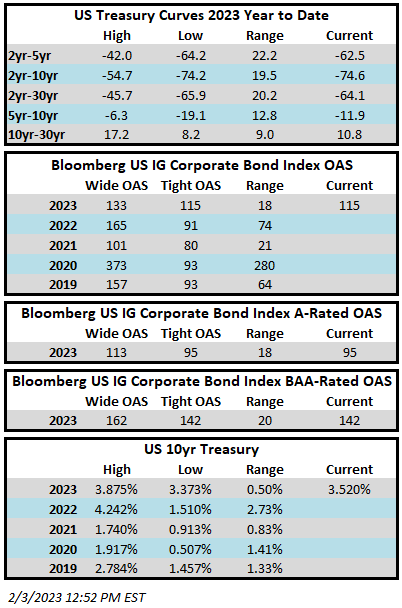

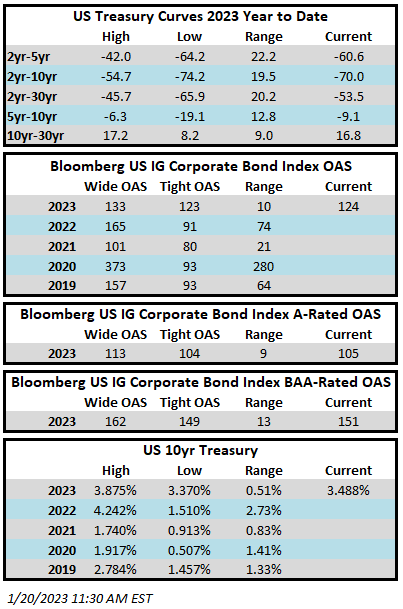

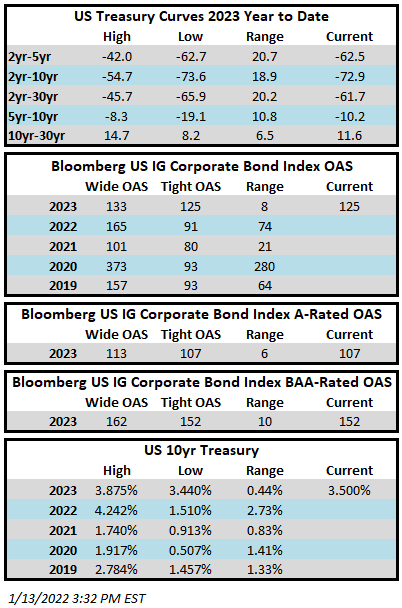

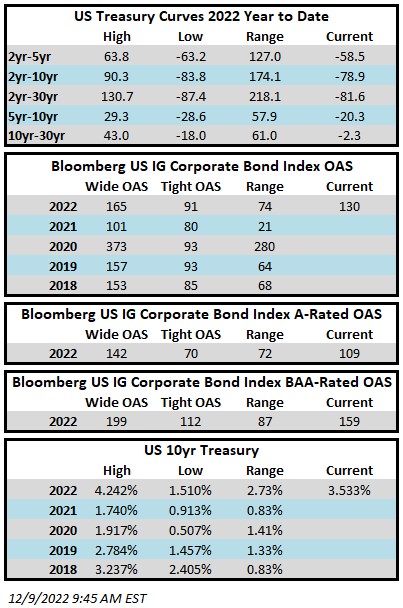

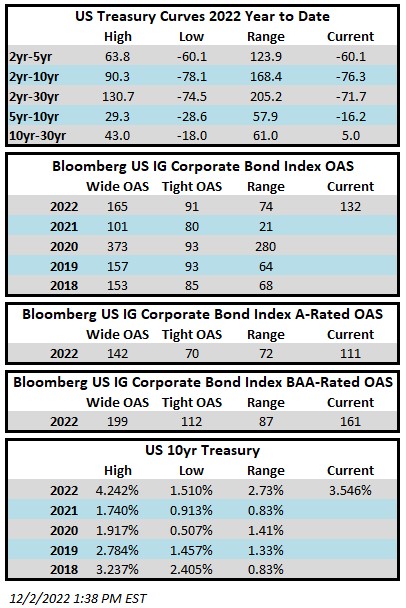

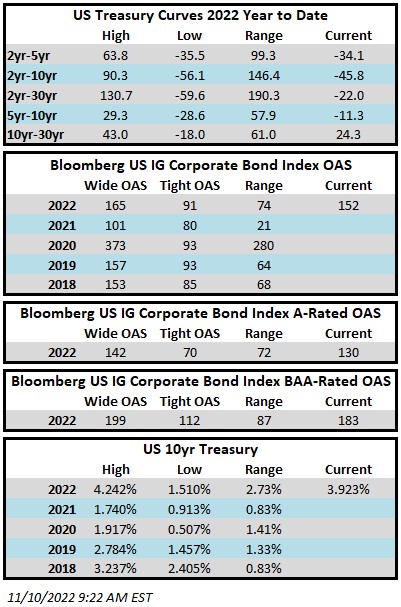

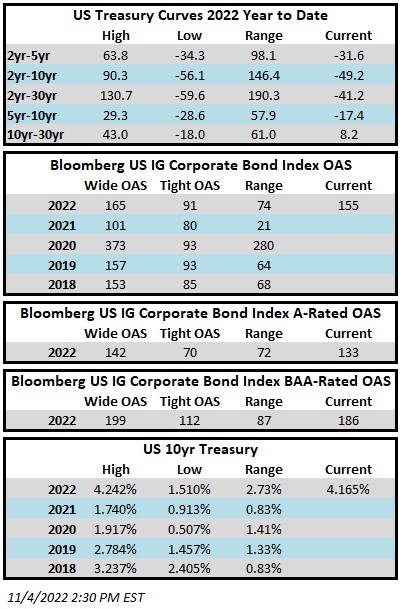

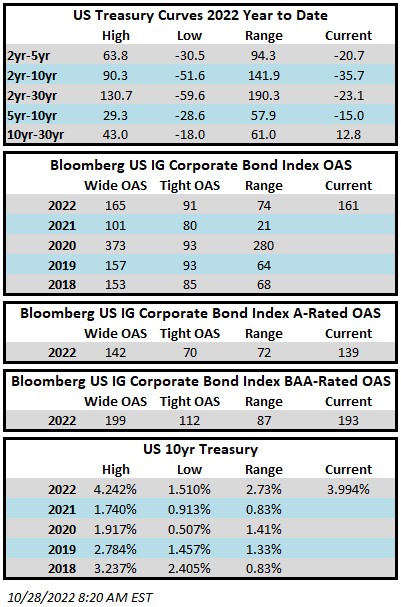

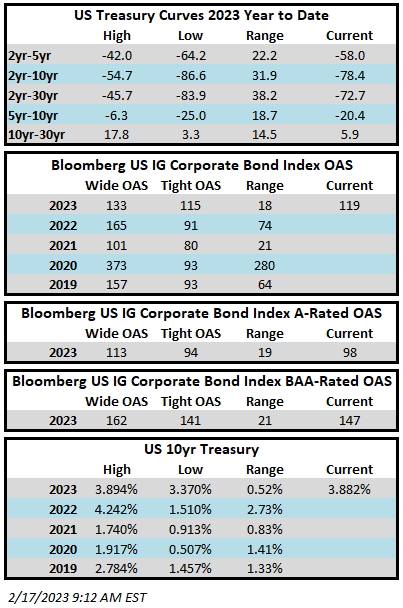

Investment grade credit spreads look set to finish the week marginally wider. The Bloomberg US Corporate Bond Index closed at 119 on Thursday February 16 after having closed the week prior at 118. The 10yr Treasury moved meaningfully higher this week as the market has begun to anticipate a more hawkish monetary policy stance from the Fed for the balance of this year. The 10yr is wrapped around 3.88% as we go to print up 15 basis points from 3.73%, where it closed the week prior. Through Thursday the Corporate Index had a YTD total return of +1.31% while the YTD S&P500 Index return was +6.8% and the Nasdaq Composite Index return was +10.7%.

Economic data was mixed this week but in concert with some Fed speakers we are definitely finishing the week with a tinge of hawkish rate fear. Quite frankly most investors were probably a bit too optimistic about a soft landing for the economy and rate-cuts by the Fed later this year. We are in the camp that there is little if any chance that the Fed will underestimate its progress against inflation thus making it a high probability event that they go too far and tighten financial conditions too much which will eventually lead to a recession. It could be this year or next –predicting the timing and depth of the recession is the difficult part. On Tuesday we got a CPI print that came in hotter than expected but the good news is that inflation continued to decelerate year over year. On Wednesday we got a surprisingly strong retail sales number –this is after retail sales declined in both November and