Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $0.5 billion and year to date flows stand at -$5.2 billion. New issuance for the week was $1.4 billion and year to date issuance is at $350.4 billion.

(Bloomberg) High Yield Market Highlights

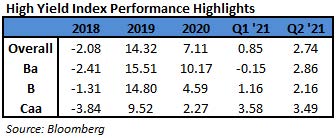

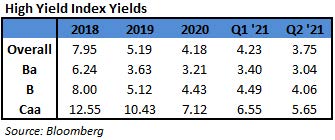

- The riskiest part of the junk bond market is on track to post the first weekly gains in seven weeks and the biggest in six months. With the primary market at a virtual standstill, CCC yields may see the biggest weekly decline in almost three months as investors steadily reposition themselves following a brief sell-off.

- The broader U.S. junk bond index is poised to end three weeks of declines, and is on track to post the biggest weekly gains in more than two months

- The index yields may see the first weekly drop in seven weeks

- The CCC index gained on Thursday for the fifth straight session, with returns of 0.1%. The week-to-date returns stood at 0.62%, the biggest since February 5th

- Yields dropped 5bps to close at 6.42% yesterday and the week-to-date drop is 23bps

- Should the trend hold, it is likely to see the biggest weekly decline since May 28

- The overall index yield was unchanged on Thursday while it fell 15bps week-to-date, to make it the biggest in eight weeks

- The primary market is expected to resume business after the Labor Day holiday as the pipeline is expected to be jammed with buyout financings

- U.S. equity futures advanced and European stocks remained steady ahead of Chair Powell’s speech at the Jackson Hole symposium later today to see if he offers any clues about the timeline for tapering bond purchases. Oil, meanwhile, is headed of the biggest weekly gain in 11 months as focus shifted to the storm that menacing the Gulf of Mexico

(Bloomberg) S&P Sees Junk Bond Defaults Vanishing Amid Recovery, Easy Money

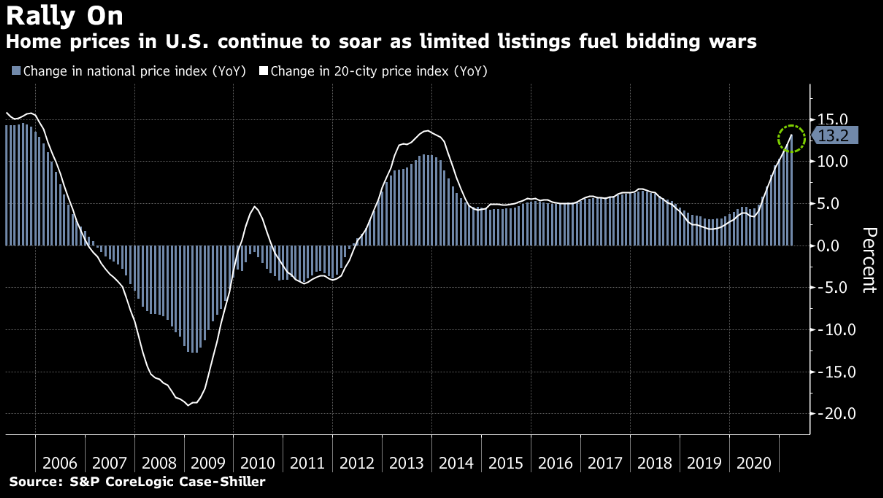

- Missed debt payments by junk-rated borrowers look set to become increasingly rare amid cheap borrowing conditions and economic recovery, according to S&P Global Ratings.

- The U.S. speculative-grade corporate default rate could fall to as low as 2% by the middle of next year on a trailing 12-month basis, from 3.8% this June, according to a report by S&P. That’s the optimistic scenario, which would be the lowest level of defaults since 2015. It compares to a 2.5% baseline and 5.5% pessimistic forecast for June 2022 by S&P.

- The junk bond default rate peaked at 6.7% in December — the highest since 2010 — after lockdowns caused by the pandemic. Most borrowers are now able to cover debt payments amid favorable lending and better operating conditions, according to the S&P analysts led by Nick Kraemer, head of ratings performance analytics.

- In the second quarter, there were only 11 defaults, the fewest since the third quarter of 2018. The number of speculative-grade upgrades outpaced downgrades by about 3-to-1 in 2021, according to the report published Aug. 20.

- The delta variant could test borrowers, especially in sectors hit hardest by Covid-19, like entertainment and travel. Energy, consumer and service companies — which led the second quarter with the most defaults — are also at risk, though they are expected to broadly recover in 2022.

(The Wall Street Journal) Western Digital in Advanced Talks to Merge With Kioxia

- Western Digital is in advanced talks to merge with Japan’s Kioxia Holdings Corp., according to people familiar with the matter.

- Long-running discussions between the companies have heated up in the past few weeks and they could reach agreement on a deal as early as mid-September, the people said. Western Digital would pay for the deal with stock and the combined company would likely be run by its Chief Executive, David Goeckeler, the people said.

- There’s no guarantee Western Digital, which had a market value of around $19 billion Wednesday afternoon, will seal an agreement, and Kioxia could still opt for an initial public offering it had been planning or another combination.

- The Wall Street Journal reported in March that Western Digital and Micron Technology were examining potential deals with Kioxia, which makes NAND flash-memory chips used in smartphones, computer servers and other devices. Micron’s interest has since cooled and Kioxia has been focused on discussions with Western Digital, which already has deep existing ties with the Japanese company.

- Western Digital, which makes hard disk drives, solid-state drives and NAND chips, has a joint venture with Kioxia for manufacturing and research and development that was set to expire starting in 2027. That agreement appears to have given Western Digital a leg up on Micron, and their existing ties could help make a WD-Kioxia combination more palatable to regulators.

- Kioxia, formerly part of Toshiba and known as Toshiba Memory, was purchased in 2018 by a group led by private-equity firm Bain Capital.