(Bloomberg) High Yield Market Highlights

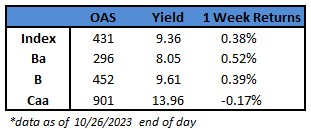

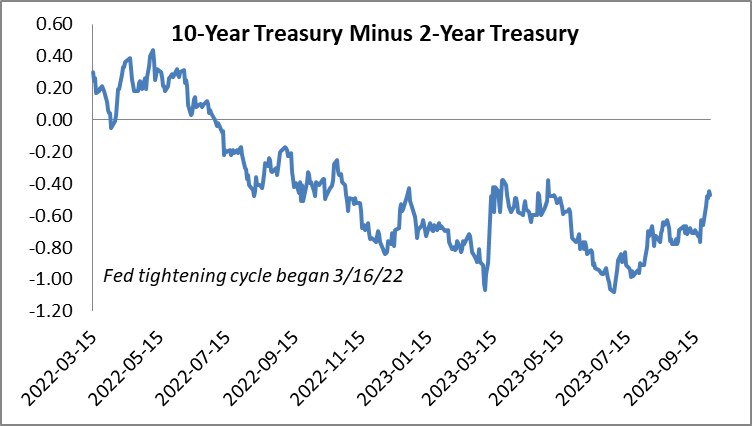

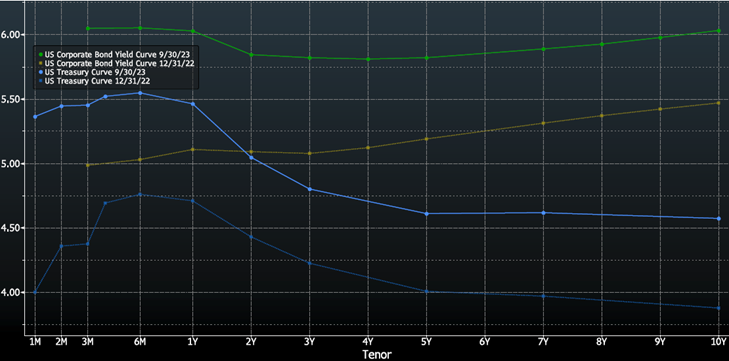

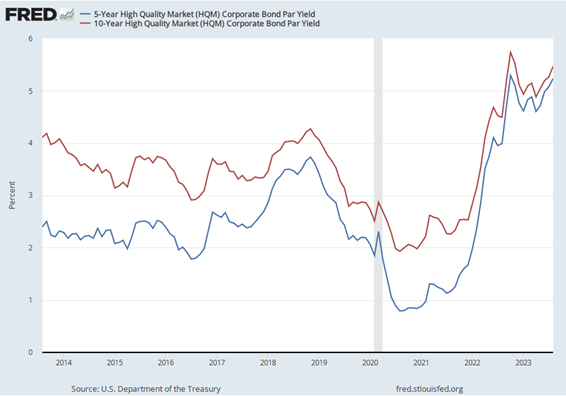

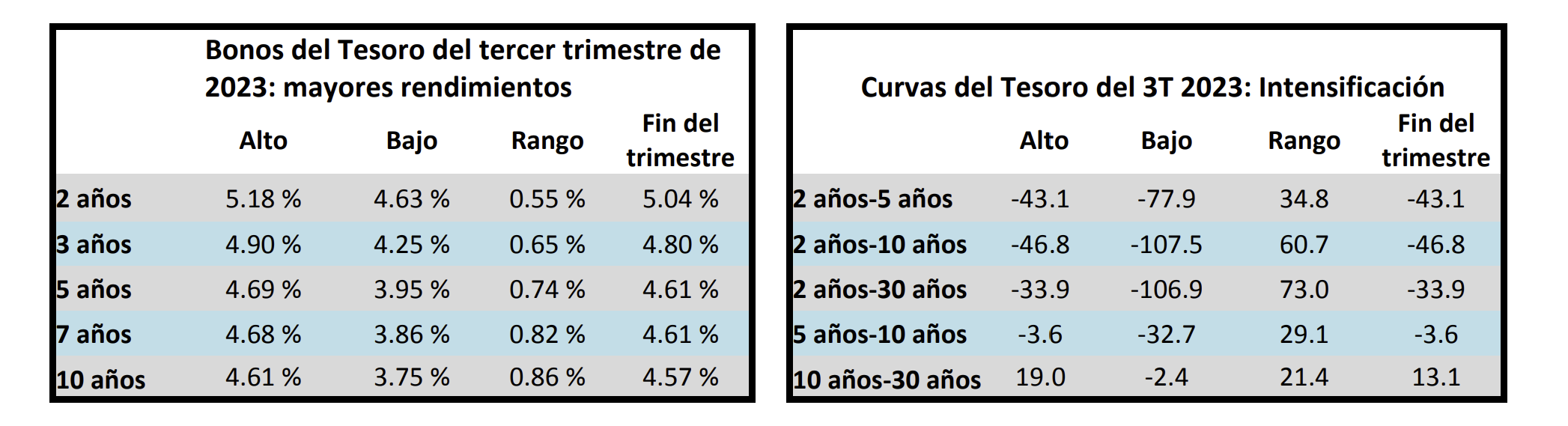

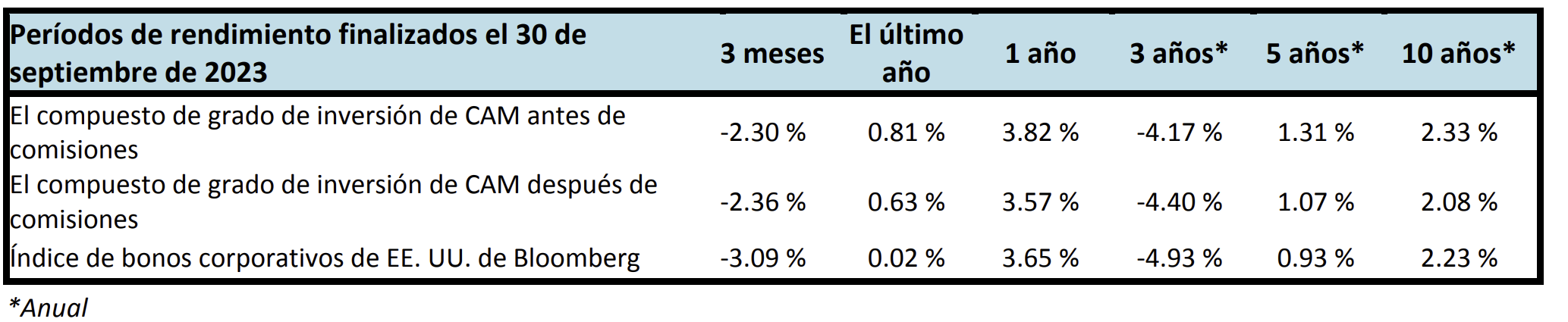

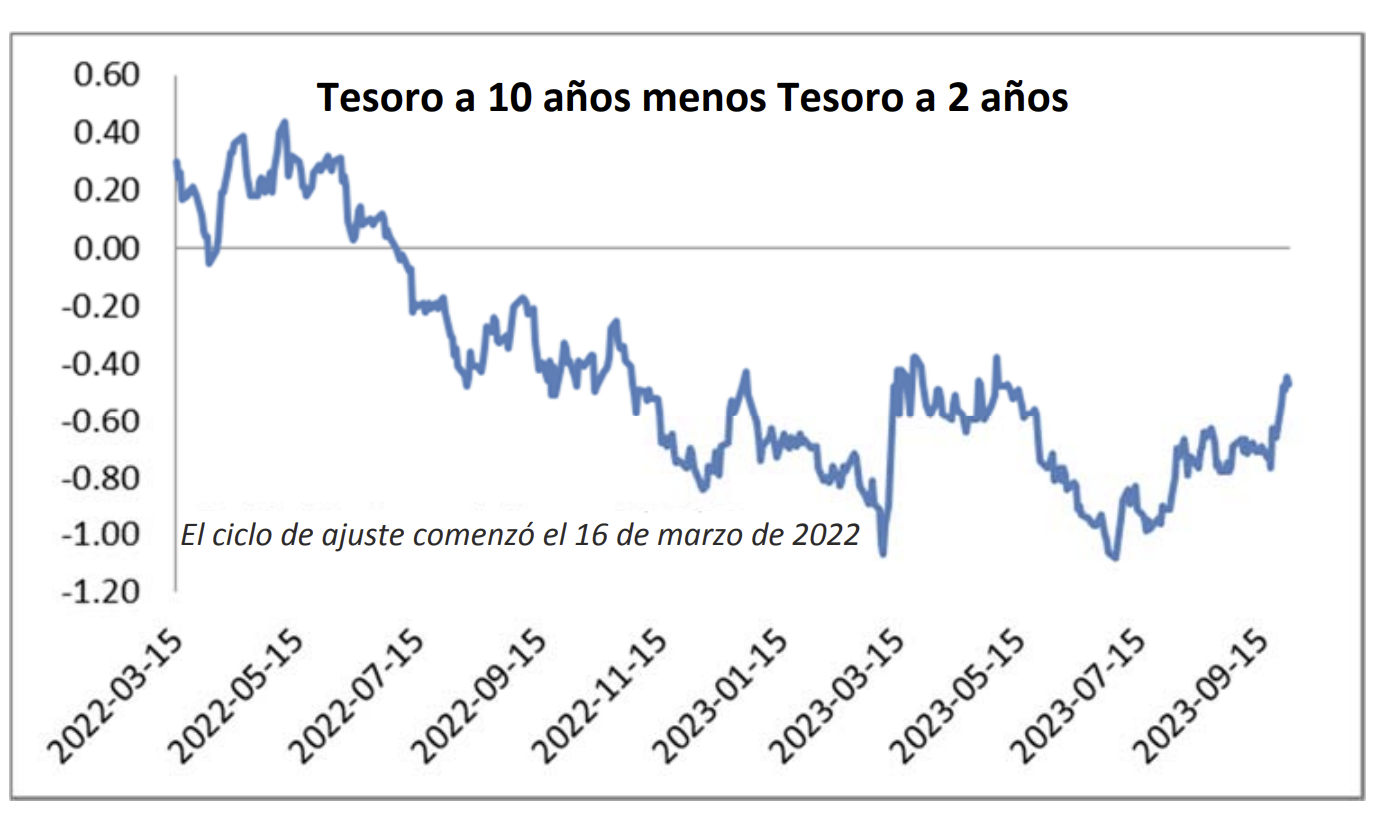

