CAM Investment Grade Weekly

02/08/2019

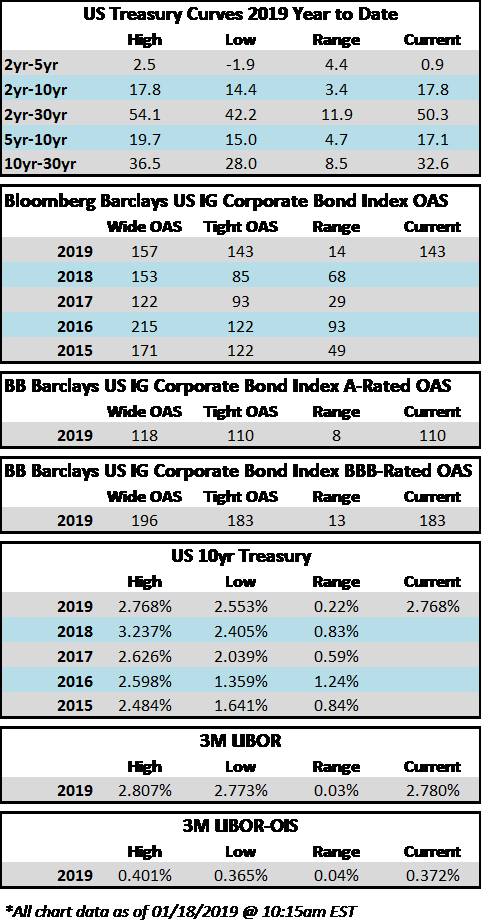

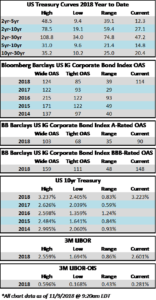

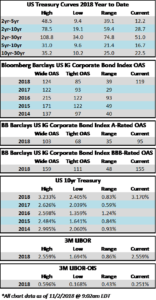

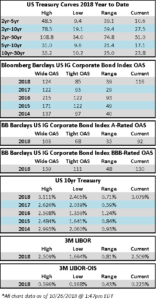

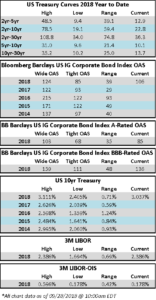

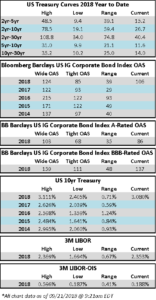

It was a mixed week for Investment Grade Credit. The spread on the Corporate Index marched tighter on Monday and Tuesday before closing wider on both Wednesday and Thursday. The wider close on Wednesday snapped a remarkable streak of 22 straight trading days where the index closed tighter than the prior day. Still, even with two days of slightly wider spreads, the index remains one basis point tighter than where it opened the week and investor sentiment in the corporate credit space remains strong.

The market tone to start the day on Friday is, like the two prior days, somewhat softer. All told, we view this as healthy after the unabated “student body left” tightening that we experienced for 3+ weeks. Ebbs and flows in the market tend to create opportunities for patient investors with longer time horizons.

According to Wells Fargo, IG fund flows during the week of January 31-February 6 were +$5.9 billion. This was the largest inflow since October 2017 according to the data that is tracked by Wells Fargo, bringing YTD fund flows to +$10.759bln.

Issuance slowed this week compared to last, as $10.350bln in new corporate bonds were priced, bringing the year-to-date total to $114.713bln. Monthly volume projections for February are calling for ~$90bln of issuance during the month, according to data compiled by Bloomberg. New issue concessions continue to hover in the low single digits as investor demand for new issues remains robust.

(Bloomberg) Greed Is Back as Debt Markets Face an $8.6 Trillion Hangover

- Prayers for a sudden return to dovish monetary policies have been answered, and now investors are living with the aftermath: a world awash with $8.6 trillion in negative-yielding debt.

- That’s one reason money managers are wading once more into the fringes of fixed-income markets across the globe.

- Consider the action over the past week: Serial defaulter Ecuador managed to sell $1 billion in new bonds even as the government is in talks for International Monetary Fund financing. Crisis-prone Greece received blockbuster orders for its 2.5 billion-euro ($2.9 billion) sale. And the decidedly frontier republic of Uzbekistan, encouraged by risk-on markets, is meeting investors for a debut international offering.

- No wonder the world’s largest funds are betting the explosive rally in developing-economy debt still has legs.

- Meanwhile, U.S. high-yield is in the throes of a rebound, as traders bet easier monetary policy will prolong the business cycle. Lower-rated borrowers are in vogue after the asset class posted the biggest monthly gain in seven years.

(WSJ) The Bond and Stock Markets Need to Talk

- Investors buying bonds should start checking what their colleagues in the stock market are doing.

- Yields on 10-year U.S. government bonds hover below 2.7%. This is extremely low considering that sovereign debt tracks where the central bank is expected to set interest rates—which the Federal Reserve now pegs between 2.25% and 2.5%—plus a premium for locking up the money long term.

- The Treasury yield is even more strikingly at odds with the S&P 500, which has climbed back from its December lows during the fourth-quarter earnings season. The technology-heavy Nasdaq is even close to exiting its recent bear market.

- In the U.S., it is likely bond investors who have got too pessimistic: Derivatives markets price in a 98% chance that interest rates will be at their current level or lower in a year’s time, according to CME Group. Only three months ago, they predicted that the Fed would tighten policy at least twice this year.

- One possibility is that the legendary pessimism of fixed-income investors is correct and stocks are treading on perilous ground because the U.S. economy is in worse shape than it looks.

- Yet if January’s improvement in economic data is pointing in the right direction, writing off rate rises with such certainty is perilous. Fed chairman Jerome Powell’s transformation from hawk to dove in January is likely explained—at least in part—by the equity rout late in 2018. If stocks keep rallying, he may very well nudge rates up again at least once.

- European stock investors, by contrast, should heed the advice of the bond market: The region’s equities have slightly outperformed U.S. ones in recent months, glossing over Europe’s greater vulnerability to the Chinese slowdown. And with rates already at record lows, the European Central Bank has little ammunition left.

- Treasurys aren’t in for a dramatic selloff, because inflation is being kept in long-term check by weak labor bargaining power. However, investors’ confidence that the Fed will sit on its hands for a full year looks misplaced.