2025 Q1 Investment Grade Quarterly

First Quarter Recap & Outlook

April 2025

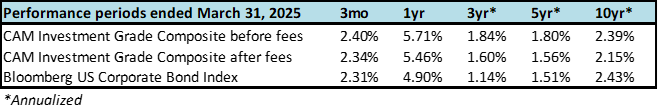

Investment grade credit performed relatively well in the first quarter, especially compared to equities and other riskier assets. Spreads were remarkably stable during the first two months of the year before volatility picked up during the month of March. Although spreads finished the quarter wider, this was more than offset by lower Treasury yields and coupon income.

First Quarter Review

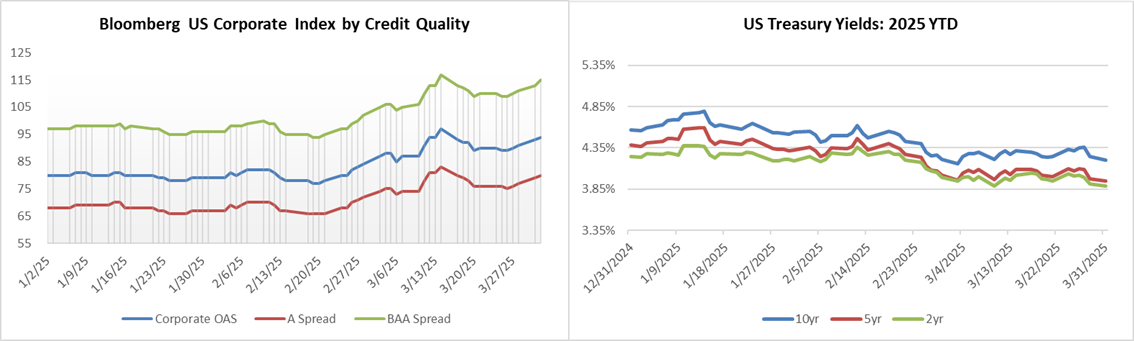

During the first quarter, the option adjusted spread (OAS) on the Bloomberg US Corporate Bond Index widened by 14 basis points to 94 after it began 2025 at a spread of 80. Higher quality credit outperformed lower quality credit amid widening spreads. The longer duration portion of the index (>10yrs to maturity) outperformed the intermediate maturity segment by 11 basis points on the back of declining Treasury yields.

Treasury yields peaked in early January with the 10-year opening the year at 4.57% then climbing higher in the first two weeks of the period, briefly touching 4.79% before drifting steadily lower, closing the quarter at 4.21%. The 2yr, 5yr and 10yr Treasury yields finished 36, 43 and 36 basis points lower, respectively, which played a large role in driving positive returns for credit.

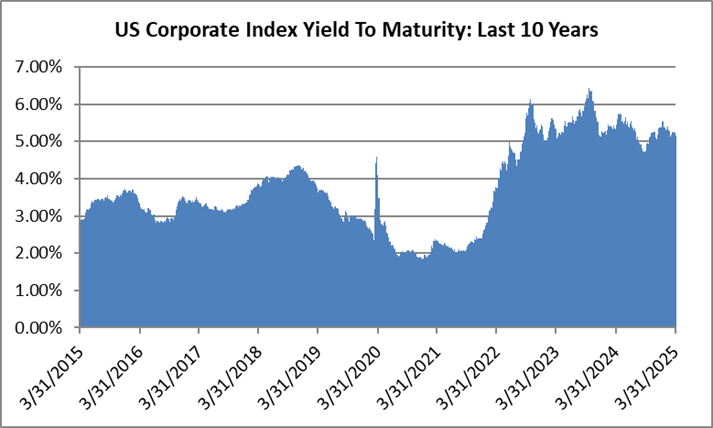

Coupon income was a key contributor to returns during the quarter, accounting for nearly half of the Corporate Index total return during the period (+1.15% of the +2.31% total return was due to coupon). This coupon benefit is directly correlated with the yields and newly minted coupons available to investors in the investment grade primary market. U.S. high grade sales posted the busiest first quarter on record as IG-rated firms printed more than $531bln of new debt, besting 2024’s haul of $529bln. The previous five-year average was $469bln. As we have written previously, we believe the primary market is in the midst of a goldilocks moment where investors and well capitalized companies are well obliged to lend and borrow.

