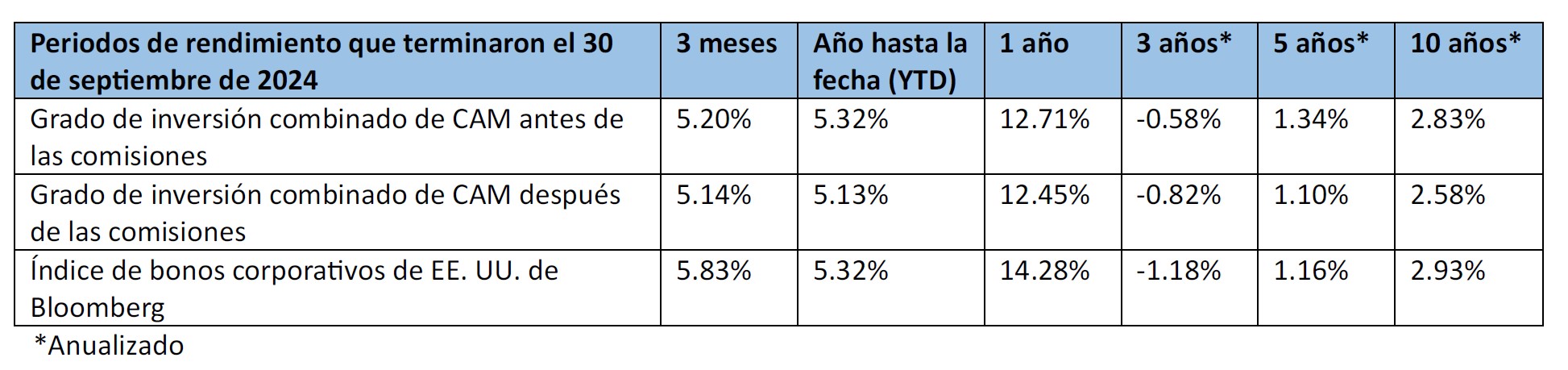

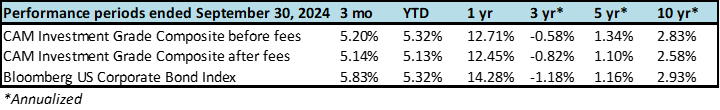

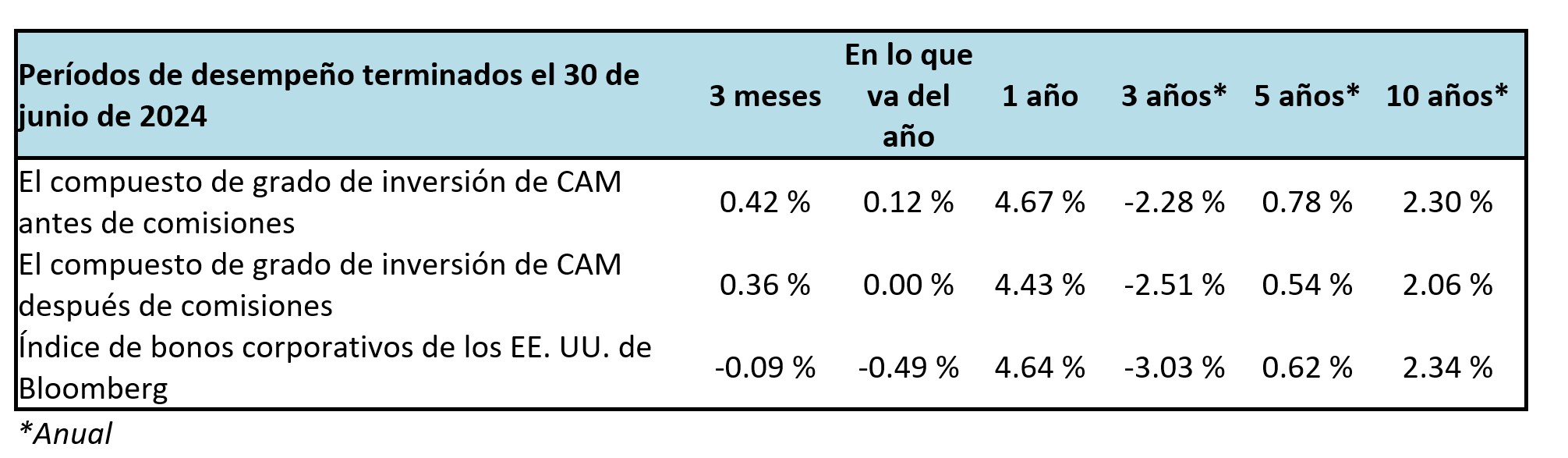

El crédito con grado de inversión registró un sólido desempeño durante el tercer trimestre, ya que los tenedores de bonos se beneficiaron de diferenciales de crédito más ajustados y rendimientos de los bonos del Tesoro más bajos. La Reserva Federal finalmente dio inicio al tan esperado ciclo de flexibilización al reducir su tasa de referencia por primera vez desde marzo de 2020. Seguimos siendo constructivos respecto del mercado de bonos con grado de inversión en el corto y mediano plazo.

