(Bloomberg) High Yield Market Highlights

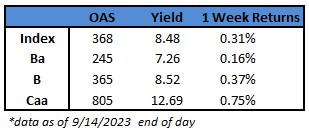

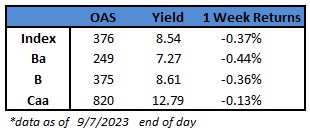

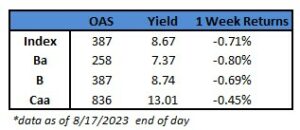

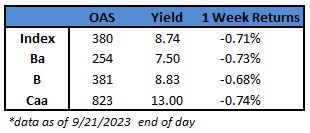

- US junk bonds posted a loss of 0.5% on Thursday, the biggest one-day drop since July, as yields jumped to a roughly four-week high of 8.74% amid a decline in equities.

- The losses spanned all high yield ratings after latest data showed that initial jobless claims dropped, suggesting that a resilient labor market will reinforce the Federal Reserve’s position of keeping rates higher for longer, fueling further increases in borrowing costs in the coming months.

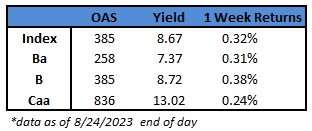

- The US high yield market is headed for the worst weekly loss since mid-August.

- The week-to-date losses are at 0.71%, reversing last week’s gains.

- CCCs, the riskiest part of the high yield market, were the worst performers on Thursday, with negative returns of 0.56%. CCCs are headed toward a weekly loss of 0.74%, the biggest in more than a month.

- CCC yields have surged to four-week high of 13%, rising for last five sessions.

- BB yields climbed to a 10-month high of 7.50%, after one-day loss of 0.52%.

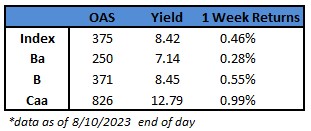

- US borrowers rush to the market amid uncertainty about the impact of rates remaining higher for longer. The week-to-date supply is almost $16b.

- The high-yield pipeline is building up as companies try to borrow before yields rise further with the Fed’s higher-for-longer policy.

- The current environment is favorable for credit, with high yields, above-trend growth, decent credit fundamentals, and positive technicals, Brad Rogoff and Dominique Toublan at Barclays wrote this morning.

- They have revised their spread forecast for 2023 to 400-425 basis points from 475-500.

- This implies that all-in yields will remain in the high 8% area for high yield, Barclays wrote.

(Bloomberg) Fed Leaves Rates Unchanged, Signals Another Hike This Year

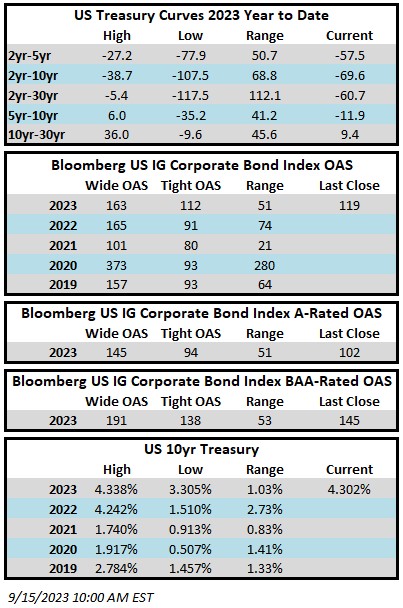

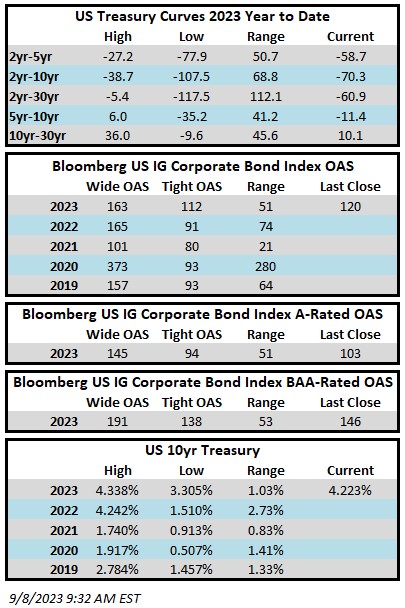

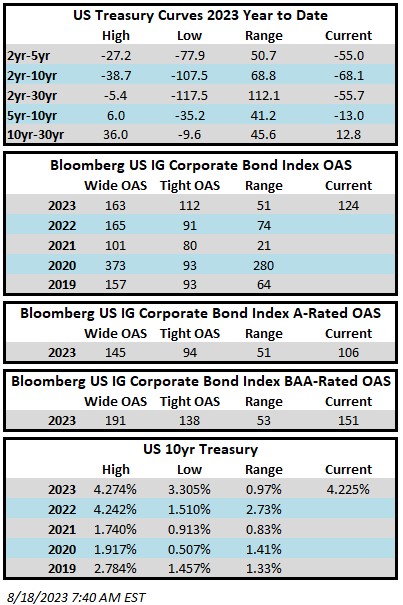

- The Federal Reserve left its benchmark interest rate unchanged while signaling borrowing costs will likely stay higher for longer after one more hike this year.

- The US central bank’s policy-setting Federal Open Market Committee, in a post-meeting statement published Wednesday in Washington, repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.”

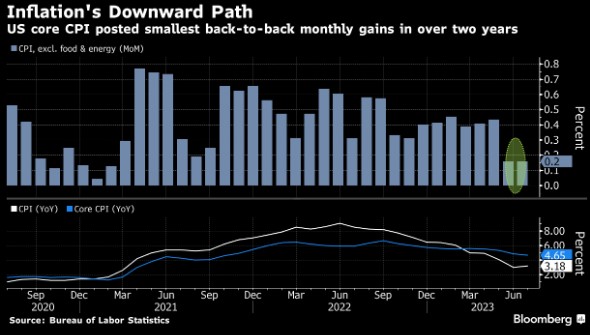

- Fed Chair Jerome Powell said officials are “prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective.”

- The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while updated quarterly projections showed 12 of 19 officials favored another rate hike in 2023, underscoring a desire to ensure inflation continues to decelerate.

- “We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to our 2% goal over time,” Powell said at a press conference following the decision.

- He emphasized the Fed will “proceed carefully” as it assesses incoming data and the evolving outlook and risks, echoing remarks he made at the Fed’s annual symposium in Jackson Hole, Wyoming last month.

- “We’re fairly close, we think, to where we need to get,” Powell said.

- Fed officials also see less easing next year than they expected in June, according to the new projections, reflecting renewed strength in the economy and labor market.

- They now expect it will be appropriate to reduce the federal funds rate to 5.1% by the end of 2024, according to their median estimate, up from 4.6% when projections were last updated in June. They see the rate falling thereafter to 3.9% at the end of 2025, and 2.9% at the end of 2026.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.