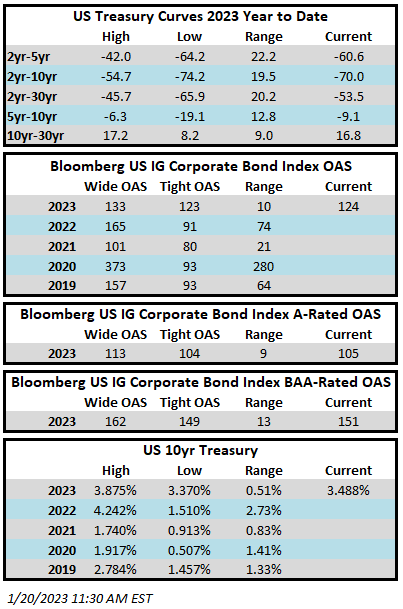

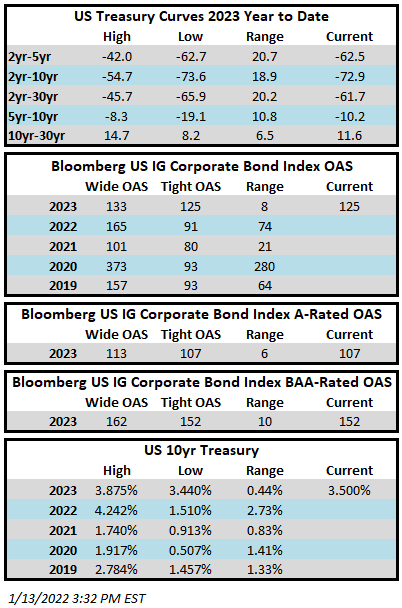

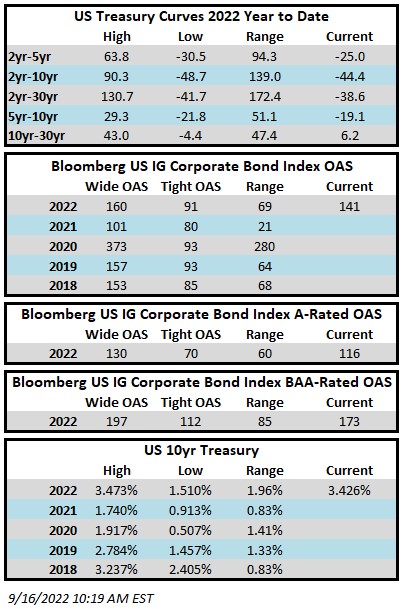

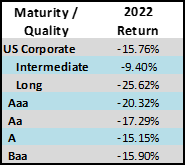

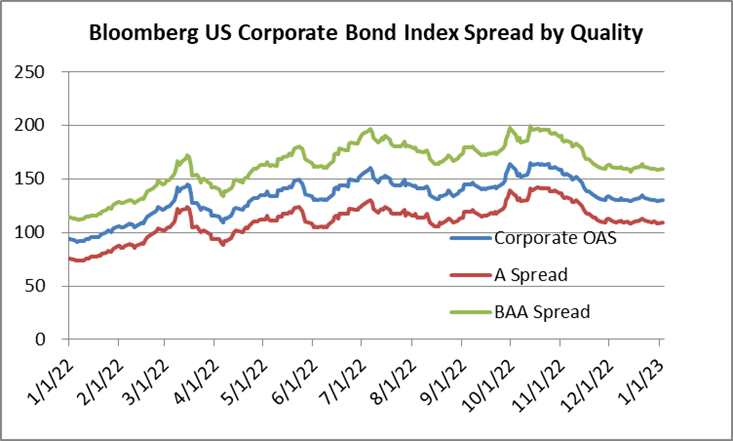

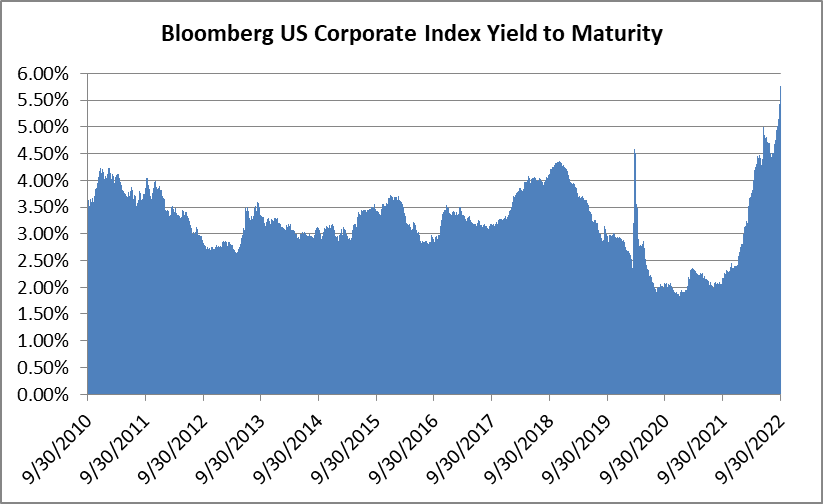

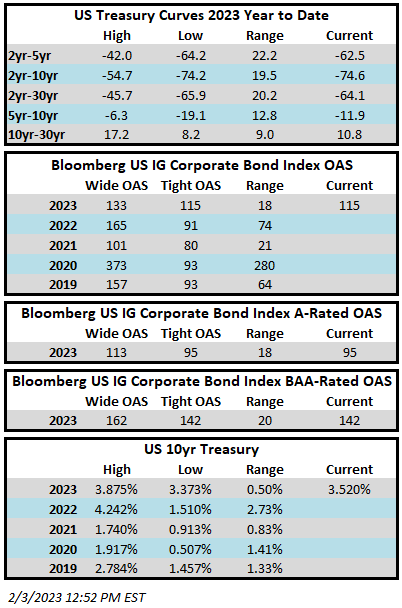

Investment grade credit spreads moved meaningfully tighter this week as demand for IG credit remained consistently strong through the first month of the year. The Bloomberg US Corporate Bond Index closed at 115 on Thursday February 3 after having closed the week prior at 119. 10yr Treasury closed the week prior at 3.50% and it is trading at 3.52% as we go to print but the benchmark rate did close as low as 3.39% on Thursday evening. A strong jobs number on Friday morning caused the entire Treasury curve to give up the gains that were made on Thursday. Through Thursday the Corporate Index had a YTD total return of +5.0% while the YTD S&P500 Index return was +8.9% and the Nasdaq Composite Index return was +16.6%.

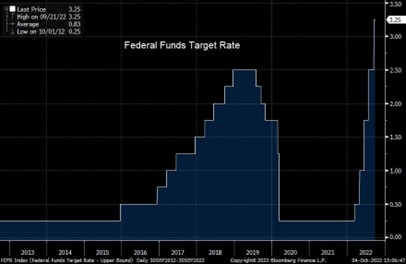

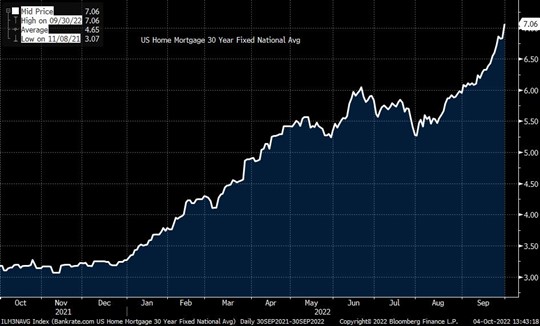

There was much to process from a data standpoint this week. The highlights were the FOMC rate decision on Wednesday which saw the central bank deliver a 25bp increase in Fed funds to a target rate of 4.50%-4.75%. Chairman Powell’s press conference was relatively neutral and he avoided hawkish overtones but the message was also clear that the Fed will not rest until more progress is made in its fight against inflation. The ECB was much more hawkish as it delivered a 50bp increase in its Deposit Rate and followed it up by pre-committing to an additional 50bp increase in March –the pre-commitment was somewhat surprising news for the market to digest. The biggest news of the week was Friday’s U.S. unemployment report which showed that the economy added 517k jobs in January relative to the 188k consensus expectation. The unemployment rate fell to 3.4%, its lowest level in more than 50 years. While the increase in average hourly earnings slowed, the strong job growth number makes it more likely that the Fed will deliver another 25bp hike at its next rate decision on March 22. Not to be outdone the BOE also threw its hat in the ring with a 50bp hike of its policy rate but its commentary was more balanced and it did not fully commit to additional rate increases but it also did not take them off the table.

Primary market volume on the week came in at just over $18bln relative to the low end of the $20-$25lbn estimate. Although volume was a little light relative to estimates, demand was extremely high for the deals that printed this week. This has led to projections of $30-$35bln of issuance next week. We anticipate some large deals next week if investor demand continues to remain strong.

Investment grade credit reported another solid week of inflows. Per data compiled by Wells Fargo, inflows for the week of January 26–February 1 were +4.8bln which brings the year-to-date total to +$22.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.