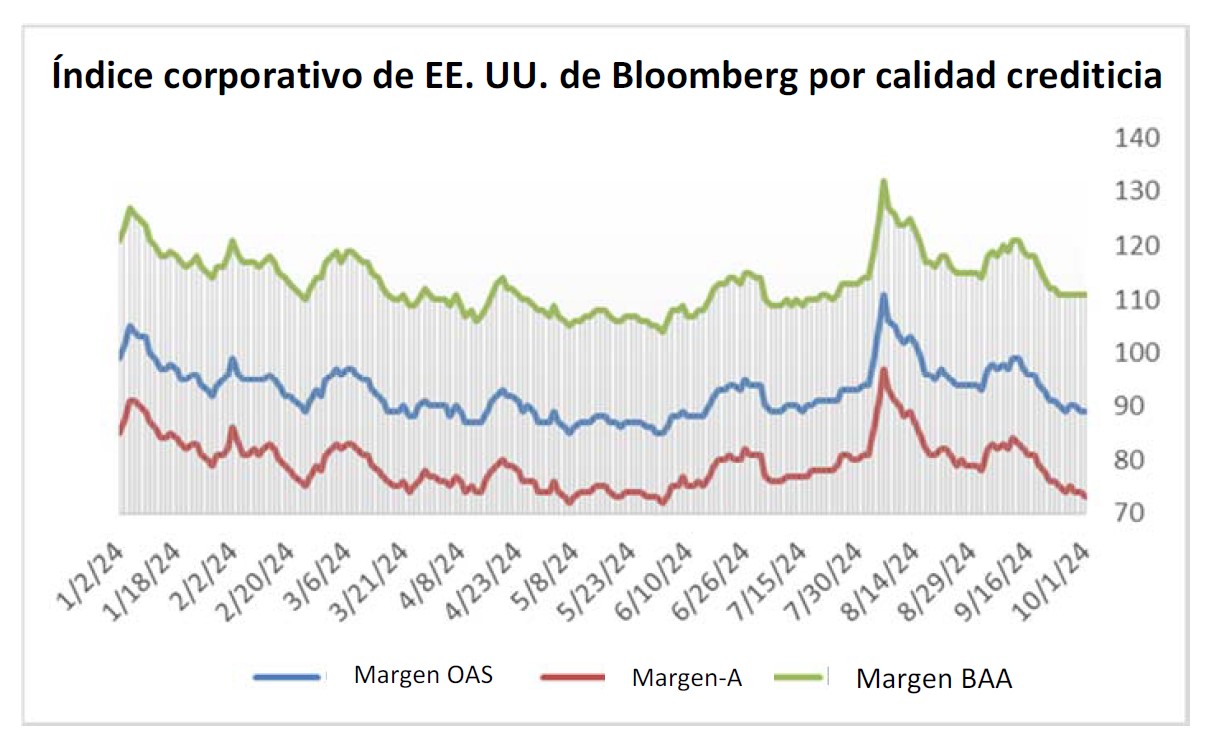

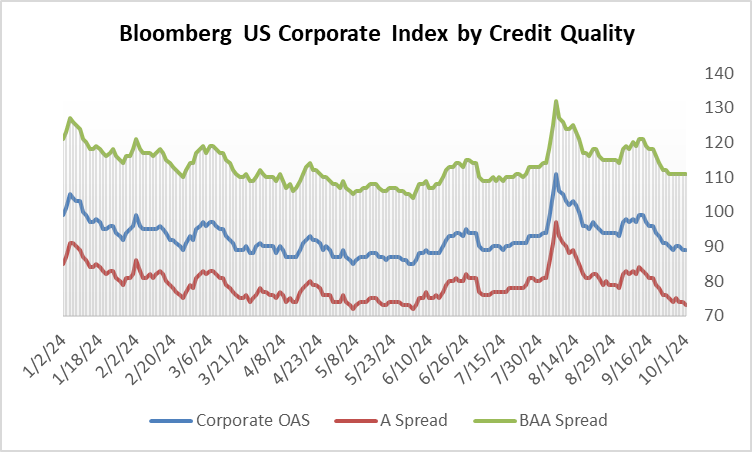

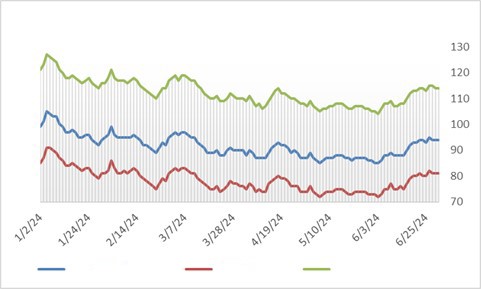

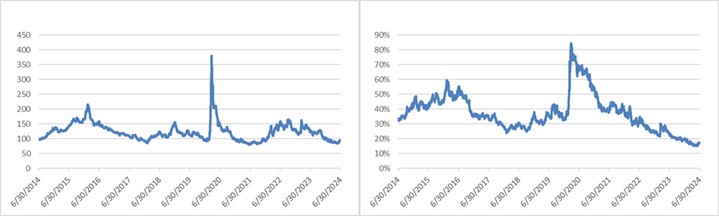

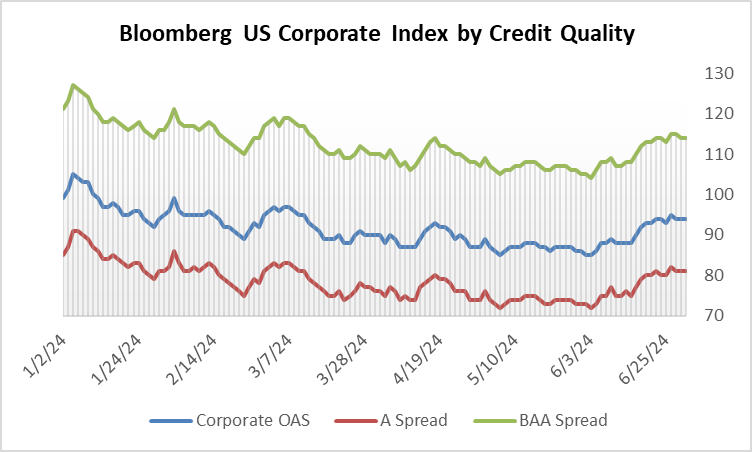

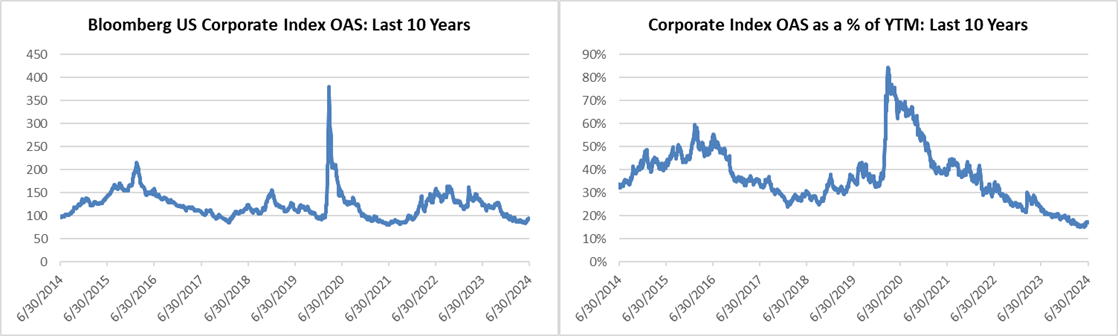

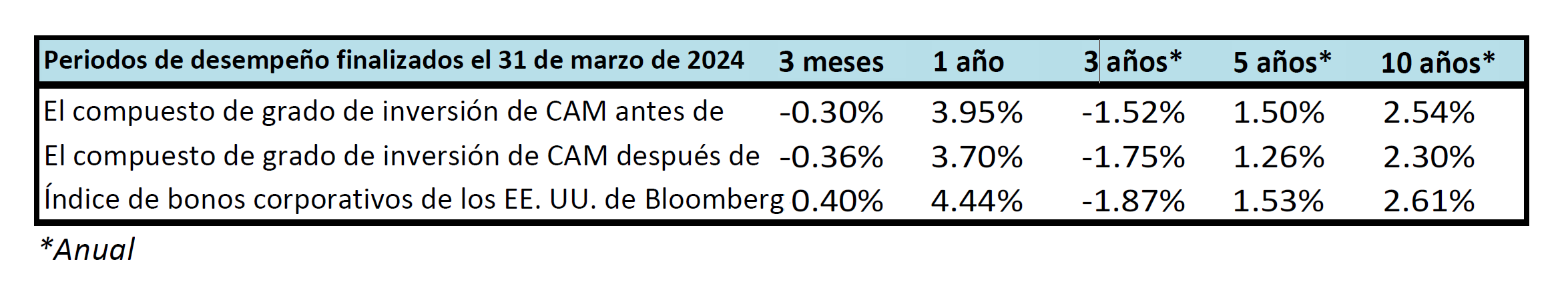

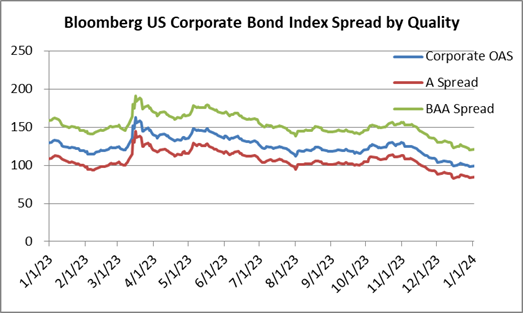

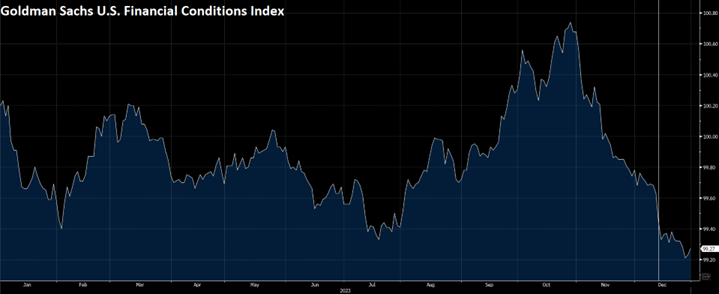

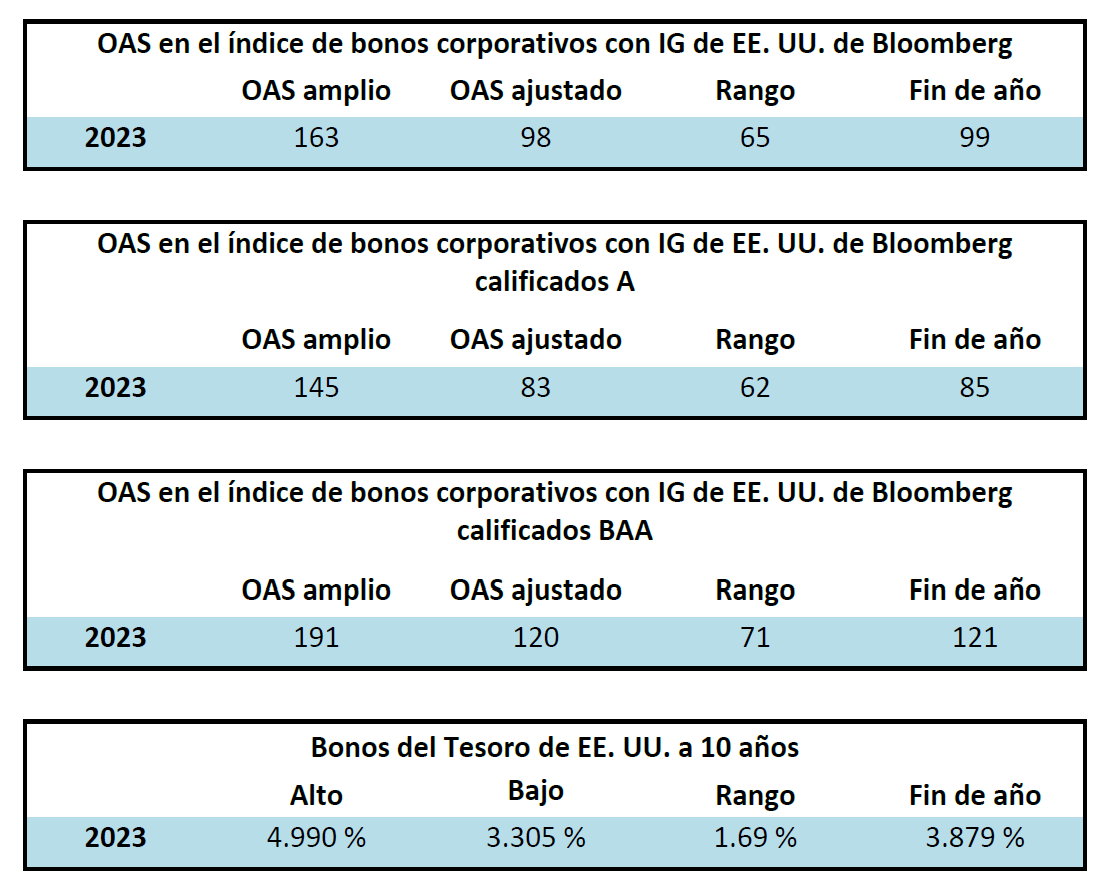

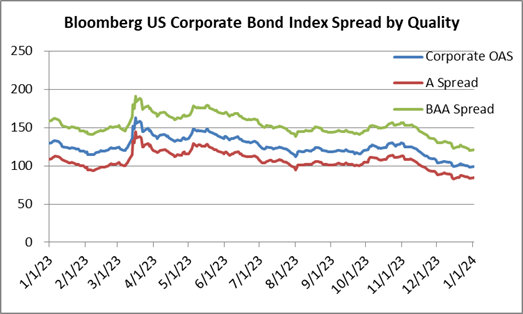

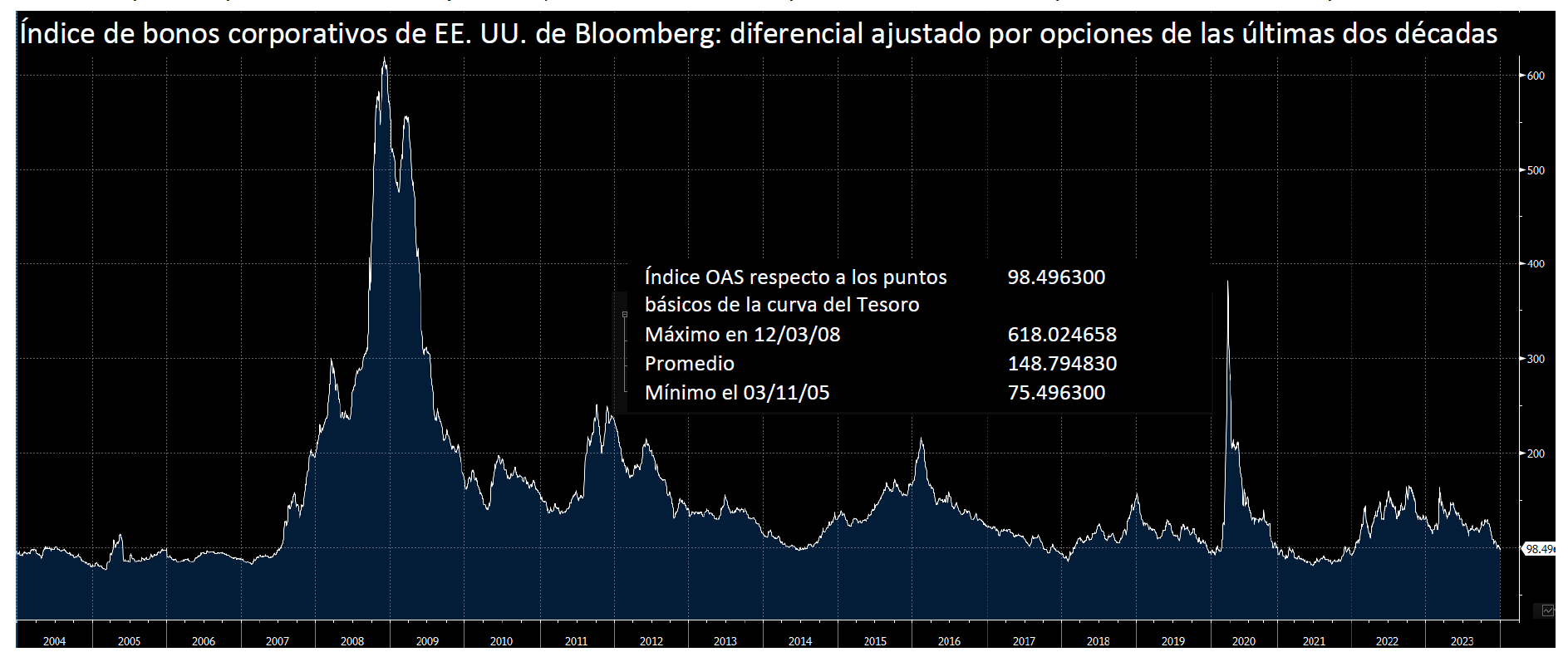

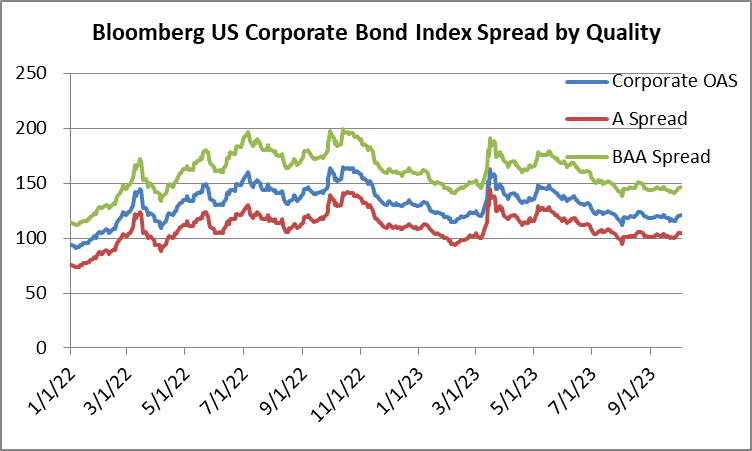

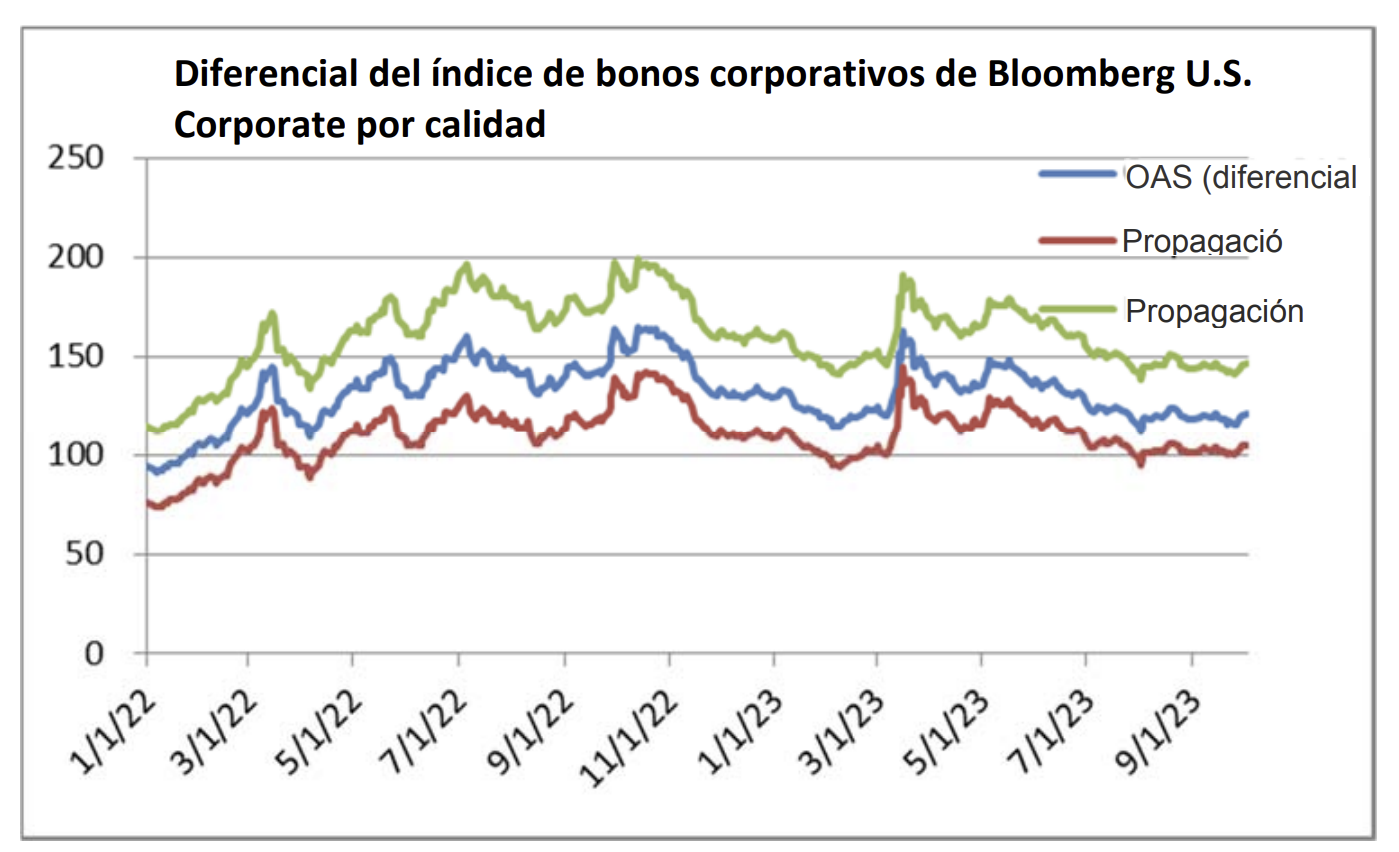

El diferencial ajustado por opciones (OAS) en el Índice de bonos corporativos de EE. UU. de Bloomberg abrió el tercer trimestre en 94 y cotizó en un amplio 111 a principios de agosto antes de terminar el trimestre con un diferencial de 89. Agosto trajo consigo algunos días hábiles volátiles, algo que aún no habíamos experimentado en 2024. La debilidad de los datos sobre manufactura y empleo perjudicaron el ánimo de los inversores y los índices bursátiles se desplomaron, lo que repercutió en los diferenciales de crédito. La debilidad en los diferenciales duró poco. El índice IG cerró en 111 el 5 de agosto antes de retroceder gradualmente hasta los 100 puntos el 14 de agosto. A partir de ahí, los diferenciales continuaron reduciéndose hacia el final del trimestre.

