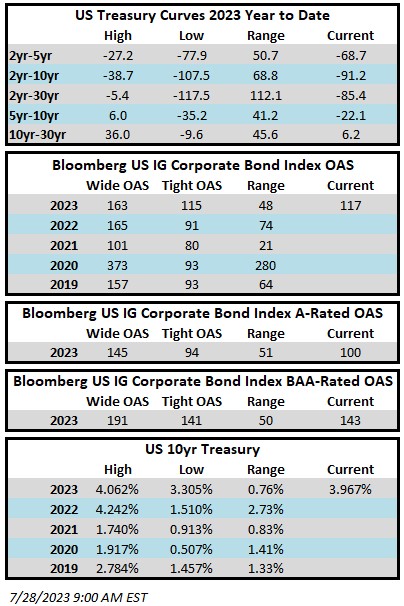

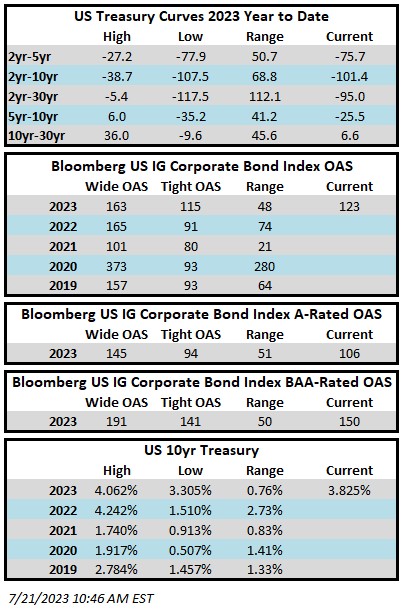

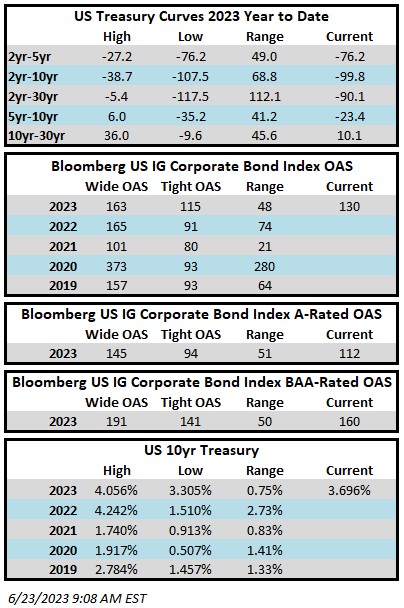

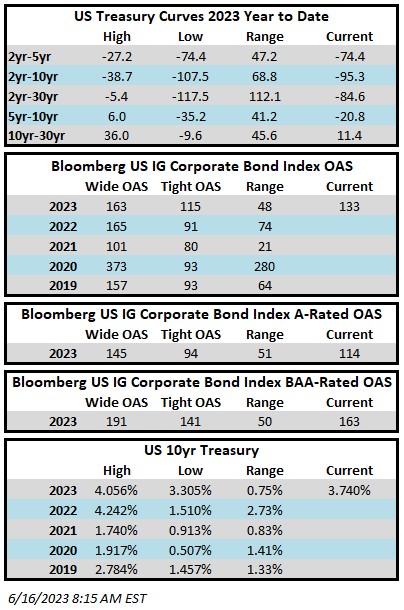

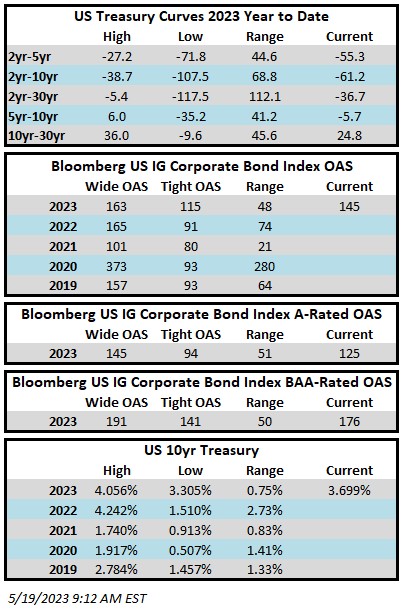

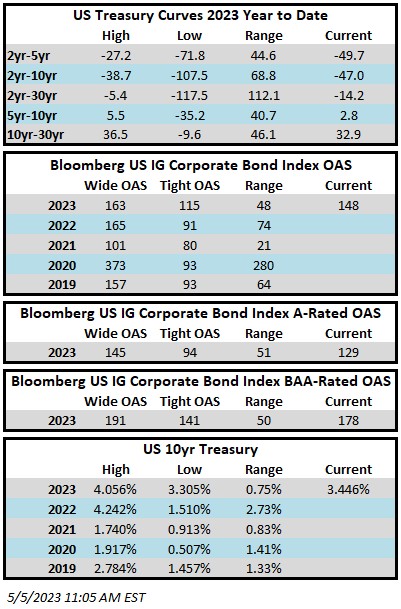

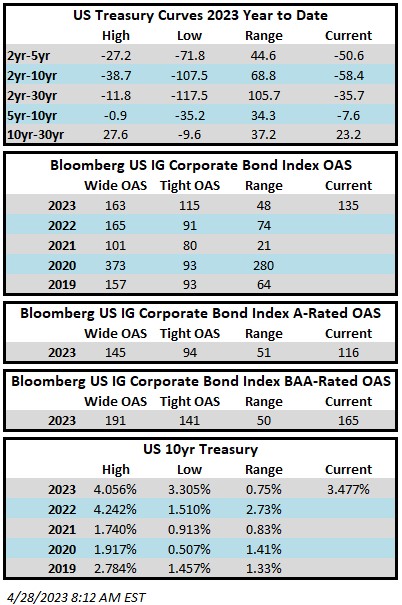

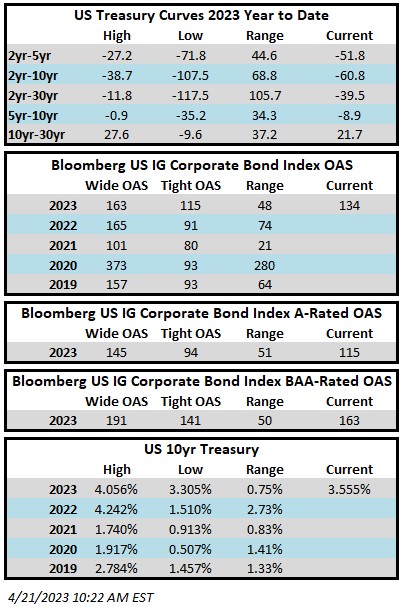

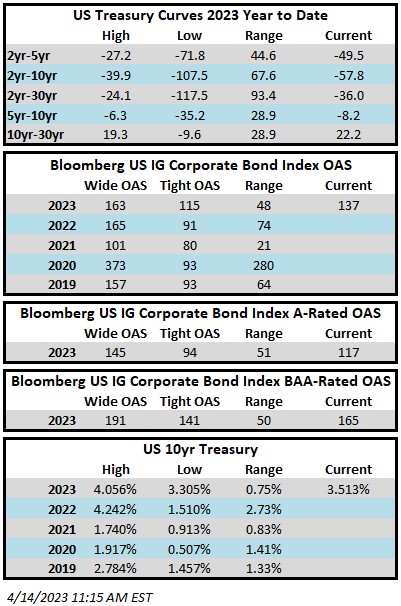

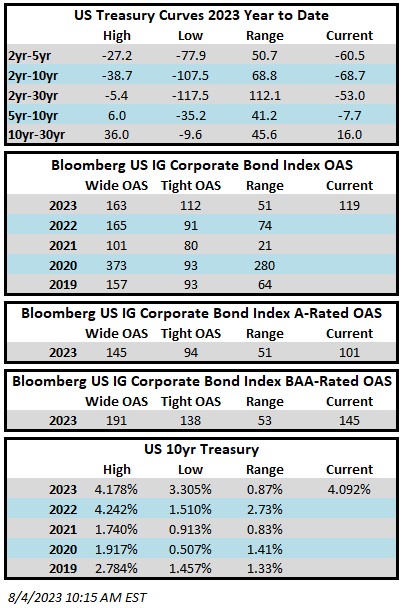

Investment grade credit spreads closed at the tightest levels of the year on Monday evening before widening throughout the rest of the week in sympathy with higher Treasury yields. The Bloomberg US Corporate Bond Index closed at 119 on Thursday August 4 after having closed the week prior at 115. The 10yr is trading at 4.09% as we go to print relative to its 3.95% close last Friday. Through Thursday August 4 the Corporate Index YTD total return was +1.62% as higher rates have taken a bite out of returns.

The biggest news this week was higher yielding Treasuries. The 10yr closed at its highest level of the year on Thursday evening – 4.18%. It’s hard to point to a real catalyst for higher rates although the easy answer is that Fitch hit the U.S. with a one notch downgrade after the close on Tuesday. We do not fully buy this argument, however, and instead we believe the announcement regarding U.S. Treasury refunding is likely having a bigger impact. The announcement indicated that the Treasury will soon begin to increase the auction amounts for longer dated securities into next year. In other news, the BOE fell into line with the rest of the world’s major central banks and delivered a 25bps increase in its policy rate. Back in the U.S., on Friday morning, the NFP report painted a picture of a job market that is still on solid footing with low unemployment and a modest increase in average hourly earnings. This will continue to give credence to the “soft landing” crowd. There are only 47 more days to parse economic data until the next FOMC rate decision.

The new issue calendar saw an active week as borrowers priced more than $34bln in new debt. We could continue to see some good activity over the next two weeks. There has been $804bln of issuance year-to-date which just barely trails 2022’s pace.

According to Refinitiv Lipper, for the week ended August 2, investment-grade bond funds reported a net outflow of -$1.765bln. This broke an 8-week streak of inflows and was just the 9th outflow YTD out of 31 weeks of reporting.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.