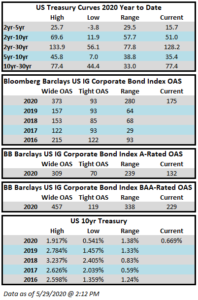

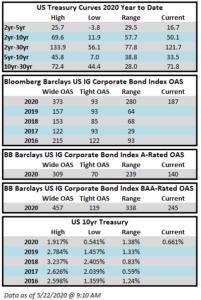

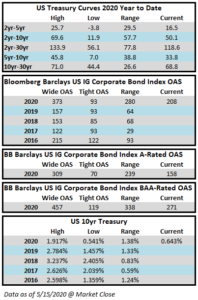

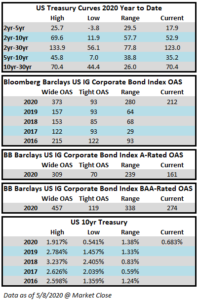

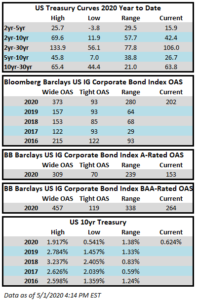

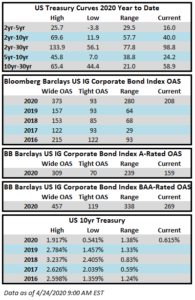

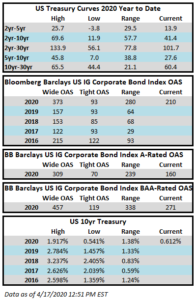

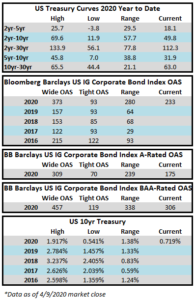

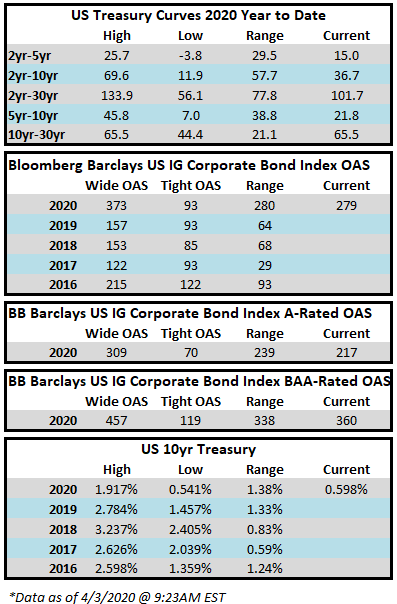

What a difference a few days makes. The investment grade credit market, like equities, went out with a whimper last week. On Monday, with the stimulus package in limbo, a deluge of supply pushed spreads out to their widest levels of the year, and the Bloomberg Barclays Corporate Index closed at 373. The next few days saw a much improved tone, and even in the face of a historically large primary calendar, spreads ratcheted in 71 basis points to close Thursday at 302. To put this 71 basis point move into context, it was larger than the yearly range of the corporate index for each of the preceding three years, and it took only three days; truly a stunning reversal. Even with the improved tone, through Thursday, the index was down -5.96% year-to-date while the S&P 500 was down -18.21%.

The primary market continues to bustle with activity and through Thursday it easily smashed the record for its busiest week in history. $98.9 billion had priced through Thursday eclipsing the previous weekly record of $74.8 billion, according to data compiled by Bloomberg. There are several deals in the market as we go to print on Friday morning which will push the final weekly total north of $100 billion. The bulk of the issuance this week was from highly rated issuers with “A” credit ratings but we started to see some BAA-rated issuers get into the mix as the week wore on. There is one lower quality BAA issuer in the market on Friday morning which is really the first of its kind in recent weeks so we will get an idea about how the market feels about lending to more challenged credit stories.

Investment grade credit was hit with major outflows for the fourth consecutive week. Flows for the week of March 19-25 were -$43.3bln according to data compiled by Wells Fargo. The four week total was nearly -$100bln. Year-to-date flows are now negative to the tune of -$28bln. We would like to think that with an improved tone that many of the panic sellers and leveraged fast money has exited a space that is more suited for strategic permanent capital. Improving flows can only help to further strengthen the tone in the credit markets.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.