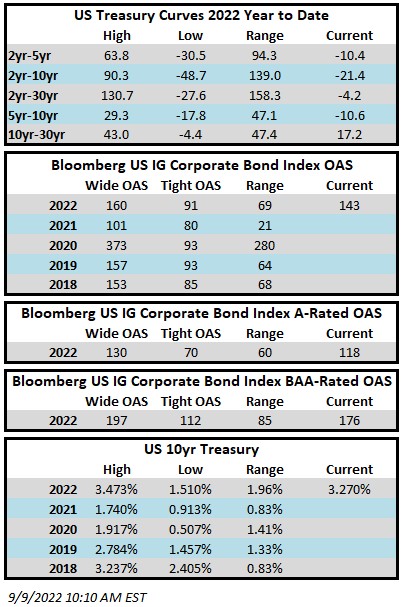

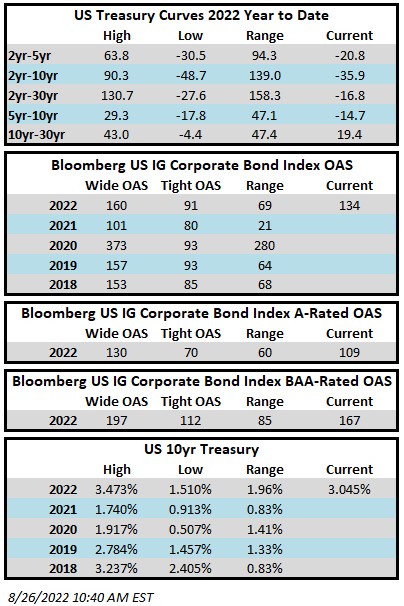

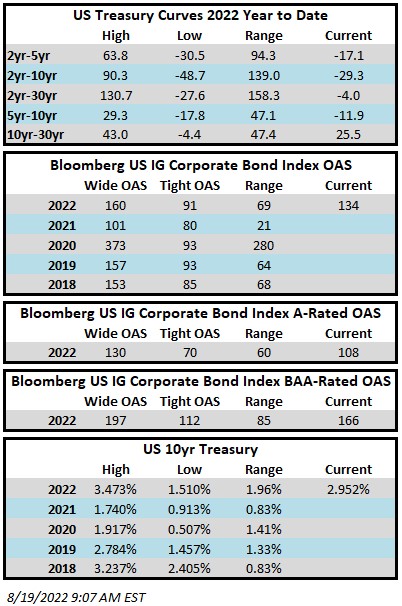

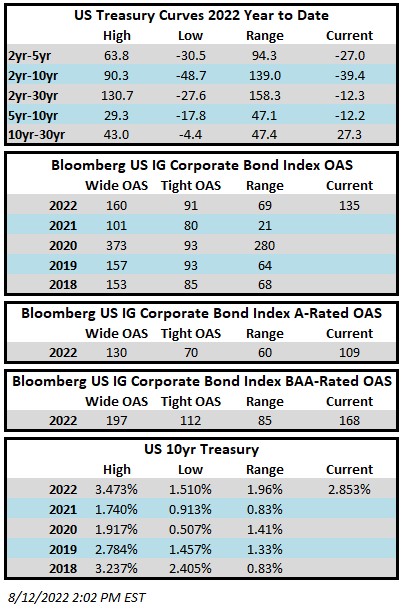

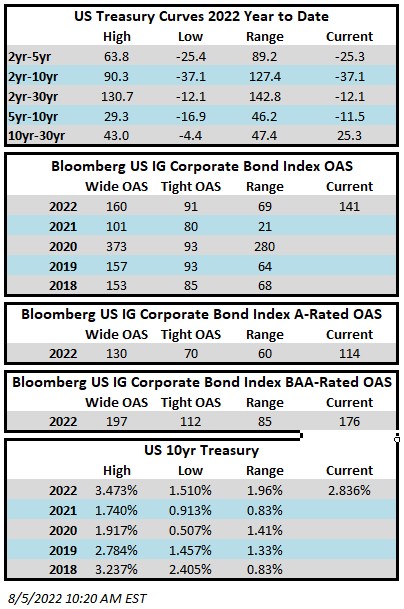

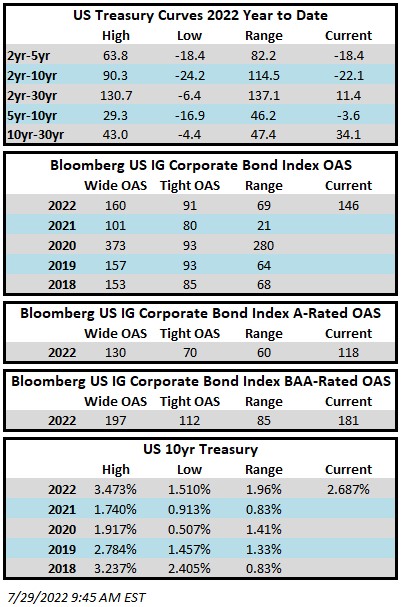

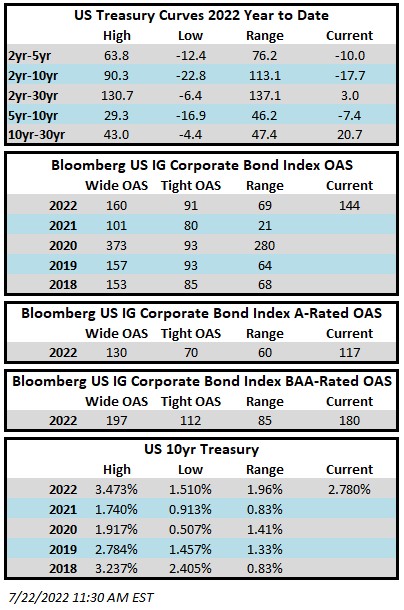

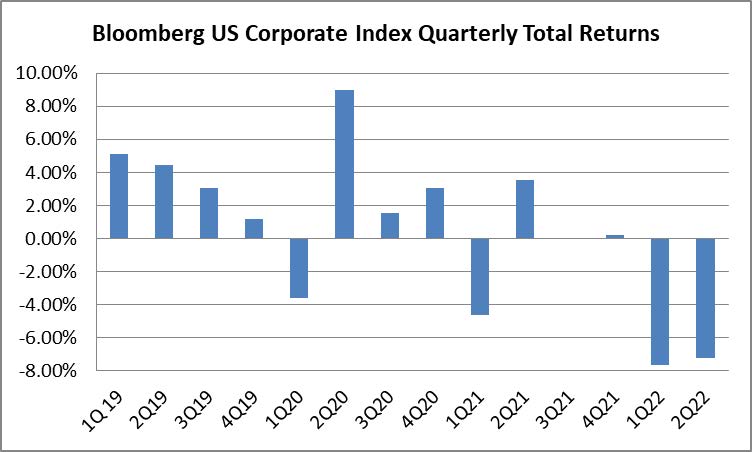

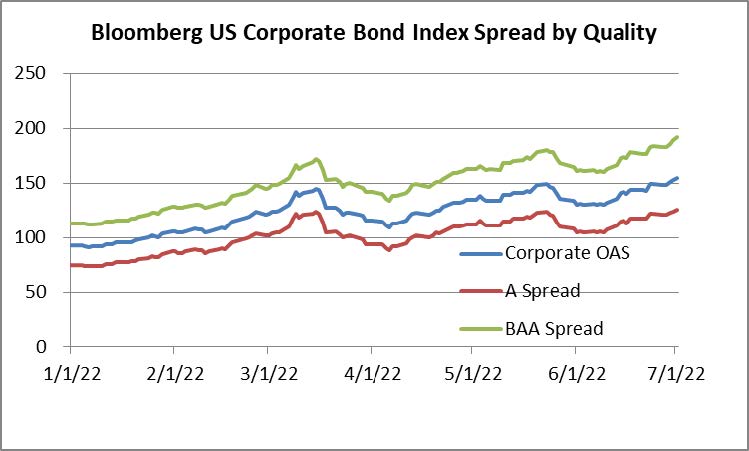

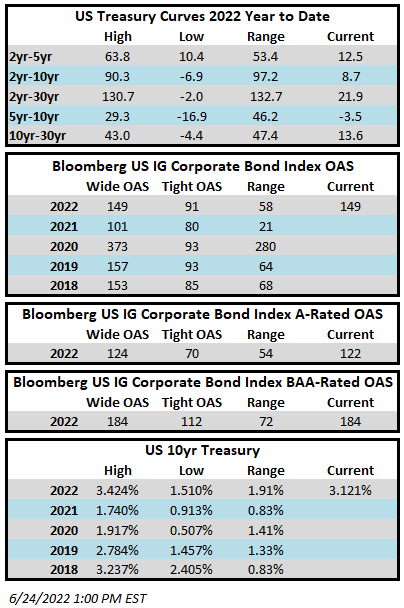

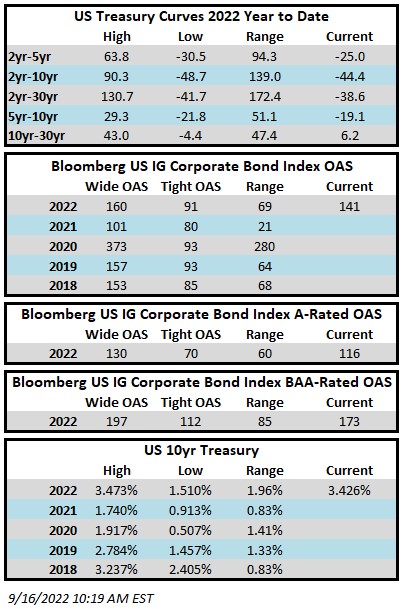

Investment grade credit spreads were unchanged for most of the week but the market has been drifting wider Friday morning so the index may finish 1-2 basis points wider by the time the sun has set on the week. IG credit led the way this week having substantially outperformed other risk assets on a spread basis. The Bloomberg US Corporate Bond Index closed at 141 on Thursday September 15 after having closed the week prior at 141. The 10yr Treasury closed last week at 3.31% and is trading at 3.43% as we go to print on Friday morning. Through Thursday