The yield to maturity on the corporate index finished the quarter at 5.15% and is still meaningfully elevated compared to the compensation that was available for most of the past decade. This has not been a fleeting opportunity as the yield for the index has exceeded 5% for the majority of trading days since the 4th quarter of 2022 while the 10-year average for this metric was just 3.73%. We believe that this continues to be an attractive entry point for IG credit and elevated yields have increased the usefulness of investment grade as a diversification tool and it has also put the asset class in a position to potentially generate attractive total returns over the next several years. Higher yields mitigate downside risk among the wide range of potential outcomes stemming from government policy, the Federal Reserve and geopolitics.

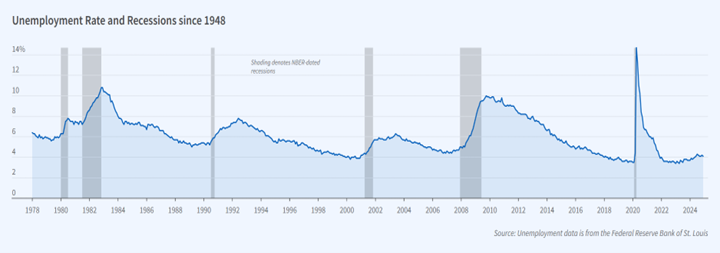

Recession Odds Increasing

According to a Bloomberg survey of economists, the probability of a recession over the course of the next year rose during the first quarter. Throughout January and most of February this indicator was at 20% but then it rose steadily to 30% by the end of March. Some of this was due to softening economic data but a large contributor was uncertainty around U.S. trade policy and geopolitical issues.

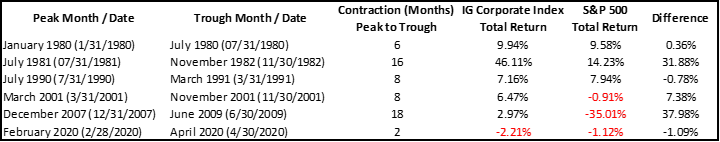

Building on our point about the diversification benefits of IG credit, it has generally performed well during recessionary periods.

Using data from the National Bureau of Economic Research, we examined the more modern era of recessions that occurred in the 1980’s and beyond. Some of these time periods are very short and do not necessarily paint a full picture, but the results showed that IG credit has been a powerful implement in achieving diversification during times of economic stress.

U.S. Trade Policy

During the first quarter, the specter of tariffs clouded investors’ attempts to quantify the impact of looming tariffs on the U.S. economy and consumer spending. We believe that tariffs will have a limited impact on our portfolio, not only because of the companies we own but also due to the contractual nature of bonds and their position within the capital structure. If a company suffers a lapse in profitability due to tariffs, then it may need to adjust its financial policy as a result. There is no requirement or enforceable agreement for a company to pay dividends or repurchase shares. If financial performance is impacted enough then discretionary shareholder returns become levers that can be pulled to increase financial flexibility. There is no such optionality for a company when it comes to interest expense and debt obligations. If a company were to default on its debt obligations, then bondholders would take control of the assets of the company.

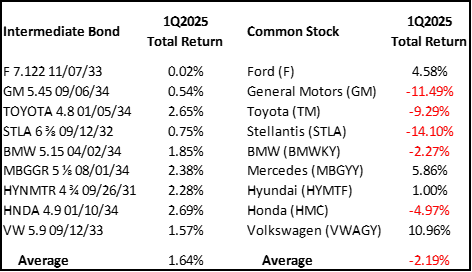

We examined intermediate bond and stock performance of the largest automakers in the world that are most exposed to the 25% tariff that went into effect on April 3. The performance time period was limited to just the first quarter of 2025, when trade policy was dominating the news cycle.

The bonds posted varying degrees of positive returns during the first quarter, while the performance of the equities was disparate. The point of this exercise was not to make the case for bonds over stocks but to indicate the potential price instability of more volatile asset classes wrought by the uncertainty of trade policy. Bottom line, by their very nature bonds have much less exposure to headline risk and manageable declines in earnings because bonds get paid first due to their priority in the capital structure. Tariffs are a headwind for profitability but is unlikely to impair an investment grade rated company from being able to adequately service its debt. The above comparison could potentially look a lot more favorable for equities if tariffs are reversed at some point in the future.