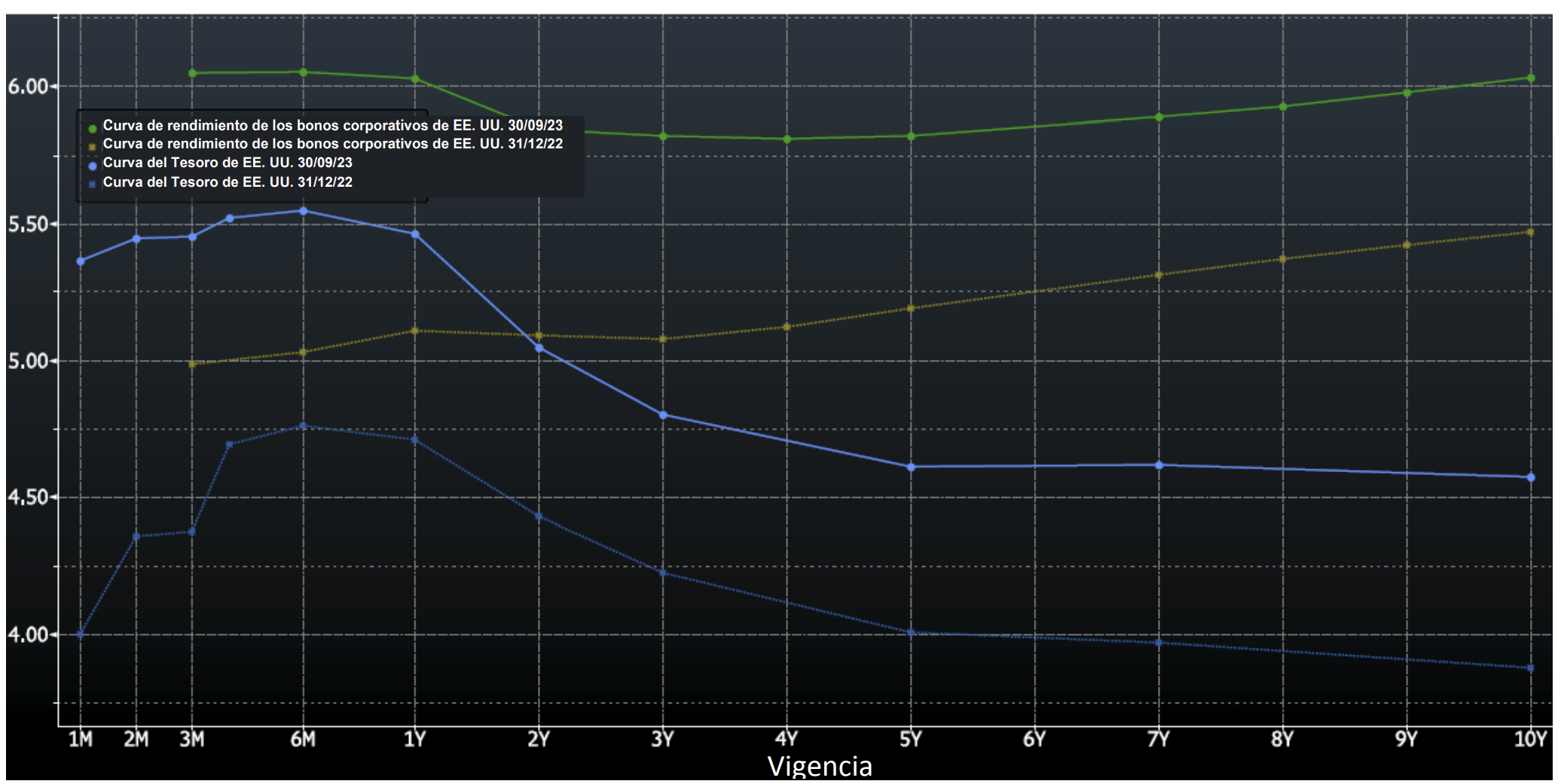

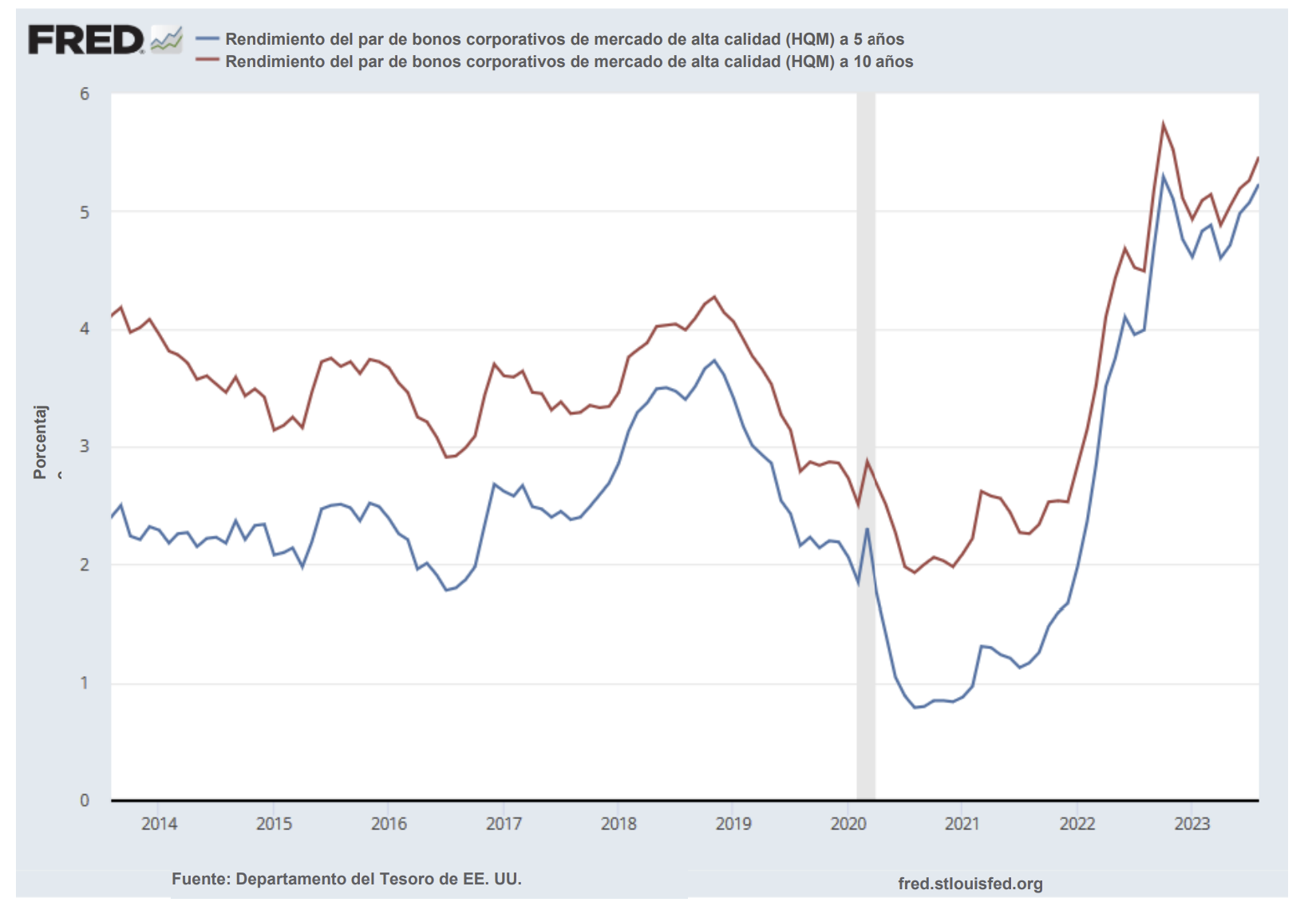

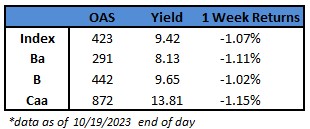

- US junk bonds scored the biggest one-day gains in nine months, driving yields lower across ratings a day after Federal Reserve Chair Jerome Powell hinted the central bank may now be finished with the most aggressive tightening cycle in four decades. The Fed implied that the recent run-up in long-term Treasury yields reduced the impetus to raise rates again. 10-year Treasury yields dropped by another eight basis points to 4.66%.

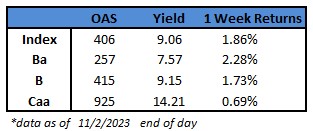

- The gains in the US junk bond market spanned across ratings after US labor productivity advanced by the most in three years, softening the inflationary impact of rising wages. CCCs, the riskiest tier of the high yield market, notched the biggest one-day gains since early February. Spreads ended the six-day widening streak and narrowed 50 basis points to 925, the biggest drop in three weeks.

