(Bloomberg) High Yield Market Highlights

- US junk bonds are poised for a second-straight monthly gains, returning 0.9% so far as investors have shrugged off a hawkish Federal Reserve that’s signaled just one quarter-point cut in 2024.

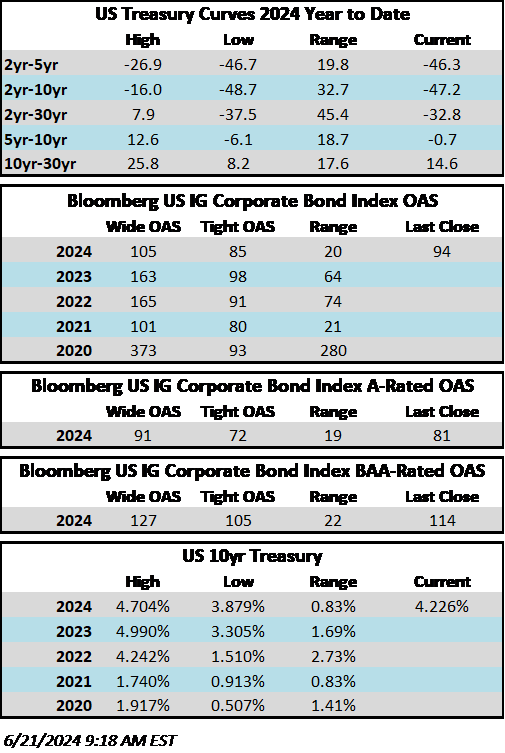