Federal Reserve

It was an uneventful quarter for the FOMC with meetings in January and March. The committee elected to hold its policy rate steady both times. The Fed released an updated dot plot in March with a few changes at the margin from December. The latest version of the plot showed that policymakers at the median continued to expect two rate cuts (50bps) in 2025. However, examining the details, there were more policymakers expecting zero or just one cut than there were in December. Investors were more dovish than the FOMC, and at quarter end, interest rate futures markets were pricing three cuts (75bps) by the end of 2025. We expect one or two cuts in 2025 as the most likely outcome but the state of the economy and the labor market will have much to say about the final outcome.

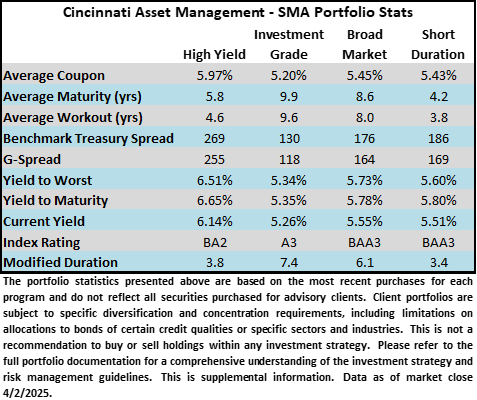

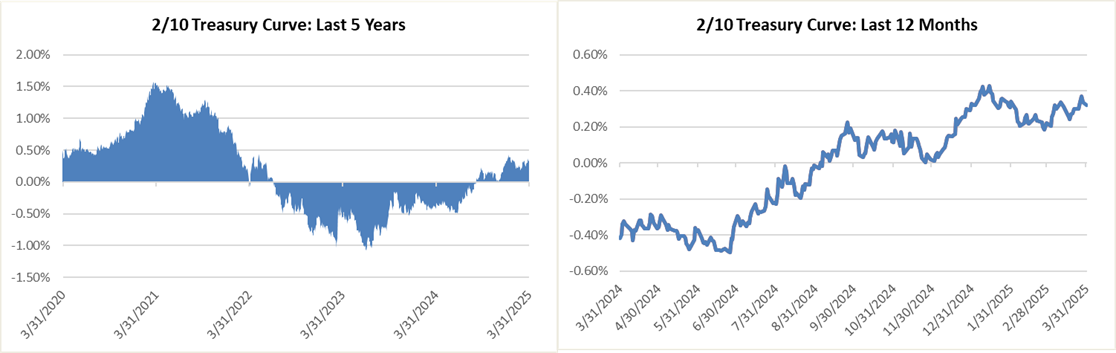

One theme we have been writing about over the course of the past few letters is the re-steepening of the 2/10 Treasury curve. We view this steepening as a product of investors reacting to the 100bps of cuts that the Fed delivered in the final months of 2024 as well as the anticipation of additional cuts in 2025 and beyond. As active managers we applaud a steeper Treasury curve because it creates a more opportunistic environment.

For those investors that have large allocations to short term investments and money markets, we recommend an evaluation of reinvestment risk. If the two-year Treasury were to continue to decline on the back of Fed cuts, then short term investments could earn substantially less than those further out the curve. Investors may consider reallocating some of that short duration capital to intermediate duration assets with greater return potential.

It’s a Marathon

The first quarter was a busy one –record primary volume, macroeconomic uncertainty and spread variability made for some long days. Given the price action in the first trading days of the second quarter it appears that volatility is here to stay. We will continue to lead with our focus on preservation of capital, carrying out our responsibilities with attention, care and a desire to please our clients. Credit selection and an ability to be nimble are paramount in order to successfully navigate what lies ahead.

Thank you for your continued interest. Please do not hesitate to contact us to discuss all topics relevant to credit.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The Index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. There is no assurance that any securities discussed herein have been held or will be held in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings, if any. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Upon request, Cincinnati Asset Management will furnish a list of all security recommendations made within the past year.

Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/

i Bloomberg First Word, March 28 2025, “US High-Grade Bond Sales Post Record 1Q; Slower Pace Next Week”

ii Bloomberg, March 31 2025, “United States Recession Probability Forecast”

iii National Bureau of Economic Research, March 31 2025, “Business Cycle Dating” The NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months, considering factors like GDP, employment, income, sales, and industrial production.”

iv We selected fixed income securities for this exercise by screening for the most recently issued corporate bonds that were nearest 10yrs to maturity that could provide a full quarter of 1Q2025 performance; we also gave credence to Bloomberg liquidity scores selecting the most liquid bonds, all else being equal.

v The Federal Reserve, March 19 2025, “Summary of Economic Projections”

vi Bloomberg, March 31 2025, “World Interest Rate Probability (WIRP)”