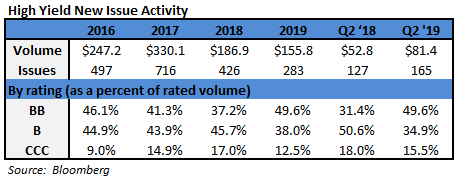

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $3.2 billion and year to date flows stand at $18.1 billion. New issuance for the week was $9.9 billion and year to date HY is at $188.0 billion, which is +32% over the same period last year.

(Bloomberg) High Yield Market Highlights

- After the biggest week of inflows since February, U.S. junk bonds are poised to edge higher again Friday, capping the fifth straight week of gains. The CDX HY index is up slightly as stock futures gain and oil rallies. Another $1 billion of deals are set to price today.

- Investors continued to put money into high-yield bond funds with Refinitiv’s Lipper reporting an inflow of $3.2b for the week ended Sept. 18. That’s the most since February.

- HYG and JNK — the two-biggest high-yield ETFs, posted a combined $340m of inflows for Thursday

- There has been a steady stream of new supply in the market this week

- At least three deals are slated to price Friday

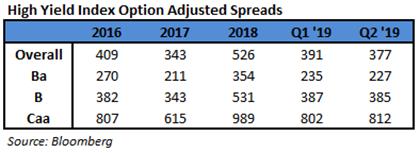

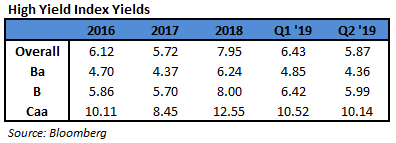

- Bloomberg Barclays index yields continued to head south, dropping to a new 20-month low of 5.57%; spreads are at a 3-month low of +355

- Single-B yields also hit a new 20-month low of 5.57% after falling by 1bps

- BB yields dropped 4bps to close at 4.03%

- CCC yields bucked the trend and rose for the third straight session to close at 10.62%, up 7bps

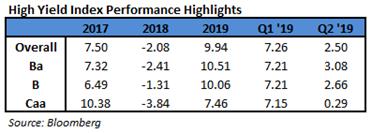

- Junk bond returns rebounded yesterday as oil recovered and posted a gain of 0.029%, taking YTD returns to 11.757%

- BBs were at 12.8% after a gain of 0.05%

- Single Bs were at a new 2019 high of 12.394% after a gain of 0.06%

- CCCs posted negative returns for the third straight session at 0.17%, taking the YTD down to 6.58%

(Bloomberg) Unhinged Money Markets Trigger Fed Action to Alleviate Stress

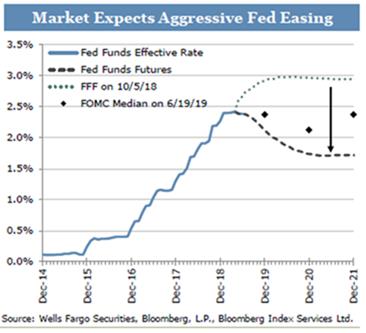

- The Federal Reserve took action to calm money markets on Tuesday, injecting billions in cash to quell a surge in short-term rates that was pushing up its policy benchmark rate and threatening to drive up borrowing costs for companies and consumers.

- While the spike wasn’t evidence of any sort of imminent financial crisis, it highlighted how the Fed was losing control over short-term lending, one of its key tools for implementing monetary policy. It also indicated Wall Street is struggling to absorb record sales of Treasury debt to fund a swelling U.S. budget deficit. What’s more, many dealers have curtailed trading because of safeguards implemented after the 2008 crisis, making these markets more prone to volatility.

- Money markets saw funding shortages Monday and Tuesday, driving the rate on one-day loans backed by Treasury bonds — known as repurchase agreements, or repos — as high as 10%, about four times greater than last week’s levels, according to ICAP data.

- More importantly, the turmoil in the repo market caused a key benchmark for policy makers — known as the effective fed funds rate — to jump to 2.25%, an increase that, if left unchecked, could have started impacting broader borrowing costs in the economy. Because that’s at the top of the range where Fed officials want the rate to be, they are likely to make yet another tweak to a key part of their policy tool set to try to get things back on track when they meet Wednesday to set benchmark rates.

- But the central bank didn’t wait until then to do something, resorting to a money-market operation it hasn’t deployed in a decade. The New York Fed bought $53.2 billion of securities on Tuesday, hoping to quell the liquidity squeeze. It appeared to help. For instance, the cost to borrow dollars for one week while lending euros retreated after almost doubling Monday.

(CNN) Coordinated strikes knock out half of Saudi oil capacity, more than 5 million barrels a day

- Coordinated strikes on key Saudi Arabian oil facilities, among the world’s largest and most important energy production centers, have disrupted about half of the kingdom’s oil capacity, or 5% of the daily global oil supply.

- Yemen’s Houthi rebels on Saturday took responsibility for the attacks, saying 10 drones targeted state-owned Saudi Aramco oil facilities in Abqaiq and Khurais, according to the Houthi-run Al-Masirah news agency.

- Yet key questions about the attacks remain unanswered. US Secretary of State Mike Pompeo pinned the strikes directly on Iran, which backs the Houthi rebels. But he said there was “no evidence the attacks came from Yemen.”

- Preliminary indications are that the attacks likely originated from Iraq, a source with knowledge of the incident told CNN. Iran wields significant influence in southern Iraq, which is situated much closer than Yemen to the affected Saudi sites.