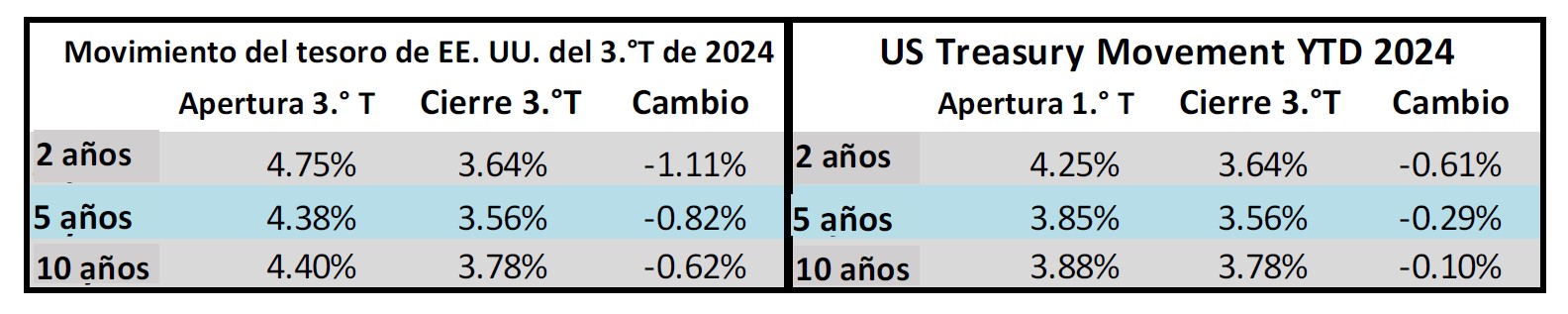

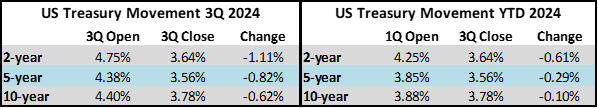

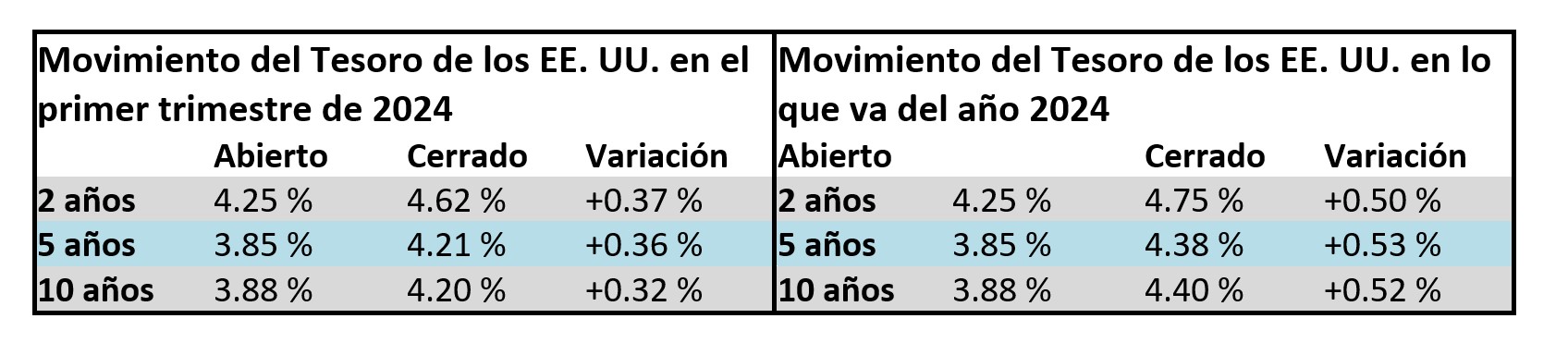

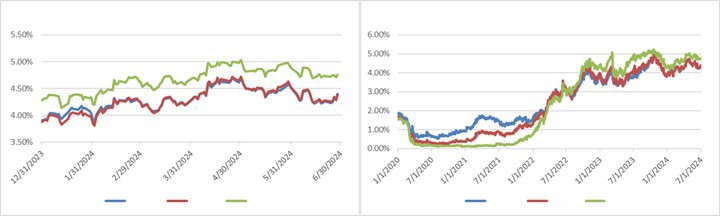

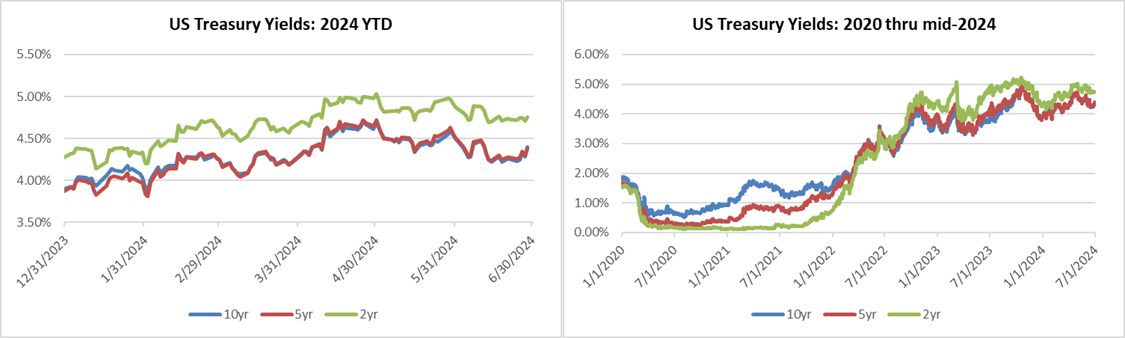

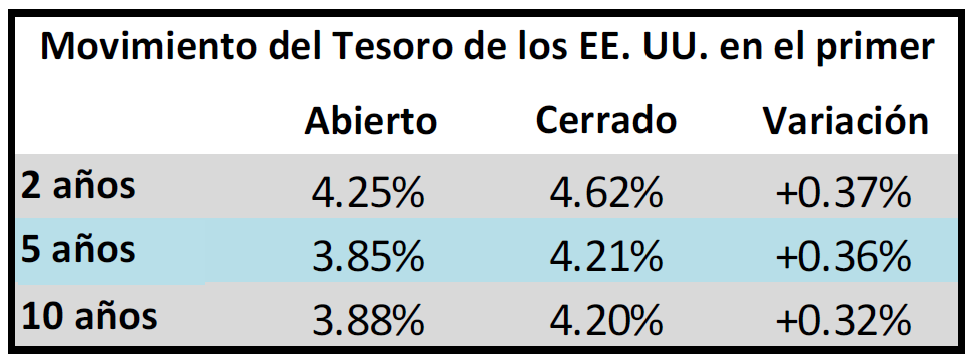

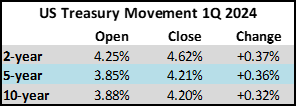

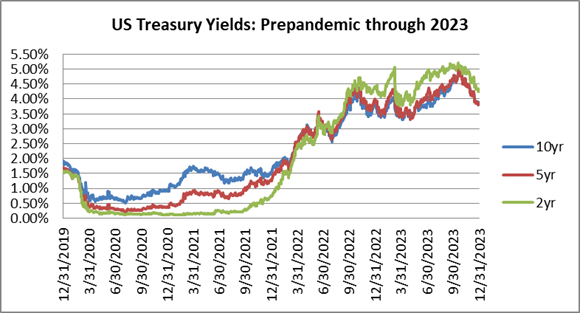

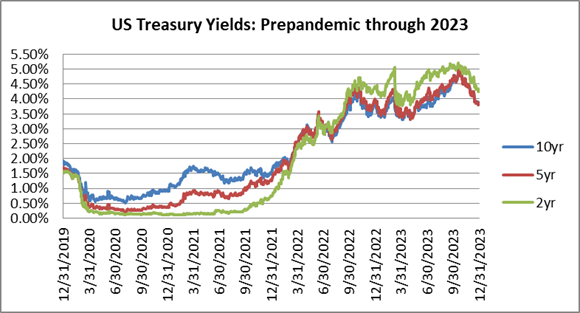

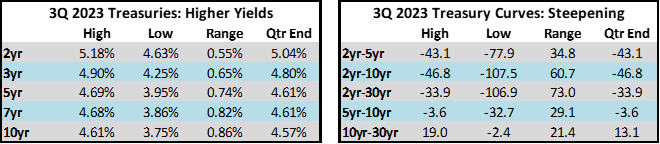

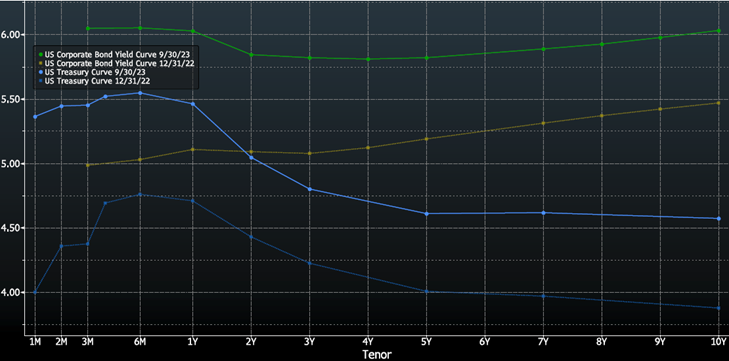

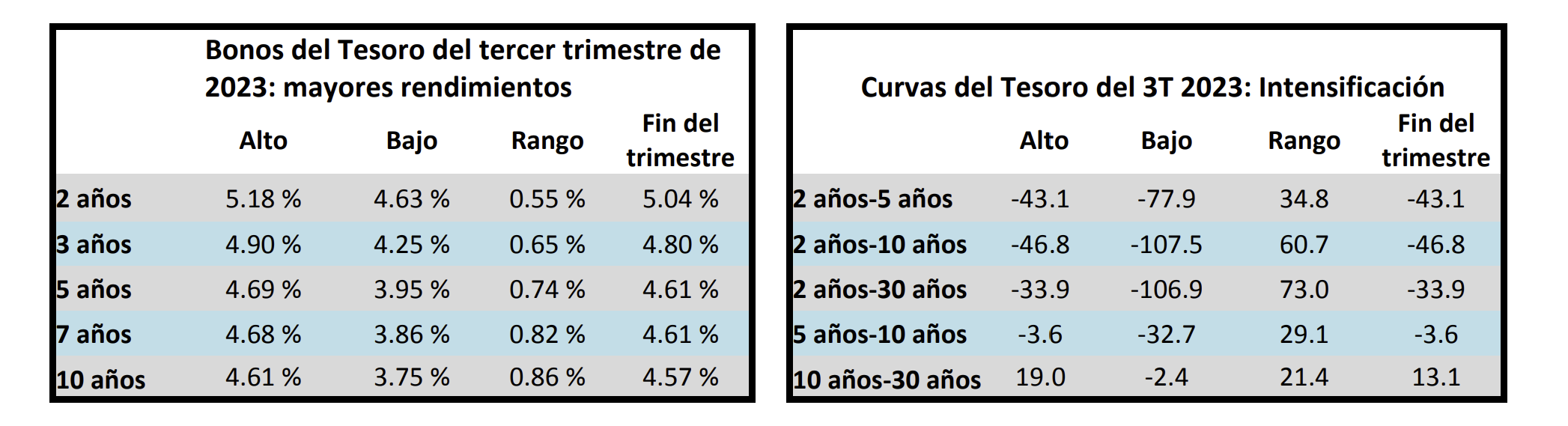

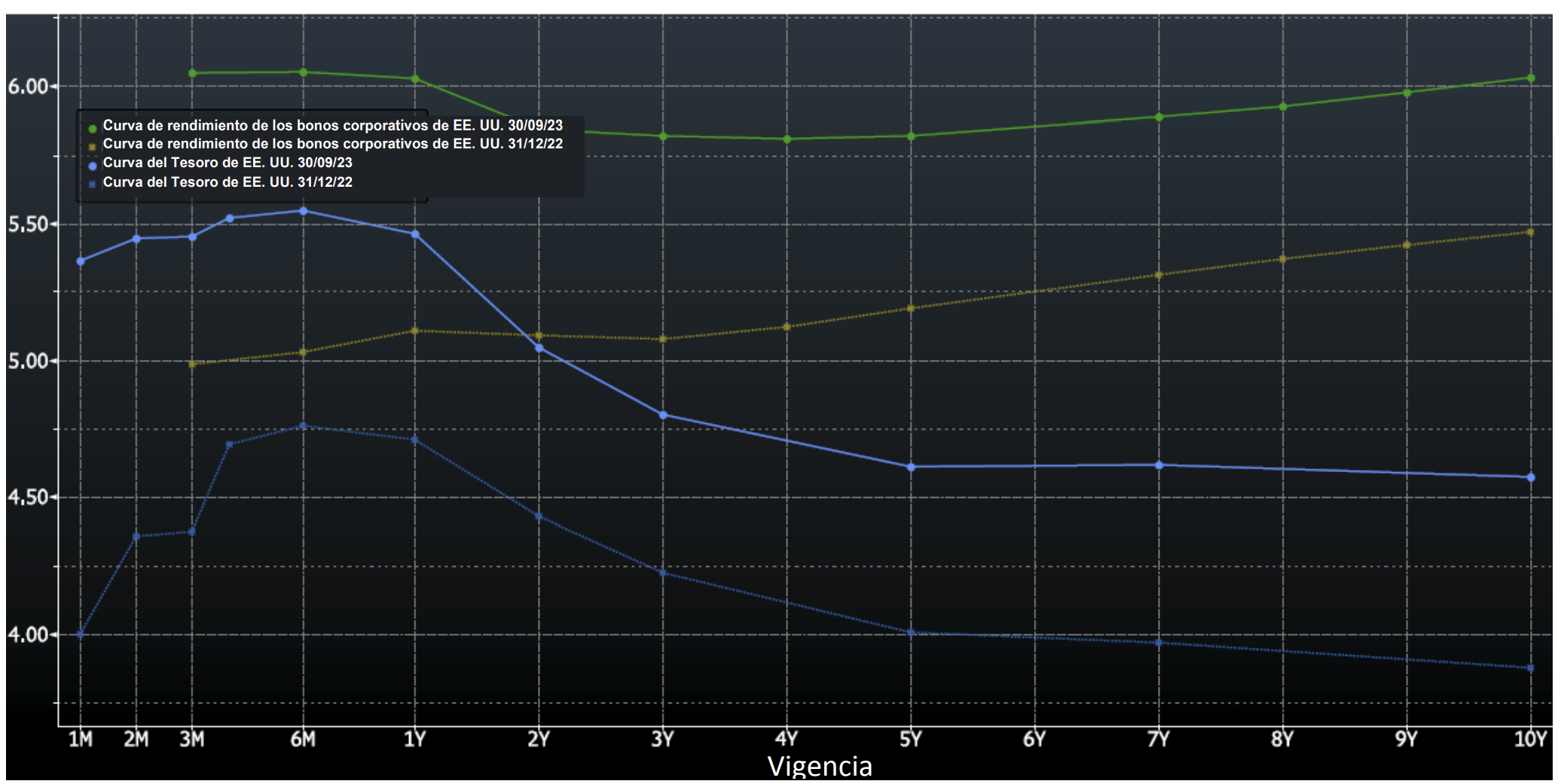

Los rendimientos de los bonos del Tesoro bajaron significativamente durante el trimestre, lo que supuso un viento a favor para los rendimientos totales. Esto contrasta con el segundo trimestre, en el que las tasas aumentaron en general. El extremo inicial de la curva de rendimiento fue especialmente más bajo en el tercer trimestre, con el Tesoro a 2 años registrando un enorme movimiento intertrimestral a la baja de -111 puntos básicos. Consideramos este repunte en la parte inicial de la curva como una respuesta clásica al recorte de la Reserva Federal, ya que históricamente las tasas a corto plazo suelen verse mucho más afectadas que las tasas más alejadas de la curva.

