(Bloomberg) High Yield Market Highlights

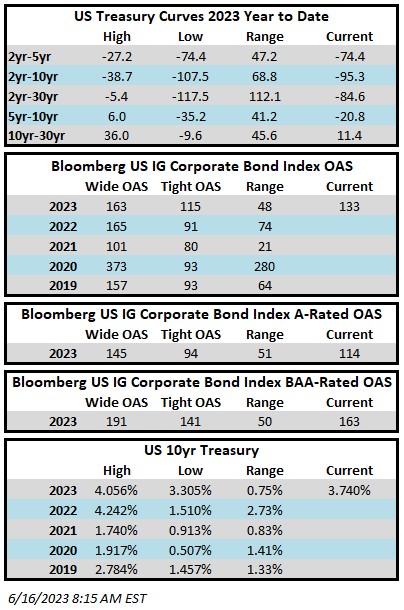

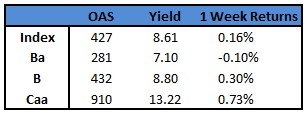

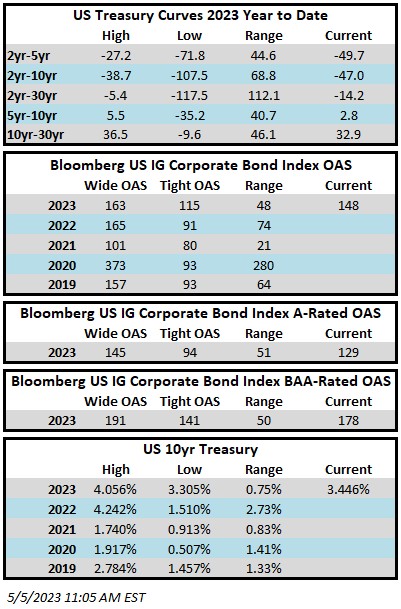

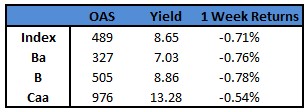

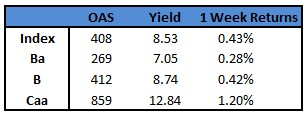

- The US junk bond market is headed toward the third week of gains largely propelled by the riskiest part of the junk market even after the Federal Reserve left the door open for future hikes. The CCC segment is on track for the biggest weekly gains since mid-April at 1.2%. Easing concerns about an imminent recession after Fed revised the growth forecast for 2023 to 1% — up from the March projection of 0.4% — pushed CCC yields to a four-month low of 12.84% after steadily declining for seven sessions in a row. That’s the longest falling streak since mid-January. CCC spreads also dropped to a four-month nadir of 859 basis points after falling for three consecutive sessions.

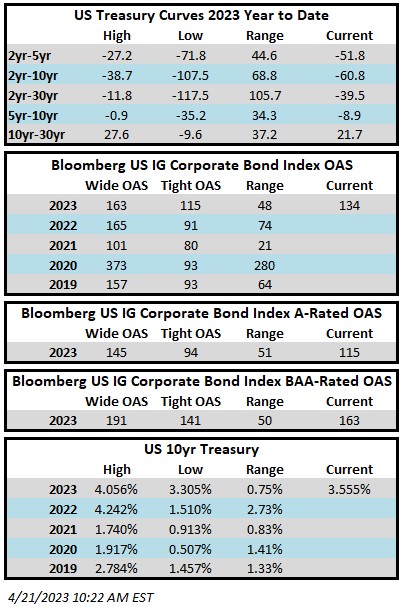

- US junk bonds rallied across the board. Yields tumbled to a six-week low of 8.53%. Spreads closed at 408 basis points.

- BB yields fell to a two-week low of 7.05% and single-Bs to a six- week low of 8.74%.

- BBs extended gains for the third straight session, with week-to-date returns at 0.28%. Single Bs rallied for six sessions in a row and are on track post gains for the third consecutive week, with week-to-date returns at 0.42%.