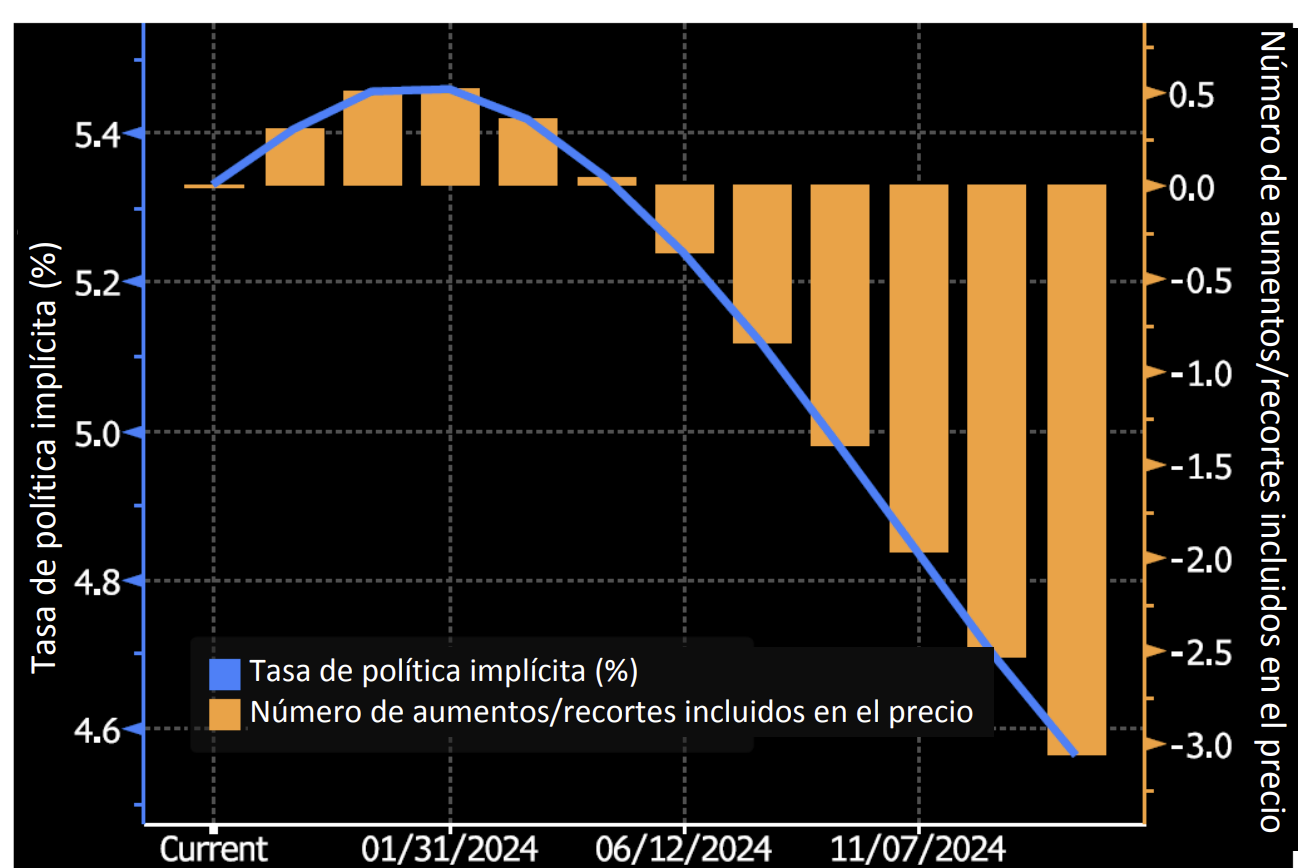

- Bloomberg economists led by Anna Wong reiterated that the FOMC policy statement was dovish overall in the post meeting review on Thursday. Fed officials have not interpreted the strong third-quarter growth numbers as a blowout suggesting that the Federal Reserve was inclined to go on an “ extended rate pause”.

- The Fed held interest-rates steady at 5.25%-5.5% range in the face of tightening financial and credit conditions. However, Powell’s dovish pivot based on market tightening may effectively loosen financial conditions, Barclays strategists Bradley Rogoff and Dominique Toublan wrote in a Friday note.

- Average speculative-grade yields fell 31 basis points to 9.06%, the biggest one-day drop in more than four months.

- Riskiest junk bonds yields tumbled by 49 basis points to 14.21%.

- BBs rallied to record the biggest one-day returns in almost 12 months, with gains of 1.11% on Thursday. BB yields closed at 7.54%, a five-week low.

(Bloomberg) US Jobs Data Show Broad Cooling After Run of Surprise Strength

- US job growth slowed by more than expected and the unemployment rate rose to an almost two-year high of 3.9%, indicating that employers’ strong demand for workers is beginning to cool.

- Nonfarm payrolls increased 150,000 in October following downward revisions to the prior two months, a Bureau of Labor Statistics report showed Friday. Monthly wage growth slowed.

- The latest figures suggest some cracks are beginning to form in a jobs market that has been gradually normalizing, thanks to an improvement in labor supply over the past year and a tempering in the pace of hiring.

