(Bloomberg) High Yield Market Highlights

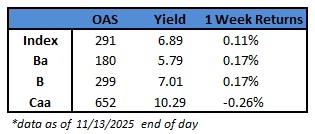

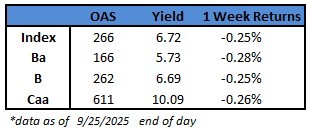

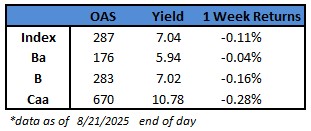

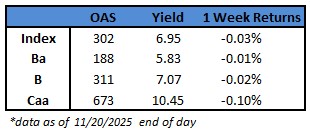

- US junk bonds posted modest gains on Thursday but still leave slight losses for the week across the rating spectrum.

- The broad gains spanned ratings, with even CCCs, the riskiest part of the credit market, rebounding from a six-day losing streak as junk bonds shrugged off a selloff in equities. CCCs notched up gains of 0.15% on Thursday, the first in seven sessions. CCC yields, however, climbed three basis points to 10.45%.

- BB yields dropped for a second day to close at 5.83% and spreads held steady to drive small gains for a second session

- Single B yields also declined to close at 7.07%, while risk premium remained unchanged. Single Bs also posted small gains for a second session

(Bloomberg) US Payrolls Grew in September, But Jobless Rate Shows Fragility

- The latest jobs report, long delayed due to the government shutdown, showed nonfarm payrolls rose 119,000 in the month after declining in August. The unemployment rate, meanwhile, rose to its highest level in nearly four years — reflecting both the positive dynamic of more Americans participating in the workforce and the gloomier reality of more people losing their jobs.

- The dated snapshot likely doesn’t change much for Federal Reserve officials, many of whom were already leaning away from cutting interest rates again next month. But it does illuminate the variety of cross-currents at play heading into the final months of the year.

- Job gains were narrow, fueled primarily by hiring in health care and leisure and hospitality. Other sectors, like manufacturing, transportation and warehousing, and business services, shed jobs. For many firms, the low-hire, low-fire environment has given way to a rash of layoff announcements, exacerbating Americans’ concerns about their job security.

- “At first glance, September’s headline payroll gain appears reassuring, but a closer look reveals that job growth remained fragile and narrowly concentrated heading into the longest government shutdown on record,” EY-Parthenon Senior Economist Lydia Boussour said in a note.

- Separate data Thursday showed applications for US unemployment benefits fell to a three-week low in the period ended Nov. 15, the Labor Department said. Continuing claims, a proxy for those receiving benefits, climbed in the prior week to the highest since late 2021.

- “I expect that’s going to mean October payrolls are a lot weaker,” said Veronica Clark, an economist at Citigroup Inc.

- The September jobs report, originally due Oct. 3, was the first major missed data point in the government shutdown. But because BLS had already completed data collection by the time the shutdown began Oct. 1, the report is among the first to be published following the reopening.

- BLS said Wednesday that the October jobs report, which was due Nov. 7, won’t be published. Instead, those payrolls figures will be incorporated into the November report. That’s due Dec. 16, after the Fed’s next meeting. Key statistics like the unemployment rate, however, won’t be included.

- The survey of households that informs those figures couldn’t be collected due to the shutdown, and BLS said it can’t gather the data retroactively.

- Given the sharp slowdown in immigration seen this year, the household survey can offer a clearer picture of US labor market dynamics. The participation rate — the share of the population that is working or looking for work — increased to a four-month high in September, due to women. The rate for workers age 25-54, also known as prime-age workers, held at a one-year high.

- Meanwhile, the number of people working part time for economic reasons declined by the most in a year, while the share of long-term unemployed fell. Private payrolls increased in September by the most in five months. Even so, permanent job losers rose to the highest since late 2021.

- At the same time, the report showed the monthly gain in average hourly earnings was the smallest since June after an upwardly revised August increase. Economists pay close attention to this metric as a driver of household spending, which has become even more bifurcated with the wealthiest Americans propelling nearly half of total spending.

- Looking ahead, while the October payrolls figures will be published, they won’t necessarily offer a clear picture either. Economists expect a sharp decline in government employment as the federal workers who took the administration’s deferred resignation offers formally roll off payrolls.