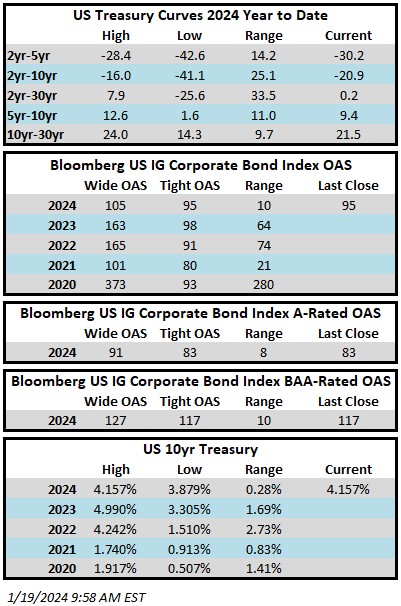

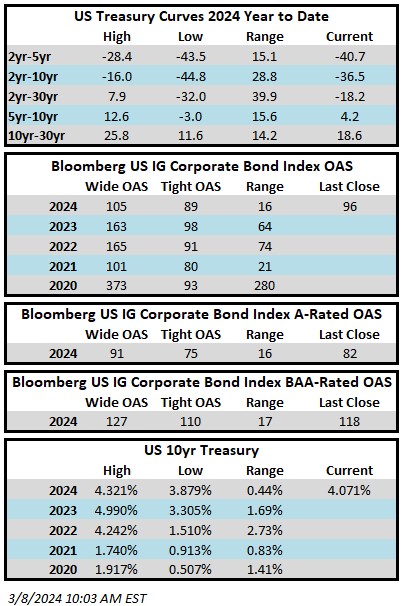

Spreads were relatively unchanged during the week as the index sat 7bps off its tightest levels of the year through Thursday’s close. The Bloomberg US Corporate Bond Index closed at 96 on Thursday March 8 after having closed the week prior at 97. The 10yr is trading at 4.07% this Friday morning after closing last week at 4.18%. Through Thursday, the Investment Grade Corporate Index YTD total return was -0.54%.

Economics

The two highlights of the week were Jay Powell’s testimony to Congress on Wednesday morning and the nonfarm payrolls report on Friday. Chairman Powell stayed on message while addressing lawmakers. He continued to emphasize the Fed’s commitment to data dependency while indicating it is likely that the FOMC will begin to cut rates in 2024. The jobs number on Friday was the type of print that had something for both the “cut now camp” and the “no cuts in 2024 camp.” The report showed that the U.S. unemployment rate climbed to a two year high for the month of February while wage growth slowed. Still, payrolls continued to grow at a healthy rate and the unemployment rate remains quite low by historical standards. Post jobs report, interest rate futures were fully pricing in a 25bp rate cut in June and a total of 100bps by the end of 2024.

Issuance

In what seems to be a recurring theme, it was another banner week for issuance as more than $50bln of new debt priced for the third consecutive week. 2024 continues to be the busiest year in the history of the investment grade primary market with supply running at ~$440bln YTD, which is +30% YoY. Next week is expected to feature brisk activity as well with estimates looking for $30-$35bln of new debt.

Flows

According to LSEG Lipper, for the week ended March 6, investment-grade bond funds reported a net inflow of +$4.5bln. This was the twelfth consecutive weekly inflow for IG funds and the largest inflow in over a year.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.