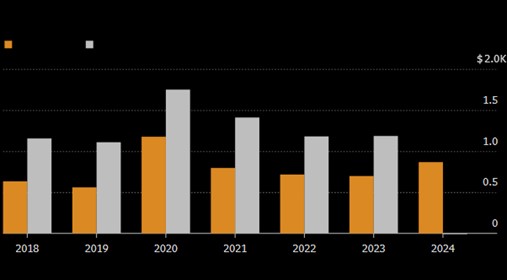

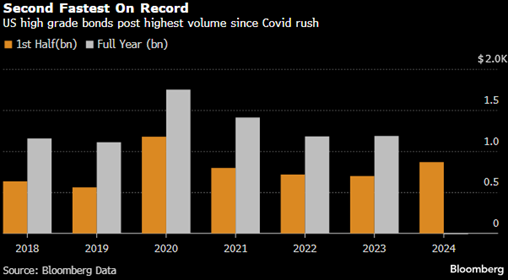

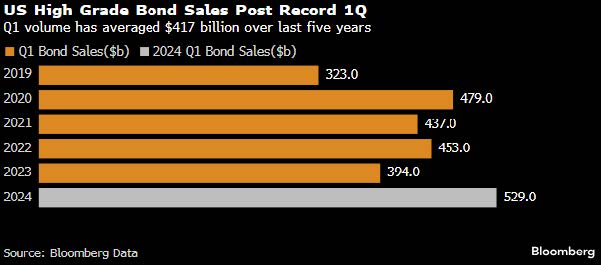

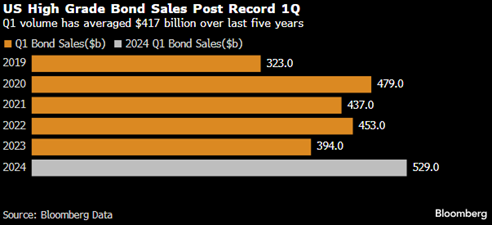

La emisión corporativa con grados de inversión continuó a su ritmo vertiginoso. Tanto julio como septiembre establecieron récords históricos por el mayor volumen jamás llevado al mercado en cada uno de esos meses. Se emitieron 1,264 billones de dólares de nueva deuda con grado de inversión durante el tercer trimestre, lo que supone una ventaja del 29% con respecto al ritmo de 2023 – y 2023 no se quedó atrás. Como hemos escrito en notas anteriores, el mercado de nuevas emisiones de 2024 ha estado en una zona privilegiada. Los prestatarios con calificación IG se han sentido cómodos con las tasas que están pagando, y los inversores han estado satisfechos con la compensación brindada. Los flujos de fondos han sido muy positivos y han apoyado la demanda de los inversores, y las concesiones por nuevas emisiones han sido razonables para la mayoría de las operaciones. La economía ha estado en una situación sólida y las empresas han necesitado capital para hacer crecer sus negocios. Queda por ver si este entorno persistirá o si tal vez se adelantó algún endeudamiento antes de las elecciones presidenciales de noviembre. En resumen, el mercado de nuevas emisiones ha estado increíblemente activo y ha funcionado a un alto nivel durante los primeros tres trimestres de 2024.

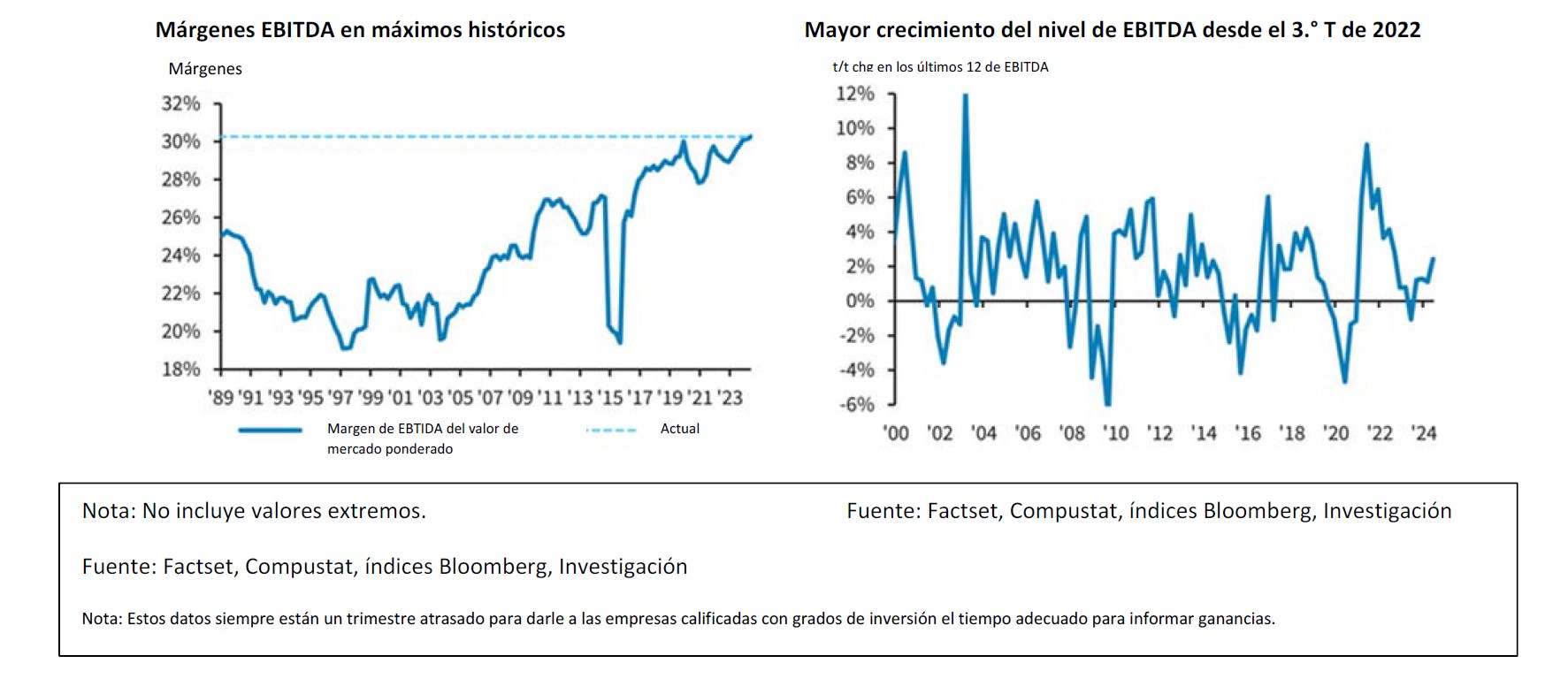

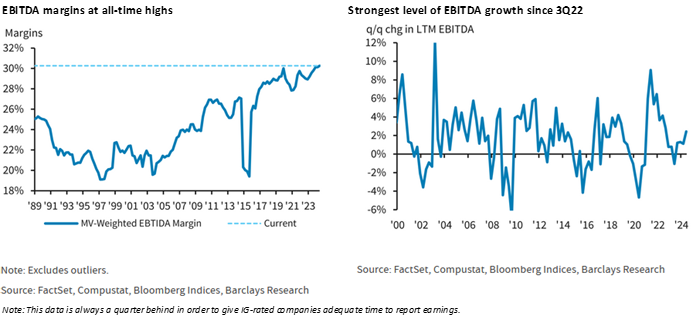

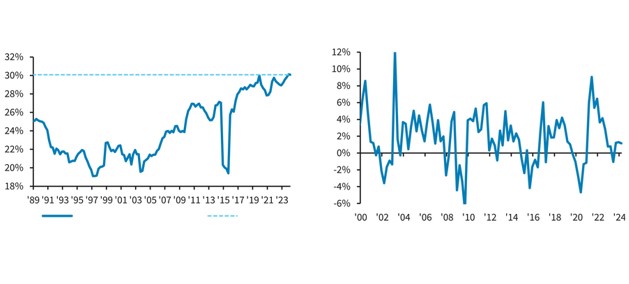

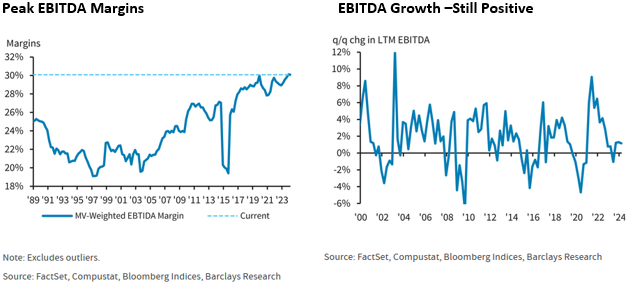

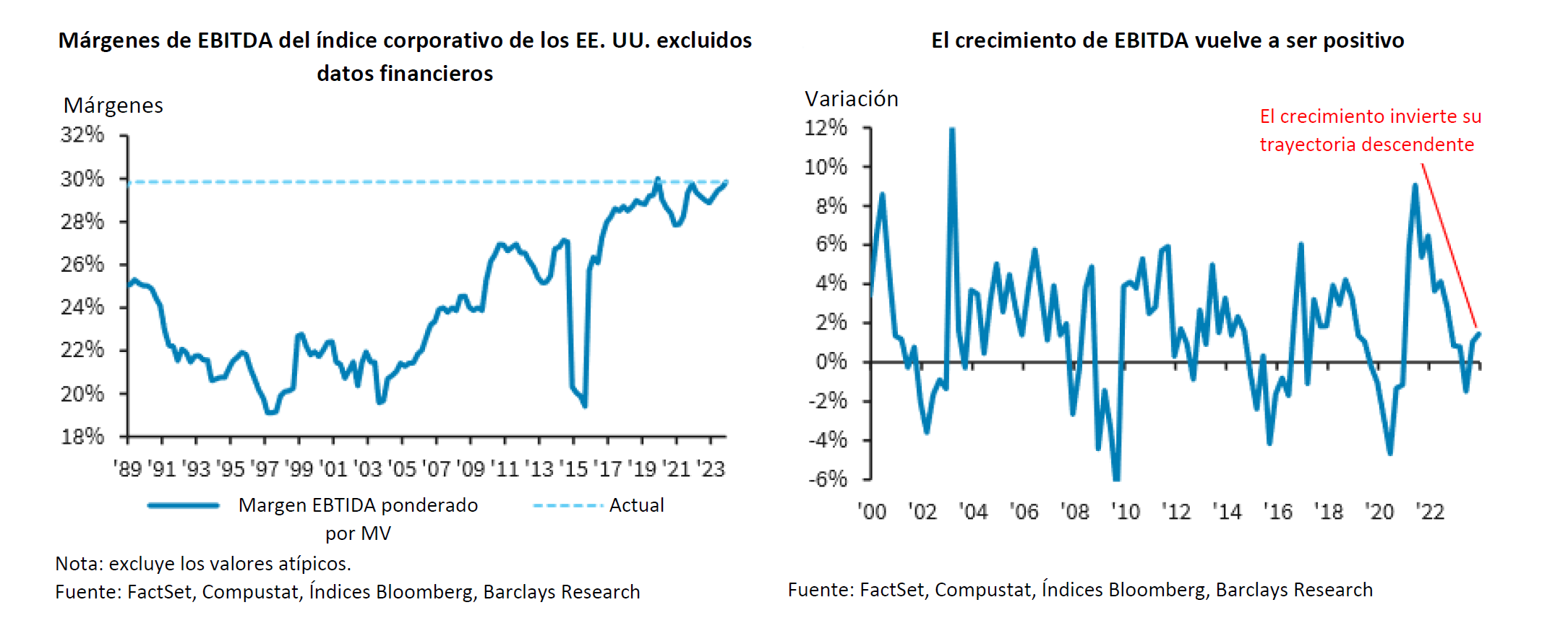

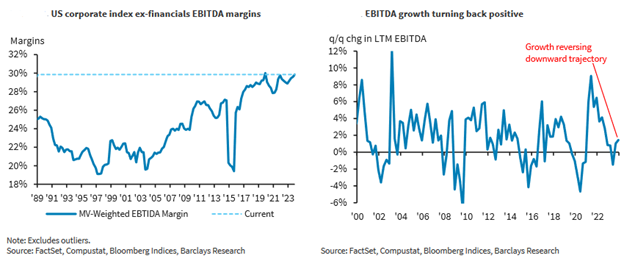

Los indicadores crediticios con grado de inversión continuaron mostrando resiliencia al final del segundo trimestre, beneficiándose de una economía que ha seguido creciendo. Los márgenes de EBITDA fueron del 30.3% al final del segundo trimestre, un nuevo máximo histórico, mientras que el crecimiento del EBITDA estuvo en su nivel más alto en dos años. La cobertura de intereses también mejoró gradualmente durante el trimestre, pero esto fue contrarrestado por un apalancamiento ligeramente mayor en todo el universo IG. En resumen, creemos que el crédito IG ofrece muchas oportunidades para invertir en empresas adecuadamente capitalizadas con buenos negocios y diferenciales atractivos.

Un año puede marcar una gran diferencia

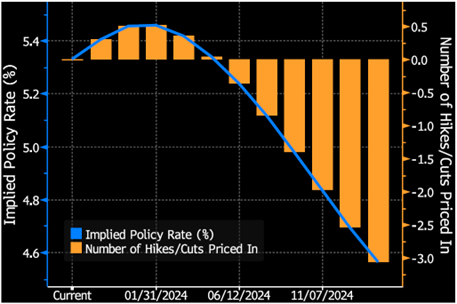

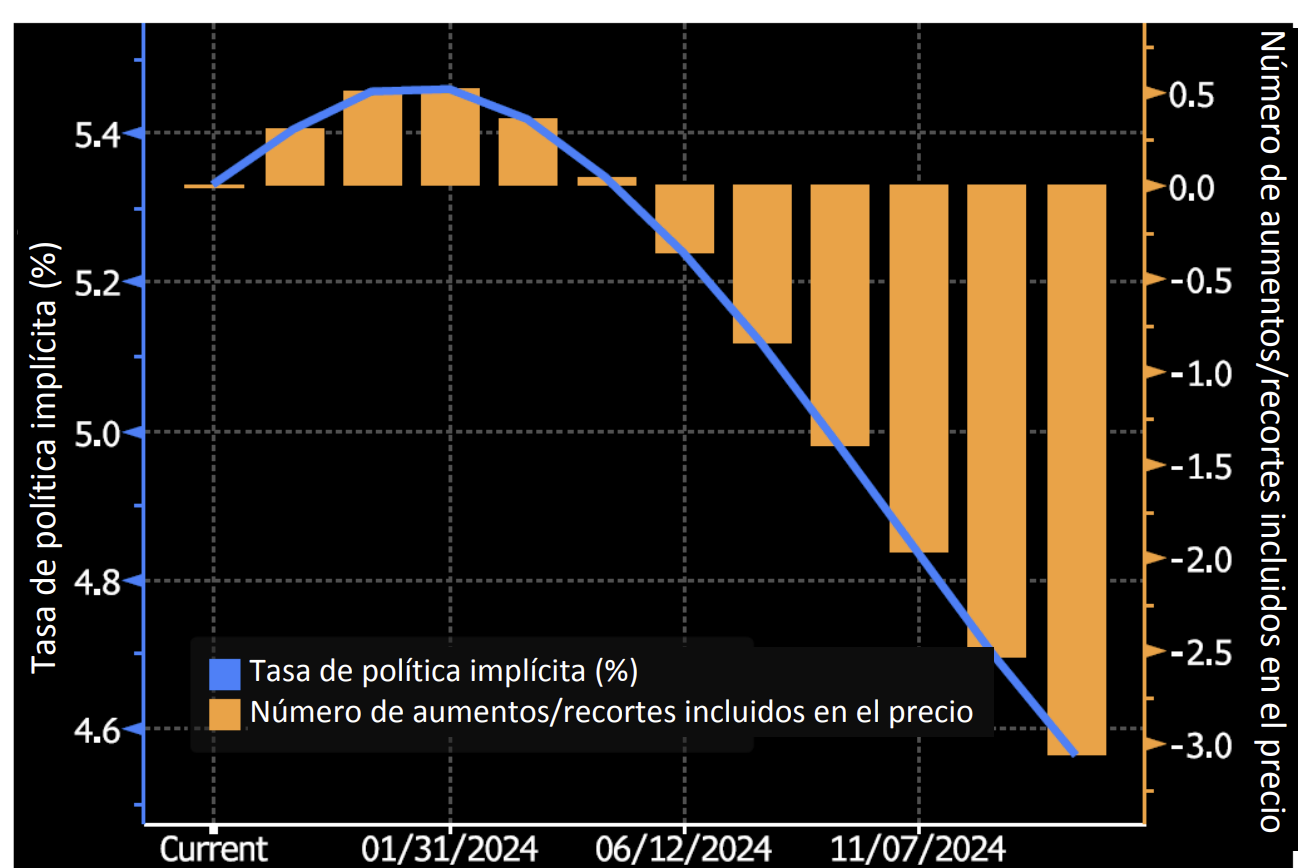

La Reserva Federal aplicó un recorte de 50 puntos básicos en su reunión de septiembre. Esto ocurrió después de haber elegido mantener constante su tasa de referencia en la reunión de julio y no haber habido reunión en agosto. El “gráfico de puntos” de la Reserva Federal que se publicó coincidiendo con la reunión mostró que la mediana de los puntos de vista de los 19 miembros del Comité Federal del Mercado Abierto (FOMC) eran las siguientes: 50 puntos básicos de recortes adicionales en 2024, 100 puntos básicos de recortes en 2025 y otros 50 puntos básicos de recortes en 2026. Los participantes del mercado adoptaron un punto de vista más moderado que la proyección de la Reserva Federal para el resto de 2024, y los futuros de los fondos de la Reserva Federal desestimaron recortes de 71 puntos básicos antes de fin de año al 1 de octubre. Creemos que este ciclo de flexibilización será deliberado y se desarrollará a lo largo de varios años. La Reserva Federal no puede darse el lujo de actuar demasiado apresuradamente debido al riesgo de reavivar las presiones inflacionarias. El comodín es que la Reserva Federal podría recortar su tasa más rápida y agresivamente si el mercado laboral se deteriora rápidamente respecto de los niveles actuales, ya que históricamente ese ha sido un indicador adelantado de recesión.

