(Bloomberg) High Yield Market Highlights

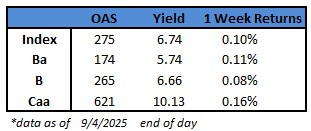

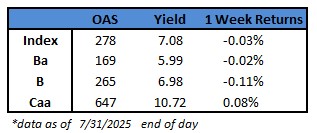

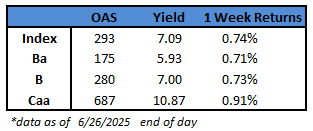

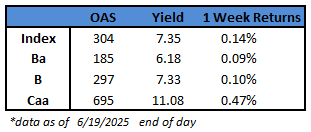

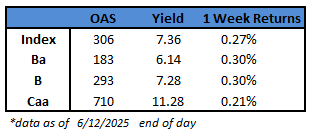

- US junk bonds have recovered from a rocky start to be on course to post gains for the fifth consecutive week. Yields remain within sight of a 40-month low after dropping eight basis points on Thursday to close at 6.74%. The risk premium fell five basis points to 275, just seven basis points higher than the six-month low of 268.

- The rally spanned across ratings, driving a boom in supply after a busy summer. The primary market priced almost $10b in just three sessions this week, including nearly $5b on Wednesday, the busiest day in three months. The wave of new bond sales continued on Thursday, with the market pricing more than $3b in a reflection of strong demand and robust risk appetite amid expectations of Fed interest-rate cuts.

- The rally gained momentum as equities hit an all-time high. Junk bonds also climbed as the markets fully priced in a rate cut this month after fresh data reinforced the broad consensus that the labor market is cooling. The latest readings show hiring plans fell to the weakest level for any August on record as intended job cuts mounted amid economic uncertainty. Hiring by US companies was less than forecast, in line with other data showing weak labor demand

- The advance in the US high-yield market was powered by CCCs, the riskiest assets. CCCs are set for a fifth week of positive returns

- BBs are also poised to record gains for a fifth week as yields linger close to a three-year low.

- Market bets for a rate cut improved after Fed Governor Christopher Waller said earlier in the week that the central bank should begin lowering rates this month and make “multiple cuts in the coming months.”

(Bloomberg) Weak US Payroll Gain of 22,000 Cements Case for Fed Rate Cut

- US job growth cooled notably last month while the unemployment rate rose to the highest since 2021, fanning concerns the labor market may be on the cusp of a more significant deterioration.

- Nonfarm payrolls increased 22,000 in August, according to a Bureau of Labor Statistics report out Friday. Revisions showed employment shrank in June — the first payrolls decline since 2020. The jobless rate ticked up to 4.3%.

- Traders solidified bets that the Federal Reserve will cut interest rates at its Sept. 16-17 meeting, which Chair Jerome Powell signaled in a speech last month during the central bank’s annual Jackson Hole symposium. Stock futures and Treasuries rallied following the report.

- The figures will likely heighten concerns about the durability of the labor market after the prior month’s report showed a shockingly cooler hiring picture than previously thought. Job gains have moderated materially in recent months, openings have declined and wage gains have eased, all of which are weighing on broader economic activity.

- Several sectors, including information, financial activities, manufacturing, federal government and business services, posted outright declines in August. Job growth was concentrated in health care and leisure and hospitality.

- While July payrolls were revised slightly higher, the jobs picture looked even worse in June. The adjustments follow the sizable downward revisions seen in the last jobs report, which were the largest since 2020.

- Accounting for the revisions in this report, employment growth in the last three months has averaged just 29,000. Payrolls have come in under 100,000 for four straight months, extending the weakest stretch of job growth since the pandemic.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.

US junk bonds shrugged off a jump in jobless claims and recurring benefits to

US junk bonds shrugged off a jump in jobless claims and recurring benefits to