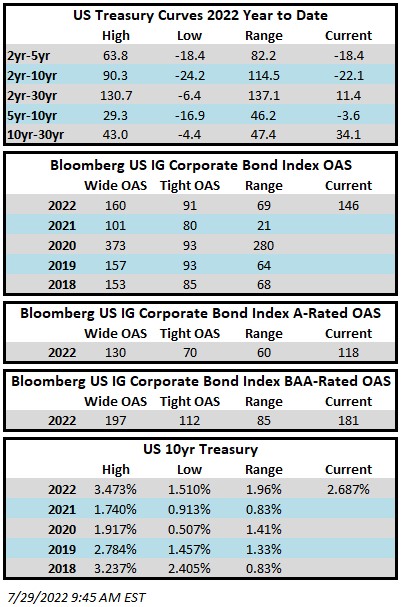

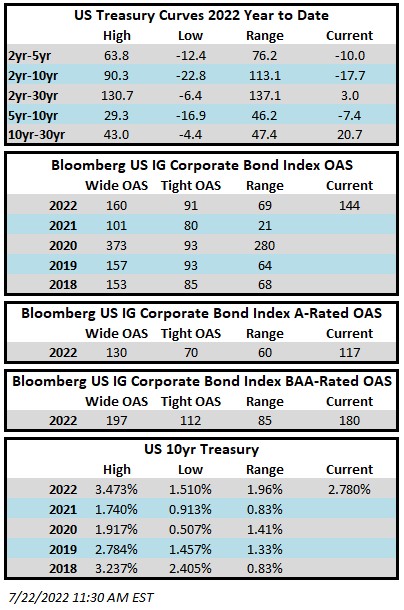

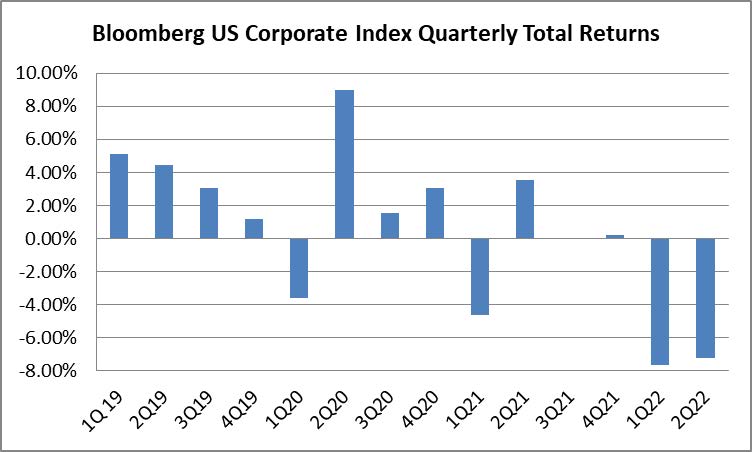

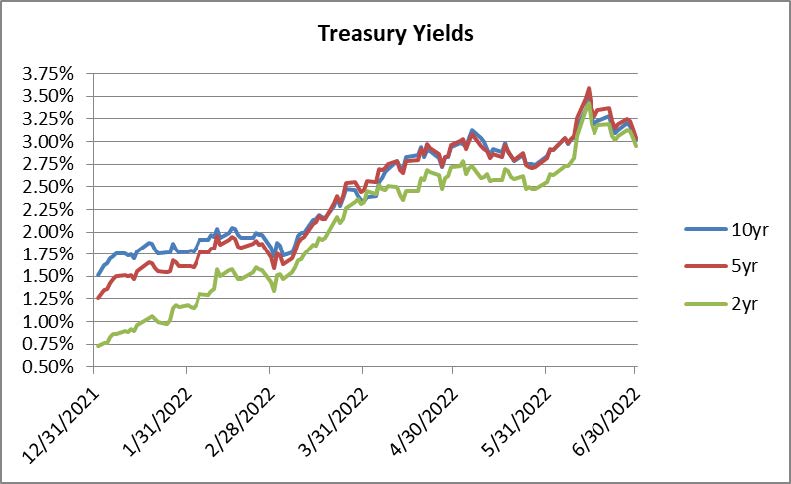

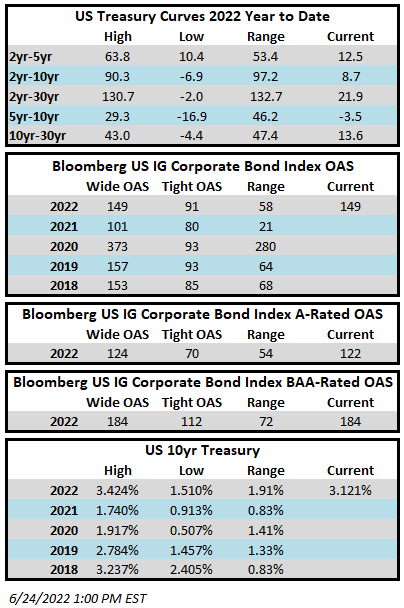

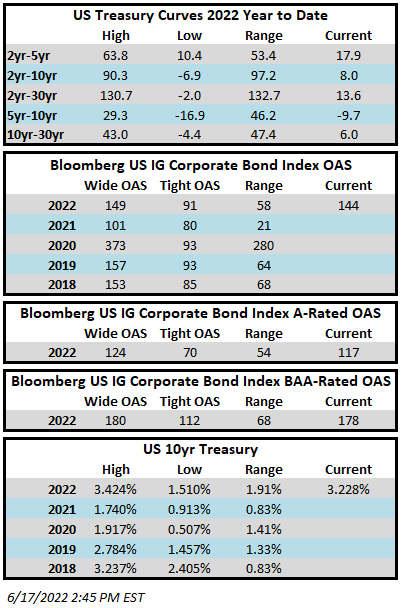

Investment grade credit performance was mixed this week and it looks as though spreads will finish a basis point or two wider. The Bloomberg US Corporate Bond Index closed at 146 on Thursday July 28 after having closed the week prior at 144. The market is better bid as we go to print this Friday morning. The 10yr Treasury is yielding 2.69% after having closed the week prior at 2.75%. Economic data was varied throughout the week and it flowed through to Treasury curves in the form of volatility. The FOMC delivered a 75bps rate hike on Wednesday, in line with expectations. On Thursday, we got an exceptionally weak GDP print relative to expectations. The economy shrank for a second straight quarter but most economists were hesitant to call it a full blow recession and instead the preference at this point is to refer to it as a slowing of economic activity. On Friday the data was more supportive of the economy but less supportive of the Fed and its quest to tame inflation. The Labor Department’s employment cost index and the Commerce Department’s personal consumption price index both posted increases that were larger than forecasts. Through Thursday the Corporate Index had a negative YTD total return of -11.80% while the YTD S&P500 Index return was -13.81% and the Nasdaq Composite Index return was -21.92%.

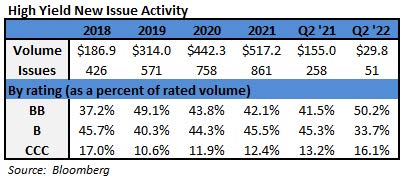

The primary market saw $18.6bln of issuance this week which was on the screws relative to the $15-20bln estimate. The pace of issuance should see a slight acceleration next week so long as the market remains receptive. Street estimates are looking for $25-30bln in issuance which would be considered a fairly brisk week for early August. Expectations for supply during August are in the $70-$80bln range relative to 2021 which saw $86bln in issuance. There has been $803bln of new issuance YTD which trails 2021’s pace by 7% according to data compiled by Bloomberg.

Investment grade credit saw an inflow this week, breaking a 21-week streak of outflows. Per data compiled by Wells Fargo, outflows for the week of July 21–27 were +$0.7bln which brings the year-to-date total to -$126.4bln.