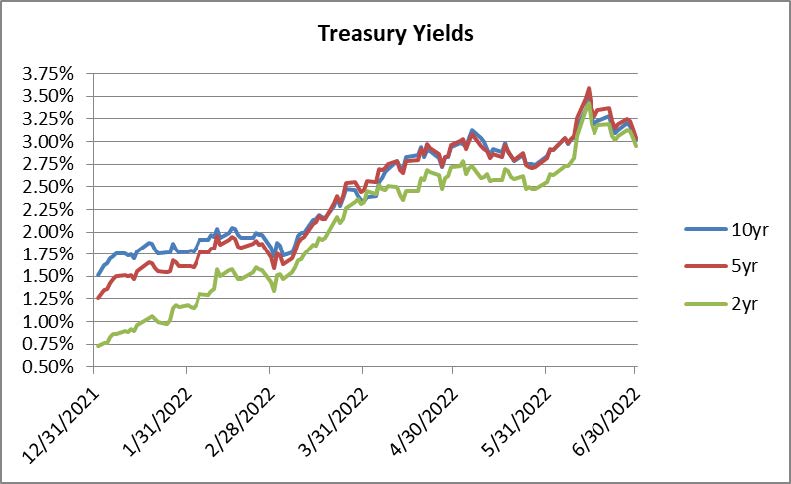

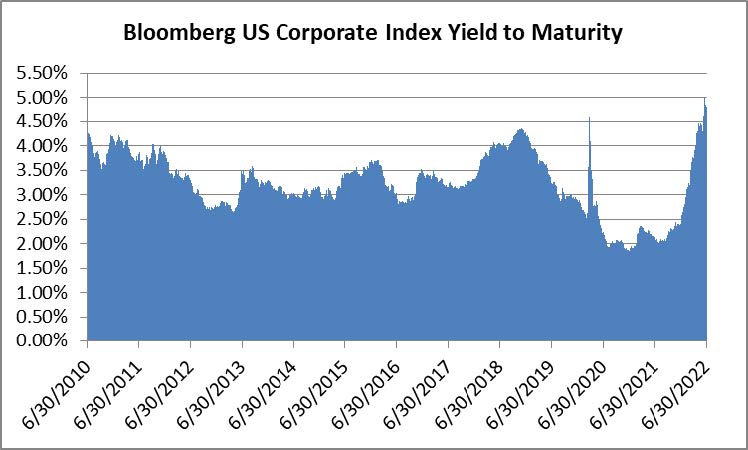

- US junk bonds are headed toward the biggest weekly gains in almost two months, with a 1.97% return, after a steady five-day rally on broad expectations that the Federal Reserve will ease its rate-hike campaign after a potential 75bps-100bps hike in the next meeting. This would be the third straight week of gains and the longest streak since December. The rally enabled CCCs, the lowest tier of the junk bond market, to reverse last week’s losses and post the biggest weekly returns since May 27. CCC yields fell 49bps this week to 13.12%, a three week low.

- The comeback was across ratings. BBs and single Bs were all on track to end the week with the biggest gains in almost two months.

- Junk bond yields have plunged 39bps week-to-date to 8.17%, the biggest such drop in eight weeks, after steadily declining for five consecutive sessions.

- Whether this resurgence from the worst June performance will be sustained would be put to test after the next week’s FOMC meeting.

- The primary remained quiet as borrowers were on a wait-and-watch mode ahead of the next Fed meeting.

- July issuance volume was a mere $1.06b and year-to-date volume was a modest $70b.

- While the junk-bond market has edged higher all week, investors still appear to be withdrawing money from high-yield funds.

- US junk bonds have seen outflows in seven of the last 10 weeks.

- The junk rally may pause on Friday, taking its cue from choppy equity markets. US equity futures fluctuated as European stocks swung between gains and losses as investors looked to second-quarter earnings season to gauge how companies are weathering the impact of surging prices.