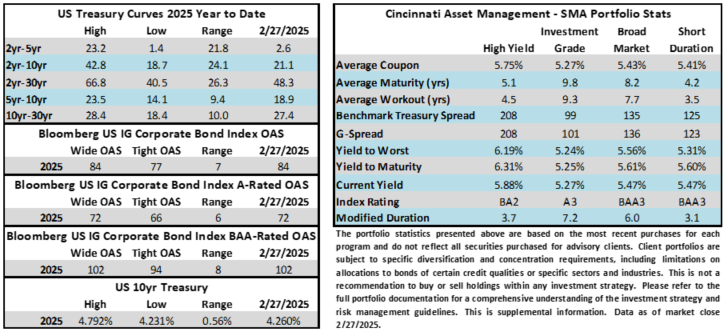

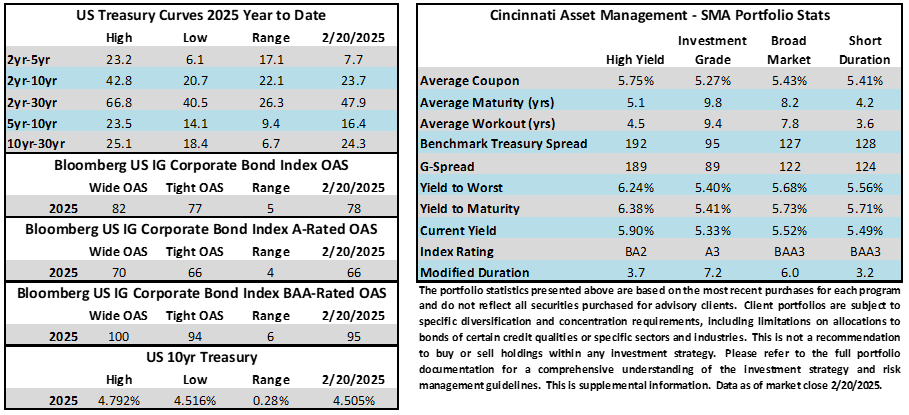

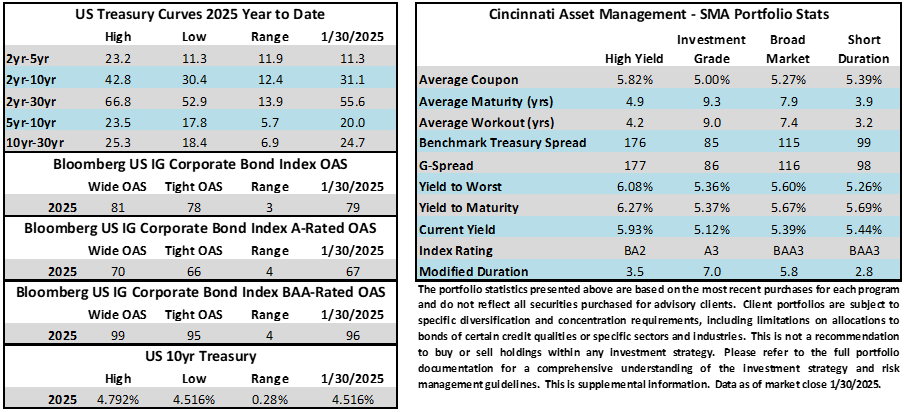

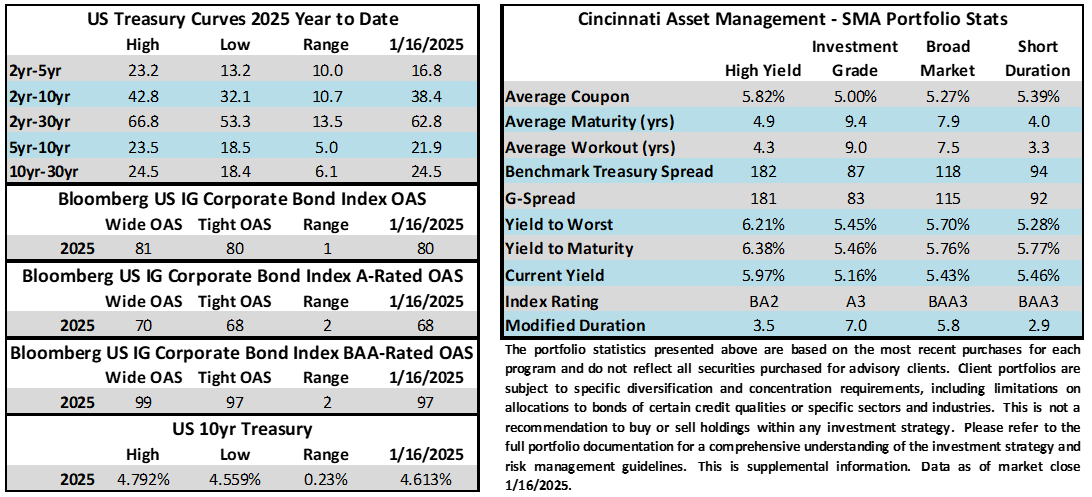

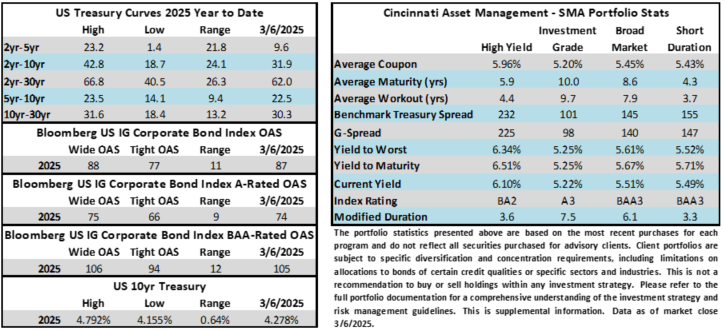

Credit spreads showed some stability this week which was impressive given the deluge of new issue supply. It looks as though the period will finish on a positive note based on price action this Friday morning. The OAS on the Corporate Index was unchanged at 87 basis points this week through Thursday. The 10yr Treasury yield rallied on Monday amid a risk-off sentiment before inching higher throughout the rest of the week. The benchmark rate was 7bps higher on the week through Thursday. Through Thursday, the Corporate Bond Index year-to-date total return was +2.10% while the yield to maturity for the Index closed the day at 5.15%.

Economics

Growth concerns were top of mind for market participants this week and Monday’s PMI report enforced some of those fears as the overall index came in lighter than expectations with a big jump in the Prices Paid component, likely due to the potential impact of tariffs. On the positive side, the ISM service index release showed an increase and it has now expanded in 54 of the past 57 months. Finally, Friday’s payroll report was slightly lower than expected in terms of jobs added during February and the unemployment rate ticked higher from 4.0% to 4.1% but both numbers were well within the margin of error and stocks actually staged a brief relief rally on the back of the release.

Next week has some economic prints of note. Things start to ramp up on Wednesday with a CPI release followed by PPI measures on Thursday. Looking further ahead, the FOMC will meet for the first time since the end of January on March 19.

Issuance

There were lofty expectations ($50bln) for issuance this week and they were exceeded in a big way. Mars Inc. led the way with a $26bln jumbo deal enroute to a $73bln week that saw dozens of companies tap the market. It was the busiest week for the primary market since the first week of September 2024 when $80bln printed. Syndicate desks are looking for more action next week with estimates calling for $45bln in new supply. Investors have plenty of cash to put to work and are still finding good value with most borrowers paying more than 5% to issue intermediate bonds. Looking at it from the standpoint of the borrowers, costs are elevated relative to the low-rate era but the cost of capital is still reasonable for large healthy companies when viewed through the lens of an overall capital allocation framework. This has served to create a win-win type of environment for both investors and borrowers. Year-to-date issuance has now surpassed $420bln which just slightly trails (-3% y/y) 2024’s pace.

Flows

According to LSEG Lipper, for the week ended March 5, investment-grade bond funds reported a net inflow of +$2.6bln. Total year-to-date flows into investment grade funds were +$18.8bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.