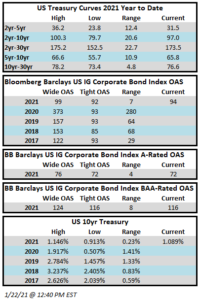

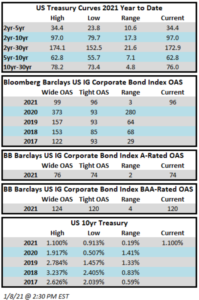

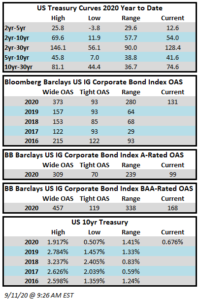

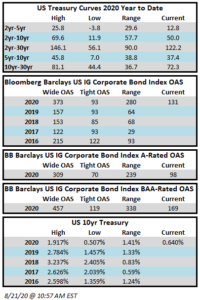

Spreads are looking likely to finish the holiday shortened week with little change. The Bloomberg Barclays US Corporate Index closed on Thursday January 21 at 94 after closing the week prior at 94. Treasuries have hardly moved this week and are currently less than 2 basis points lower since last Friday. Through Thursday, the corporate index had posted a year-to-date total return of -1.22%.

The high grade primary market saw reasonable volume during the week that was right in line with concensus expectations. Over $25bln priced during the week. Year-to-date issuance stands at $100.3 billion.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of January 14-20 were +$7.7bln which brings the year-to-date total to +$22.7bln.