Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.9 billion and year to date flows stand at -$5.7 billion. New issuance for the week was $7.8 billion and year to date issuance is at $348.9 billion.

(Bloomberg) High Yield Market Highlights

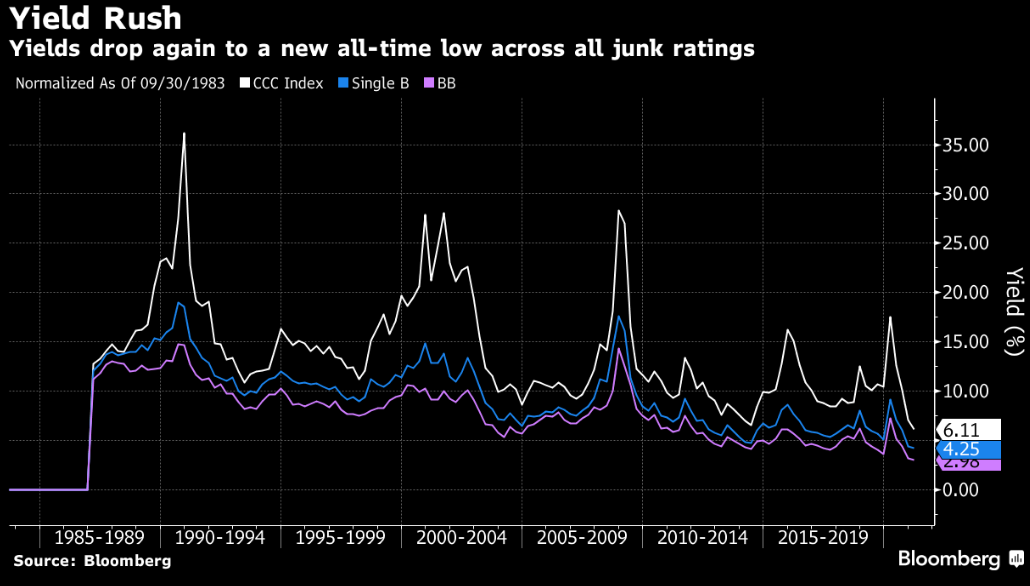

- S. junk bonds are headed for a third straight week of losses, the longest such streak in five months, while the cost of borrowing has jumped. Yields have risen to a more than three-month high of 4.19% amid concerns about the spread of the delta variant and its impact on economic growth, and on expectations that the Federal Reserve will soon scale back bond purchases.

- CCCs, the riskiest junk bonds, have lost 0.19%, and are on track for the seventh consecutive week of losses. Yields soared 31bps Thursday, the biggest one-day jump in more than three months, to a five-month high of 6.63%

- Borrowers have retreated amid market volatility after selling more than $33b this month, according to data compiled by Bloomberg

- Yields on the broader junk-bond index rose 8bps to 4.19% Thursday, and are poised to end higher for the six straight week, the longest stretch since July 2015, the Bloomberg-compiled data show

- Losses amount to 0.12% this week

- CCC yields have jumped 66bps this month to a five-month high of 6.63%

- Markets are fragile again Friday with a key measure of high-yield credit risk higher, and U.S. equity futures lower as faltering growth and China’s regulatory curbs compound risks before the Fed’s Jackson Hole symposium next week. Oil is headed for its longest run of daily declines since 2019 on worries about global energy demand

(Bloomberg) Fed Minutes Show Most Officials See Taper Starting This Year

- Most Federal Reserve officials agreed last month they could start slowing the pace of bond purchases later this year, judging that enough progress had been made toward their inflation goal, while gains had been made toward their employment objective.

- “Various participants commented that economic and financial conditions would likely warrant a reduction in coming months,” minutes of the Federal Open Market Committee’s July 27-28 gathering, released Wednesday, said. “Several others indicated, however, that a reduction in the pace of asset purchases was more likely to become appropriate early next year.”

- The minutes also showed that most participants “judged that it could be appropriate to start reducing the pace of asset purchases this year.”

- S. central bankers next meet September 21-22. While the record shows that they don’t yet have agreement on the timing or pace of tapering asset purchases, most had reached consensus on keeping the composition of any reduction in Treasury and mortgage-backed securities purchases proportional.

- Policy choices going forward are also likely to be influenced by new appointees to the Fed Board as the Biden administration moves to fill as many as four positions by early 2022.

- Fed policy makers have differed publicly in the weeks since the meeting over when the central bank should start tapering, with some, like Minneapolis Fed President Neel Kashkari, wanting to a see a “few more” strong jobs reports and others, such as Boston Fed President Eric Rosengren, saying he’s open to announcing plans for a reduction at the next meeting if employment figures come in well.

- Fed officials cut their benchmark lending rate to zero in March 2020 and announced they would buy $200 billion of agency mortgage-backed securities and $500 billion of Treasuries to support market functioning. By December 2020, they realigned their guidance saying they would purchase $80 billion a month in Treasuries and $40 billion a month on mortgage securities “until substantial further progress has been made toward its maximum employment and price stability goals.

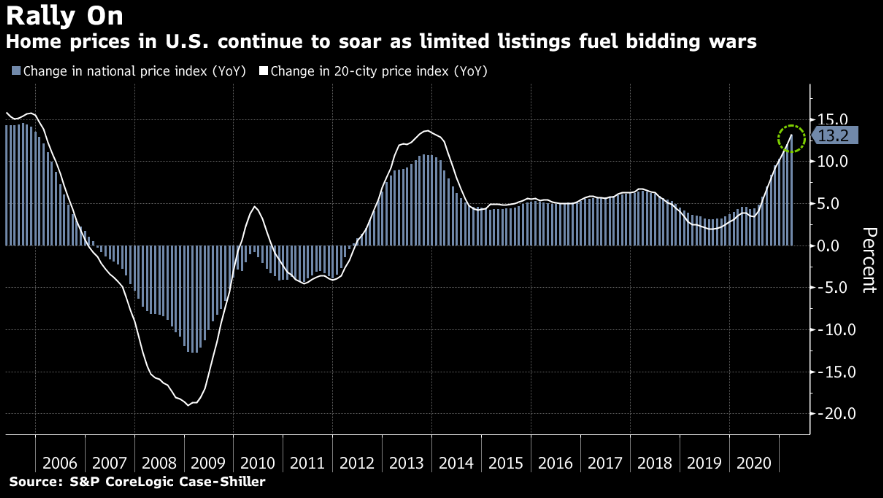

- The asset purchases have lowered longer-term interest rates and helped fuel a rise in housing prices and other financial assets, with one-month gains in home price indices breaking records while stock indexes trade around record highs.