Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.9 billion and year to date flows stand at -$0.1 billion. New issuance for the week was $15.1 billion and year to date issuance is at $72.3 billion.

(Bloomberg) High Yield Market Highlights

- In terms of issuance, this has been the second busiest week of the year, according to data compiled by Bloomberg. With yields at record lows, more borrowers are expected to hit the market after the long weekend.

- High-yield funds returned to outflows for the week, following an inflow of $1.34b last week

- Investors are still buying new issues in droves, and the risky debt is headed for its second straight week of positive returns

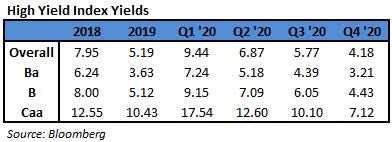

- The Bloomberg Barclays U.S. Corporate High-Yield index yield held steady at a record low of 3.95% on Thursday

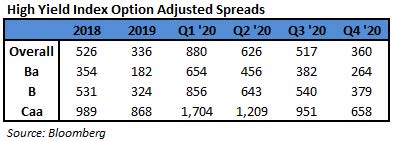

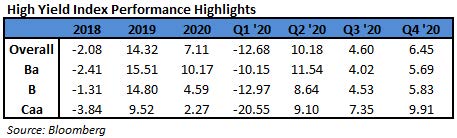

- A strong technical backdrop and improving fundamentals could drive spreads even tighter in the short term, Barclays Plc credit analysts led by Brad Rogoff wrote in a note Friday

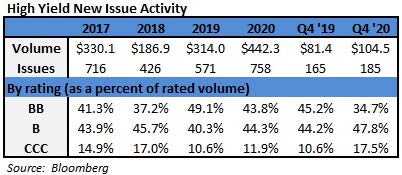

- A roster of formerly distressed companies have sold notes this week and CCCs, the riskiest junk bonds, accounted for about 19% of total bond sales, the data compiled by Bloomberg show

- CCC yields rose to 6.19%, just 3bps off an all-time low of 6.16%

(Bloomberg) U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever

- The average yield on U.S. junk bonds dropped below 4% for the first time ever as investors seeking a haven from ultra-low interest rates keep piling into an asset class historically known for its high yields.

- The measure for the Bloomberg Barclays U.S. Corporate High-Yield index dipped to 3.96% on Monday evening, making it six straight sessions of declines.

- Yield-hungry investors have been gobbling up junk bonds as an alternative to the meager income offered in less-risky bond markets. Demand for the debt has outweighed supply by so much that some money managers are even calling companies to press them to borrow instead of waiting for deals to come their way. A majority of new issues, even those rated in the riskiest CCC tier of junk, have been hugely oversubscribed.

- The lower yields should encourage more speculative-grade companies to tap the market after raising more than $7 billion last week. January was a record month for sales with $52 billion priced.

- Buyers have been snapping up CCC graded issues as yields for that slice of high yield also decline. They dropped to 6.21% on Monday, also a record low, and have outperformed the rest of the market for three consecutive months, according to data compiled by Bloomberg.

- Issuance conditions have been so conducive that some of the riskiest types of transactions come to market, such as bonds that are used to fund dividends to a company’s owners and so-called pay-in-kind bonds that allow a borrower to pay interest with more debt.