Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.1 billion and year to date flows stand at $0.8 billion. New issuance for the week was $5.5 billion and year to date issuance is at $20.4 billion.

(Bloomberg) High Yield Market Highlights

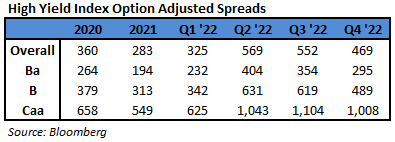

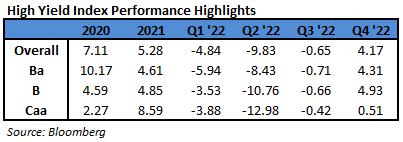

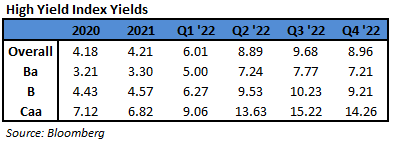

- US junk bonds rallied for the third straight session Thursday, posting their biggest one-day gain in three months, with returns of 1.18%, after Federal Reserve Chair Jerome Powell said that the process of disinflation has begun. Yields plunged to a more than five-month low of 7.73%, tumbling 30bps in their largest one-day drop in 12 weeks. Spreads tightened by the most in four months to close at a nine-month low of +386bps. The gains spanned across all high yield ratings on expectations that the Federal Reserve may be nearing the end of the tightening cycle. CCCs, the riskiest segment of junk bond market, posted the biggest one-day gains in more than two years, with returns of 1.52%. Yields plummeted to an eight-month low of 12.19%.

- Risk assets rallied on a higher probability of a soft landing, Barclays’ Brad Rogoff wrote on Friday

- The junk bond market is on track for its second consecutive week of gains, with week-to- date returns of 1.5%. The week-to-date returns for CCCs are at 2.23%, making them the best performing asset class within high yield

- The rally was fueled by Powell’s signaling that the bank was open to adjusting its rate hike plans if inflation fell faster than expected, implying that the Fed is flexible and would consider stopping rate hikes altogether

- Yields tumbled across ratings, with BB yields falling to a five-month low of 6.27% and spreads at a 10-month low of +240bps

- BBs also posted the biggest one-day returns in three months, with 1.08%

- Single B yields fell 33bps to 7.88%, the lowest since mid-August of last year. The index gained 1.22%, the largest one-day return since Nov. 10

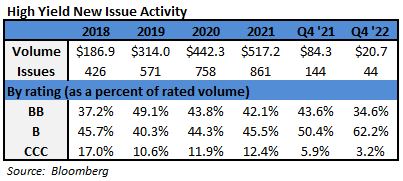

- The primary market is expected to see a steady flow of new issuance after a relatively busy January.

