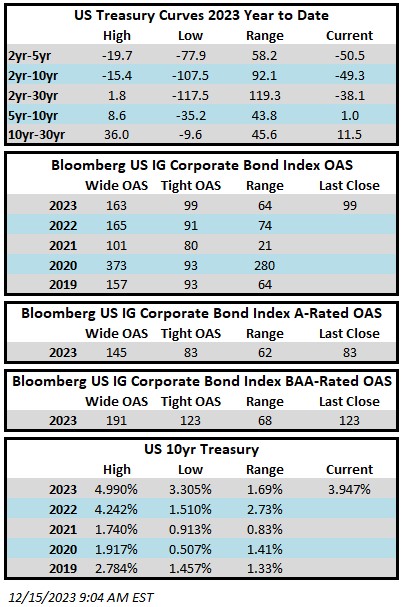

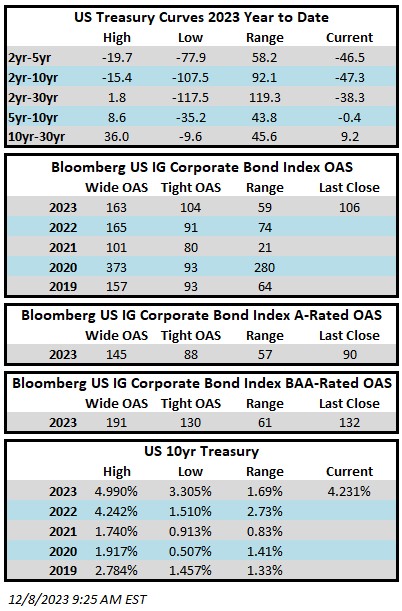

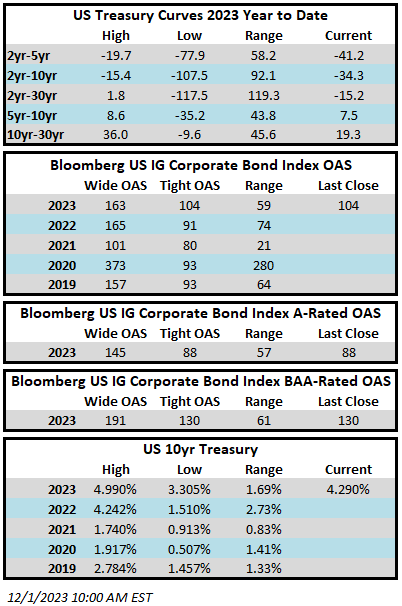

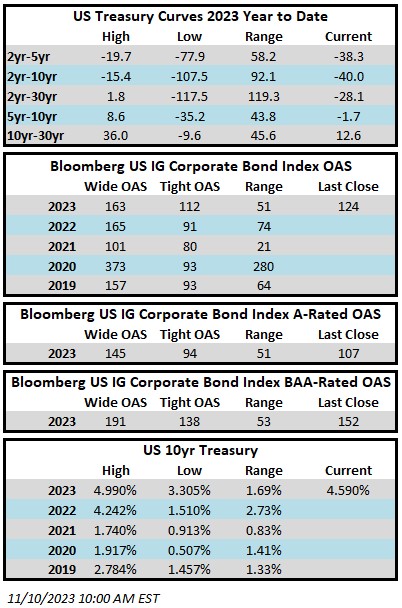

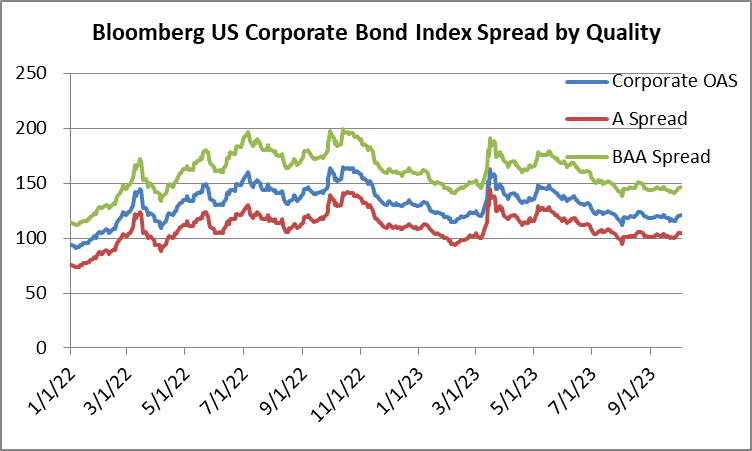

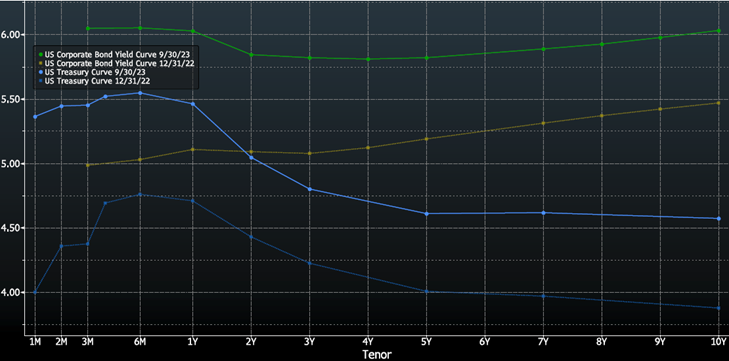

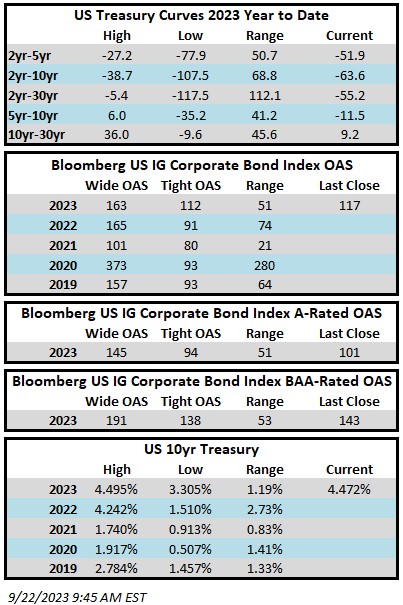

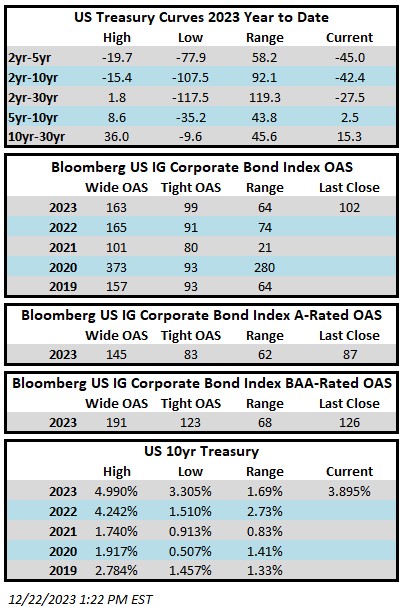

Credit spreads will finish the week a touch wider but levels remain near the tights of 2023. The Bloomberg US Corporate Bond Index closed at 102 on Thursday December 21 after having closed the week prior at 100. The 10yr is trading a 3.895% as we go to print Friday afternoon, which is only a single basis point lower from its close the week prior. Through Thursday, the Corporate Index YTD total return was +7.95%.

Economics

It was another heavy week of economic releases. The most meaningful print of the week was Core PCE on Friday. Recall that this is the Fed’s preferred inflation gauge. The release showed that PCE rose by a mere 0.1% in November. The full year release showed that underlying inflation advanced by 3.2% over the course of the past 12 months while the six month annualized number showed that the core metric rose by just 1.9%. According to sources compiled by Bloomberg, this is the first time in more than three years that this six month measure came in below the Fed’s 2% target.

Issuance

Issuance was extremely light on the week coming in at $0.7bln as just one issuer priced a single 5yr tranche of debt on Monday. January sales are expected to be robust with underwriters predicting monthly volume of around $160bln. The first week of business in 2024 is likely to be quite busy so long as funding conditions remain favorable. For context, the first week of 2023 saw issuers price almost $60bln in new debt.

Flows

According to Refinitiv Lipper, for the week ended December 20, investment-grade bond funds reported a net inflow of +$1.6bln. Flows for the full year are net positive +$13.4bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.