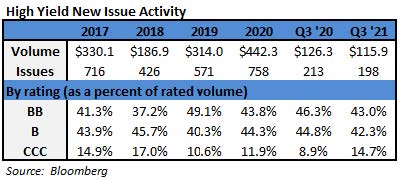

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.6 billion and year to date flows stand at -$1.0 billion. New issuance for the week was $6.0 billion and year to date issuance is at $10.5 billion.

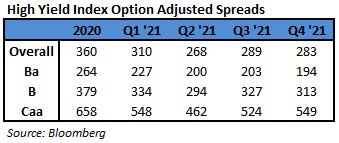

(Bloomberg) High Yield Market Highlights

- The U.S. junk-bond market rebounded from last week’s losses and is on track to end the week with gains, powered by a jump in oil prices and shrugging off outflows from retail funds. The rally boosted the primary market, which has seen $6 billion price.

- The risk-on mood was evident as two first-time issuers came to market. Borrowers sold debt to fund a dividend and buy back shares even as investors pulled cash from U.S. high-yield funds.

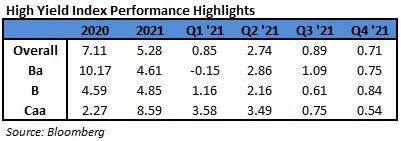

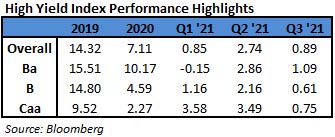

- The broader junk-bond index has made modest gains of 0.28% week-to-date after posting a small loss of 0.05% on Thursday.

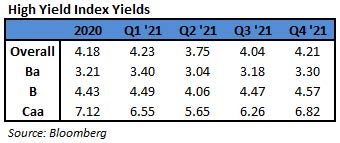

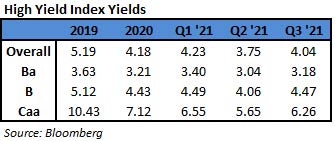

- Junk-bond index yields rose to 4.51% yesterday, up 6bps, and is down 9bps week-to-date.

- The CCC index has gained 0.31% week-to-date after posting a modest loss of 0.02% yesterday.

- CCC yields rose 4bps to close at 6.95%, down 11bps week-to-date.

- The markets may waver as U.S. equity futures fluctuated ahead of the earnings season as investors turn away from inflation concerns and Federal Reserve policy. And oil, meanwhile, headed for a fourth straight weekly gain, the longest streak since October.

(Bloomberg) U.S. Inflation Hits 39-Year High of 7%, Sets Stage for Fed Hike

- U.S. consumer prices soared last year by the most in nearly four decades, sapping the purchasing power of American families and setting the stage for the Federal Reserve to begin hiking interest rates as soon as March.

- The consumer price index climbed 7% in 2021, the largest 12-month gain since June 1982, according to Labor Department data released Wednesday. The widely followed inflation gauge rose 0.5% from November, exceeding forecasts.

- Excluding the volatile food and energy components, so-called core prices accelerated from a month earlier, rising by a larger-than-forecast 0.6%. The measure jumped 5.5% from a year earlier, the biggest advance since 1991.

- The increase in the CPI was led by higher prices for shelter and used vehicles. Food costs also contributed. Energy prices, which were a key driver of inflation through most of 2021, fell last month.

