Fund Flows & Issuance: According to Wells Fargo, IG fund flows for the week of April 12-April 18 were negative, posting an outflow of $1.2bn. According to data analyzed by Wells Fargo, IG funds have garnered $53 billion in net inflows YTD, which is less than half the amount of net inflows recorded in the first four months of 2017.

The IG new issue calendar saw its most active week since the week ending March 9th. U.S. banks led the way as they began to bring new bond deals coincident with earnings reports. According to Bloomberg, $36.4bn in new corporate debt priced during the week. This brings the YTD total to $392.17bn, which is down 14% year over year. 2018 issuance will see a significant impact pending regulatory reviews of large M&A deal such as AT&T/Time Warner and Bayer/Monsanto, among others.

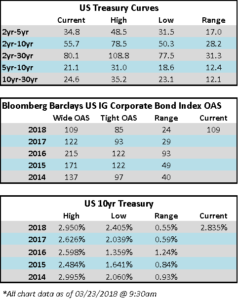

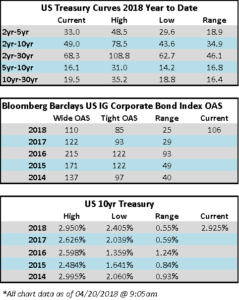

The Bloomberg Barclays US IG Corporate Bond Index opened on Friday with an OAS of 106.

(Bloomberg) Dealers Kicking Abbott Debt to Curb Missed Out on Outperformance

- Abbott Laboratories’ debt has outperformed peers in 2018 following Moody’s upgrade and positive outlook in February.

- The Abbott Labs’ bonds have outperformed similarly dated BBB tier health-care and pharmaceutical debt by about 90 bps in 2018, including issues from Thermo Fisher, CVS and Mylan, driven by debt pay down and an upgrade by Moody’s in February.

- Dealers have been net sellers of Abbott debt over the past three months, notably at the front-end of the curve, including the 2.35% bonds due in 2019, 2.9% bonds due in 2021 and 3.75% bonds of 2026.

(WSJ) Morgan Stanley Posts Record Earnings, Revenue

-

- Morgan Stanley MS on Wednesday reported record quarterly profits, the last of the big U.S. banks to benefit from a potent cocktail of lower taxes, active markets, lower expenses and economies growing in lockstep.

- The Wall Street firm’s first-quarter profits of $2.6 billion and revenues of $11.1 billion were both record highs after reflecting accounting adjustments and jettisoned businesses. Morgan Stanley’s traders had their best quarter since 2009, riding a wave of increased volume and volatility that also aided rivals, including Goldman Sachs Group Inc. and JPMorgan Chase & Co.

- Combined profits at the six largest U.S. banks, which all reported first-quarter results in recent days, rose 24% from a year ago, outpacing an 18% rise in revenues. Meanwhile, the banks’ level of profitability as measured by the return they generate on their equity—a key gauge for shareholders—rose to its highest level in years.

- The first quarter is typically the strongest of the year for banks. Investors put on new positions, which boost trading results, and companies raise money to fund new projects, which spurs lending and underwriting.

(WSJ, Press Release) Crown Castle Reports First Quarter 2018 Results and Raises Outlook for Full Year 2018

- “After another quarter of very good financial and operating performance in the first quarter, we remain excited about the opportunities for our business to support growing data demand in the U.S.,” stated Jay Brown, Crown Castle’s Chief Executive Officer.

- “We continue to see tremendous activity across our unique portfolio of infrastructure assets. In our tower business, we have recently signed comprehensive leasing agreements with several of our largest customers, which we believe signals the beginning of a sustained period of infrastructure investments by our customers.

- In our fiber business, the volume of small cell bookings in the first quarter was comparable to what we booked during all of 2016, resulting in an increase in our contracted pipeline to more than 30,000 nodes. We also continue to make very good progress on integrating our recent fiber acquisitions.

- We believe our unique value proposition as a shared communications infrastructure provider will allow us to translate the growing demand for data into growth in cash flows and, thus, deliver on our 7% to 8% annual growth target in dividends per share.”+

- Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 60,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service – bringing information, ideas and innovations to the people and businesses that need them.

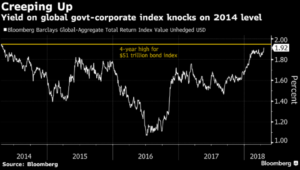

(Bloomberg) Global Yield Surge Defies Skepticism on Inflation’s Momentum

- Rising inflation expectations in the world’s biggest economy are pushing up U.S. benchmark yields, putting pressure on rates to climb around the world and causing more than a few heads to swivel.

- Federal Reserve officials may be attempting to tamp down concern of a U.S. price surge, but it hasn’t stopped yields from Tokyo to Frankfurt and New Yorkticking higher. In fact the yield of a $51 trillion Bloomberg Barclays index of global sovereigns and corporate debt is nearing a four-year high of 1.949 percent.

- Yet even as April’s surge in raw materials drives inflation bets and those higher yields, the moves are relatively gentle. Treasury long-bond rates remain below February highs, and that suggests bond traders are so far taking events in stride.

- “Actually there’s no overconcern yet in the market of inflation drifting dramatically higher — if you look at long, medium or short Treasuries,” said Joe Lovrics, Citigroup Inc.’s Iberia Markets head in Madrid. “In fact there’s a growing group talking about the U.S. economy actually cooling now.”

- Although Fed official Loretta Mester mentioned inflation 18 times in a preparedspeech Thursday, she concluded it probably won’t pick up sharply even as unemployment is likely to fall below 4 percent this year and remain there through 2019.

- In Europe, where the European Central Bank’s unconventional stimulus has been crushing rates since 2015, ECB President Mario Draghi is seen taking longer to lay out its plan to exit that program as protectionism threatens the euro-area outlook, economists said in a Bloomberg survey.

- While there has been some market excitement this year over the potential return of inflation and a possible bond bear market, a number of other factors having been fueling yield increases, according to Lovrics.

- “We’ve had an unexpected rally in oil, tax stimulus, strong employment in the U.S. plus Fed remarks about rising inflation, and this kind of feeds on itself,” he said.