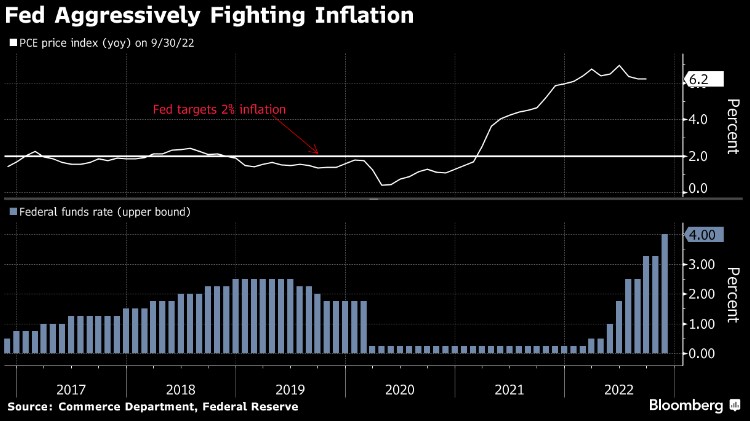

(Bloomberg) Fed Slows Rate Hikes Even as Powell Says There’s More Work to Do

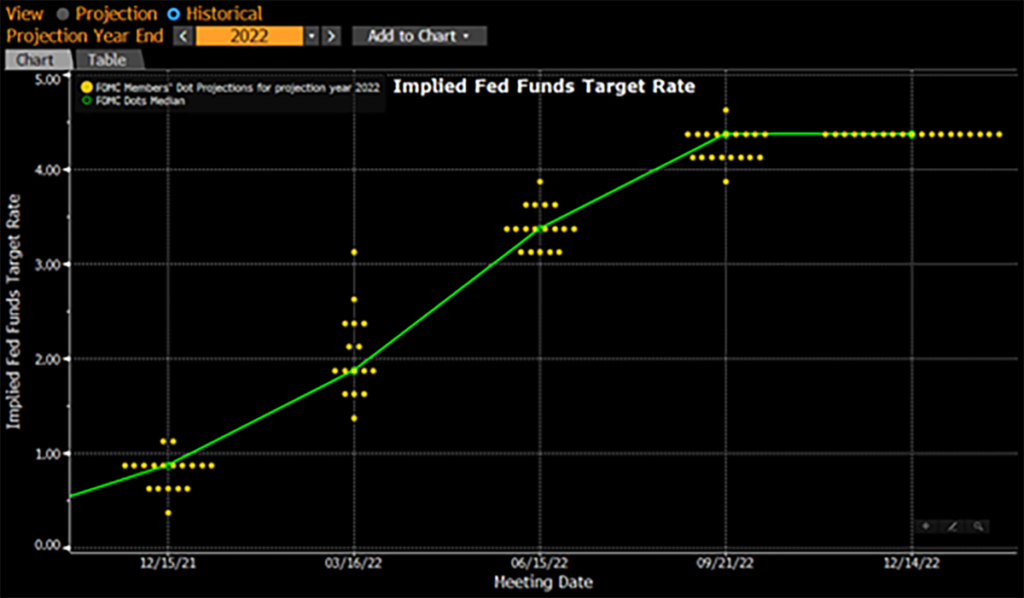

- Federal Reserve Chair Jerome Powell said policymakers expect to deliver a “couple” more interest-rate increases before putting their aggressive tightening campaign on hold, even as they slowed their drive to curb inflation.

- Powell and his colleagues lifted the Fed’s target for its benchmark rate by a quarter percentage point to a range of 4.5% to 4.75%. The smaller move followed a half-point increase in December and four jumbo-sized 75 basis-point hikes prior to that.

- Still, investors took heart from the chair’s remarks acknowledging that price pressures have started to ease,despite his emphasis on the Fed’s outlook for more rate hikes.

- “We think we’ve covered a lot of ground,” Powell told reporters after the meeting. “Even so, we have more work to do.”

- The vote by the Federal Open Market Committee was unanimous.

- “The committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time,” the Fed said in a statement issued after the two-day policymaking meeting, repeating language it has used in previous communications.

- In a sign that the end of the hiking cycle may be in sight, the committee said the “extent of future increases” in rates will depend on a number of factors including cumulative tightening of monetary policy. It had previously tied the “pace” of future increases to those factors.

- Powell, during his press conference, added to that sense.

- “We’ve raised rates four and a half percentage points, and we’re talking about a couple of more rate hikes to get to that level we think is appropriately restrictive,” he said.

- In another shift from its last statement, the Fed noted that inflation “has eased somewhat but remains elevated,” suggesting policymakers are growing more confident that price pressures have peaked.

- That compares with prior language where officials simply stated price growth was “elevated.”

- Investors wanted to know if Powell would push back against market expectations that the Fed will cut rates later in the year as inflation eases and economic growth slows. He did.

- “Restoring price stability will likely require maintaining a restrictive stance for some time,” he told reporters. While recent readings on price pressures were encouraging, he added that “I just don’t see us cutting rates this year,” if the economy evolves as he and his colleagues expect.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.