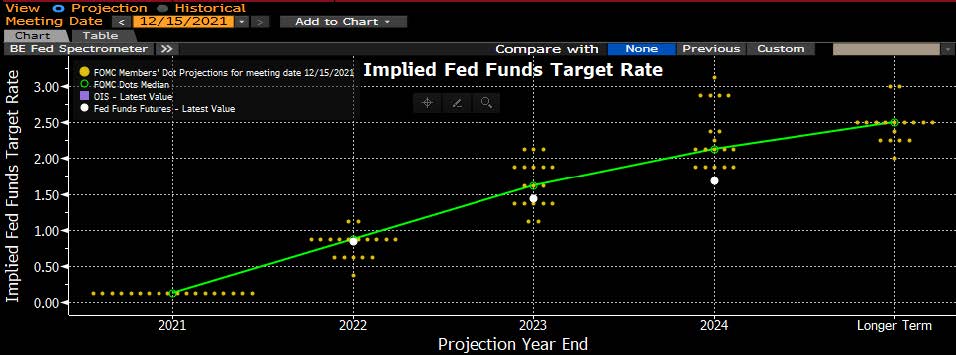

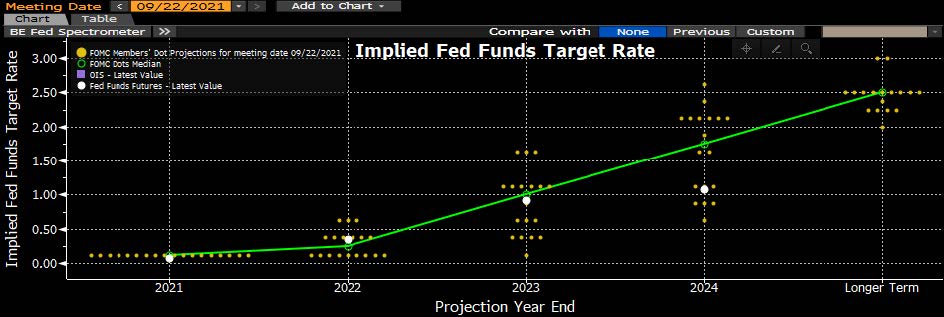

- The data bolster expectations that the Fed will begin raising interest rates in March, a sharp policy adjustment from the timeline projected just a few months ago. High inflation has proven more stubborn and widespread than the central bank predicted amid unprecedented demand for goods along with capacity constraints related to the supply of both labor and materials.

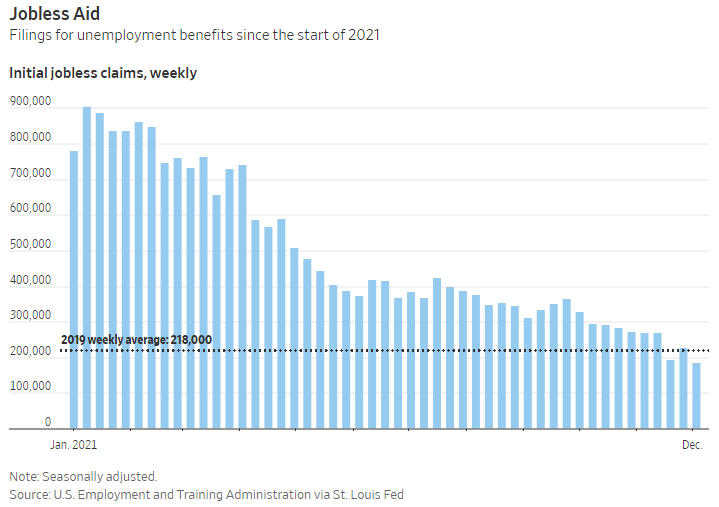

- Meanwhile, the unemployment rate has now fallen below 4%. Against this evolving backdrop, some Fed policy makers have said that it could be appropriate to begin shrinking the central bank’s balance sheet soon after raising rates.

- “In terms of where the Fed is on their dual mandate — inflation and the labor market — they’re basically there,” Michael Gapen, chief U.S. economist at Barclays Plc, said on Bloomberg Television. “I don’t really think anything stops them going in March except one of these kind of outlier events. I think they’re ready.”

(Bloomberg) U.S. Retail Sales Slide Most in 10 Months on Inflation, Omicron

- U.S. retail sales slumped in December by the most in 10 months, suggesting the fastest inflation in decades is taking a greater toll on consumers just as the nation confronts more coronavirus infections.

- The value of overall purchases decreased 1.9%, after a revised 0.2% gain a month earlier, Commerce Department figures showed Friday.

- The median estimate in a Bloomberg survey called for a 0.1% drop in overall retail sales from the prior month.

- The year-end slide in retail purchases sets up for a tepid handoff to the first quarter. Combined with the impact from the omicron variant, which is denting outlays for services such as travel and dining out, the figures help explain why economists project household spending to soften.

- Furthermore, falling price-adjusted wages, dwindling savings and the end of the government’s pandemic-related financial programs suggest a more moderate pace of spending.

- December, at the tail end of the holiday-shopping season, is traditionally a solid month for retail sales. However, concerns about shipping delays prompted many consumers to shop earlier than usual to ensure gifts arrived on time. Because the figures are adjusted for seasonal variations, the earlier shopping may have contributed to the weaker-than-expected figures.

(Bloomberg) Fed’s Brainard Says Curbing Inflation Is ‘Most Important Task’

- Federal Reserve Governor Lael Brainard said tackling inflation and getting it back down to 2% while sustaining an inclusive recovery is the U.S. central bank’s most pressing task.

- “Inflation is too high, and working people around the country are concerned about how far their paychecks will go,” Brainard said in remarks prepared for a confirmation hearing before the Senate Banking Committee. “Our monetary policy is focused on getting inflation back down to 2% while sustaining a recovery that includes everyone. This is our most important task.”

- Brainard was nominated by President Joe Biden to serve as Fed vice chair.