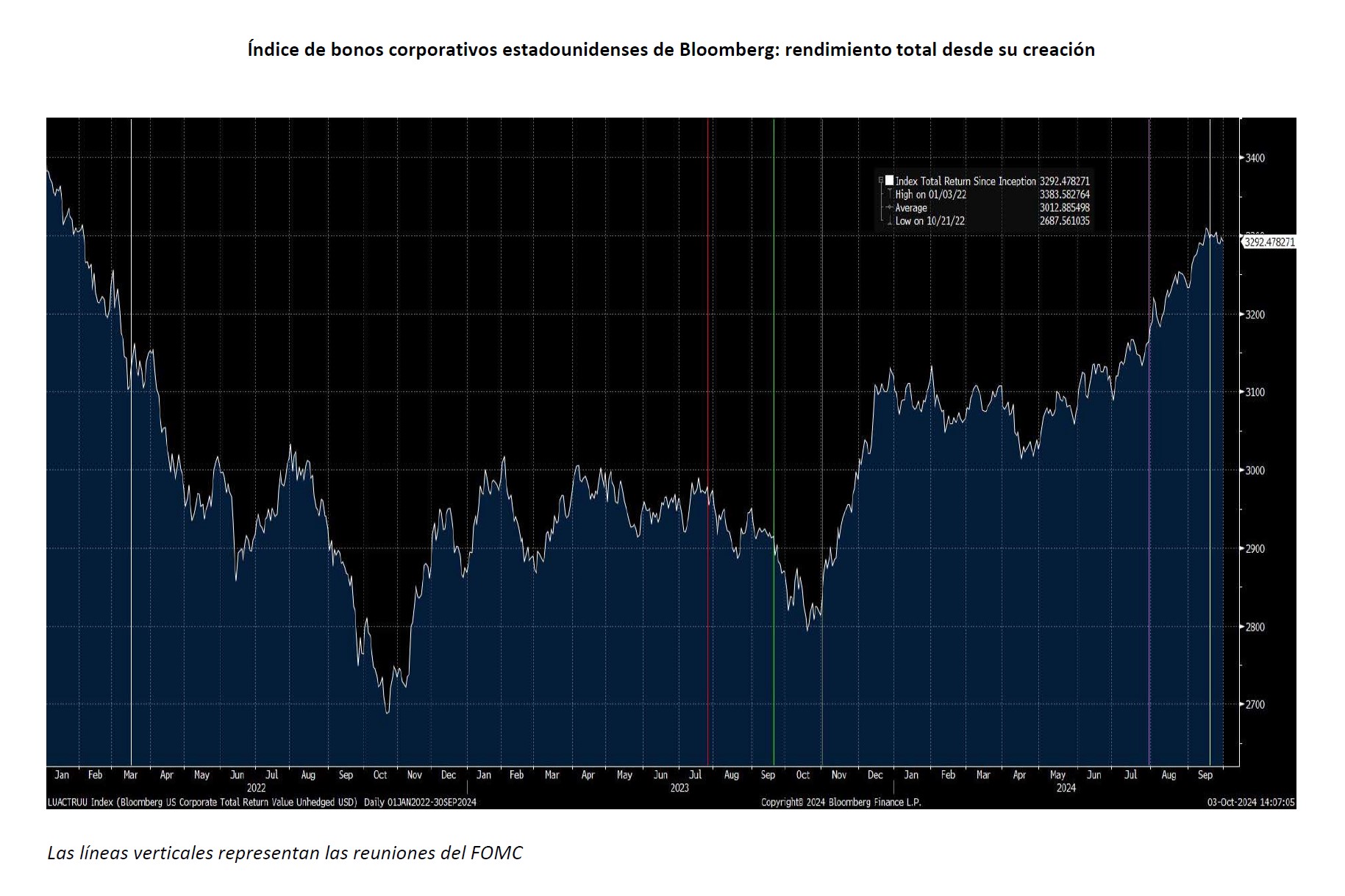

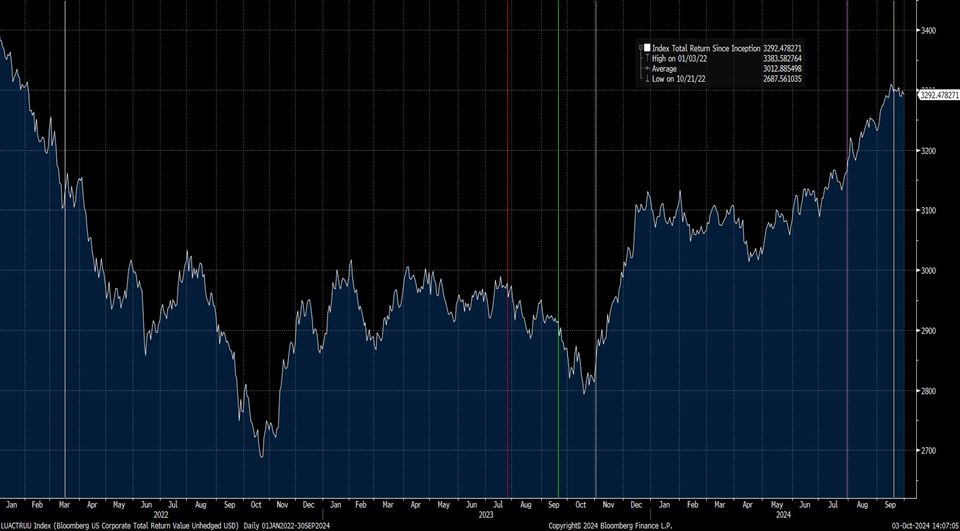

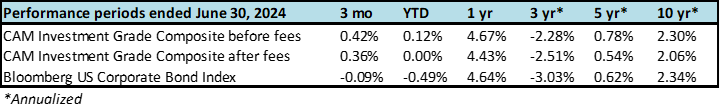

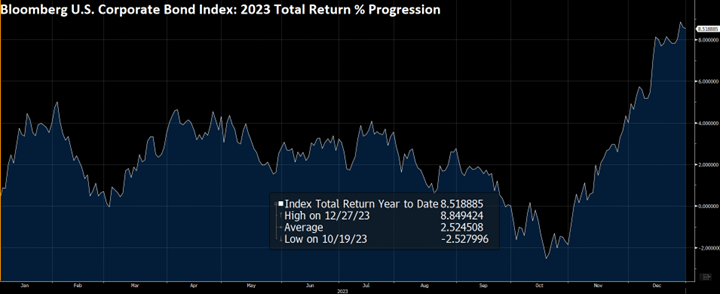

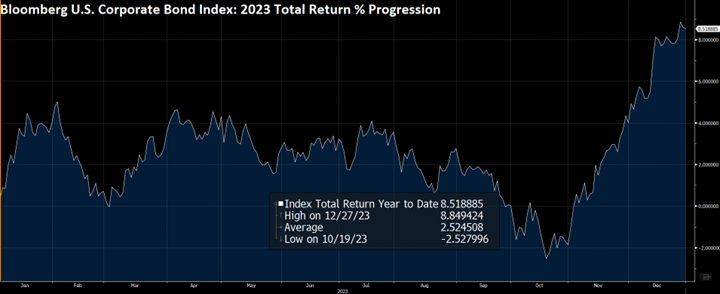

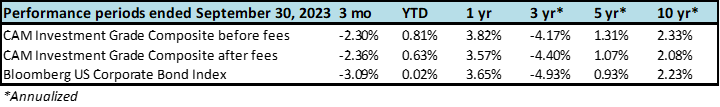

Pensamos que sería instructivo ilustrar la progresión de los rendimientos de grado de inversión a lo largo del ciclo de ajuste que desde entonces se ha convertido en un ciclo de flexibilización. El gráfico de la página siguiente muestra el rendimiento total del índice IG desde su inicio, pero hemos recortado los datos para mostrar el ciclo actual desde principios de 2022 hasta el tercer trimestre de 2024. El mercado alcanzó su mínimo del ciclo actual en octubre de 2022 antes de recuperarse en 2023, operando de forma lateral antes de volver a caer en octubre de 2023. Hubo un poderoso aumento durante el cuarto trimestre de 2023 antes de que el mercado se mantuviera estancado durante la mayor parte de este año hasta el último trimestre, donde una vez más ha tendido en una dirección positiva.

Las líneas verticales del gráfico representan reuniones cruciales de la Reserva Federal que han tenido lugar desde principios de 2022, las cuales exploraremos más adelante. A modo de aclaración, seríamos negligentes si no dijéramos que este análisis es mucho más fácil con el beneficio de la retrospectiva, pero creemos que, no obstante, es un ejercicio interesante.

3/16/2022: El primer aumento de la tasa de referencia del ciclo de ajuste. Esto fue bien anunciado y anticipado por los inversores y muchos pensaron que la Reserva Federal debería haber actuado incluso antes para combatir la inflación.

7/26/2023: El último aumento de la tasa del ciclo de ajuste. Esto llevó la tasa de referencia a su nivel más alto en 22 años. Recordemos que, en ese momento, no estaba del todo claro si la Reserva Federal había concluido con los aumentos. Después de todo, la Reserva Federal ya hizo una pausa en junio para luego volver a aumentar las tasas en esta reunión. En la conferencia de prensa posterior a la decisión del FOMC, el presidente Powell dijo: “Ciertamente es posible que volvamos a aumentar las tasas en la reunión de septiembre”. “Y yo también diría que es posible que optemos por mantenernos firmes en esa reunión”.

9/20/2023: La Reserva Federal vuelve a hacer una pausa por primera vez desde junio, pero no se compromete a realizar más alzas.

11/1/2023: La Reserva Federal hace una tercera pausa en el ciclo y los comentarios de Powell indican que la vara está más alta para un mayor ajuste a través de ajustes a la tasa de referencia. ¿Es coincidencia que el mercado haya subido mucho a finales de año?

7/31/2024: La Reserva Federal mantiene estables las tasas, pero indica que se vislumbran recortes a corto plazo.

9/18/2024: La Reserva Federal aplica su primer recorte de tasas del ciclo actual. Al final del tercer trimestre, el índice IG había recuperado casi la totalidad del valor que perdió durante el ciclo de ajuste. El índice ha registrado un rendimiento total del +14.28% desde el final del tercer trimestre de 2023 hasta el final del tercer trimestre de 2024.

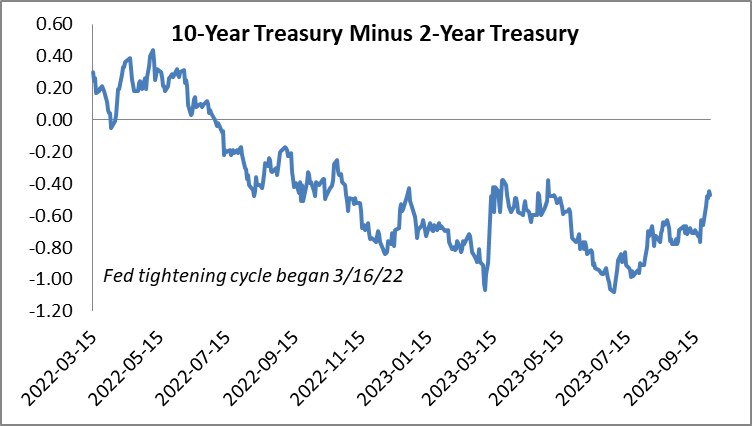

¿Qué ha cambiado en nuestra cartera?

