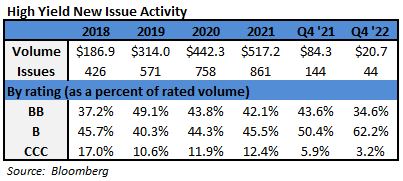

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$2.1 billion and year to date flows stand at -$10.4 billion. New issuance for the week was $6.9 billion and year to date issuance is at $37.9 billion.

(Bloomberg) High Yield Market Highlights

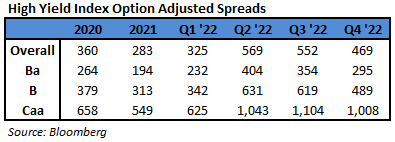

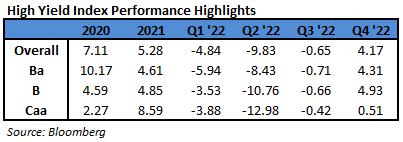

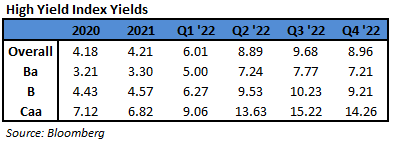

- US junk bonds dropped heading into the end of the week, eroding earlier gains, as anxious investors pulled cash out for the third week in a row. The losses reached across ratings after data showed a strong jobs market and manufacturing shrinking less than expected, renewing concerns about inflation and more restrictive monetary policy.

- Strong economic data led Fed officials to again reiterate that the central bank may have to raise interest rates by more than previously expected.

- Price pressures remain firm, disrupting the dis-inflationary narrative, Brad Rogoff and Dominique Toublan from Barclays wrote on Friday. The market may be capitulating toward a higher terminal rate, but elevated yields and a lack of near-term catalysts for material de-risking should keep spreads range-bound in the medium term, they wrote.

- US junk bond yields rose for the second day in a row Thursday to close 8.72%.

(Bloomberg) Fed Officials Warn They May Need to Lift Rates to a Higher Peak

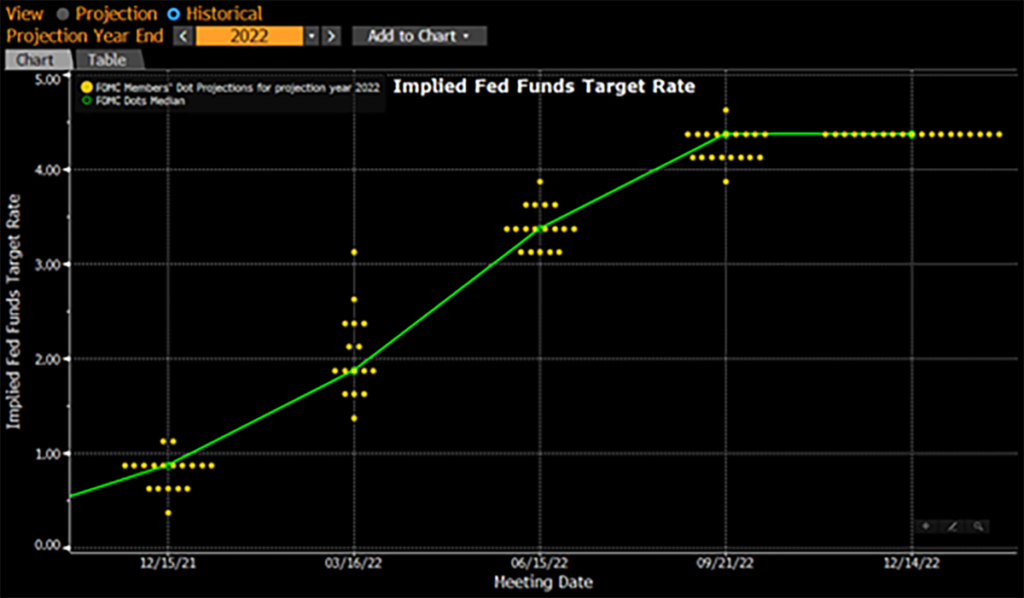

- Two Federal Reserve policymakers cautioned that recent stronger-than-expected readings on the US economy could push them to raise interest rates by more than previously expected.

- In remarks Thursday, Governor Christopher Waller said that if payroll and inflation data cool after hot prints in January, “then I would endorse raising the target range for the federal funds rate a couple more times, to a projected terminal rate between 5.1% and 5.4%.”

- “On the other hand, if those data reports continue to come in too hot, the policy target range will have to be raised this year even more to ensure that we do not lose the momentum that was in place before the data for January were released,” Waller said in remarks prepared for delivery at an event hosted by the Mid-Size Bank Coalition of America.

- Waller’s speech followed comments by Atlanta Fed President Raphael Bostic, who told reporters that he still favored raising rates by 25 basis points in March but was open to lifting borrowing costs higher than he had envisioned if the economy remained so robust.

- “I want to be completely clear: There is a case to be made that we need to go higher,” Bostic said. “Jobs have come in stronger than we expected. Inflation is remaining stubborn at elevated levels. Consumer spending is strong. Labor markets remain quite tight.”

- Officials next meet March 21-22, and by then they will have seen fresh reports on employment and inflation. Recent incoming data has been surprisingly strong: Employers added 517,000 new workers in January while inflation remains well above the central bank’s 2% target.

- Waller said the payroll report, together with a decline in the unemployment rate in January to 3.4%, showed “that, instead of loosening, the labor market was tightening.”

- Fed officials are discussing their evolving outlook, which may include holding the policy rate higher for longer than they expected when they published their last forecast in December.

- Fed Chair Jerome Powell will have a chance to update lawmakers on the outlook when he heads to Capitol Hill next week to deliver his semi-annual testimony to Congress. He appears before the Senate Banking Committee on Tuesday and the House Financial Services Committee Wednesday.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.