(Bloomberg) High Yield Market Highlights

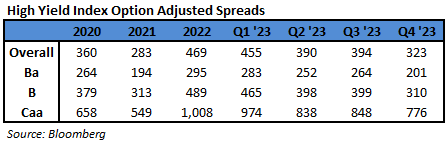

- After a bumpy start to the year, US junk bonds are headed for their third straight week of gains, propelled by CCCs, the riskiest tier of the high yield market.

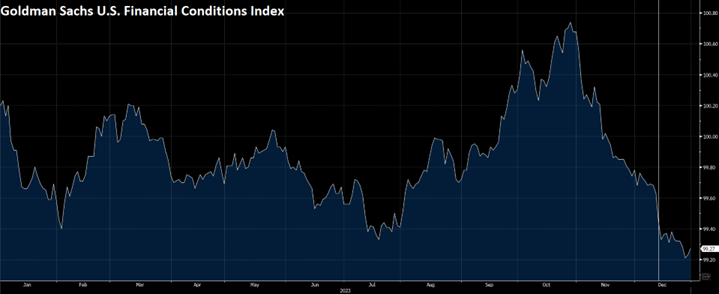

- Gains spanned across the market, spurred by economic growth backed by strong labor market, expanding business activity and cooling inflation data, brushing off Federal Reserve officials’ chorus reiterating that the central bank is not in a hurry to ease monetary policy.

- Risk assets were mostly higher this week, along with yields, as earnings results remained largely positive, Barclays’ Brad Rogoff and Dominique Toublan wrote on Friday

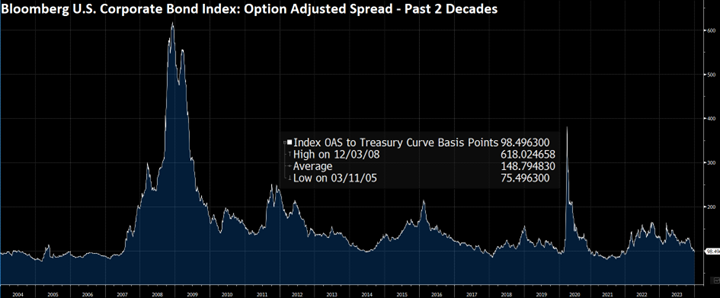

- With macro data still benign, spreads should continue to react to yield moves as the incremental buyer is yield-focused, they wrote

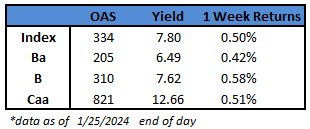

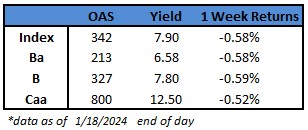

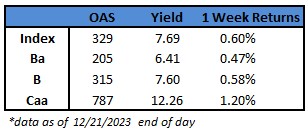

- CCC yields fell 11 basis points week-to-date to 12.45%, the biggest weekly decline within the high yield market. CCCs are on track to be the best performing asset in the US junk bond market, with week-to-date gains of 0.32%

- The rally gained legs as fears of a recession receded in the backdrop of continuing strength in the labor market as US unemployment claims fell for the first time in three weeks

- The broader US high yield index yield rose by three basis points to 7.79%. The rally in CCCs drove the modest gains in broader index

