(Bloomberg) High Yield Market Highlights

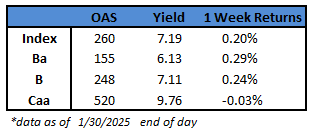

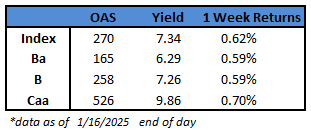

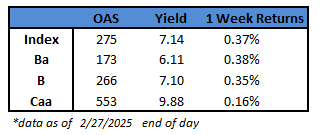

- US junk bonds defied policy uncertainty, elevated volatility, and tumbling equities as they headed for their second monthly gain this year, with modest returns of 0.6%. Yields also declined for the second consecutive month, falling six basis points to 7.14%.

- The broad gains in the US junk bond market extended across all ratings. The rally was partly fueled by light supply. The year-to-date volume is at $40b, down 31% from the same period last year. February supply stands at $18b, down 32% from last February.

- The US high yield market shrugged off rising inflation expectations, a sharp decline in home sales, weakening consumer confidence, and repeated assertions by various Fed officials including Chair Powell that the rates are likely to stay higher for longer

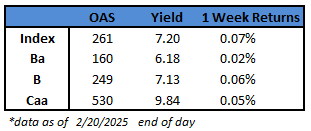

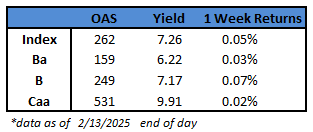

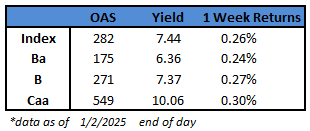

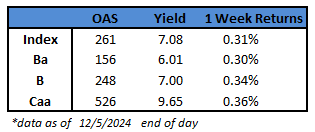

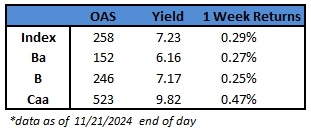

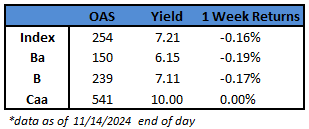

- US high yield spreads held firm, widening just 14 basis points so far this month, even though the 10- and 5-year Treasury yields fell 28 and 20 basis points. The 5-year Treasury yield closed at a more than a two-month low, reflecting the flight to safety

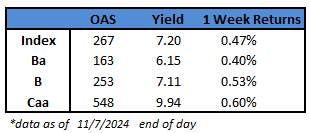

- BB spreads, which are the most rate sensitive, widened 17 basis points for the month to 173. Yields fell three basis points to 6.11%, their second monthly decline. The index registered gains of 0.65% in February

- CCCs racked up gains for the 10th straight month, the longest winning streak since June 2021. The gains were modest and the lowest in the US high yield universe. CCC yields jumped to close at 9.88% and spreads widened 35 basis points to close at 553. CCCs have started coming under pressure

(Bloomberg) Fed’s Favored Inflation Gauge Rises at Mild Pace, Spending Falls

- The Federal Reserve’s preferred measure of underlying inflation rose at a mild pace in January, offering some relief after a string of reports suggested price pressures are heating up again, while consumers pulled back on spending.

- The so-called core personal consumption expenditures price index, which excludes food and energy items, rose 0.3% from December. From a year ago, it increased 2.6%, matching the smallest annual increase since early 2021, Bureau of Economic Analysis data out Friday showed.

- Inflation-adjusted consumer spending fell 0.5%, marking the biggest monthly decline in almost four years amid extreme winter weather after a robust holiday season. The outsize decline in spending was driven by a drop in durable goods purchases, and may raise concerns about the resilience of the US economy.

- Still, Friday’s report also offers some relief on the inflation front after other reports on prices have suggested progress has not only stalled but is now reversing. Fed officials have indicated they need to see a meaningful easing in inflation before they begin lowering interest rates again, especially when they factor in the uncertainty around how President Donald Trump’s policies will impact prices.

- US Treasury yields fluctuated following the release, while stock futures and the dollar remained higher.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.