CAM Investment Grade Weekly Insights

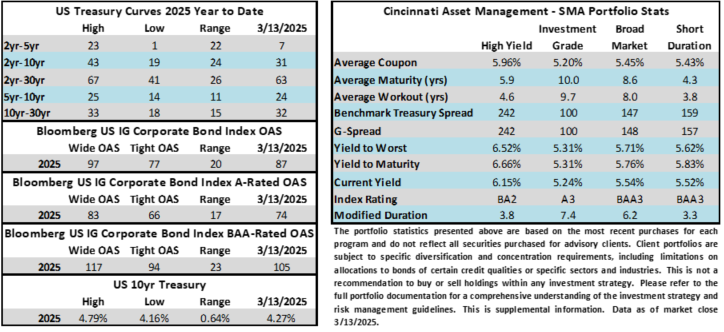

Credit spreads moved meaningfully wider this week in sympathy with the rout in equities but the credit market has a more optimistic vibe as we go to print Friday morning. The OAS on the Corporate Index was 10 basis points wider on the week, closing at 97, its widest level of 2025 and the widest going back to early September 2024. It is worth noting that the move in credit spreads was extremely orderly relative to equities and the new issue market remained open. The 10yr Treasury was relatively stable during the week, especially compared to risk assets. The benchmark rate was 3bps higher on the week through Thursday. Through Thursday, the Corporate Bond Index year-to-date total return remained in positive territory at +1.73% while the yield to maturity for the Index closed the day at 5.22%.

Economics

Investors remained focused on the possibility of a slowing U.S. economy as they watched the data this week. Midweek headline CPI and PPI prints came in lower than expectations. These releases are not as meaningful to the FOMC as February PCE which will be released on March 28. Friday brought some gloomy data with the release of the U-Mich. Consumer sentiment data which showed that consumer long-term inflation expectations hit a 32-year high.

Next week’s focus will be on retail sales, housing starts and the FOMC meeting. Interest rate futures are pricing in a 99+% chance of no change in the Fed’s policy rate at the conclusion of that meeting on Wednesday. Looking ahead, traders expect ~2.7 cuts before year end with them likely occurring in June and September. To be clear, market sentiment and economic data can send those expectations in either direction at any given time.

Issuance

The new issue market remained active and healthy this week amid heightened volatility. Companies priced $35bln in new bonds which fell short of the $45bln estimate. Both Monday and Thursday saw some issuers stand down preferring to wait for quieter days to tap the market. Syndicate desks are looking for around $35bln of issuance next week and Monday is poised to be especially busy as rumor has it that more than a dozen companies will look to front-run the FOMC meeting if the tone is receptive. Issuers have historically avoided bringing new deals coincident with FOMC releases just to avoid any market surprises from the release itself or the ensuing press conference.

Flows

According to LSEG Lipper, for the week ended March 12, investment-grade bond funds reported a net inflow of +$942mm. Total year-to-date flows into investment grade funds were +$19.74bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.