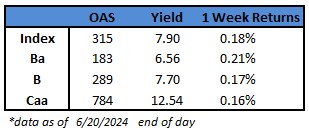

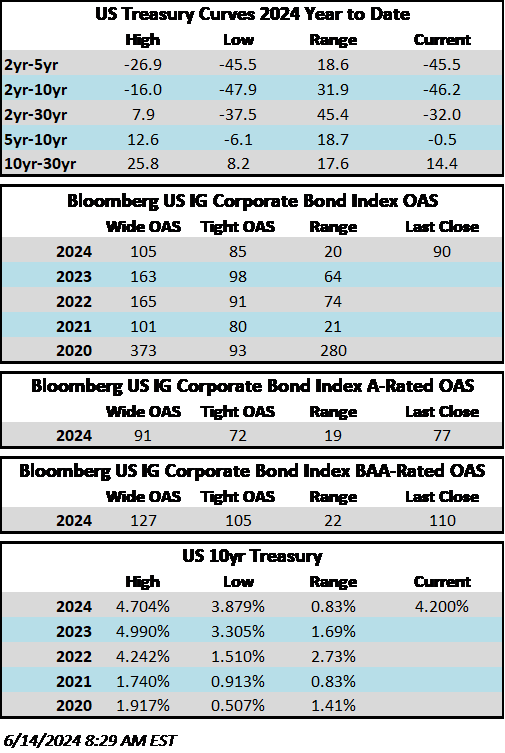

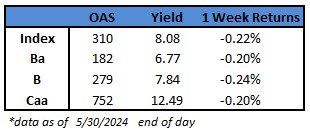

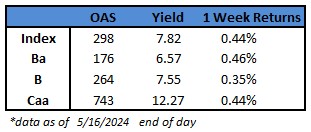

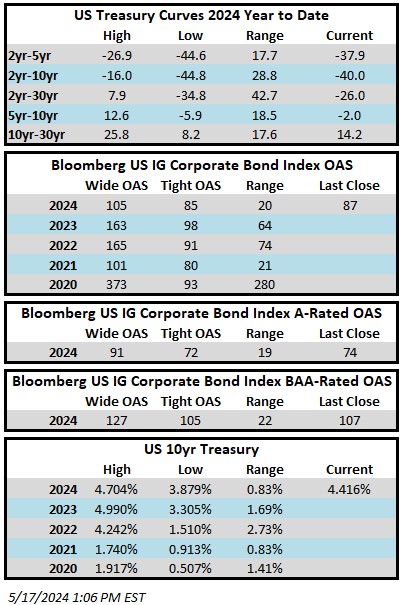

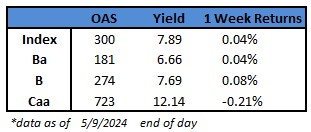

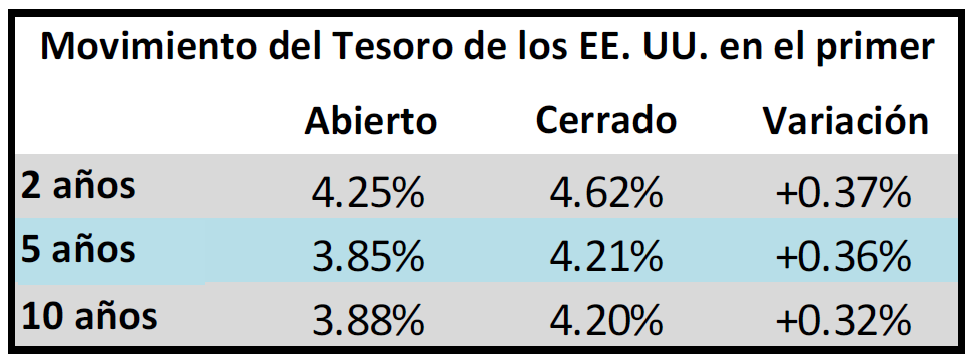