the Corporate Index had a negative YTD total return of -15.58% while the YTD S&P500 Index return was -17.2% and the Nasdaq Composite Index return was -26.98%.

The big economic news of the week was the CPI print on Tuesday morning which showed that prices increased slightly in August versus market expectations for a slight decrease. This was a disappointing number for risk assets and stocks immediately reacted by trading much lower and Treasuries of all maturities sold off sharply. This report showed that the Fed still has much work to do before inflation cools to a level nearer its 2% target. CPI data has assured a 75bp hike at the FOMC meeting next week and has even brought forth the possibility of a surprise 100bp hike. Thursday morning brought with it the second big economic data point of the week with mixed retail sales numbers that showed a stronger than expected increase for August but a revision downward for July. The broad picture painted by the last couple retails sales reports has showed that consumer spending has been slowing for durable goods but has remained relatively strong for services. The Fed will be on the tape next week with its rate decision on Wednesday.

This was a volatile week with equities trading lower and Treasuries selling off, both of which served to impugn supply estimates with $18.7bln of new debt priced relative to estimates of $35-40bln. Next week the street is looking for about $15bln of issuance with Wednesday off limits for issuers due to the FOMC. Once again we find ourselves in more of a day-to-day type of environment for the new issue calendar.

Fund flows held up remarkably well this week considering the soft sentiment for risk assets. Per data compiled by Wells Fargo, outflows for the week of September 8–14 were -$0.4bln which brings the year-to-date total to -$111.6bln. This was the third consecutive week of modest outflows and the pace of outflows has decelerated each of the past three weeks.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.