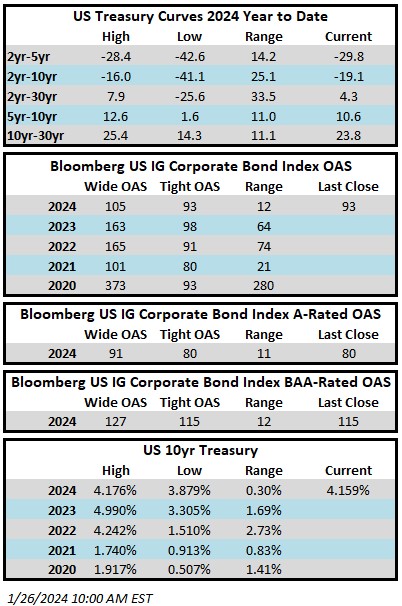

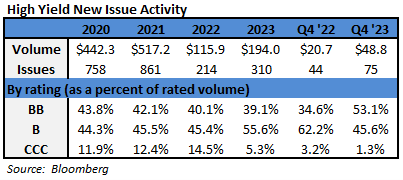

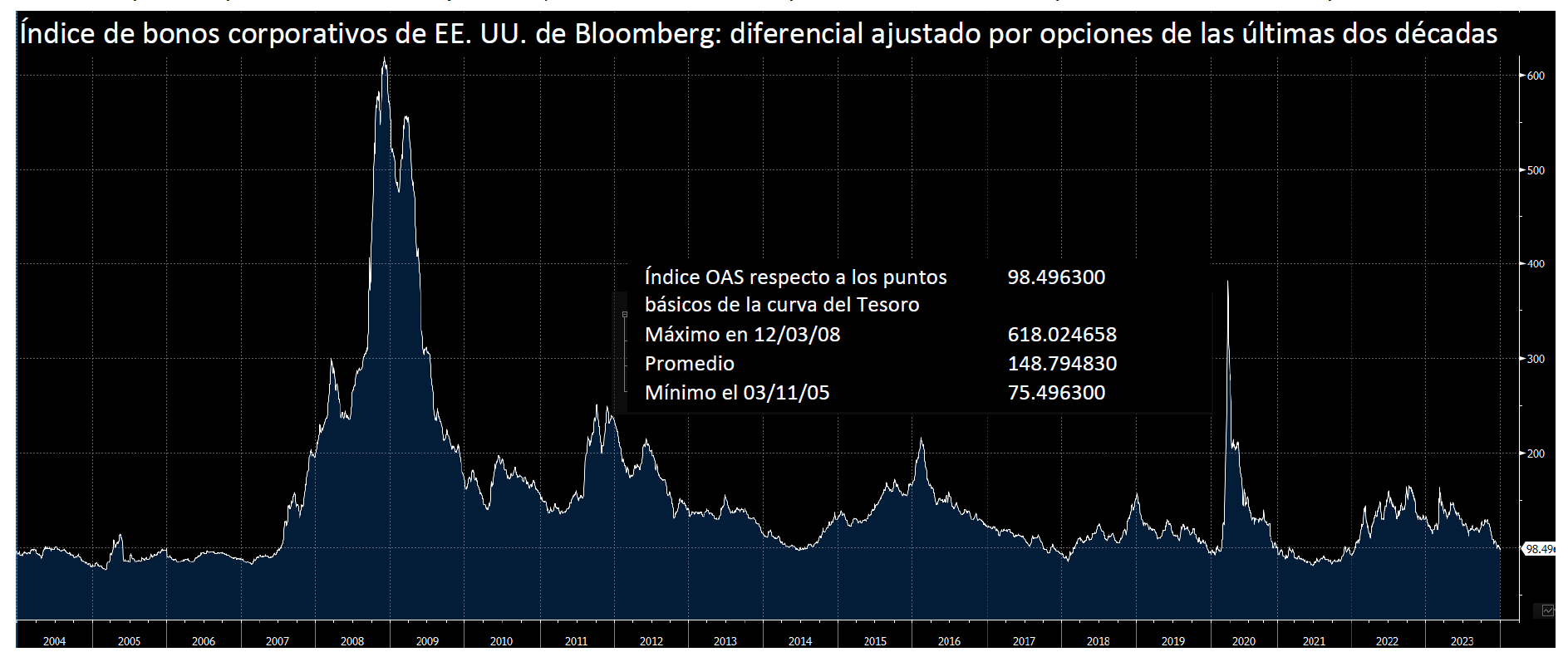

- As spreads dropped to a six-week low of 321 basis points and yields hovered near 8%, US borrowers continued to crowd the primary market. Borrowers were in a hurry to capitalize on the still-low cost of debt, yet high enough to attract buyers, before the economy begins to show some expected signs of slowing in the second half

- After a busy January, with the month-to-date supply at $8.55b, February is on track to be the busiest since 2021

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.