CAM Investment Grade Weekly

7/19/2019

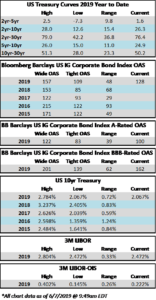

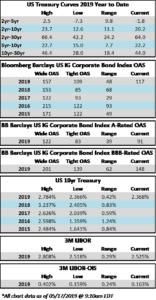

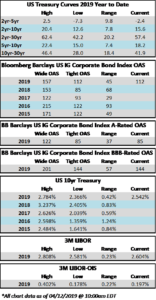

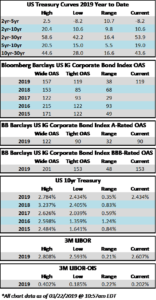

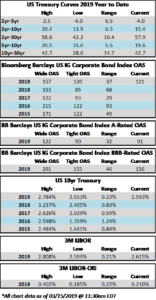

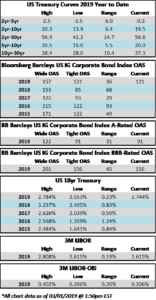

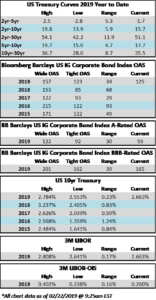

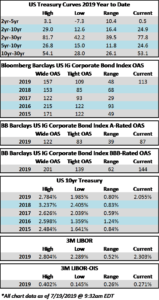

The corporate market was modestly wider on the week with the spread on the index 1 basis point wider week over week as we go to print on Friday morning. Spreads have largely been in a holding pattern for the month of July, as the index opened the month at an OAS of 115 versus a 113 close yesterday evening. The 10yr Treasury continues to hover just above 2% amid dovish commentary from Federal Reserve officials. Media blackout begins tomorrow for Fed officials so we will get a respite from commentary until after the July 31 FOMC decision.

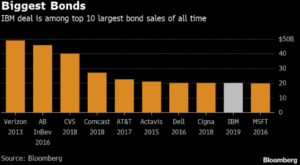

It was a quiet for the primary market as less than $15bln in new corporate debt was brought to the market which was underwhelming relative to the $30bln consensus figure. According to data compiled by Bloomberg, year-to-date corporate supply has topped $600bln, which trails 2019 supply by 10%.

Fund flows into U.S. corporates escalated throughout the week. According to Wells Fargo, IG fund flows during the week of July 11-July 17 were +$4.8bln. This brings YTD IG fund flows to +$158bln. 2019 flows to this juncture are up 6.1% relative to 2018.

(Bloomberg) After Times Square Goes Dark, NYC’s ConEd Faces More Heat

- It lasted all of five hours — and hit just the spot on New York’s power system to take out the lights in Times Square, force the evacuation of Madison Square Garden in the middle of a Jennifer Lopez concert and bring parts of the city’s subway system to a screeching halt.

- The Saturday evening blackout on Consolidated Edison Inc.’s grid — extending from about Fifth Avenue to the Hudson River and from the 40s to 72nd Street — was so widespread that it took out much of Midtown, Hell’s Kitchen, Rockefeller Center and the lower reaches of Manhattan’s Upper West Side. Now ConEd, already under fire because of other mechanical breakdowns in recent years, is facing renewed calls to overhaul its network.

- The power failure struck on the anniversary of the historic 1977 blackout that led to widespread looting and other crimes across New York City. And it peeled back disparities between old technology and new: halted subways meant a $2.75 fare ballooned to a $57 Uber primed to surge pricing.

- Just over six months ago, ConEd was facing an investigation after an electrical fire at a substation turned New York City’s night sky blue, temporarily disrupting flights and subway services. In July 2018, it was the subject of a probe after an asbestos-lined steam pipe ruptured in Manhattan’s Flatiron district. And a power failure in 2017 led to significant delays on the subway during a morning commute, triggering an investigation that cost the company hundreds of millions of dollars.

- ConEd Chief Executive Officer John McAvoy told reporters late Saturday that the company would investigate the root cause of the event and “restore the system to a fully normal condition once we understand what exactly occurred.” He said the power failure didn’t appear to be weather-related. Hot weather typically sends power demand surging as people blast air conditioners.