- The rise in the unemployment rate points to a pickup in layoffs — a development employers had so far broadly avoided. The survey of households showed a more than 200,000 increase in those who lost their job or completed a temporary one.

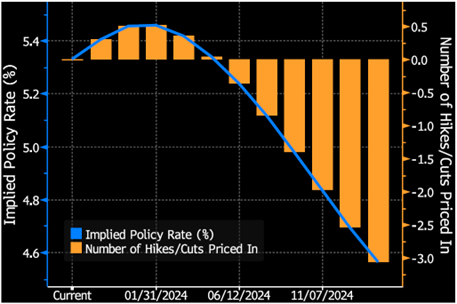

- As investors judged it more likely the Federal Reserve is finished with its run of interest-rate hikes, traders marked down chances of a rate increase in coming months and boosted bets on an earlier cut next year.

- Health care and social assistance, as well as government, drove the payrolls gain. Other categories, however, showed tepid growth or outright declines. Manufacturing payrolls fell by 35,000 in October, largely a reflection of the United Auto Workers union strike. The hit will prove temporary though, given union members have since struck tentative deals with the nation’s largest automakers.

- Easing demand for workers is putting downward pressure on wage growth. Average hourly earnings rose 0.2% last month and were up 4.1% from a year earlier, the smallest annual advance since mid-2021. Earnings for nonsupervisory employees, who make up the majority of workers, increased 0.3% for a second month.

- The jobs report is composed of two surveys: one of households and one of businesses. While both showed signs of weakening, the households poll was particularly concerning, due to rising unemployment, declining participation and a drop in the number of employed workers.

- The smaller gain in payrolls, combined with slower wage growth and a drop in hours worked, led a broad measure of labor market health to stagnate. Moreover, a gauge of take-home pay declined by the most since the start of 2022.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.