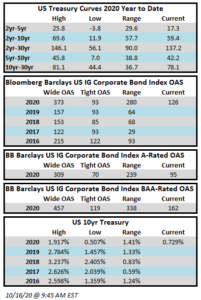

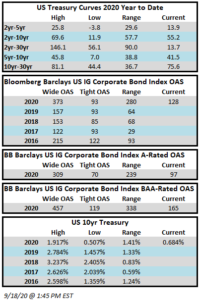

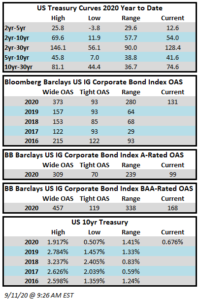

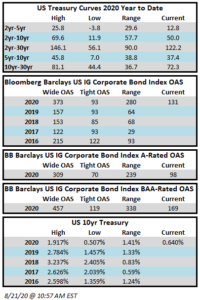

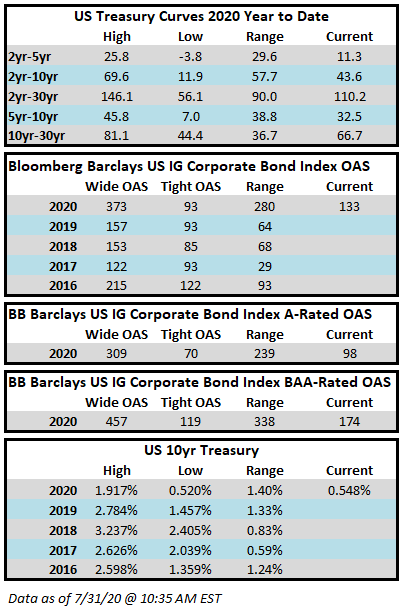

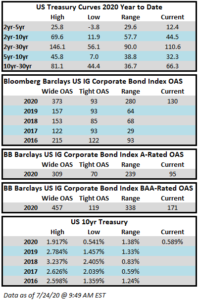

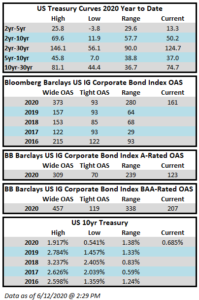

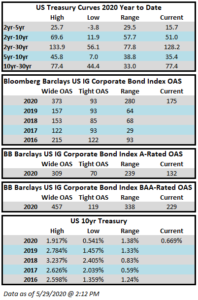

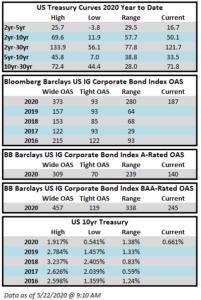

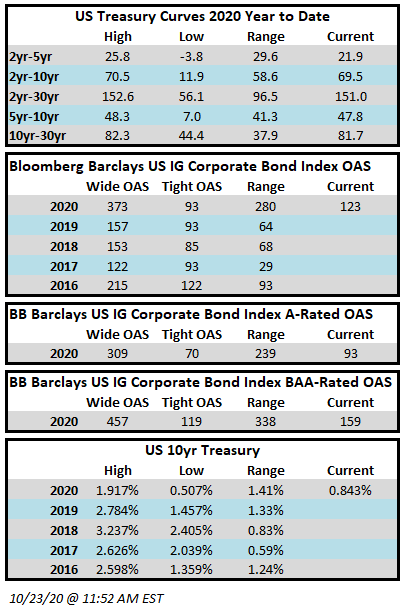

Spreads are modestly tighter on the week. The Bloomberg Barclays US Corporate Index closed on Thursday October 22 at 123 after closing the week prior at 125. Through Thursday, the corporate index posted a year-to-date total return of +6.51%. Falling Treasuries have been a headwind for corporate credit performance over the course of the past week with the 10-year Treasury nearly 10 basis points higher from its close the week prior.

The high grade primary market was quiet again this week, with just over $15bln in new debt brought to market. Issuance is likely to remain in a holding pattern until after the election.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of October 15-21 were +$8.0bln which brings the year-to-date total to +$231bln.