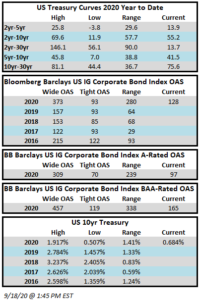

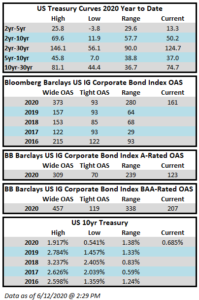

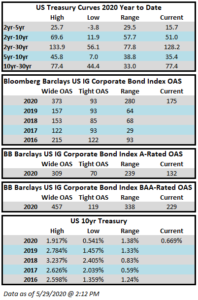

Spreads are opening Friday morning unchanged as we head toward the conclusion of this holiday shortened week that featured only four trading days. The Bloomberg Barclays US Corporate Index closed on Thursday October 15 at 126 after closing the week prior at 126. Through Thursday, the corporate index has posted a year-to-date total return of +7.43%.

The high grade primary market was relatively quiet this week, with $15bln in new debt brought to market. The next several weeks are likely to see more subdued levels of issuance as companies work their way through earnings reports and the election fast approaches.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of October 8-14 were +$8.5bln which brings the year-to-date total to +$220bln.

(Bloomberg) Hunt for Yield Pushes Investors Into Riskier Bonds Around Globe

- Bond investors are pouring back into riskier debt in search of higher returns as they increasingly factor in years of low interest rates.

- Even in Europe, where coronavirus cases are on the rise and Brexit negotiations are entering a critical phase, investors are taking more risks in a hunt for yield. The scarcity was highlighted this week by Italy’s sale of three year debt without offering any coupon on the bonds.

- Junk-rated jet-engine maker Rolls-Royce Holdings Plc drew such demand for a bond sale this week that the company doubled the size of the offering to 2 billion pounds ($2.59 billion) equivalent and tightened the pricing.

- European junk-rated borrowers have issued the most bonds since 2017 so far this year despite a lack of deals in March and August. Polish packaging firm Canpack, French shipping giant CMA CGM SA and French sugar producer Tereos are all currently marketing high-yield bonds.

- Even more money could flow into riskier assets ahead. A flood of central bank liquidity meant to support struggling economies during the pandemic has left investors sitting on $16.3 trillion of negative-yielding debt.

- Money managers are increasingly hungry for alternatives, particularly after Federal Reserve officials in September indicated they see rates holding near zero for at least three years. The world’s stock of negative-yielding bonds rose to a 13-month high this week on speculation central banks will keep buying.

- Elsewhere in the hunt for yield, China drew bumper demand for a bond sale this week even amid increasing tensions with the U.S. Turkey returned to international debt markets last week despite mounting geopolitical risks. And across emerging markets, dollar notes sold by the lowest-rated borrowers are returning more than top-rated peers.

- Nearly a third of Asia Pacific companies have scrapped or reduced dividends this year after the pandemic forced them to conserve cash.

- CAM NOTE: We do not intend to engage in this yield chasing behavior for our portfolio and instead will focus on companies with durable businesses that have sustainable capital structures with the ability to weather the current downturn. Additionally we intend to keep our structural underweight on the lower-rated BAA portion of the investment grade universe.