(Bloomberg) High Yield Market Highlights

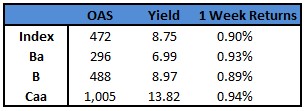

- US junk bonds are headed to close the month with modest gains even after a tumultuous two-week stretch fueled by instability in the banking industry. All told, junk bonds have managed to rebound from February losses that were spurred by fears that aggressive interest-rate hikes would trigger a recession. Spreads tightened and yields dropped in the last two weeks, helped by market expectations that the Fed’s policy-tightening campaign has peaked. Spreads fell from 509 bps to 472, a 37 bps fall since March 17. Yields tumbled from near 9% to 8.75% over the same period.

- The recent banking turmoil, however, has bifurcated the market into high- and low-risk segments, with BBs, the highest rating in the junk universe, poised to post gains of 1.16% as yields tumbled 14 bps month-to-date to around 6.99%.

- CCC spreads, the riskiest of junk bonds, were still in the distress zone of +1,005. They are on track to post the biggest monthly loss since September of last year. The month-to-date losses are 2.12%. Yields jumped 50bps month-to-date to close at 13.82%.

- As spreads and yields stabilized after the banking turmoil, the primary market doors cracked open with a bit on new issuance.

- All told, US junk bonds are headed to end the quarter with gains of 2.71%. Despite a loss for the month, CCCs are still ready to close the quarter with the biggest gains since the second quarter 2021, thanks to an earlier advance in January.

- The first quarter supply is at $38.875b, the lowest since first quarter of 2016. March priced $4.8b, the lowest March tally since 2020.

- The market may extend the rally on a broader risk-on move as US equity futures climb and stocks were headed for a second quarterly gain, underscoring investor optimism in the face of banking turmoil and elevated interest rates.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.