CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bond racked up the biggest one-day loss in nearly eight weeks on Thursday as equities plunged. High-yield markets, which have been jittery amid evolving headlines over US tariffs, are on track for their biggest weekly loss since mid-December.

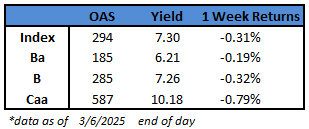

- Spreads surged to a near five-month high after jumping 11 basis points on Thursday and closing in on 300 basis points, the most in two months.

- Yields rose by nine basis points to a three-week high of 7.30%, the biggest one-day jump in seven weeks

- The losses spanned across ratings; CCC yields soared to a 7-week high of 10.18%, rising by 17 basis points, driving a loss of 0.33% on Thursday; CCCs are headed for their worst week in 10 months

- CCC spreads climbed to a more than four-month high of 587, rising by 19 basis points, the biggest one-day widening since September

- BB spreads widened 9 basis points to 185 and yields advanced to a three-week high of 6.21%

- While there was a selloff in equities amid policy uncertainty, the US junk bond primary market continued at a steady pace

- 10 borrowers sold debt this week; 2 borrowers sold more than $2b on Thursday driving the week’s supply to more than $8b

- 8 of the 10 companies sold bonds with BB ratings, the best credit quality in the high-yield universe

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.