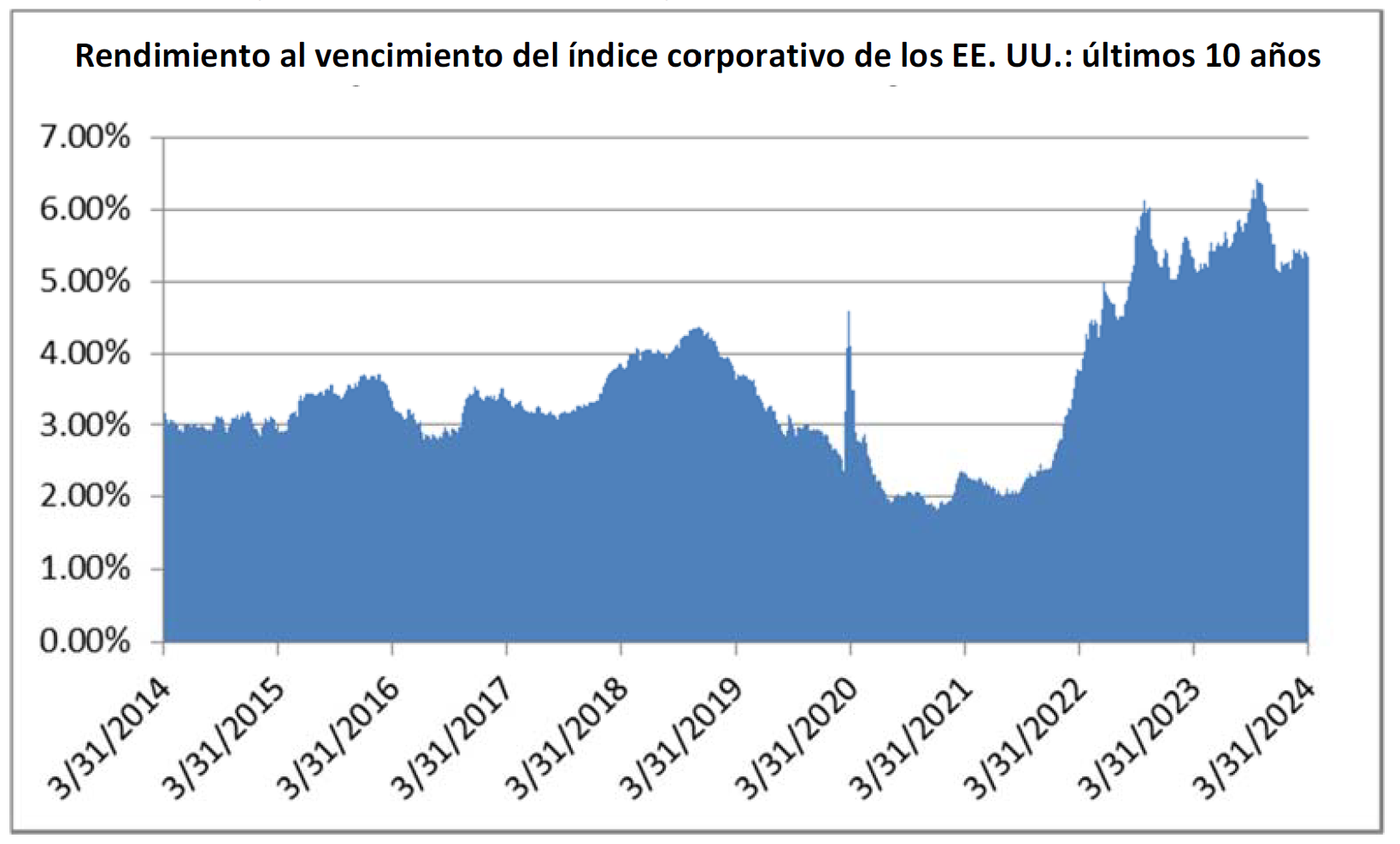

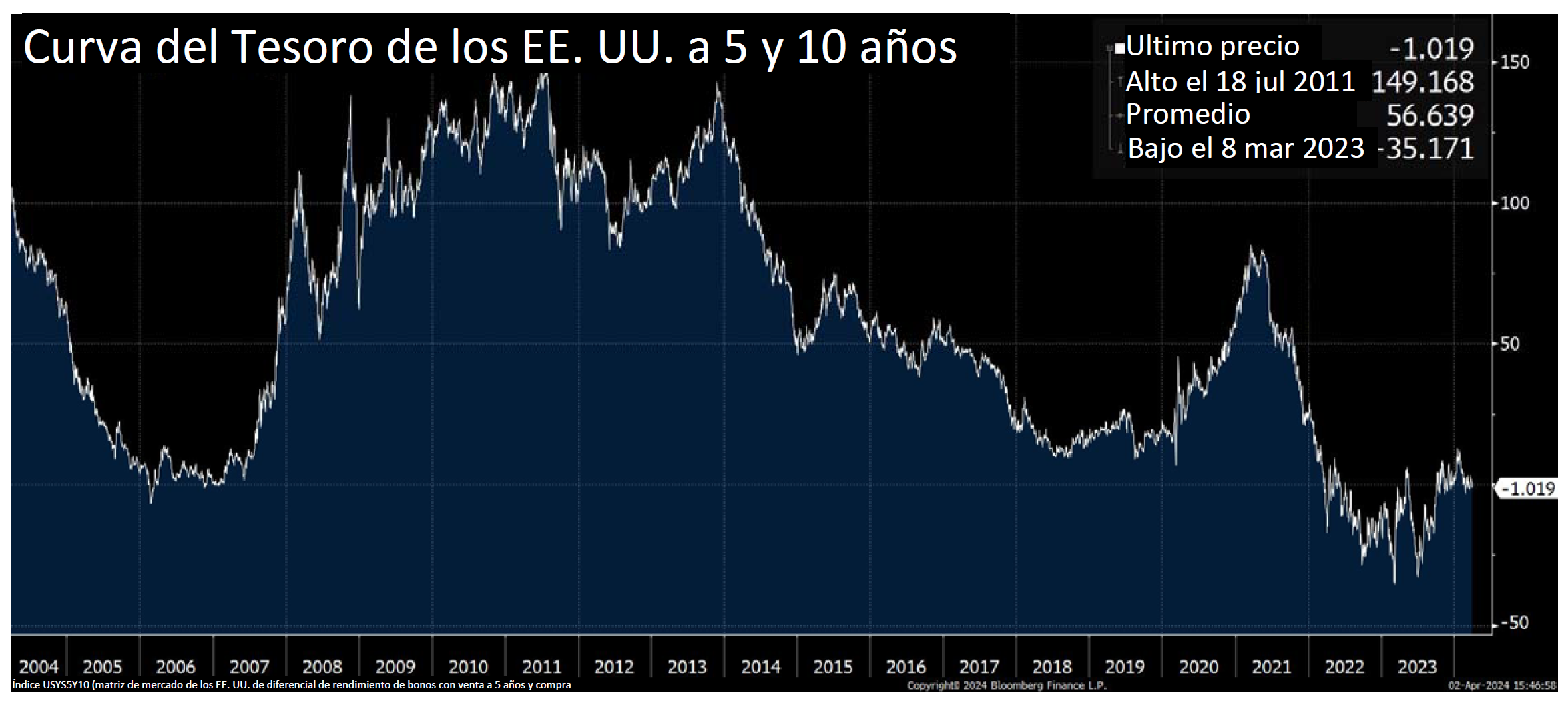

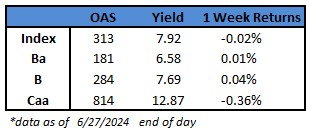

- Yields have dropped eight basis points to 7.92%, while spreads widened just five basis points to 313bps as 5- and 10-year Treasury yields through Thursday had both fallen 21 basis points