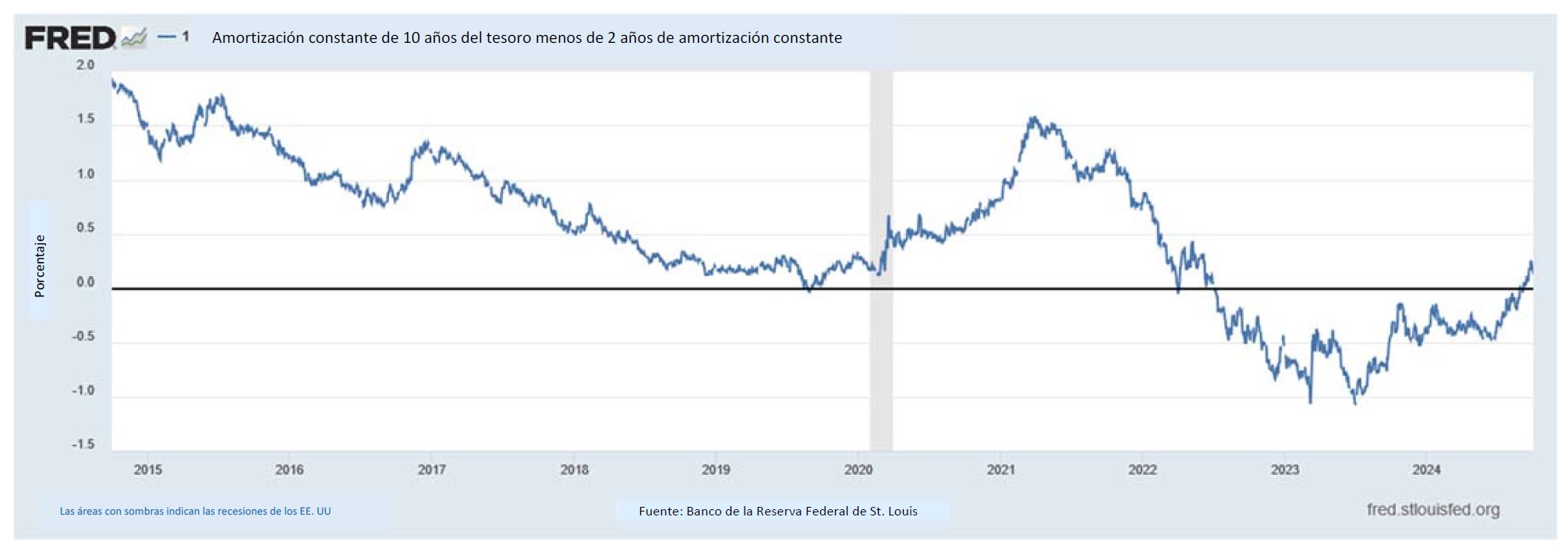

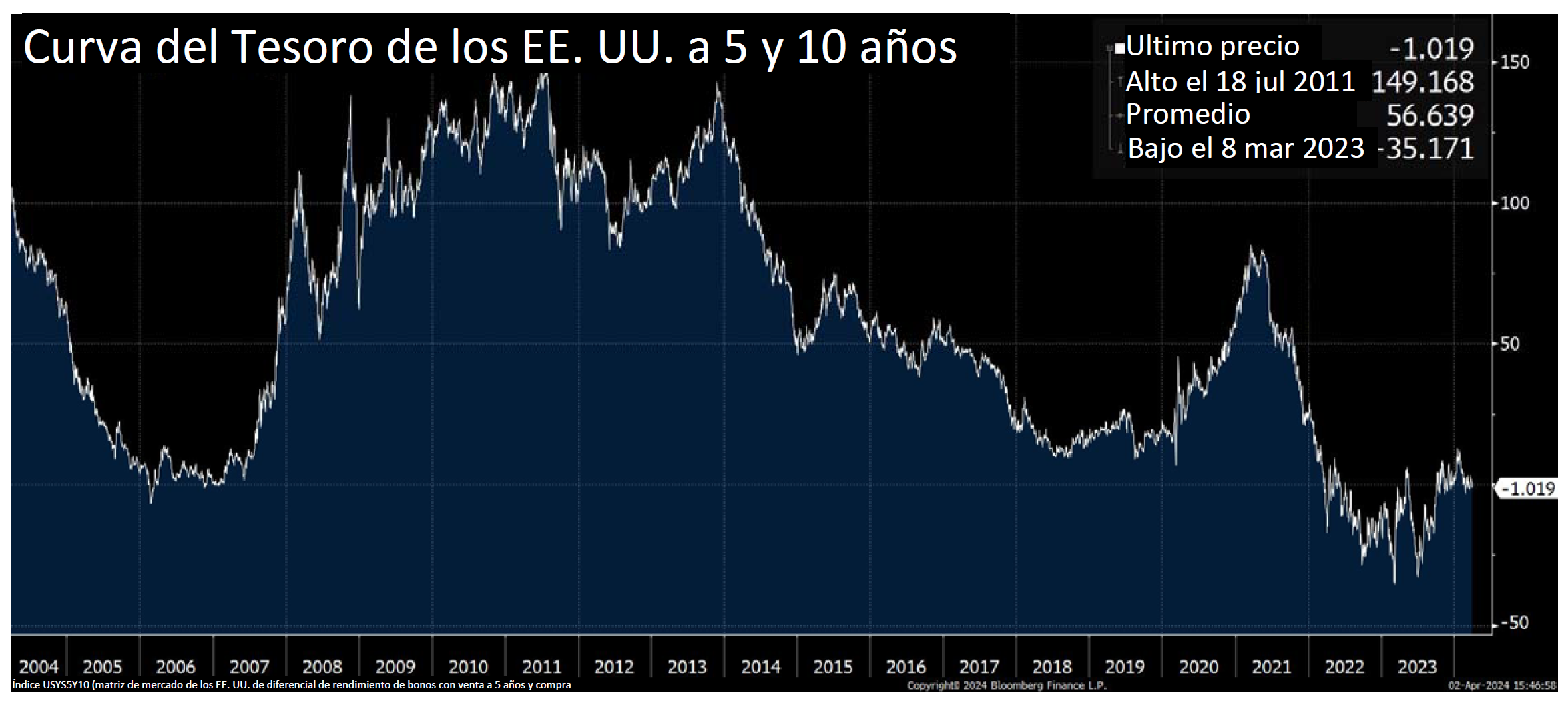

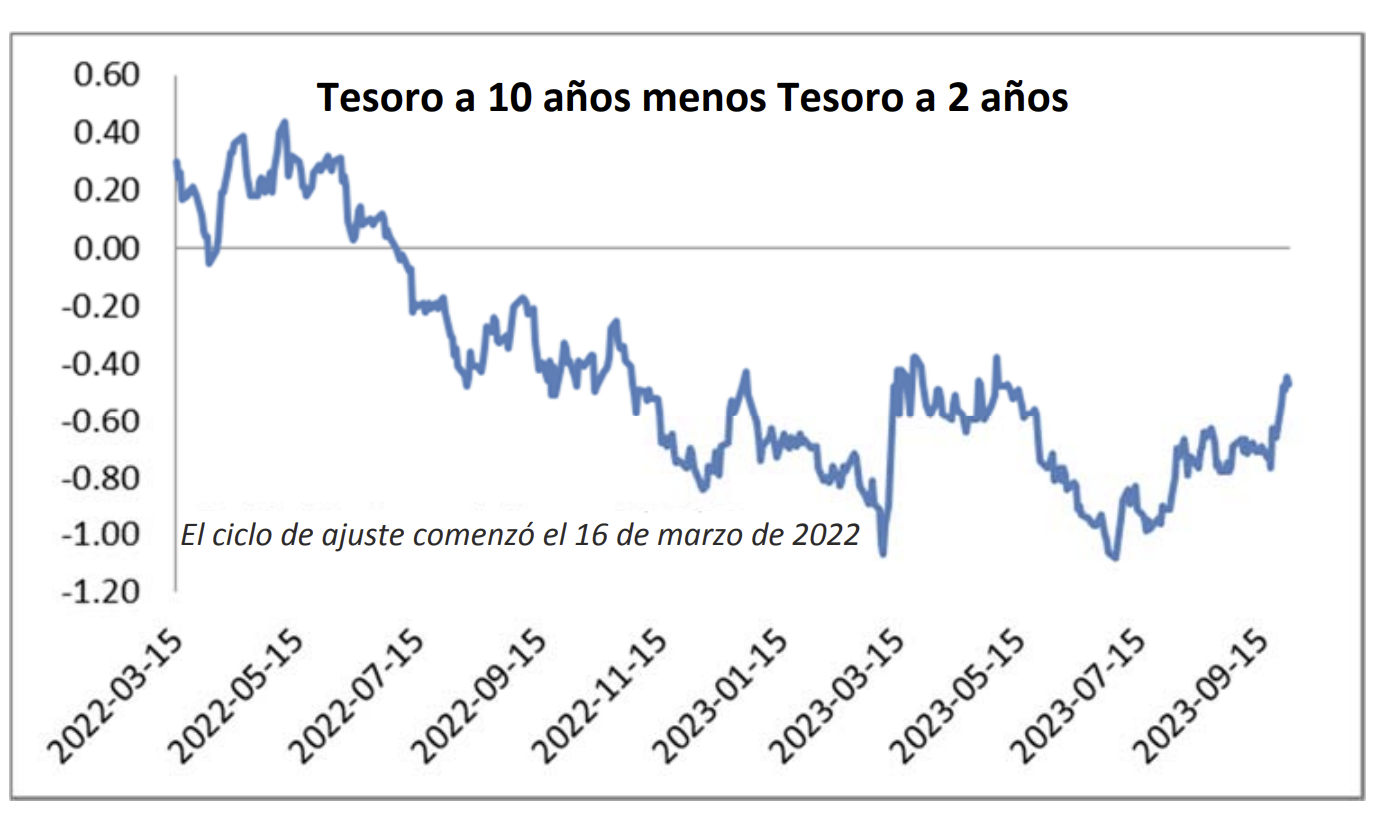

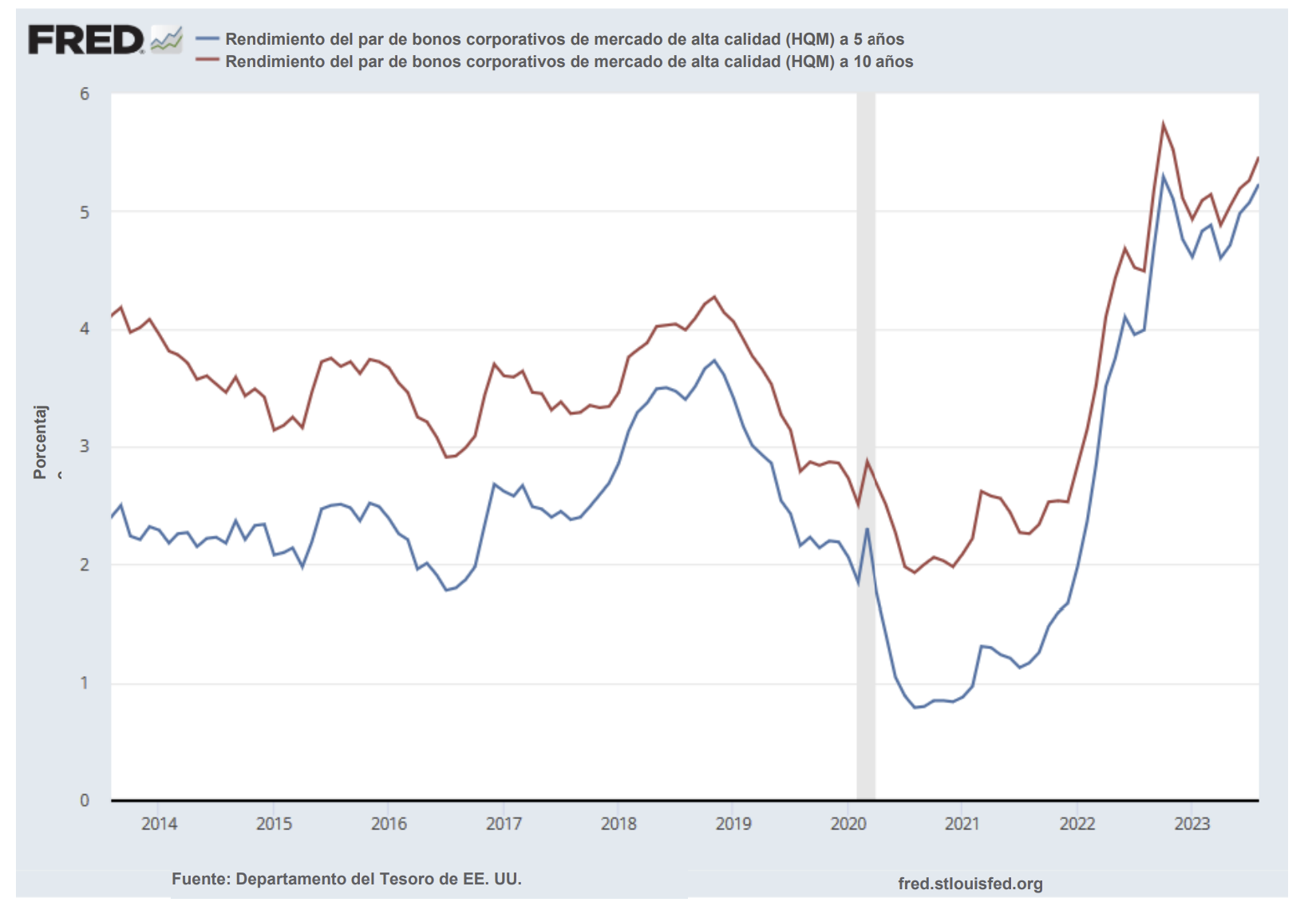

El mayor cambio que hemos podido implementar en 2024 es que las ventas y ampliaciones han vuelto a ser económicas. Gran parte de lo que intentamos lograr para nuestros clientes se deriva de nuestro posicionamiento intermedio. Generalmente poblamos las cuentas nuevas con bonos que vencen en 8 a 10 años. Luego permitiremos que esos bonos desciendan por la curva de rendimiento, con el objetivo de comprimir los diferenciales a medida que los bonos se acerquen a la marca de los 5 años. Cuando falten unos 5 años para el vencimiento, empezaremos a vender bonos y a ampliar la curva. Esto nos permite mitigar el riesgo de tasa de interés y captar la inclinación de la curva de 5/10 del Tesoro, así como la curva de crédito corporativo. ¡Todo esto es cierto en tiempos normalizados, pero los últimos dos años han sido todo lo contrario! La curva de bonos 2/10 del Tesoro se invirtió durante un récord de 25 meses consecutivos (consulte el gráfico a continuación de la Reserva Federal de St. Louis).[i] Esto hizo que nuestras operaciones de venta y extensión fueran antieconómicas: las matemáticas simplemente dictaban que a nuestros clientes, en muchos casos, les convenía mantener sus bonos existentes durante más tiempo del habitual, para permitir que pasara el ciclo de ajuste y ganar tiempo para que la curva recuperara su inclinación. Durante este tiempo, seguíamos ocupados investigando y supervisando los créditos y realizando cambios en los márgenes, pero nuestra actividad de venta de cuentas totalmente invertidas durante el punto máximo de la inversión de la curva se vio gravemente disminuida. Esto cambió de manera importante en 2024, ya que las curvas comenzaron a normalizarse y estamos encontrando oportunidades comerciales mucho más atractivas que hemos utilizado para agregar valor para nuestros clientes. Nuestro volumen se duplicó durante el último año y ahora se acerca a una cifra mucho más acorde con los promedios históricos.

