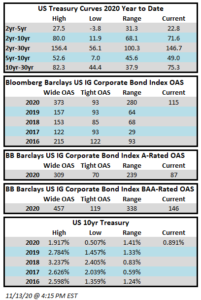

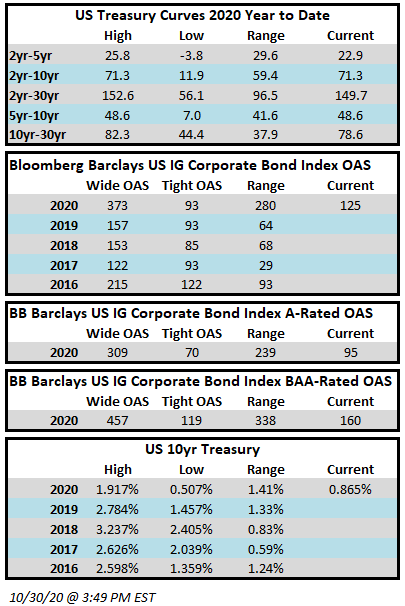

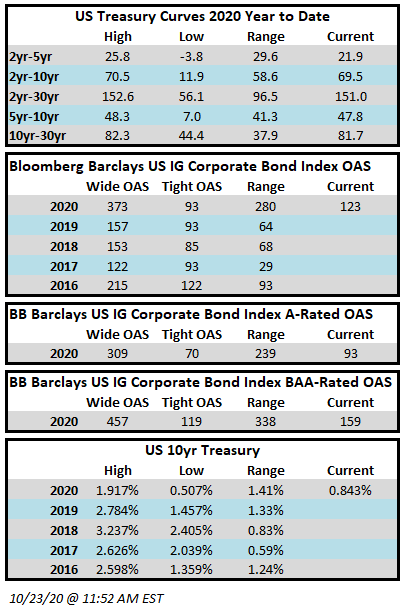

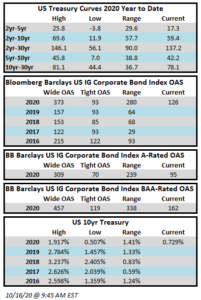

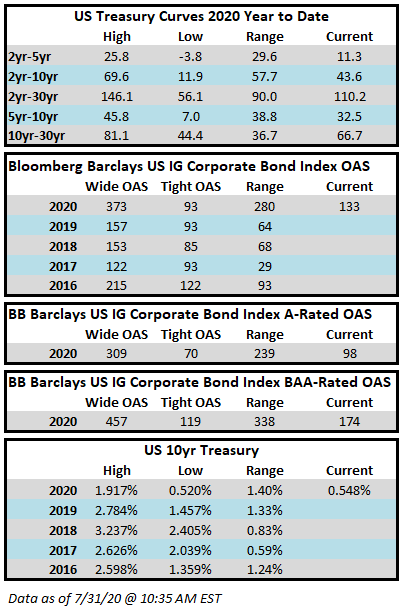

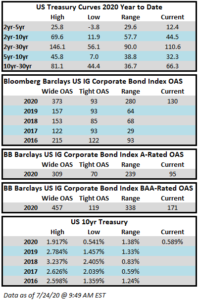

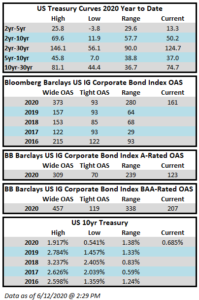

Spreads are all set to finish the week tighter. Risk assets fared well across the board this week on the back of positive vaccine news. The Bloomberg Barclays US Corporate Index closed on Thursday November 12 at 115 after closing the week prior at 117. Through Thursday, the corporate index posted a year-to-date total return of +7.71%.

The high grade primary market was fairly active given the Veterans Day holiday in the middle of the week. Jumbo deals from Verizon and Bristol-Myers pushed the weekly issuance total north of $41bln. Next week will be the last chance for issuers to access the market before things slow down ahead of Thanksgiving.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of November 5-11 were +$5.4bln which brings the year-to-date total to +$240.2bln.