December. Finally on Thursday, the U.S. Producer Price Index came in hot with January up 0.7% relative to expectations of 0.4%. Housing starts were released as well and were down 4.5% y/y in January but this was easily overlooked by the market due to an increase in permitting activity which may filter through soon to housing starts leading to a bounce off the lows. The housing picture is still quite grim for single family but it is multifamily that is seeing the vast majority of the permitting activity and it is multifamily construction that will at some point likely lead to a bounce of the bottom for housing starts. Thursday also brought us a couple of hawkish speeches by Federal Reserve Bank president’s Mester and Bullard. It is worth noting that Mester, who has repeatedly advocated for additional (and larger) rate hikes, is not currently a voting member for FOMC-rate decisions nor is St. Louis Fed President Bullard.

It was a big week for the primary market as issuers sold $54bln+ of new debt. This was double the consensus estimate and points to continued strong investor demand for corporate credit. Perhaps most surprising was that secondary spreads actually held in pretty well given the deluge of new issue supply and the relatively hawkish backdrop for risk throughout the week. The largest deal of the week and was Amgen’s $24bln deal to help fund its acquisition of Horizon Therapeutics. The Amgen deal was spread across 8 tranches spanning from 2-40 years. The Amgen print was the 9th largest deal on record and at its peak the deal had over $90bln in orders. Monday is a holiday and the bond markets will be closed but investors are still expecting about $25bln of new supply next week.

Investment grade credit reported another week of inflows. Per data compiled by Wells Fargo, inflows for the week of February 9–15 were +2.5bln which brings the year-to-date total to +$40.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.