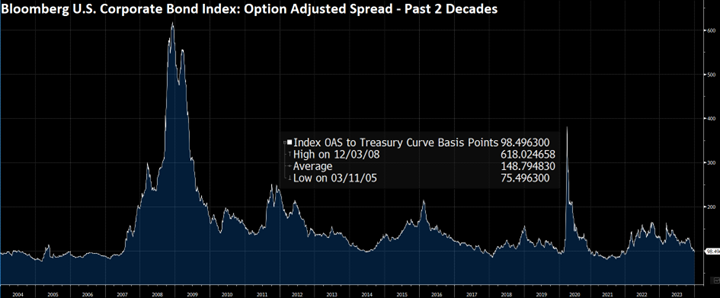

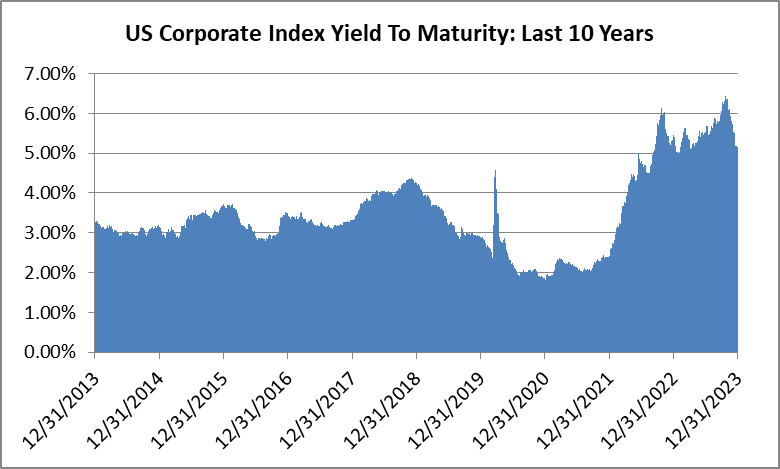

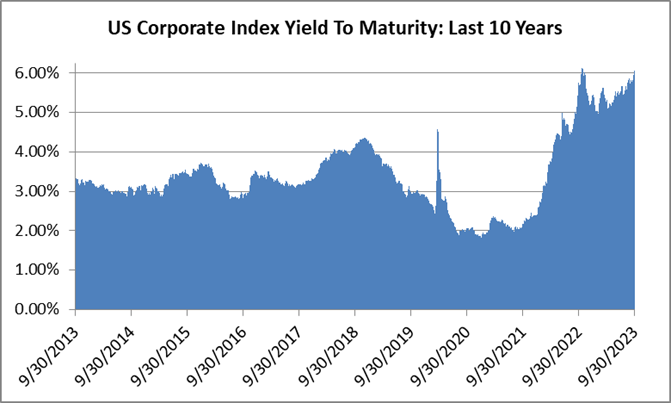

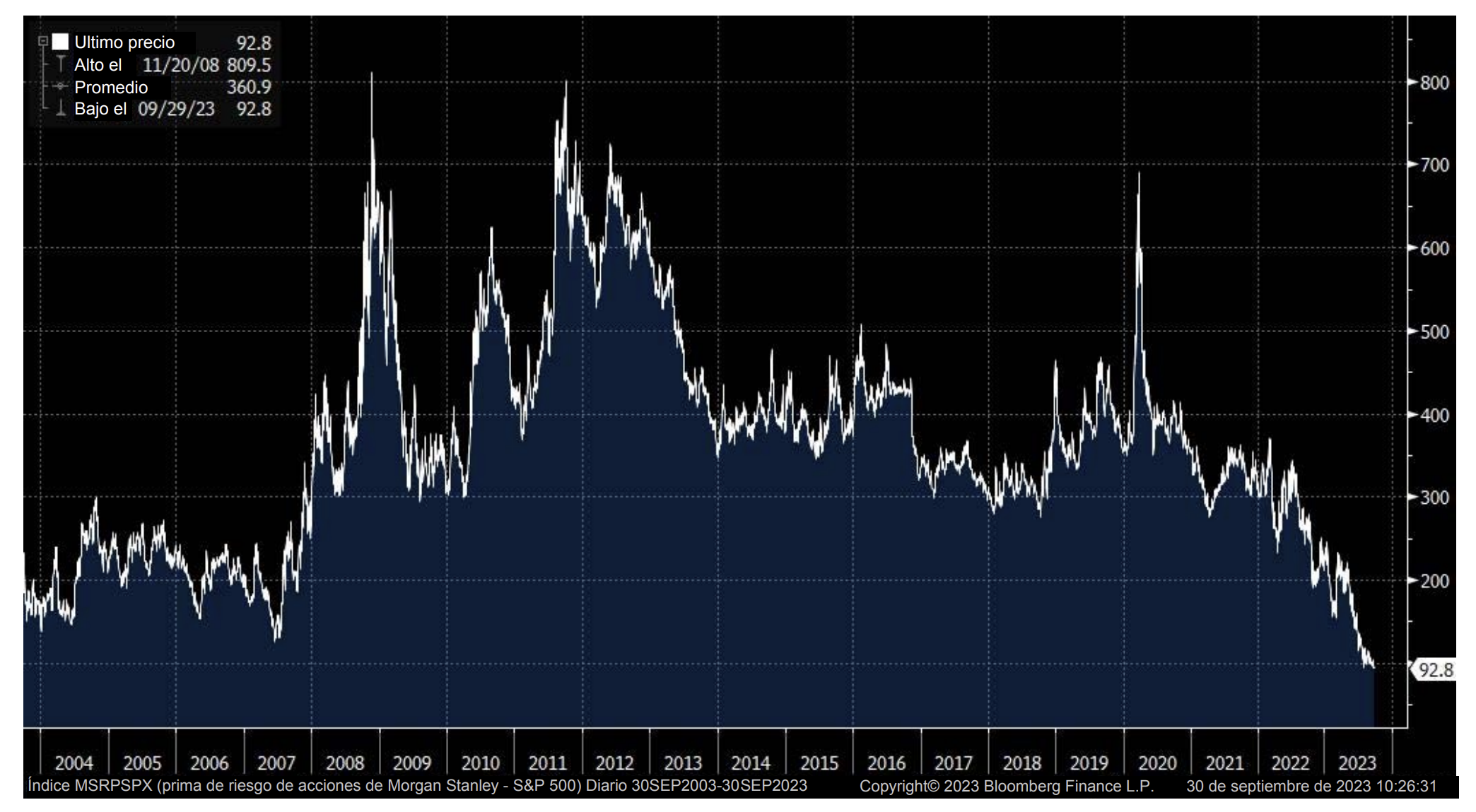

¿El crédito IG es caro o barato?