(WSJ) Cellphone Tower Companies Race Higher

- As the biggest wireless companies in the U.S. prepare to bring 5G to more customers, cellphone-tower operators are shaping up to be big winners in the stock market. They could be ready to get another boost if or when the deal between T-Mobile US Inc. TMUS -0.37% and Sprint Corp. S +0.37% closes, some analysts say.

- Shares of Crown Castle International Corp., American Tower Corp. and SBA Communications Corp. all hit records in 2019, and are currently up at least 20% from where they traded six months ago. Cellphone companies like Verizon, AT&T and T-Mobile pay these tower companies fees to use their high-up real estate.

- A concern among some investors is that these companies soared too high too fast. Of the trio, only shares of SBA Communications have risen in the past month. Part of the reason for that is a slowdown in talks between T-Mobile and Sprint.

- While final conditions for the merger deal remain to be seen, a key component of the Federal Communications Commission’s conditions is an accelerated 5G rollout in rural areas, UBS notes. That stands to benefit American Tower most, as about 65% of its macro portfolio covers the most rural part of the U.S., according to a research report by UBS last month that looked at the FCC’s antenna registration database of tower locations throughout the U.S.

- Another potential overhang has been worries that private operators could be competition for these three big public tower owners as wireless carriers seek out lower rents. However, UBS’s report also found that the big three public tower companies remain the dominant players in a hot business, with the largest private owner of tower sites accounting for just about 2% of all towers. That bodes well for SBA Communications, American Tower and Crown Castle.

- “While the private operators have increased their tower counts…this competitive threat is far more limited in practice at this time,” UBS said in its note.

(Bloomberg) A Leveraged Loan Collapses and Reveals Key Risk in Credit Market

- Operating out of a Chicago suburb, in a low-slung, red-brick building wedged between a Hyatt and a Radisson, Clover Technologies is in the mundane business of recycling everything from inkjet cartridges to mobile phones.

- But in the past week it abruptly — and alarmingly — caught the attention of Wall Street. Almost overnight, a $693 million loan Clover took to the market five years ago lost about a third of its value. The startling nosedive stung even sophisticated investors, people who deal in the arcane business of trading corporate loans.

- Clover’s loan isn’t especially large by Wall Street standards, yet its stark and swift decline set off fresh alarm bells — bells that regulators have been sounding for months. It immediately became a real life example of the perils of investing these days in the $1.3 trillion market for leveraged loans, where a global chase for yield has allowed an explosion in borrowing and lax underwriting. In a market where trading can be thin — and at a time when illiquidity is suddenly becoming a prominent concern in credit circles — the episode shows how loans to highly leveraged companies can quickly implode when fortunes change.

- Using the leveraged loan market as a wallet, the company took loans that funded dividend payments totaling at least $278 million — $100 million in 2013 and $178 million in 2014. (Portions of the overall proceeds went to shareholders as well as to refinance the company’s existing debt and certain fees, according to a Moody’s report.) Clover also asked lenders for a further $100 million in 2014 to pay for an acquisition.

- Those loans, as is typically done, were bought mostly by mutual funds and collateralized loan obligations, which bundle such leveraged debt into higher-rated securities that are pitched to more risk-averse investors. There’s been little trouble finding buyers for CLOs in recent years. With yields on high-grade bonds hovering near zero across much of the world, investors have been hungry for the juicy returns that these loans offer and, more and more, tend to overlook the lack of protection afforded.

- Moody’s now predicts a higher likelihood Clover will default on its debt obligations. The ratings agency cites concerns over long-term viability of the business and “unexpected” operational developments. Its debt is just over 6 times its earnings, a level that typically raises lender concerns about the company’s ability to meet its financial obligations. Another warning sign came in May when the company pulled a seemingly attractive refinancing plan that offered a high yield of nearly 9% with a short, three-year maturity.

- Investors may recall similar blowups in the credit market. American Tire Distributors’ bonds and loans plunged into distress less than a month after it announced the loss of two key suppliers, Goodyear and Bridgestone. ATM-maker Diebold Nixdorf Inc. also saw its bonds fall to almost half their face value after it posted an unexpected second quarter loss.