- As we’ve written this week, uncertainty about the Fed’s rate outlook continued to take its toll in June on CCCs, the riskiest segment of the junk bond market

- Yields have jumped six straight sessions, the longest since January, and have surged 50bps in June to 12.87%, on track for their first three-month uptrend since October 2022

- Spreads have climbed 68bps this month to 814bps, set for the most since last October and this week hitting their widest since early February

- Still, CCCs have returned 50% so far in June

- Ba rated securities have returned 98% so far in June

- B rated securities have returned 90% so far in June

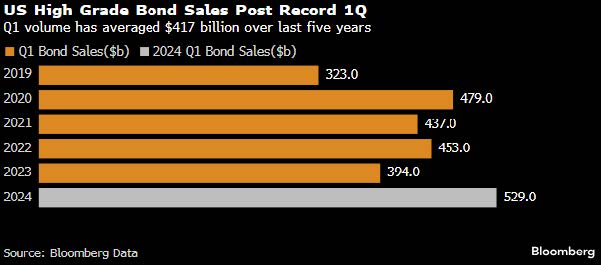

- Fed-fueled uncertainty has started keeping some high-yield borrowers on the sideline, with the primary market in June the slowest this year with almost $18b of issuance

- In the wake of the big start to the year, Barclays boosted its 2024 forecast to $280-300b from $200-230b

(Bloomberg) Fed’s Favored Price Gauge Slows, Supporting Case for Rate Cut

- The Federal Reserve’s preferred measure of underlying US inflation decelerated in May, bolstering the case for lower interest rates later this year.

- The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.1% from the prior month. That marked the smallest advance in six months. On an unrounded basis, it was up just 0.08%, the least since November 2020.

- From a year ago, it rose 2.6%, the least since early 2021, according to Bureau of Economic Analysis data out Friday. Inflation-adjusted consumer spending posted a solid advance after a pullback in April, driven by goods and fueled in part by a jump in incomes.

- The report offers welcome news for Fed officials seeking to commence with rate cuts in the coming months, though policymakers will likely want to see additional reports like this one first. They recently dialed back their projections for rate cuts this year following worse-than-expected inflation data in the first quarter.

- “The deflation in goods prices and weakness we are starting to see at least gets us a path to a possible September cut,” said KPMG Chief Economist Diane Swonk.

- Central bankers pay close attention to services inflation excluding housing and energy, which tends to be more sticky. That metric increased 0.1% in May from the prior month, according to the BEA, the least since October.

- Household demand has so far remained resilient even as borrowing costs have taken a toll on some sectors of the economy. The report showed inflation-adjusted outlays for services rose 0.1%, driven by airfares and health care. Spending on merchandise advanced 0.6%, led by computer software and vehicles.

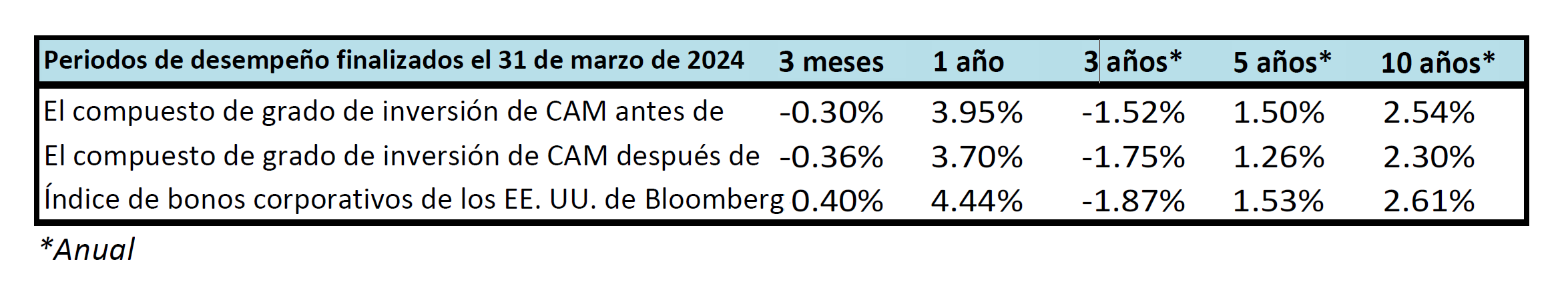

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.