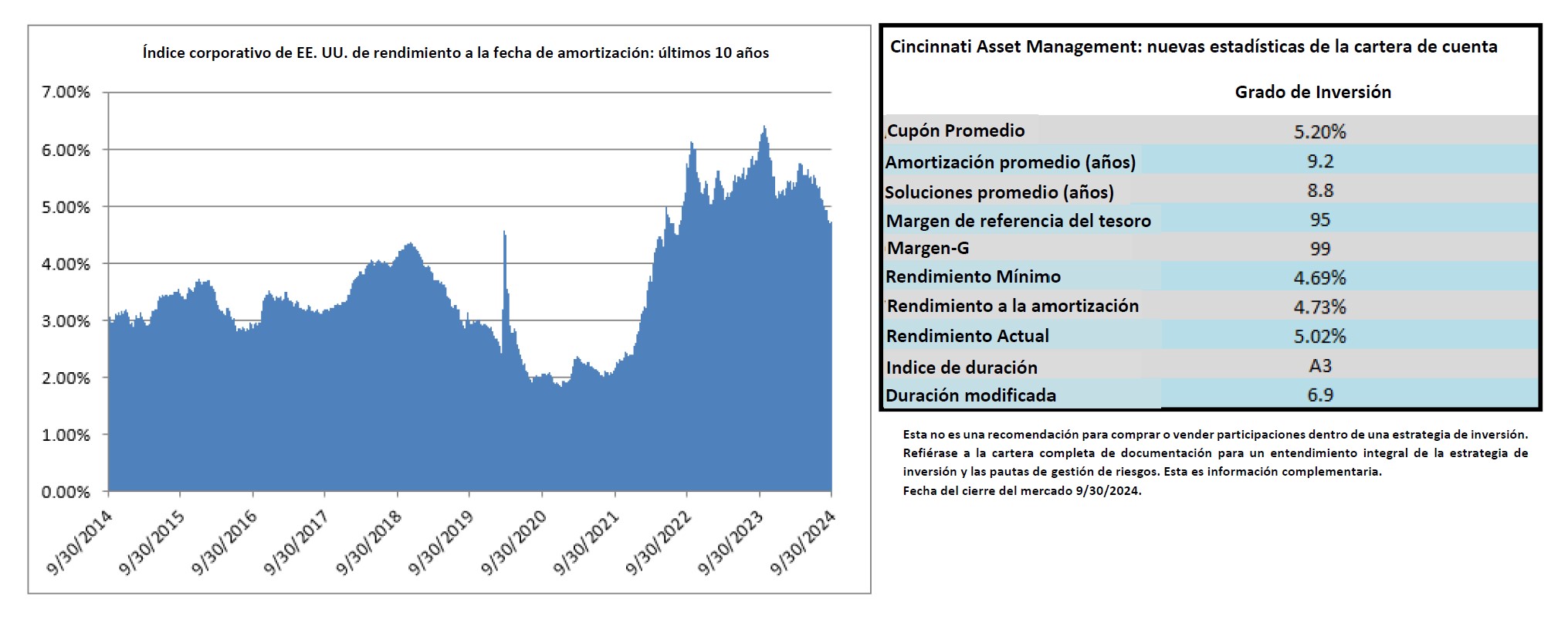

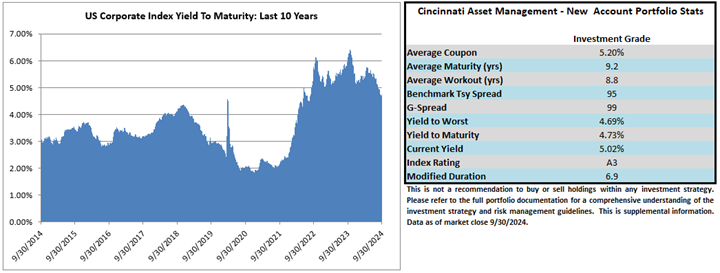

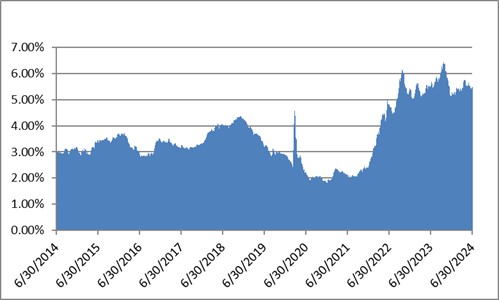

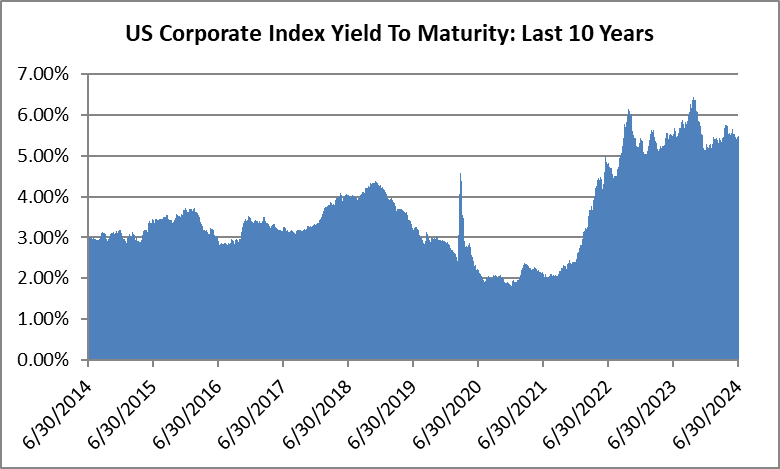

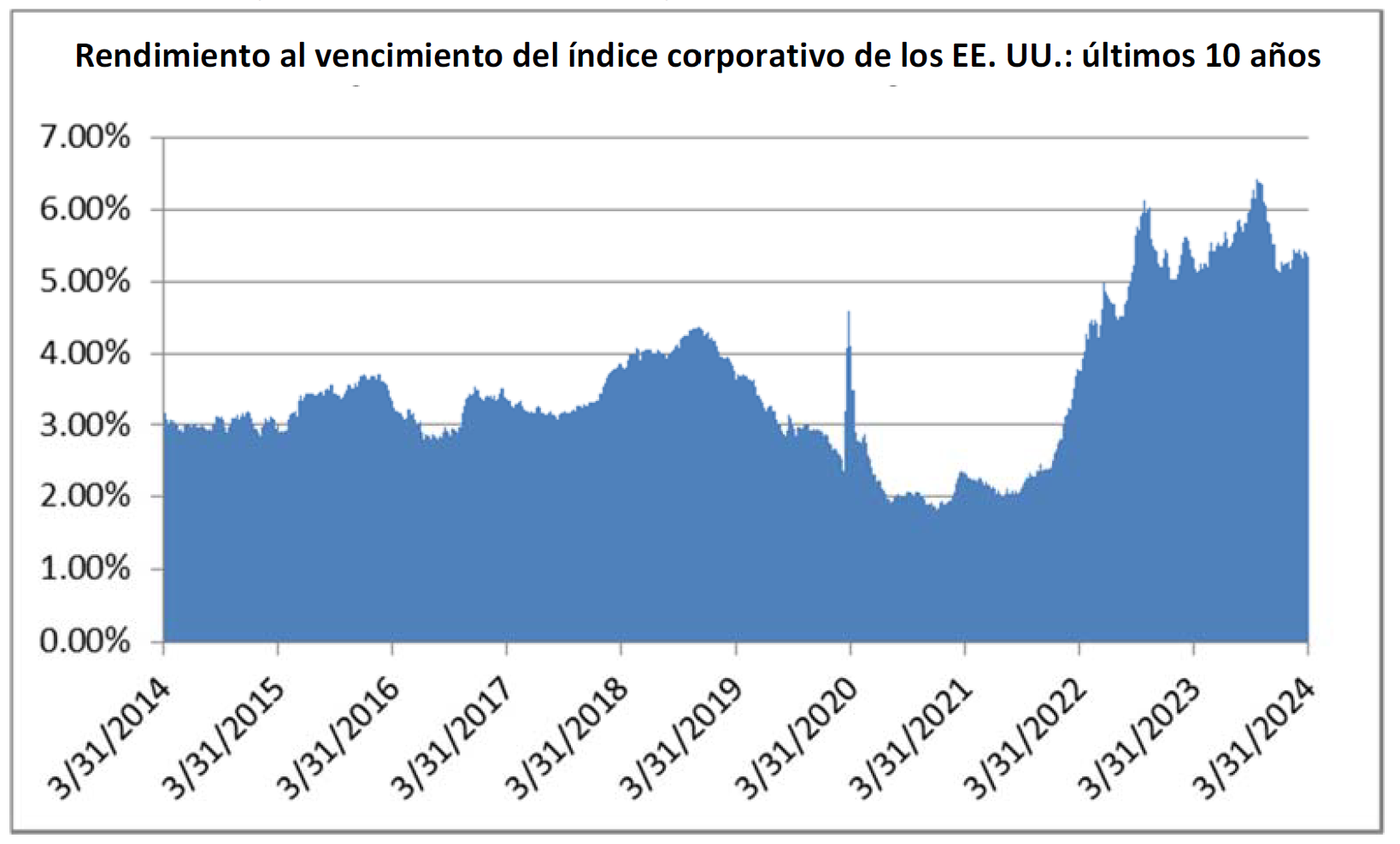

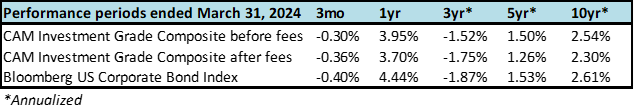

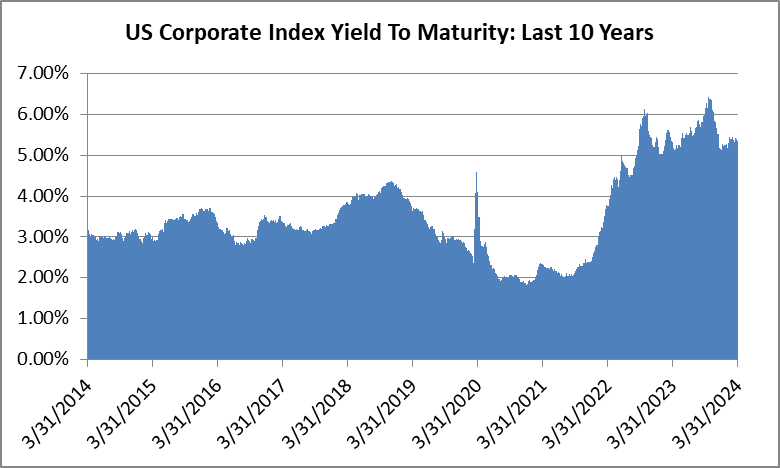

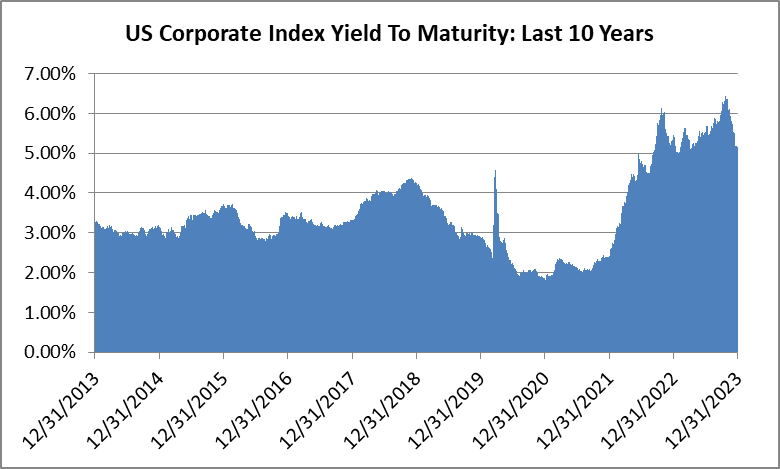

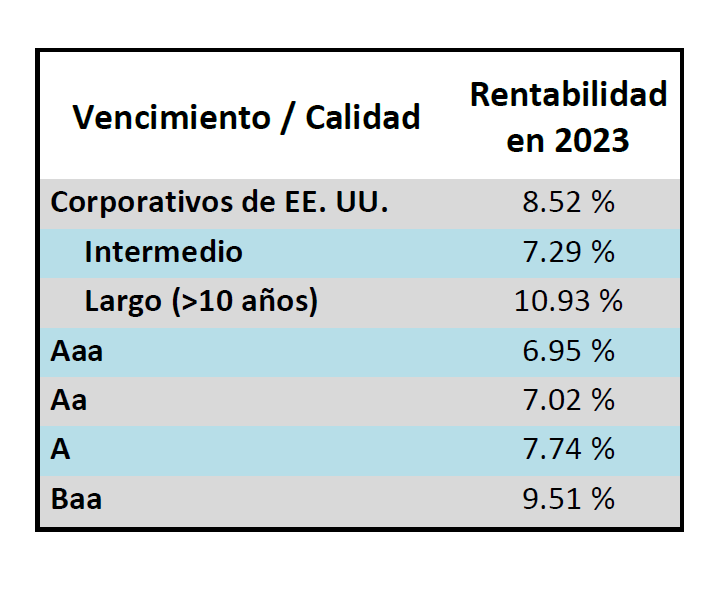

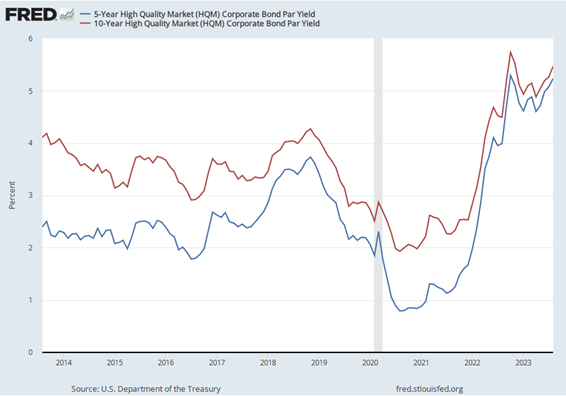

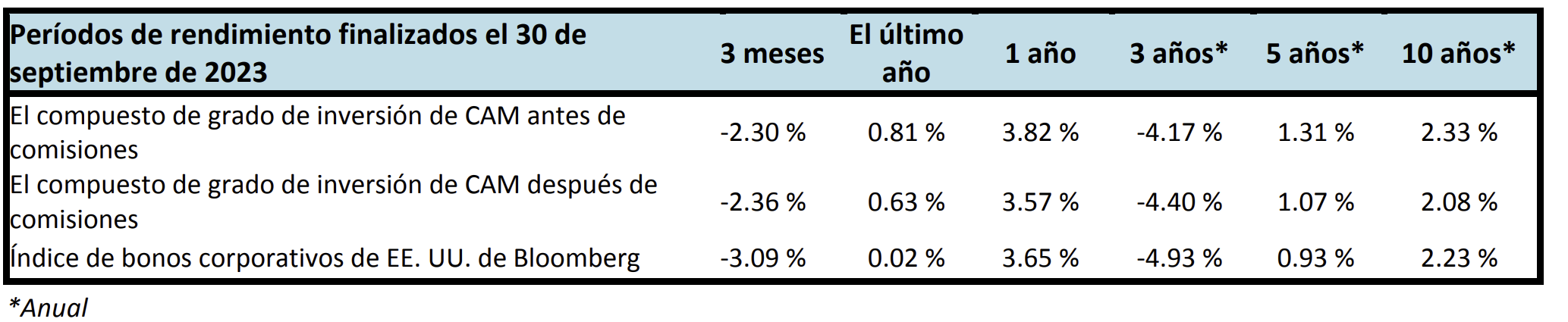

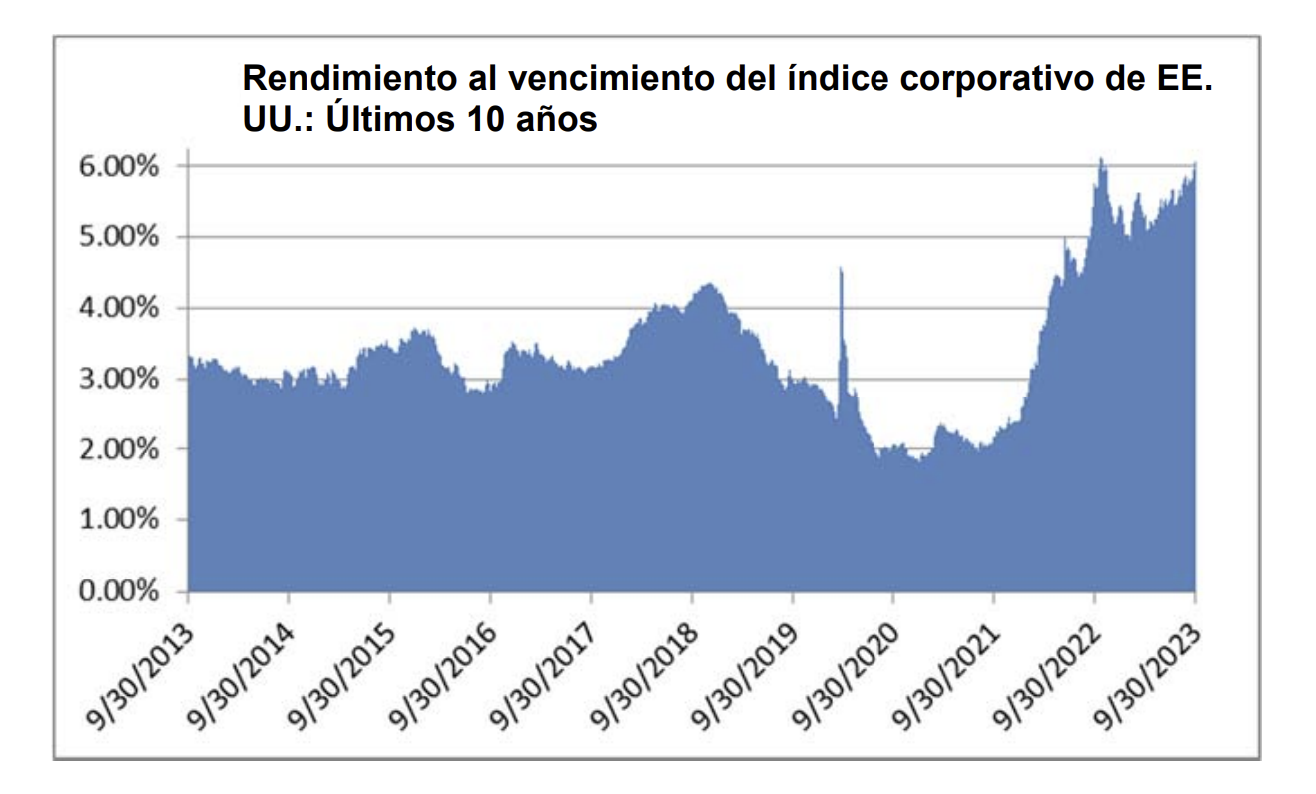

En lo que se refiere a la valoración, los diferenciales de crédito de IG se encuentran en el extremo ajustado de los rangos históricos. Creemos que los diferenciales están bastante valorados dada la solidez de las métricas crediticias en todo el universo IG y la resiliencia de la economía estadounidense. Los diferenciales de crédito incorporan en los precios muy pocas probabilidades de una recesión, pero creemos que los inversores cuentan con cierta protección frente a una desaceleración económica debido a que los rendimientos de los bonos del Tesoro aún son elevados en relación con los promedios de mediano plazo. El rendimiento al vencimiento del índice de grado de inversión al final del tercer trimestre fue del 4.73%, mientras que el promedio de 10 años fue del 3.62%. El gráfico de la derecha muestra una imagen aproximada de lo que una nueva cuenta en el programa de Grado de Inversión de Cincinnati Asset Management, Inc. (CAM) podría esperar al final del trimestre.

Entrando en la recta final

A medida que entramos en los últimos meses del año, no podemos evitar la sensación de que los participantes del mercado están casi demasiado cómodos. La probabilidad media de una recesión durante el próximo año calendario, según una encuesta de economistas de Bloomberg, ha caído al 30% frente al 55% de hace un año. Se han logrado grandes avances en materia de inflación, pero aún queda trabajo por hacer y hay riesgos a la baja si la Reserva Federal es demasiado agresiva al flexibilizar su tasa de referencia. Existen numerosos problemas geopolíticos y graves conflictos en curso en todo el mundo. Las elecciones presidenciales en Estados Unidos se celebrarán en menos de un mes. A pesar de estos riesgos, los índices bursátiles nacionales se encuentran en máximos históricos y los diferenciales de crédito se mantienen ajustados. Si bien es cierto que la probabilidad de un impacto controlado ha aumentado, todavía hay motivos para ser cautelosos.

Seguimos siendo meticulosos a la hora de completar nuestras carteras de inversores. Estamos en la búsqueda de empresas duraderas con un fuerte flujo de caja libre y métricas crediticias que sean lo suficientemente sólidas como para resistir una recesión. Contáctenos si tiene alguna pregunta o desea hablar sobre algún tema. Agradecemos su interés y colaboración.

Esta información solo tiene el propósito de dar a conocer las estrategias de inversión identificadas por Cincinnati Asset Management. Las opiniones y estimaciones ofrecidas están basadas en nuestro criterio y están sujetas a cambios sin previo aviso, al igual que las declaraciones sobre las tendencias del mercado financiero, que dependen de las condiciones actuales del mercado. Este material no tiene como objetivo ser una oferta ni una solicitud para comprar, mantener ni vender instrumentos financieros. Los valores de renta fija pueden ser vulnerables a las tasas de interés vigentes. Cuando las tasas aumentan, el valor suele disminuir. El rendimiento pasado no es garantía de resultados futuros. El rendimiento bruto de la tarifa de asesoramiento no refleja la deducción de las tarifas de asesoramiento de inversión. Nuestras tarifas de asesoramiento se comunican en el Formulario ADV Parte 2A. En general, las cuentas administradas mediante programas de firmas de corretaje incluyen tarifas adicionales. Los rendimientos se calculan mensualmente en dólares estadounidenses e incluyen la reinversión de dividendos e intereses. El índice no está administrado y no considera las tarifas de la cuenta, los gastos y los costos de transacción. Se muestra con fines comparativos y se basa en información generalmente disponible al público tomada de fuentes que se consideran confiables. No se hace ninguna afirmación sobre su precisión o integridad.

La información suministrada en este informe no debe considerarse una recomendación para comprar o vender ningún valor en particular. No hay garantía de que los valores que se tratan en este documento permanecerán en la cartera de una cuenta en el momento en que reciba este informe o que los valores vendidos no se hayan vuelto a comprar. Los valores de los que se habla no representan la cartera completa de una cuenta y, en conjunto, pueden representar solo un pequeño porcentaje de las tenencias de cartera de una cuenta. No debe suponerse que las transacciones de valores o participaciones analizadas fueron o demostrarán ser rentables, o que las decisiones de inversión que tomemos en el futuro serán rentables o igualarán el rendimiento de la inversión de los valores discutidos en este documento. Como parte de la educación de los clientes sobre la estrategia de CAM, podemos proporcionar información de vez en cuando que incluya referencias a tasas y diferenciales históricos. Los ejemplos hipotéticos que hacen referencia al nivel o cambios en las tasas y diferenciales tienen únicamente fines ilustrativos y educativos. No pretenden representar el desempeño de ninguna cartera o valor en particular, ni incluyen el impacto de las tarifas y gastos. Tampoco toman en consideración todas las condiciones económicas y de mercado que habrían influido en nuestra toma de decisiones. Por lo tanto, las cuentas de los clientes pueden experimentar o no escenarios similares a los mencionados en este documento.

En nuestro sitio web se encuentran disponibles las divulgaciones adicionales sobre los riesgos materiales y los posibles beneficios de invertir en bonos corporativos: https://www.cambonds.com/disclosure-statements/

i Bloomberg, 1 de octubre de 2024 “IG PIPELINE: Comienzo tranquilo del cuarto trimestre tras un septiembre récord”

ii Investigación de Barclays FICC, 9 de septiembre de 2024 “Métricas de crédito con grado de inversión de EE. UU., actualización del segundo trimestre de 2024: mantenimiento a flote”

iii Junta de la Reserva Federal, 19 de septiembre de 2024 “Resumen de proyecciones económicas”

iv Bloomberg, 1 de octubre de 2024 “Probabilidad de la tasa de interés mundial”

v AP News, 26 de julio de 2023 “La Reserva Federal aumenta las tasas por undécima vez para combatir la inflación, pero no da señales claras de su próximo movimiento”

vi Thomson Reuters, 5 de agosto de 2024 “La curva de rendimiento de los bonos clave de EE. UU. se vuelve positiva por temores de recesión”

vii Bloomberg, 3 de octubre de 2024, “Pronóstico de probabilidad de recesión en Estados Unidos”