(Bloomberg) JPMorgan’s Michele Says Exit ‘Cash Trap’ for Bonds on Rate Call

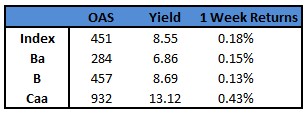

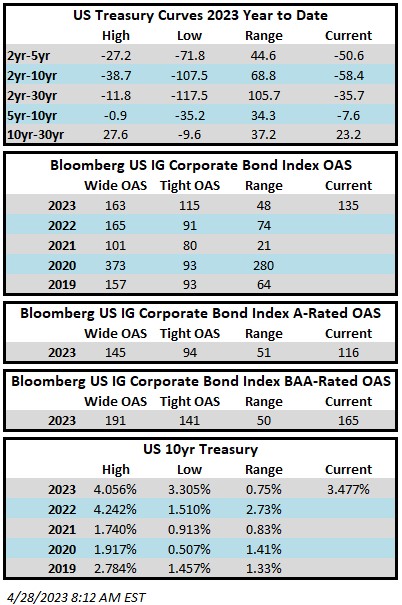

- It’s time to exit the “cash trap” of money market funds and move into bonds as the Federal Reserve is set to pause its rate-hike campaign and then cut as soon as September, according to Wall Street veteran Bob Michele.

- “If we are right and we’ve seen the last Fed rate hike and the market starts pricing in rate cuts and they start cutting rates, then those cash returns will start to evaporate,” Michele told Bloomberg Television’s The Open on Wednesday. With a switch to bonds, “you will have locked in not only the carry but will also get some capital appreciation,” he said.

- The chief investment officer for global fixed income at JPMorgan Investment Management Inc., who has previously recommended five-year Treasuries and US investment-grade corporate bonds, said the central bank is set to hold rates “where they are” when its policy-setting committee meets on Wednesday. Michele sees the US economy entering a recession within a year as unemployment rises.

- “Unemployment at 4.5% is recession, I don’t think there’s ever been a jump of 1.1% in unemployment and the NBER (National Bureau of Economic Research) hasn’t come in and said we’re in recession,” Michele said. “So the Fed is predicting recession there.”

- Price pressures haunting the Fed will continue to fade, according to Michele, who sees the disinflationary trend as “intact.” Tuesday’s consumer price index report showed inflation decelerating, followed by US producer prices declining in May, bolstering expectations that the Fed will be on hold this month.

- The market for wagers on the outlook for central bank policy shows traders now expect the benchmark rate to peak in September, instead of July.

- “We have never gone from the last rate hike to recession without the Fed cutting rates before then,” Michele said. “If everything we are seeing is telling us a recession by year-end, I am still sticking with September as the first rate cut.”

(Bloomberg) Powell Says Nearly All Officials Expect ‘Some’ Further Fed Hikes

- Federal Reserve officials paused on Wednesday following 15 months of interest-rate hikes but signaled they would likely resume tightening at some point to cool inflation.

- “Holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy,” the Federal Open Market Committee said in a statement released in Washington Wednesday.

- The decision left the benchmark federal funds rate in a target range of 5% to 5.25%.

- The FOMC vote was unanimous. Of the 18 policymakers, 12 penciled in rates at or above the median range of 5.5% to 5.75%, showing most policymakers agree further tightening is needed to contain price pressures. The forecasts imply officials expect two additional quarter-point rate hikes or one half-point increase before the end of the year.

- Chair Jerome Powell said nearly all Fed officials expect it will be appropriate to raise interest rates “somewhat further” in 2023 to bring down inflation. He declined to say whether another hike could come as soon as July.

- “Inflation pressures continue to run high and the process of getting inflation back down to 2% has a long way to go,” Powell said at a post-meeting press conference.

- The committee “judged it prudent” to hold rates steady this month given how quickly rates have risen, he added, saying the pause is a continuation of the moderating pace of policy measures.

- “We’ve covered a lot of ground and the full effects of our tightening have yet to be felt,” the Fed chief said.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.